MoonGirl

No content yet

MoonGirl

Hurry up join live stream friends 🤝 💯 🔥 ♥️

- Reward

- 5

- 6

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#GateSquareValentineGiveaway

#GateSquareValentineGiveaway #我最中意的加密货币

Roses are red, charts are green — my heart belongs to one token this season.

While others celebrate love, I’m celebrating the coin that never leaves my watchlist.

My recent “heartthrob token” is the one I keep accumulating, no matter the market mood.

Because real love in crypto is conviction, patience, and belief in the long term.

This Valentine’s, I’m confessing to my favorite token on Gate Square.

What’s the coin you love the most right now, and why?

#MoonGirl

#GateSquareValentineGiveaway #我最中意的加密货币

Roses are red, charts are green — my heart belongs to one token this season.

While others celebrate love, I’m celebrating the coin that never leaves my watchlist.

My recent “heartthrob token” is the one I keep accumulating, no matter the market mood.

Because real love in crypto is conviction, patience, and belief in the long term.

This Valentine’s, I’m confessing to my favorite token on Gate Square.

What’s the coin you love the most right now, and why?

#MoonGirl

- Reward

- 6

- 6

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#GlobalTechSell-OffHitsRiskAssets

#GlobalTechSell-OffHitsRiskAssets #BTC

Tech stocks selling off is spilling pressure into crypto and other risk assets.

When Nasdaq weakens, BTC often feels the weight through sentiment and liquidity.

I’m watching correlation closely — especially how BTC reacts to U.S. market opens.

If tech stabilizes, crypto may find footing faster than expected.

For now, smaller positions, faster reactions, and patience over prediction.

Do you think this tech sell-off will drag crypto lower, or create a rebound setup?

#MoonGirl

#GlobalTechSell-OffHitsRiskAssets #BTC

Tech stocks selling off is spilling pressure into crypto and other risk assets.

When Nasdaq weakens, BTC often feels the weight through sentiment and liquidity.

I’m watching correlation closely — especially how BTC reacts to U.S. market opens.

If tech stabilizes, crypto may find footing faster than expected.

For now, smaller positions, faster reactions, and patience over prediction.

Do you think this tech sell-off will drag crypto lower, or create a rebound setup?

#MoonGirl

BTC1,54%

- Reward

- 7

- 6

- Repost

- Share

MrFlower_ :

:

