# GOLD

233.47K

AngelEye

#MiddleEastTensionsEscalate 🌍

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

- Reward

- 7

- 8

- Repost

- Share

xxx40xxx :

:

2026 GOGOGO 👊View More

The Unstoppable Surge in Precious Metals

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

The weekend has brought an explosive move in the commodities market. As we observe the #Gold and Silver Reach New Highs trend, the breakout above $4,950 for Gold and $97 for Silver marks a significant structural shift in global finance.

🔍 Key Drivers of the Rally:

Geopolitical Risk Aversion: Rising tensions and trade frictions have triggered a "flight to safety," making Gold the ultimate hedge.

Monetary Policy Tailwinds: With markets pricing in Federal Reserve rate cuts, non-yielding assets like Gold and Silver are becoming more attractive compared to

- Reward

- 10

- 10

- Repost

- Share

BabaJi :

:

2026 GOGOGO 2026 👊View More

#MiddleEastTensionsEscalate 🌍

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

- Reward

- 5

- 5

- Repost

- Share

AngelEye :

:

2026 GOGOGO 👊View More

#GoldandSilverHitNewHighs

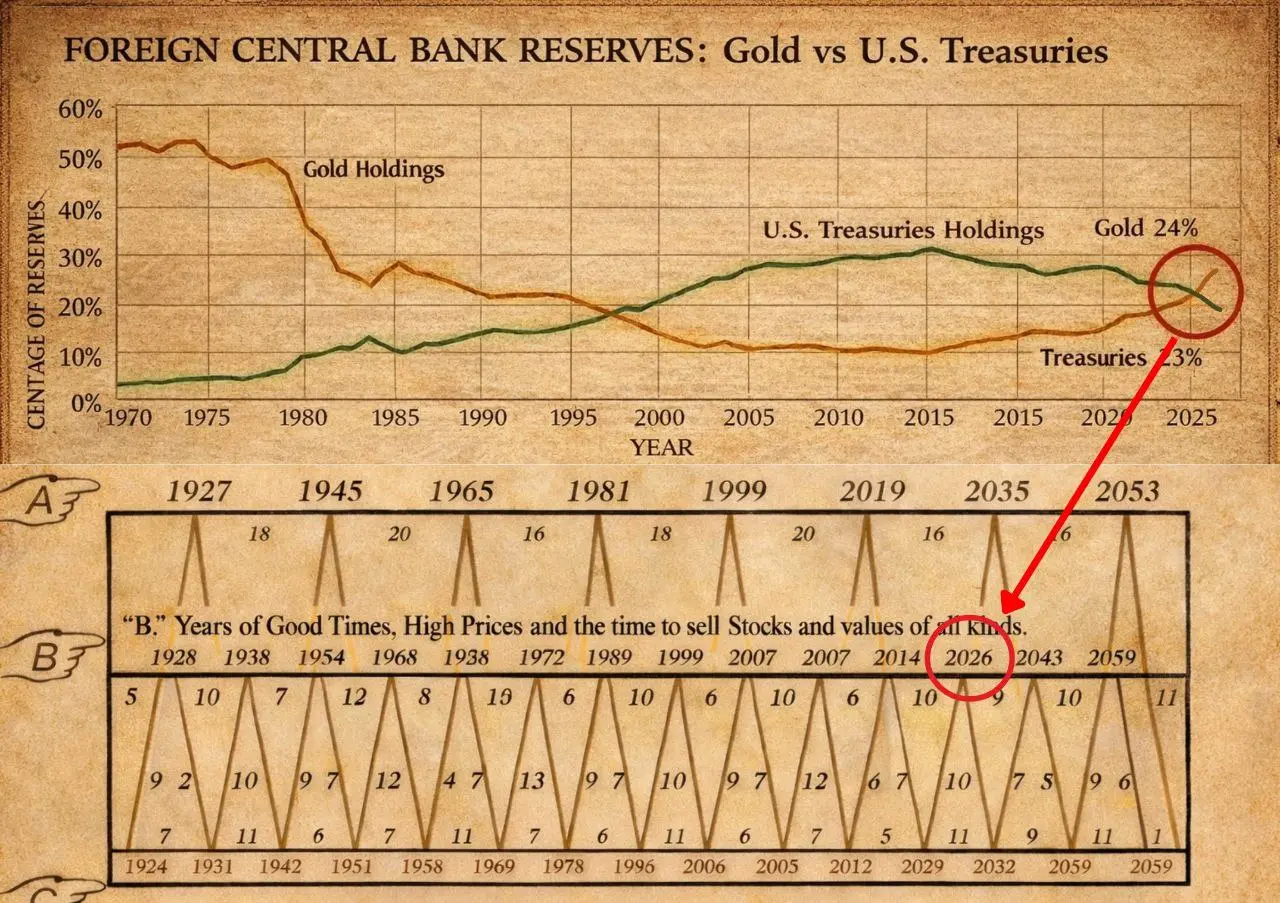

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

🚨#GOLD JUST FLIPPED THE DOLLAR FOR THE FIRST TIME IN 30 YEARS.. AND IT'S A GLOBAL RED FLAG ⚠️

The data is clear and the shift is massive. For the first time in three decades central banks now hold more gold than US debt. This is not a minor rebalancing. It is a global vote of no confidence in the dollar. Foreign holders are no longer chasing yield. They are protecting principal because treasuries can be seized inflated away or weaponized through sanctions.

Gold carries zero counterparty risk and that single feature has changed the entire reserve playbook. The moment

- Reward

- 11

- 13

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate 🌍

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

- Reward

- 1

- Comment

- Repost

- Share

#BitcoinFallsBehindGold

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

Bitcoin is underperforming gold as investors reassess risk amid rising global uncertainty. While gold continues to attract strong inflows as a traditional safe-haven asset, Bitcoin’s momentum has slowed, highlighting a divergence between digital assets and hard assets in the current market cycle.

Gold’s strength is being driven by macroeconomic stress, geopolitical risks, expectations of interest rate cuts, and sustained central bank buying. In contrast, Bitcoin—often referred to as “digital gold”—is still viewed by many investors as a risk-on asset, making it more sens

