# BTC

37.68M

AylaShinex

#CryptoSurvivalGuide This market isn’t for the emotional.

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

It’s for the prepared.

BTC is volatile.

Altcoins are fragile.

Liquidity is thin.

If you want to survive this phase, follow rules — not feelings.

🛡️ Rule 1: Protect Capital First

No trade is better than a bad trade. Cash is also a position.

🛡️ Rule 2: Reduce Leverage

High leverage in unstable markets = donation.

🛡️ Rule 3: Respect Key Levels

Breakdown zones matter more than opinions.

🛡️ Rule 4: Don’t Marry Altcoins

In corrections, BTC dominance usually rises.

🛡️ Rule 5: Wait for Confirmation

Reversal candles + volume > hope.

This is

BTC3,51%

- Reward

- 7

- 10

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

Weekend Market Reality Check (BTC Near $60K)

The current market is not about chasing profits — it’s about staying alive. With BTC struggling around the $60K psychological zone, volatility is being used as a weapon to drain emotions and liquidity.

1️⃣ Survival Tactics: My Top Priority Right Now

Capital preservation > profit hunting

In a pullback-driven market:

I reduce leverage and exposure

I only engage at clear HTF demand zones

Cash is not fear — cash is optional power

Survival means staying liquid enough to act when real opportunities appear, not reacting to every red candle.

2️⃣ Mindset Bui

The current market is not about chasing profits — it’s about staying alive. With BTC struggling around the $60K psychological zone, volatility is being used as a weapon to drain emotions and liquidity.

1️⃣ Survival Tactics: My Top Priority Right Now

Capital preservation > profit hunting

In a pullback-driven market:

I reduce leverage and exposure

I only engage at clear HTF demand zones

Cash is not fear — cash is optional power

Survival means staying liquid enough to act when real opportunities appear, not reacting to every red candle.