Happy New Year! 🤑View More

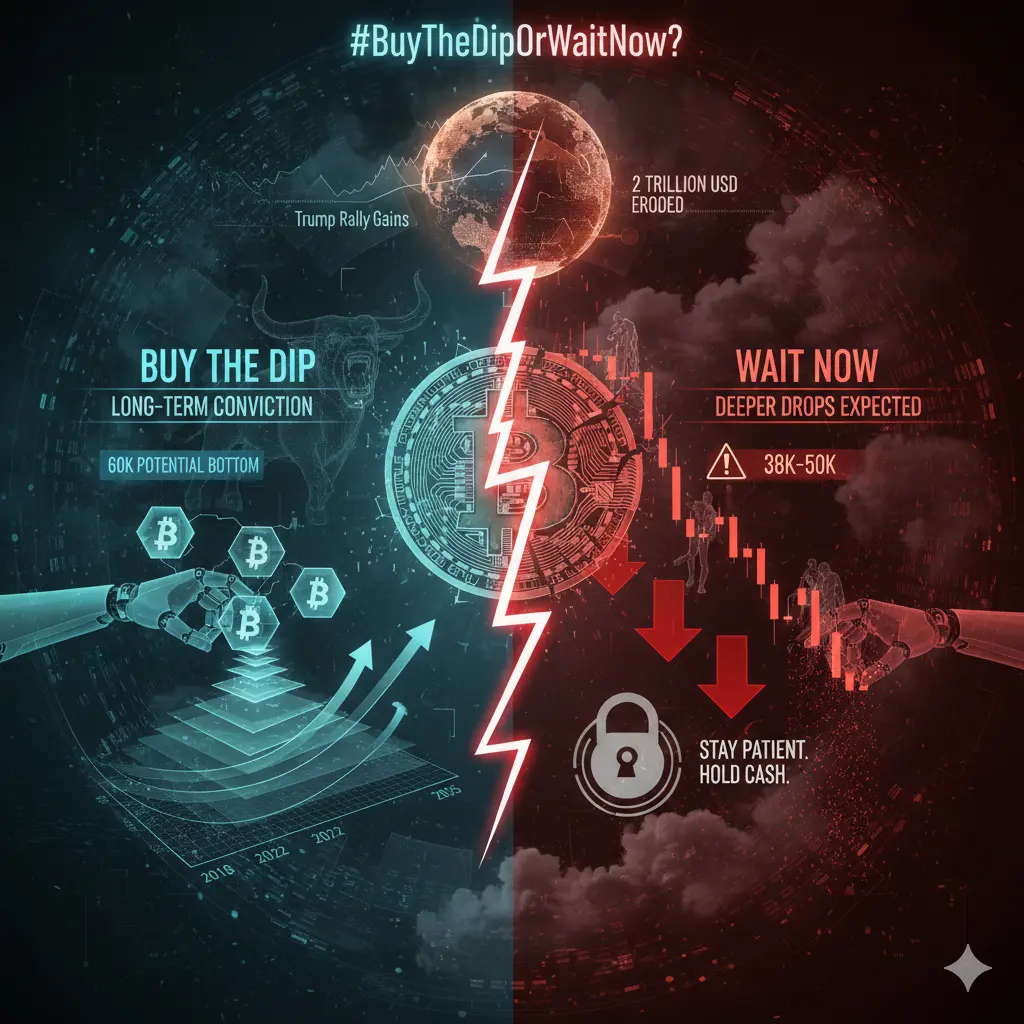

#BuyTheDipOrWaitNow?

Market pullbacks are a normal part of the crypto market cycle. While price corrections can present potential opportunities, reacting impulsively to short-term movements often leads to suboptimal outcomes. The decision to buy during a dip or wait for further confirmation should be guided by strategy, not sentiment.

Key factors to consider include market fundamentals, broader macro conditions, and individual risk tolerance. Not all price declines are equal — some reflect temporary market uncertainty, while others may signal deeper structural or fundamental challenges. Under

Market pullbacks are a normal part of the crypto market cycle. While price corrections can present potential opportunities, reacting impulsively to short-term movements often leads to suboptimal outcomes. The decision to buy during a dip or wait for further confirmation should be guided by strategy, not sentiment.

Key factors to consider include market fundamentals, broader macro conditions, and individual risk tolerance. Not all price declines are equal — some reflect temporary market uncertainty, while others may signal deeper structural or fundamental challenges. Under

- Reward

- 6

- 8

- Repost

- Share

MrFlower_ :

:

Happy New Year! 🤑View More

🚀 #BitwiseFilesforUNISpotETF — Institutional DeFi Access Takes a Big Step

Bitwise Asset Management has officially filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch a spot ETF tied to the Uniswap (UNI) token, marking a potentially historic expansion of regulated crypto products. This proposed “Bitwise Uniswap ETF” would hold UNI tokens directly, providing investors with regulated exposure to one of the leading DeFi protocol tokens.

📊 What’s Significant:

• First of Its Kind: If approved, this would be the first U.S. spot ETF focused on a

Bitwise Asset Management has officially filed a Form S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) to launch a spot ETF tied to the Uniswap (UNI) token, marking a potentially historic expansion of regulated crypto products. This proposed “Bitwise Uniswap ETF” would hold UNI tokens directly, providing investors with regulated exposure to one of the leading DeFi protocol tokens.

📊 What’s Significant:

• First of Its Kind: If approved, this would be the first U.S. spot ETF focused on a

- Reward

- 8

- 14

- Repost

- Share

MrFlower_ :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback

A crypto market pullback refers to a temporary decline in prices after a recent upward move. It is a normal and healthy part of market behavior and does not automatically signal the start of a bear market. Understanding the difference between a pullback and a trend reversal is key to making better decisions.

What Causes a Crypto Market Pullback?

Several factors usually work together:

Short-term profit-taking after strong rallies

Price reaching major resistance or overbought levels

Negative or uncertain macroeconomic news

Increased liquidations in leveraged positions

Mark

A crypto market pullback refers to a temporary decline in prices after a recent upward move. It is a normal and healthy part of market behavior and does not automatically signal the start of a bear market. Understanding the difference between a pullback and a trend reversal is key to making better decisions.

What Causes a Crypto Market Pullback?

