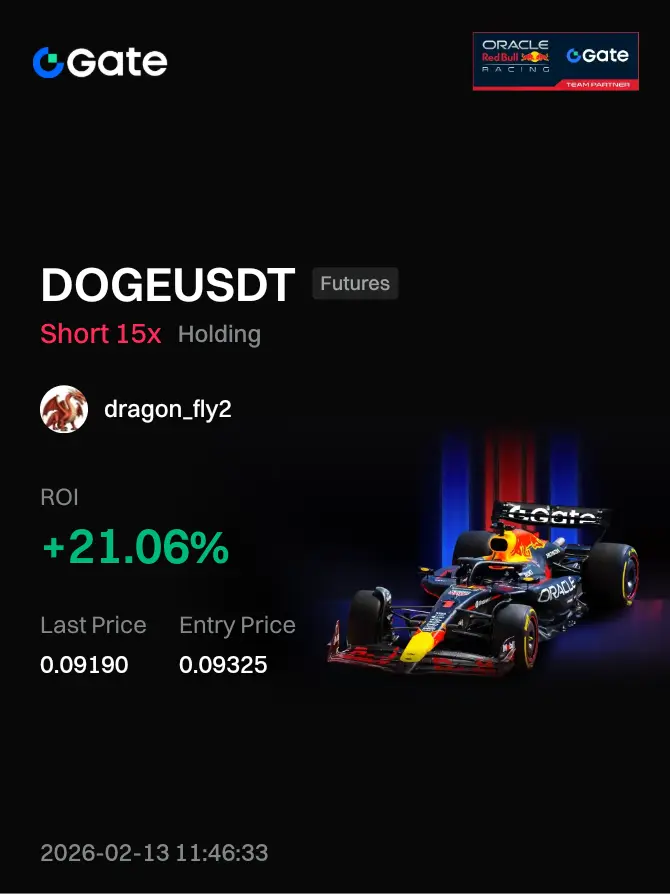

#GateSquare$50KRedPacketGiveaway 🎉 Kick Off the New Year with a Massive Win on Gate Square!

💰 $50,000 Red Packet Rain Is LIVE — Your Fortune Starts Here!

New Year, new opportunities, new rewards! Gate Square is launching 2026 with one of its biggest community events ever — the $50,000 Red Packet Rain.

This isn’t just a giveaway — it’s a full-scale celebration where every post, interaction, and creative contribution can earn you real crypto rewards. Whether you’re a new user or a seasoned creator, there’s something for everyone.

👉 Join now: Gate Square Campaign

🧧 Three Reward Tracks Designed for Maximum Participation

Gate Square’s New Year event is thoughtfully structured to reward engagement, creativity, and loyalty. Here’s how you can maximize your rewards:

1️⃣ $50,000 Red Packet Rain – Guaranteed Wins for New Users

This is the flagship event, designed to kickstart the year with a bang:

• Total prize pool: $50,000 in GT

• 100% win rate for new users

• Rewards: Up to 28 GT per post

• How to participate: Simply post content to earn your red packet

• Encourages activity while giving newcomers instant rewards

It’s a simple, fun way to get started in the community, earn crypto, and feel the festive spirit immediately.

2️⃣ New Year Lucky Winner – Post & Win Exclusive Gifts

Feeling lucky? This track adds a social and viral element to the celebration:

• Post with the hashtag:

#CelebratingNewYearOnGateSquare • Win 50 GT plus an exclusive New Year gift box

• Boost your visibility in the community while earning rewards

• Helps create momentum and trending engagement for the campaign

This is perfect for users who love to mix creativity with rewards.