2️⃣ Mindset Bui

BTC3,51%

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

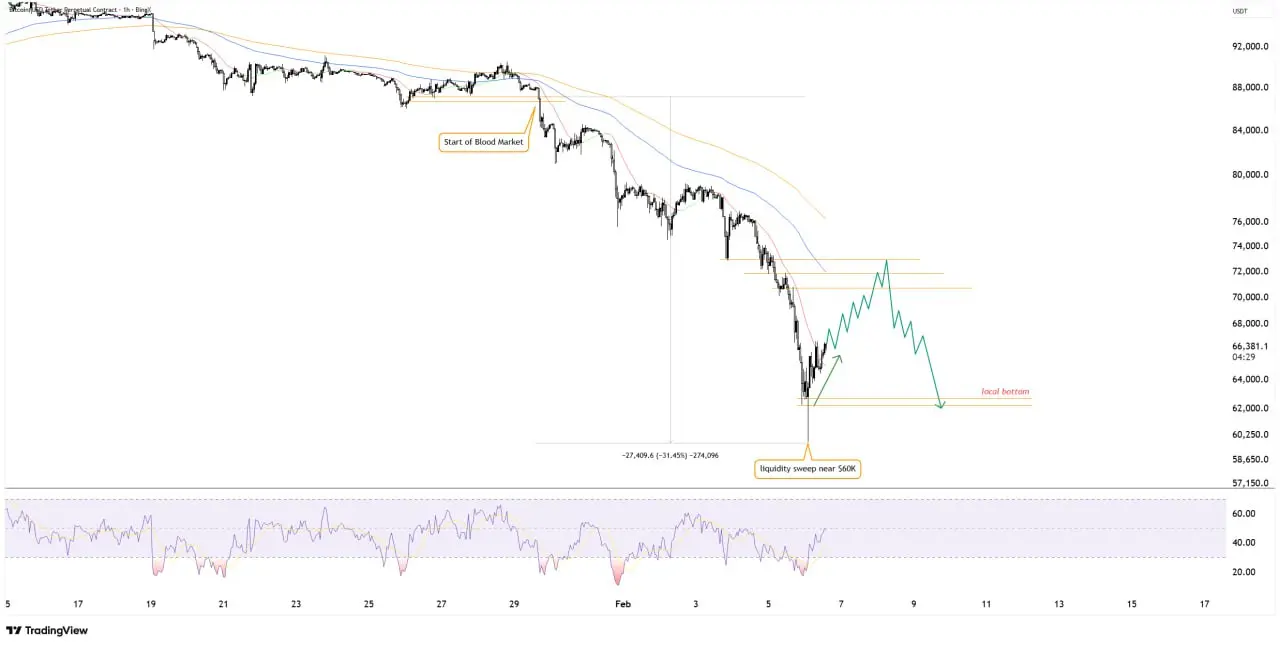

Bitcoin remains volatile, and current price action suggests the market has unfinished business on the downside. While short-term bounces are possible, the broader structure still leaves room for a deeper test.

My view: BTC may move toward the 75,000 USDT zone before the next meaningful reaction.

📉 Short-Term Outlook (Derivatives Traders)

The 75K area stands out as a major liquidity and reaction zone

If price reaches this level, I expect strong volatility and a tradable rejection

Strategy:

Wait patiently

Look for rejection signals near 75K

Consider short positions only af

Bitcoin remains volatile, and current price action suggests the market has unfinished business on the downside. While short-term bounces are possible, the broader structure still leaves room for a deeper test.

My view: BTC may move toward the 75,000 USDT zone before the next meaningful reaction.

📉 Short-Term Outlook (Derivatives Traders)

The 75K area stands out as a major liquidity and reaction zone

If price reaches this level, I expect strong volatility and a tradable rejection

Strategy:

Wait patiently

Look for rejection signals near 75K

Consider short positions only af

BTC3,51%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

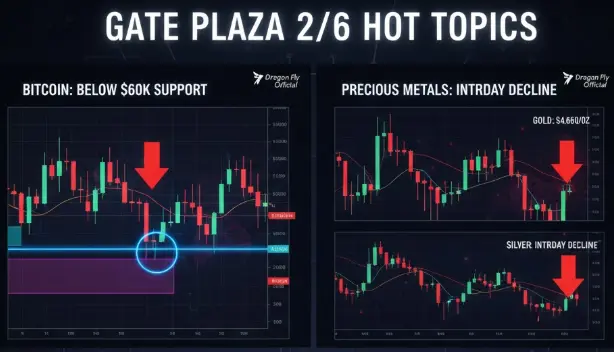

Thanks for sharing#WhyAreGoldStocksandBTCFallingTogether?

It’s not just crypto — gold and gold-related stocks are also taking a hit. Investors are asking: why are “safe havens” and high-beta assets falling at the same time?

1️⃣ Macro Pressure:

Rising U.S. interest rates, potential Fed hawkishness, and dollar strength are making both risk assets and commodities volatile. When the dollar rallies, gold often struggles despite being a safe-haven.

2️⃣ Risk-Off Sentiment:

Geopolitical uncertainty, including ongoing Middle East tensions, is pushing investors to liquidate positions across the board — not just crypto.

It’s not just crypto — gold and gold-related stocks are also taking a hit. Investors are asking: why are “safe havens” and high-beta assets falling at the same time?

1️⃣ Macro Pressure:

Rising U.S. interest rates, potential Fed hawkishness, and dollar strength are making both risk assets and commodities volatile. When the dollar rallies, gold often struggles despite being a safe-haven.

2️⃣ Risk-Off Sentiment:

Geopolitical uncertainty, including ongoing Middle East tensions, is pushing investors to liquidate positions across the board — not just crypto.