Several factors usually work together:

Short-term profit-taking after strong rallies

Price reaching major resistance or overbought levels

Negative or uncertain macroeconomic news

Increased liquidations in leveraged positions

Mark

- Reward

- 8

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#WhyAreGoldStocksandBTCFallingTogether?

It’s not just crypto — gold and gold-related stocks are also taking a hit. Investors are asking: why are “safe havens” and high-beta assets falling at the same time?

1️⃣ Macro Pressure:

Rising U.S. interest rates, potential Fed hawkishness, and dollar strength are making both risk assets and commodities volatile. When the dollar rallies, gold often struggles despite being a safe-haven.

2️⃣ Risk-Off Sentiment:

Geopolitical uncertainty, including ongoing Middle East tensions, is pushing investors to liquidate positions across the board — not just crypto.

It’s not just crypto — gold and gold-related stocks are also taking a hit. Investors are asking: why are “safe havens” and high-beta assets falling at the same time?

1️⃣ Macro Pressure:

Rising U.S. interest rates, potential Fed hawkishness, and dollar strength are making both risk assets and commodities volatile. When the dollar rallies, gold often struggles despite being a safe-haven.

2️⃣ Risk-Off Sentiment:

Geopolitical uncertainty, including ongoing Middle East tensions, is pushing investors to liquidate positions across the board — not just crypto.

