# BitwiseFilesforUNISpotETF

2.17K

Korean_Girl

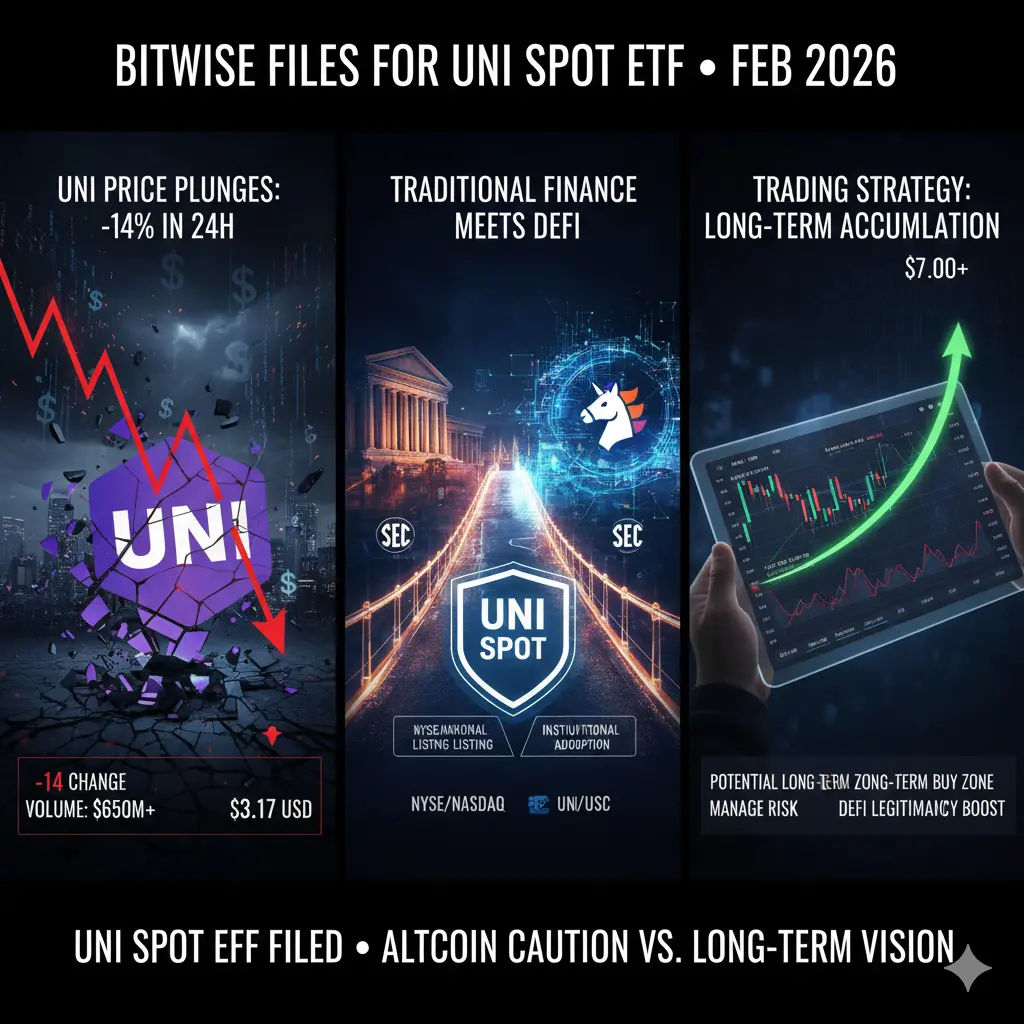

#BitwiseFilesforUNISpotETF Institutional adoption in cryptocurrency markets is now extending beyond Bitcoin and Ethereum toward the core infrastructure of decentralized finance. Following the success of spot BTC and ETH ETFs, Bitwise Asset Management’s filing for a spot Uniswap (UNI) ETF represents a strategic milestone — signaling that DeFi governance assets are entering the regulatory and institutional mainstream.

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026. Th

- Reward

- 2

- 1

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊#BitwiseFilesforUNISpotETF 🚀Institutional adoption in cryptocurrency markets is now extending beyond Bitcoin and Ethereum toward the core infrastructure of decentralized finance. Following the success of spot BTC and ETH ETFs, Bitwise Asset Management’s filing for a spot Uniswap (UNI) ETF represents a strategic milestone — signaling that DeFi governance assets are entering the regulatory and institutional mainstream.

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026.

After establishing its legal trust structure in Delaware, Bitwise submitted its S-1 registration statement to the U.S. Securities and Exchange Commission in early February 2026.