BTC3,51%

- Reward

- 5

- 6

- Repost

- Share

AngelEye :

:

Happy New Year! 🤑View More

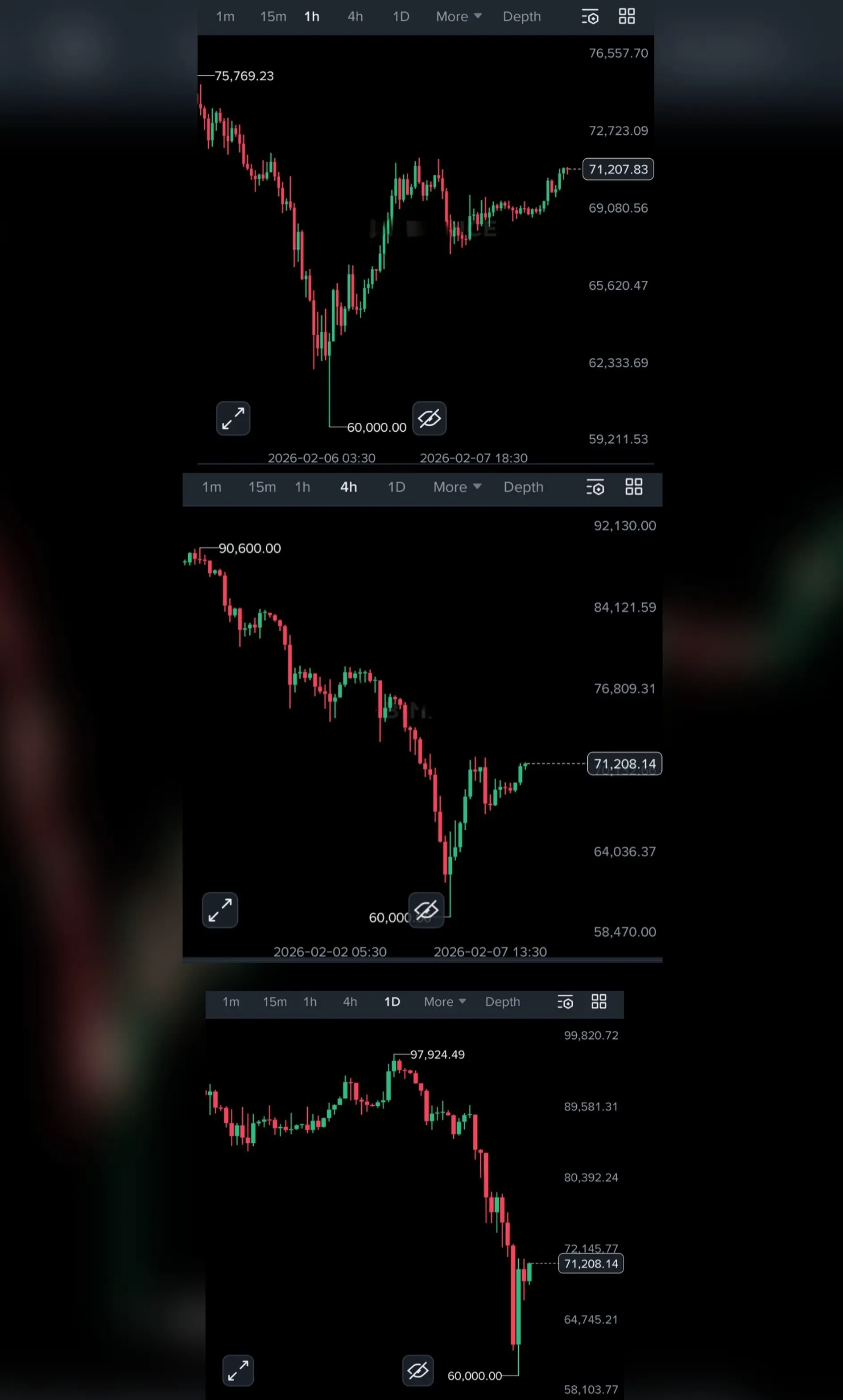

#CryptoMarketPullback #Bitcoin is showing strong short-term recovery momentum as price pushes higher after recent downside pressure.