BTC1,54%

- Reward

- 8

- 9

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

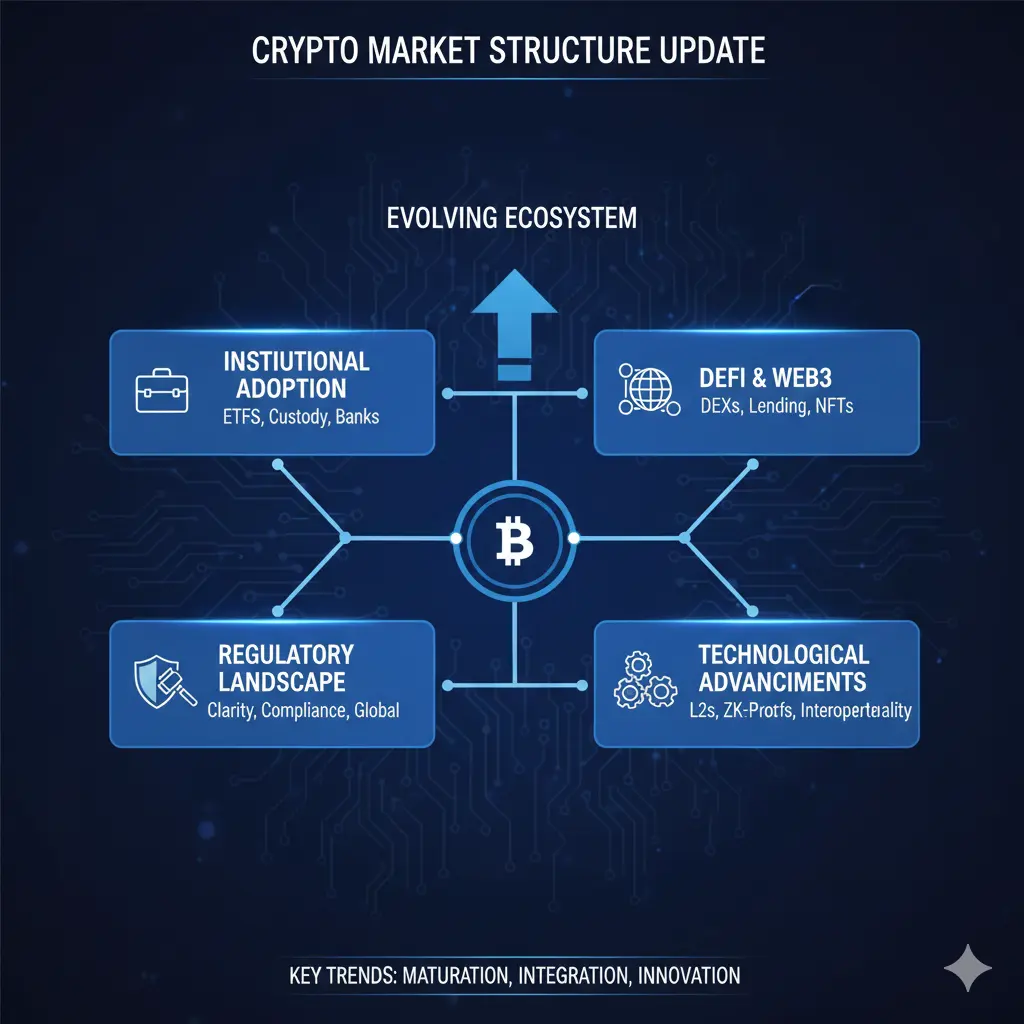

#CryptoMarketStructureUpdate

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 9

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC1,54%

- Reward

- 7

- 6

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#EthereumL2Outlook 🔥 Ethereum L2 Outlook – Early 2026 Reality Check: Scaling Evolution, Consolidation & the New Reality 🔥

Ethereum’s Layer 2 ecosystem in February 2026 is at a pivotal juncture. Mainnet scaling has improved significantly — gas fees are near-zero, throughput is surging, and L1 activity is up over 41% year-over-year. Meanwhile, L2 activity has dropped roughly 50% from mid-2025 peaks, with monthly addresses falling from 58M to ~30M. L2s still process 95–99% of all Ethereum transactions, but their role as pure “scaling solutions” is under scrutiny. The community now demands real

Ethereum’s Layer 2 ecosystem in February 2026 is at a pivotal juncture. Mainnet scaling has improved significantly — gas fees are near-zero, throughput is surging, and L1 activity is up over 41% year-over-year. Meanwhile, L2 activity has dropped roughly 50% from mid-2025 peaks, with monthly addresses falling from 58M to ~30M. L2s still process 95–99% of all Ethereum transactions, but their role as pure “scaling solutions” is under scrutiny. The community now demands real

- Reward

- 9

- 14

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide 🚀 Top Coins Defying the Downtrend

While the total market cap hovers around $2.45 trillion, certain assets are outperforming the "benchmark" assets (BTC and ETH) through localized strength or technical upgrades.

1. Ethereum (ETH)

Surprisingly, Ethereum has recently shown a "divergence" from Bitcoin. While Bitcoin dipped by ~1% today, Ethereum has posted gains of 2.27%, trading near $2,086.

The Catalyst: The market is pricing in the Dencun update and the upcoming Prague release, which significantly reduce Layer-2 costs.

Institutional Shift: Major asset managers like BlackRo

While the total market cap hovers around $2.45 trillion, certain assets are outperforming the "benchmark" assets (BTC and ETH) through localized strength or technical upgrades.

1. Ethereum (ETH)

Surprisingly, Ethereum has recently shown a "divergence" from Bitcoin. While Bitcoin dipped by ~1% today, Ethereum has posted gains of 2.27%, trading near $2,086.

The Catalyst: The market is pricing in the Dencun update and the upcoming Prague release, which significantly reduce Layer-2 costs.

Institutional Shift: Major asset managers like BlackRo

- Reward

- 9

- 13

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#MyFavoriteCryptocurrency

💎 #MyFavoriteCryptocurrency: GT – The Ultimate Power Token on Gate.io! 🌟

In the fast-evolving crypto world of 2026, my absolute favorite is GT (GateToken) – the native powerhouse of Gate.io, one of the most reliable, innovative, and user-centric exchanges out there. If you're trading seriously (or just starting), GT + Gate.io is the unbeatable duo that delivers

real value every day. Here's why GT stands out:

🔐 Top-Tier Security & Trust – Gate.io boasts industry-leading protections, a 125%+ reserve ratio (as per their latest transparency reports), and consistent b

💎 #MyFavoriteCryptocurrency: GT – The Ultimate Power Token on Gate.io! 🌟

In the fast-evolving crypto world of 2026, my absolute favorite is GT (GateToken) – the native powerhouse of Gate.io, one of the most reliable, innovative, and user-centric exchanges out there. If you're trading seriously (or just starting), GT + Gate.io is the unbeatable duo that delivers

real value every day. Here's why GT stands out:

🔐 Top-Tier Security & Trust – Gate.io boasts industry-leading protections, a 125%+ reserve ratio (as per their latest transparency reports), and consistent b

GT-0,14%

- Reward

- 6

- 7

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#CryptoMarketPullback 📉⚠️

The market is bleeding — but panic is not a strategy.

Bitcoin is testing major support.

Ethereum is under pressure.

Altcoins are correcting harder than expected.

This isn’t chaos. This is a liquidity reset.