BTC1,29%

- Reward

- 4

- 5

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

#GoldandSilverHitNewHighs

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

✨ Ride the Bull: Gold & Silver Shatter Records! 🚀

The market is witnessing a historic surge! With Spot Gold smashing through $4,950/ounce and Silver soaring past $97/ounce, the "safe haven" trade has turned into a high-speed chase. As risk aversion takes the driver's seat, precious metals are proving why they remain the ultimate hedge in a volatile economy.

Whether you are a seasoned commodity trader or just caught your first wave of the gold rush, now is the time to share your strategy!

🎁 Exclusive Weekend Benefits: Join the Conversation!

Gate Plaza is celebrating

- Reward

- 3

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

⚠️ US Government Shutdown Risk Spikes to 81%

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

Polymarket now shows an 81% probability of a US government shutdown — political & fiscal uncertainty is back on the table.

📉 If a shutdown happens:

Short-term market volatility spikes

Gold & Silver benefit as safe havens

Crypto reacts mixed: initial risk-off, but potential inflows as alternative hedge

📈 If avoided:

Risk assets like BTC & stocks may rally on relief

Dollar stability could slow safe-haven flows

💡 Markets are watching Washington closely — headline risk is alive.

Are you hedging or staying risk-on?

#USGovShutdown #CryptoMarket #BTC #G

BTC1,29%

- Reward

- 2

- 1

- Repost

- Share

CryptoChampion :

:

2026 GOGOGO 👊- Reward

- 1

- 1

- Repost

- Share

deltapro :

:

Sony will postpone the release of the PS6 to 2029 due to a shortage of RAM, the price will become much higher, - media.Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

53.95K Popularity

13.29K Popularity

12.61K Popularity

5.89K Popularity

4.95K Popularity

5.15K Popularity

4.6K Popularity

4.34K Popularity

70.01K Popularity

113.03K Popularity

79.72K Popularity

20.19K Popularity

46.77K Popularity

41.07K Popularity

176.31K Popularity

News

View MoreData: 27 million OP tokens transferred from anonymous addresses, worth approximately $8.1 million

12 m

Euro first breaks above 1.2, Trump's speech triggers massive stop-losses

32 m

U.S. stocks close with mixed gains and losses; Micron Technology rises over 5%

1 h

US Dollar Index (DXY) short-term declines by over 50 points, Trump signals a weak dollar

2 h

US Dollar Index (DXY) falls below 96, hitting a new low since 2022

2 h

Pin