📊 Market Data:

• Price: $70,172.4

• 24h Change: +$2,275.2 (+3.35%)

• 24h High: $70,794.0

• 24h Low: $67,608.9

• 24h Volume: 17.24K BTC

• 24h Turnover: $1.19B USDT

📈 Market Insight:

The rebound from the $67.6K low suggests active dip-buying and short covering. Strong volume confirms participation, but price is now testing the $70K–$71K resistance zone, which remains a key level to watch.

🔍 What to Watch Next:

• Holding above $69K–$70K may support continuation

•

📊 Market Data:

• Price: $70,172.4

• 24h Change: +$2,275.2 (+3.35%)

• 24h High: $70,794.0

• 24h Low: $67,608.9

• 24h Volume: 17.24K BTC

• 24h Turnover: $1.19B USDT

📈 Market Insight:

The rebound from the $67.6K low suggests active dip-buying and short covering. Strong volume confirms participation, but price is now testing the $70K–$71K resistance zone, which remains a key level to watch.

🔍 What to Watch Next:

• Holding above $69K–$70K may support continuation

•

BTC3,51%

- Reward

- 1

- 2

- Repost

- Share

AylaShinex :

:

Happy New Year! 🤑View More

#BuyTheDipOrWaitNow?

Gate Plaza 2/6 Hot Topics — Bottom-Fishing or Staying Cautious?

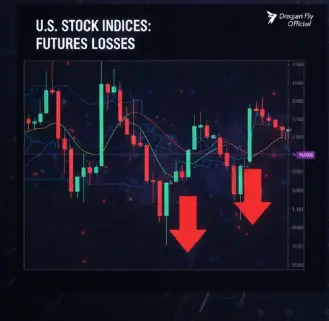

This morning, global risk markets plunged — Bitcoin dipped below $60,000, U.S. stock index futures extended losses, spot gold retreated to $4,660 per ounce, and silver fell by up to 9% intraday. Dragon Fly Official emphasizes that in such volatile conditions, understanding market structure, liquidity, and macro drivers is critical before making any move.

🎁 Fan Appreciation Benefits — Rewards Keep Increasing!

Post with a topic or #BTC trading pair for a chance to win one of 10 lucky draw prizes, each includin

Gate Plaza 2/6 Hot Topics — Bottom-Fishing or Staying Cautious?

This morning, global risk markets plunged — Bitcoin dipped below $60,000, U.S. stock index futures extended losses, spot gold retreated to $4,660 per ounce, and silver fell by up to 9% intraday. Dragon Fly Official emphasizes that in such volatile conditions, understanding market structure, liquidity, and macro drivers is critical before making any move.

🎁 Fan Appreciation Benefits — Rewards Keep Increasing!

Post with a topic or #BTC trading pair for a chance to win one of 10 lucky draw prizes, each includin

- Reward

- 3

- 3

- Repost

- Share

AYATTAC :

:

2026 GOGOGO 👊View More

#CryptoSurvivalGuide

#CryptoSurvivalGuide #BTC

BTC hovering around 60K is testing patience more than portfolios.

In pullbacks like this, survival > profit. Risk control becomes the real strategy.

I reduce size, avoid emotional entries, and wait for clear structure before acting.

No revenge trades, no panic dips — just discipline and levels.

Weekends often bring fake moves, so I’m watching candles, not headlines.

Do you lie flat, short, or prepare for a rebound here?

#CryptoSurvivalGuide #BTC

BTC hovering around 60K is testing patience more than portfolios.

In pullbacks like this, survival > profit. Risk control becomes the real strategy.

I reduce size, avoid emotional entries, and wait for clear structure before acting.

No revenge trades, no panic dips — just discipline and levels.

Weekends often bring fake moves, so I’m watching candles, not headlines.

Do you lie flat, short, or prepare for a rebound here?

BTC3,51%

- Reward

- 1

- Comment

- Repost

- Share

$BTC is showing hesitation into Sunday evening. Price wants to move higher, but external pressure is clearly capping momentum. The zone around 71k–72k has turned into a hard supply wall, with repeated rejections and visible sell pressure.