When leverage builds too fast, the market corrects aggressively. Weak hands exit. Overexposed positions get liquidated. Structure gets cleaned.

Now the real game begins.

🔎 What matters here: • Is BTC holding key higher-timeframe demand?

• Are liquidations slowing down?

• Is volume showing absorption or continued selling?

Extreme fear often appears near turning po

The market is bleeding — but panic is not a strategy.

Bitcoin is testing major support.

Ethereum is under pressure.

Altcoins are correcting harder than expected.

This isn’t chaos. This is a liquidity reset.

When leverage builds too fast, the market corrects aggressively. Weak hands exit. Overexposed positions get liquidated. Structure gets cleaned.

Now the real game begins.

🔎 What matters here: • Is BTC holding key higher-timeframe demand?

• Are liquidations slowing down?

• Is volume showing absorption or continued selling?

Extreme fear often appears near turning po

- Reward

- 9

- 11

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#CryptoSurvivalGuide

#CryptoSurvivalGuide

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining yo

#CryptoSurvivalGuide

Building a Financial Fortress: Deepening Risk Control

Severe market fluctuations (volatility) represent chaos for the unprepared investor, yet for the disciplined one, they are merely a "data set." In the tense atmosphere of February 2026, it is vital to activate these three core mechanisms to protect your portfolio:

1. Asymmetric Risk and Loss Management

A common mistake made by market analysts is focusing solely on profit targets. Professionals, however, prioritize calculating the "risk/reward ratio."

The Psychology of Stop-Loss: When determining yo

BTC1,54%

- Reward

- 6

- 7

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

- Reward

- 9

- 8

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#GateJanTransparencyReport 🚀 BTC Trade Setup: #BuyTheDipOrWait?

Bitcoin is currently navigating a range after a rejection, showing some short-term downward pressure. However, the key support zone is still holding firm. Are we looking at a trap or a launchpad?

📉 The Strategy

Entry Zone: $69,200 – $70,200 (Watch for price stability here)

Target 1: $72,000

Target 2: $74,000+

Bitcoin is currently navigating a range after a rejection, showing some short-term downward pressure. However, the key support zone is still holding firm. Are we looking at a trap or a launchpad?

📉 The Strategy

Entry Zone: $69,200 – $70,200 (Watch for price stability here)

Target 1: $72,000

Target 2: $74,000+

BTC1,54%

- Reward

- 10

- 11

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#BitwiseFilesforUNISpotETF

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

🚨 Big DeFi News: Bitwise Asset Management has officially filed an S-1 registration with the U.S. SEC (February 5, 2026) for the Bitwise Uniswap (UNI) Spot ETF — potentially the first-ever spot ETF tracking Uniswap’s governance token, UNI.

If approved, this ETF would allow traditional investors to gain direct exposure to UNI through regular brokerage accounts, without holding the token themselves. Coinbase Custody would manage custody (no staking at launch, but it could be added later).

This marks a major step toward bridging DeFi with regulated Wall Street products.

- Reward

- 9

- 9

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#BitwiseFilesforUNISpotETF

The wave of institutional adoption in cryptocurrency markets is now extending toward the flagships of decentralized finance (DeFi), following in the footsteps of spot Bitcoin and Ethereum ETFs. Bitwise Asset Management’s application for a spot Uniswap (UNI) ETF has been recorded as a strategic move opening the doors to a new era in the financial world.

An Era of Institutional Transparency in DeFi

Following its legal trust registration in Delaware, Bitwise officially submitted its S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) in earl

The wave of institutional adoption in cryptocurrency markets is now extending toward the flagships of decentralized finance (DeFi), following in the footsteps of spot Bitcoin and Ethereum ETFs. Bitwise Asset Management’s application for a spot Uniswap (UNI) ETF has been recorded as a strategic move opening the doors to a new era in the financial world.

An Era of Institutional Transparency in DeFi

Following its legal trust registration in Delaware, Bitwise officially submitted its S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) in earl

- Reward

- 9

- 12

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

#BTC

#当前行情抄底还是观望?