- Reward

- 2

- 2

- Repost

- Share

HeavenSlayerSupporter :

:

2026 Go Go Go 👊View More

#BitwiseFilesforUNISpotETF

Bitwise Files for a Spot UNI ETF : A Major Leap for DeFi’s Institutional Recognition

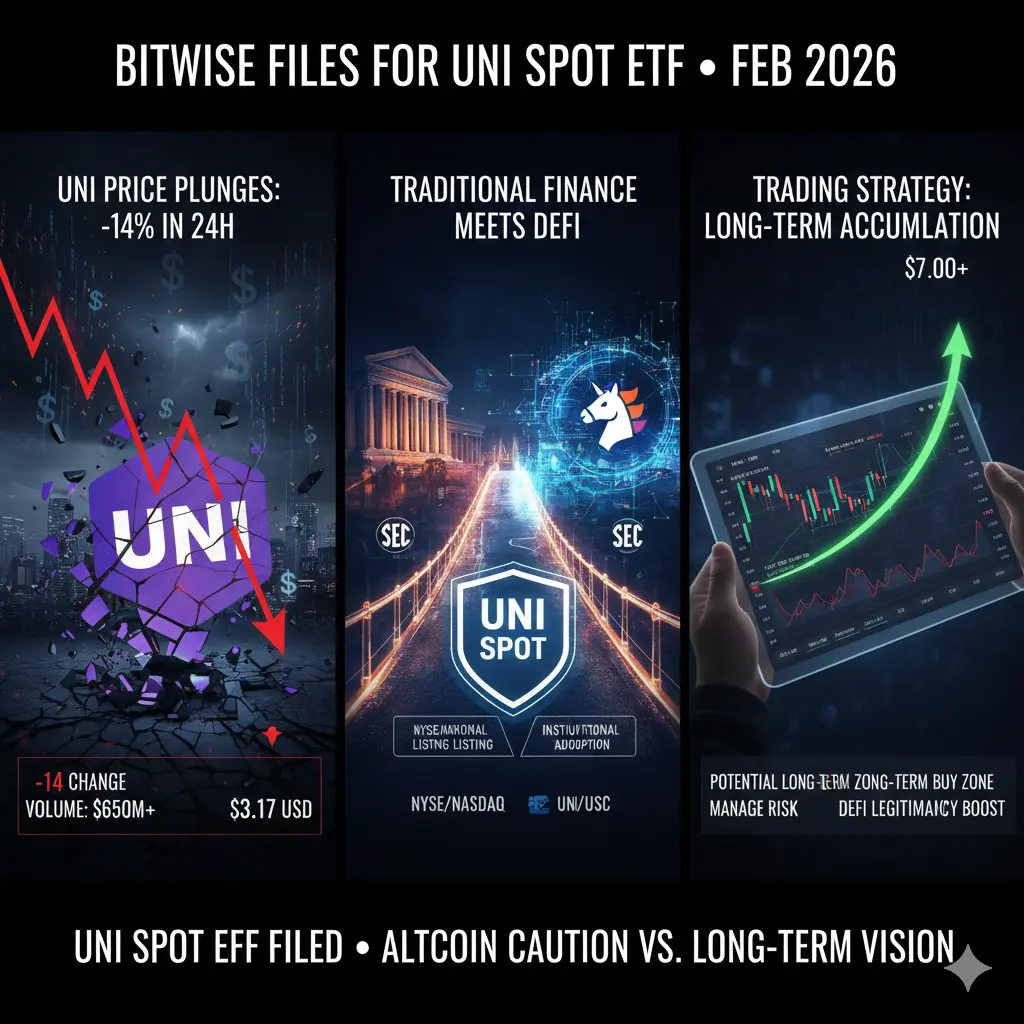

The recent filing by Bitwise for a spot Uniswap (UNI) ETF marks a significant milestone in the evolution of decentralized finance and its integration into traditional financial markets. Following the approval and growing acceptance of spot Bitcoin and Ethereum ETFs, this move signals that institutional interest is expanding beyond foundational blockchain assets and into core DeFi infrastructure.

Uniswap stands as one of the most influential protocols in the crypto ecosystem. As the

Bitwise Files for a Spot UNI ETF : A Major Leap for DeFi’s Institutional Recognition

The recent filing by Bitwise for a spot Uniswap (UNI) ETF marks a significant milestone in the evolution of decentralized finance and its integration into traditional financial markets. Following the approval and growing acceptance of spot Bitcoin and Ethereum ETFs, this move signals that institutional interest is expanding beyond foundational blockchain assets and into core DeFi infrastructure.