Right now, this is a compression battle, not a trend reversal.

Price is holding above the recent panic low near 60k, which keeps the broader structure alive.

However, upside attempts keep stalling at 71k–72k, confirming active distribution in this area.

If #BTC breaks and holds above 72k, this down-pressure gets absorbed and the path opens toward 77k–79k as a

Right now, this is a compression battle, not a trend reversal.

Price is holding above the recent panic low near 60k, which keeps the broader structure alive.

However, upside attempts keep stalling at 71k–72k, confirming active distribution in this area.

If #BTC breaks and holds above 72k, this down-pressure gets absorbed and the path opens toward 77k–79k as a

BTC3,51%

- Reward

- like

- Comment

- Repost

- Share

#当前行情抄底还是观望? $BTC

The cryptocurrency market has recently experienced significant volatility, with Bitcoin (BTC) seeing sharp movements across global markets. This morning, BTC briefly dipped below $60,000, alongside extended losses in U.S. stock futures, a retreat in spot gold to $4,660 per ounce, and silver plummeting by up to 9% intraday. These moves underscore the interconnectedness of crypto, traditional markets, and precious metals in times of risk-off sentiment. Traders and investors are left asking the crucial question: Is this the moment to buy the dip, or should we adopt a cautious w

The cryptocurrency market has recently experienced significant volatility, with Bitcoin (BTC) seeing sharp movements across global markets. This morning, BTC briefly dipped below $60,000, alongside extended losses in U.S. stock futures, a retreat in spot gold to $4,660 per ounce, and silver plummeting by up to 9% intraday. These moves underscore the interconnectedness of crypto, traditional markets, and precious metals in times of risk-off sentiment. Traders and investors are left asking the crucial question: Is this the moment to buy the dip, or should we adopt a cautious w

BTC3,51%

- Reward

- 10

- 12

- Repost

- Share

Ryakpanda :

:

Hold on tight, we're about to take off 🛫View More

📉 Why Are Gold, Gold Stocks, and Bitcoin Falling Together?

Recently, investors have observed an unusual phenomenon: traditional safe-haven assets like gold and gold stocks, along with Bitcoin (BTC), are declining simultaneously. Understanding why this is happening requires looking at macroeconomic trends and investor behavior.

💡 Key Factors Behind the Sell-Off:

Rising Interest Rates:

Central banks around the world have been raising interest rates to combat inflation. Higher interest rates make fixed-income assets like bonds more attractive, drawing capital away from gold and cryptocurrencies

Recently, investors have observed an unusual phenomenon: traditional safe-haven assets like gold and gold stocks, along with Bitcoin (BTC), are declining simultaneously. Understanding why this is happening requires looking at macroeconomic trends and investor behavior.

💡 Key Factors Behind the Sell-Off:

Rising Interest Rates:

Central banks around the world have been raising interest rates to combat inflation. Higher interest rates make fixed-income assets like bonds more attractive, drawing capital away from gold and cryptocurrencies

BTC3,51%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

155.83K Popularity

15.37K Popularity

395.17K Popularity

5.81K Popularity

17.51K Popularity

14.25K Popularity

15.5K Popularity

13.74K Popularity

62.62K Popularity

3.58K Popularity

23.13K Popularity

14.36K Popularity

26.58K Popularity

35.28K Popularity

29.55K Popularity

News

View MorePump.fun has accumulated a total buyback value of over $280 million in PUMP tokens.

9 m

Strategy Bitcoin Strategy Manager: Will Never Stop Buying Bitcoin

20 m

National Two Sessions Policy Preview Closed-Door Seminar: Recommend implementing a moderate overall interest rate cut, with at least 50 basis points or more for the entire year

21 m

If Bitcoin breaks through $73,000, the total liquidation strength of mainstream CEX open short positions will reach 482 million.

44 m

Based releases the BASED tokenomics: a total supply of 1 billion tokens, with 36% allocated to the community

1 h

Pin