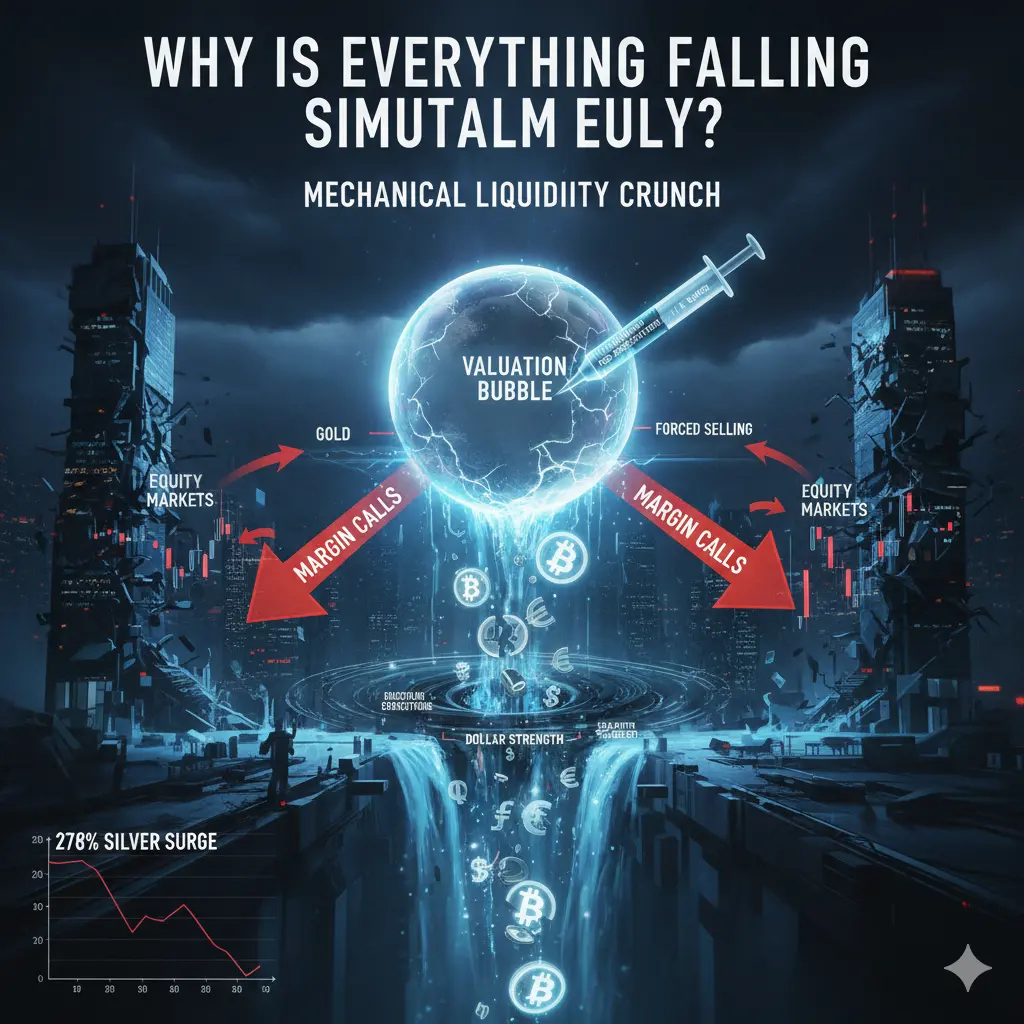

why ls Everything Falling Simultaneously?

The real factor behind the simultaneous collapse of gold, silver, and cryptocurrencies—which are normally expected to show an inverse correlation—is a "Mechanical Liquidity Crunch."

The Fed and "Hawkish" Expectations: The nomination of figures like Kevin Warsh, known for favoring restrictive monetary policies, to the Federal Reserve leadership in the US has triggered fears that "there may be no rate cuts in 2026, and perhaps even increases." This situation strengthened the dollar while exerting pressure across all asset classes.

#当前行情抄底还是观望?

why ls Everything Falling Simultaneously?

The real factor behind the simultaneous collapse of gold, silver, and cryptocurrencies—which are normally expected to show an inverse correlation—is a "Mechanical Liquidity Crunch."

The Fed and "Hawkish" Expectations: The nomination of figures like Kevin Warsh, known for favoring restrictive monetary policies, to the Federal Reserve leadership in the US has triggered fears that "there may be no rate cuts in 2026, and perhaps even increases." This situation strengthened the dollar while exerting pressure across all asset classes.

BTC1,54%

- Reward

- 11

- 13

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

Hurry up join live stream friends 🤝

- Reward

- 7

- 5

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More