Uniswap stands as one of the most influential protocols in the crypto ecosystem. As the

- Reward

- 5

- 9

- Repost

- Share

HeavenSlayerSupporter :

:

Hold on tight, we're about to take off 🛫View More

#BitwiseFilesforUNISpotETF

The filing by Bitwise for a spot Uniswap (UNI) ETF marks a pivotal moment in the ongoing convergence between decentralized finance and traditional investment vehicles. Under the theme #BitwiseFilesforUNISpotETF, this development reflects a broader institutional willingness to engage not just with crypto assets as commodities, but with DeFi governance tokens as legitimate components of diversified portfolios. Unlike earlier ETF narratives centered around Bitcoin or Ethereum, this move shifts attention toward protocol-level value, signaling that regulators and asset m

The filing by Bitwise for a spot Uniswap (UNI) ETF marks a pivotal moment in the ongoing convergence between decentralized finance and traditional investment vehicles. Under the theme #BitwiseFilesforUNISpotETF, this development reflects a broader institutional willingness to engage not just with crypto assets as commodities, but with DeFi governance tokens as legitimate components of diversified portfolios. Unlike earlier ETF narratives centered around Bitcoin or Ethereum, this move shifts attention toward protocol-level value, signaling that regulators and asset m

- Reward

- 3

- 8

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#BitwiseFilesforUNISpotETF

The wave of institutional adoption in cryptocurrency markets is now extending toward the flagships of decentralized finance (DeFi), following in the footsteps of spot Bitcoin and Ethereum ETFs. Bitwise Asset Management’s application for a spot Uniswap (UNI) ETF has been recorded as a strategic move opening the doors to a new era in the financial world.

An Era of Institutional Transparency in DeFi

Following its legal trust registration in Delaware, Bitwise officially submitted its S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) in earl

The wave of institutional adoption in cryptocurrency markets is now extending toward the flagships of decentralized finance (DeFi), following in the footsteps of spot Bitcoin and Ethereum ETFs. Bitwise Asset Management’s application for a spot Uniswap (UNI) ETF has been recorded as a strategic move opening the doors to a new era in the financial world.

An Era of Institutional Transparency in DeFi

Following its legal trust registration in Delaware, Bitwise officially submitted its S-1 registration statement to the U.S. Securities and Exchange Commission (SEC) in earl

- Reward

- 10

- 10

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#BitwiseFilesforUNISpotETF

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

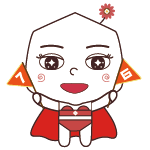

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

UNI-7,87%

- Reward

- like

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

UNI-7,87%

- Reward

- 10

- 17

- Repost

- Share

Falcon_Official :

:

HODL Tight 💪View More

#BitwiseFilesforUNISpotETF

The crypto market just witnessed another major institutional signal as Bitwise officially moved forward with plans to launch a spot ETF tied to Uniswap’s UNI token. This development has quickly become a hot topic because it goes far beyond price action it touches regulation, DeFi legitimacy, and the future direction of crypto investment products.

What makes this filing especially significant is that it focuses on UNI, a governance token deeply connected to decentralized finance rather than a base-layer asset like Bitcoin or Ethereum. By targeting UNI, Bitwise is eff

The crypto market just witnessed another major institutional signal as Bitwise officially moved forward with plans to launch a spot ETF tied to Uniswap’s UNI token. This development has quickly become a hot topic because it goes far beyond price action it touches regulation, DeFi legitimacy, and the future direction of crypto investment products.

What makes this filing especially significant is that it focuses on UNI, a governance token deeply connected to decentralized finance rather than a base-layer asset like Bitcoin or Ethereum. By targeting UNI, Bitwise is eff

- Reward

- 5

- 12

- Repost

- Share

Falcon_Official :

:

good workView More

#BitwiseFilesforUNISpotETF In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing marks a significant milestone as it would create the first regulated exchange-traded fund that directly tracks the price of the UNI governance token, allowing both institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels. By enabling mainstream market participation in Uniswap, the ETF could bridge the gap betw

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitwiseFilesforUNISpotETF In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing marks a significant milestone as it would create the first regulated exchange-traded fund that directly tracks the price of the UNI governance token, allowing both institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels. By enabling mainstream market participation in Uniswap, the ETF could bridge the gap betw

UNI-7,87%

- Reward

- 5

- 7

- Repost

- Share

GateUser-e008d658 :

:

Continue to plummet, heading towards 2u. The market is experiencing a sharp decline, and if the downward trend continues, the price may reach 2u soon. Investors should stay cautious and monitor the situation closely.View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

106.06K Popularity

18.46K Popularity

387.67K Popularity

5.99K Popularity

3.72K Popularity

3.37K Popularity

2.17K Popularity

3.36K Popularity

1.94K Popularity

3.34K Popularity

12.05K Popularity

8.03K Popularity

20.09K Popularity

28.41K Popularity

23.31K Popularity

News

View MoreETH Breaks Through 2000 USDT

3 m

Token trading infrastructure provider Relay Protocol completes $17 million Series B funding, led by USV and others

5 m

Analysis: Bitcoin's current support level is above $60,000, and the resistance level is around $80,000.

7 m

Over the past hour, the entire network has been liquidated for over $45 million, mainly short positions.

8 m

The three major U.S. stock indices all rose over 1%, with technology stocks rebounding collectively.

8 m

Pin