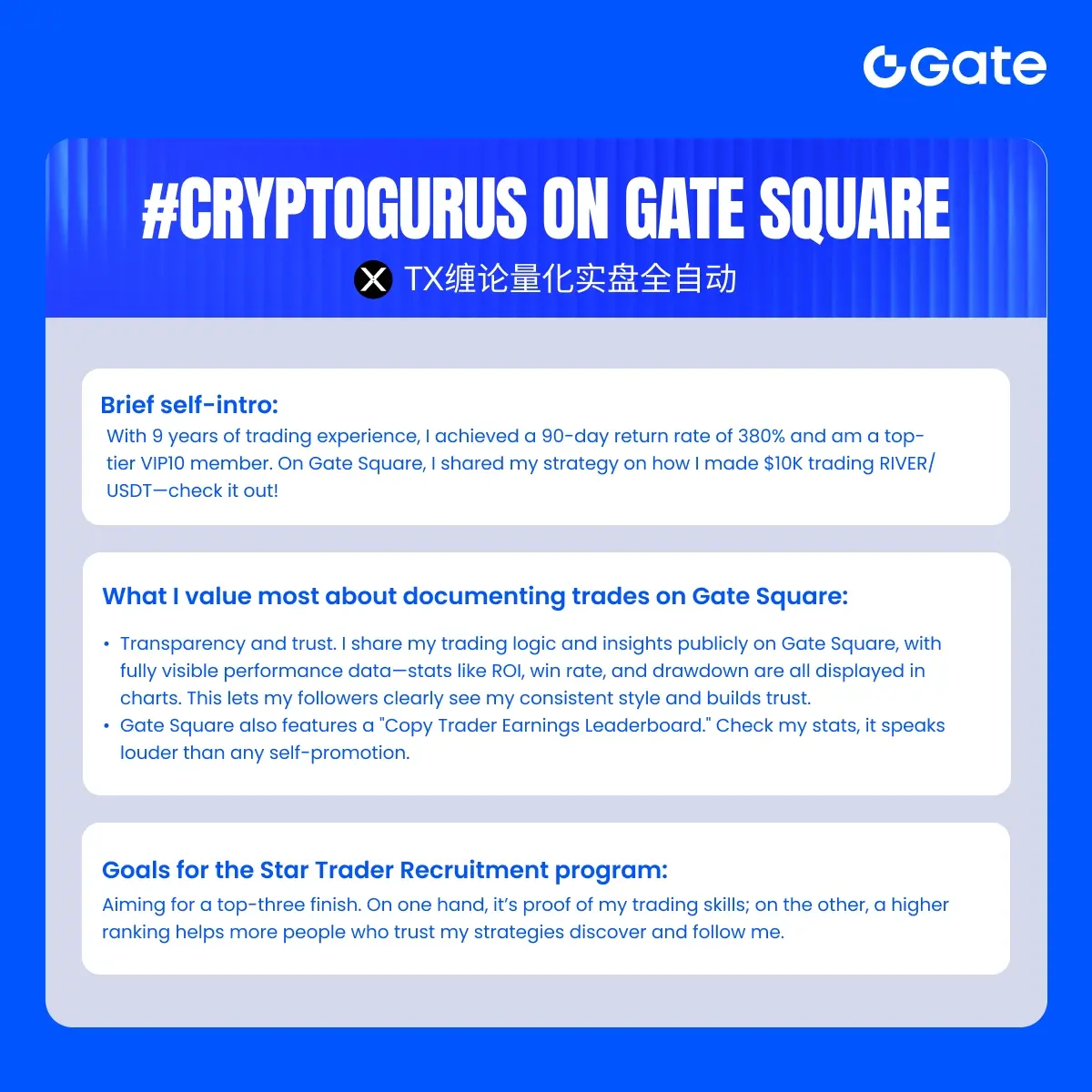

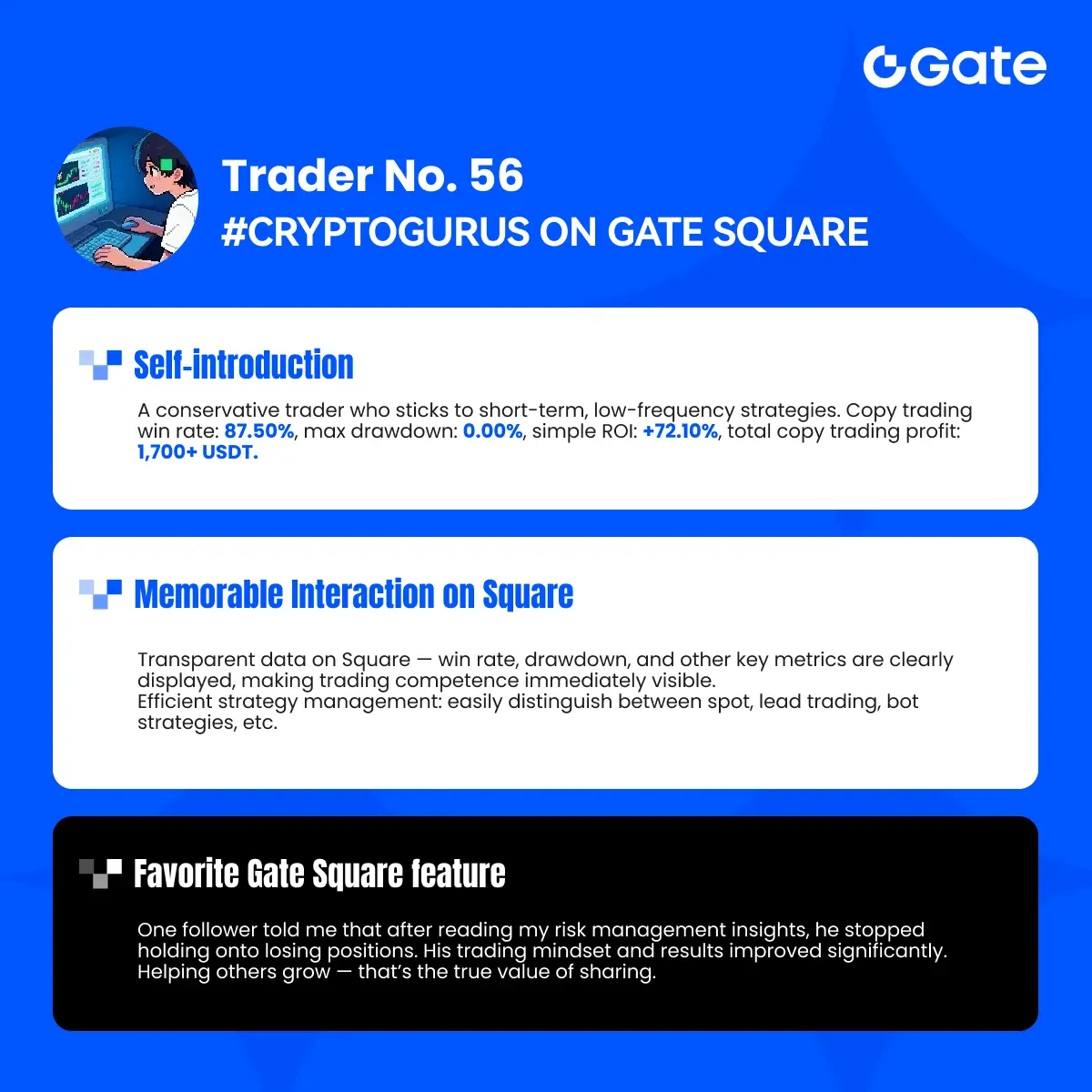

3️⃣ Creator Leaderboard – Compete for Exclusive Prizes

For content creators and power users, the Leaderboard is where skill, consistency, and engagement pay off:

Top performers can win:

• Official Inter Milan jerseys

• Limited-edition Red Bull co-branded jackets

• Special NFT-style prizes or exclusive collectibles

The leaderboard gamifies engagement, rewarding consistent posting, creativity, and influence.

📅 Event Duration & Timeline

🗓 Start: February 9, 2026, 09:00 UTC

🗓 End: February 23, 2026, 16:00 UTC

• Two-week window of high-energy activity

• Early participation can improve your chances of winning larger rewards

• Reward pools are limited — first movers often benefit most

📲 How to Participate

• The web platform is fully live

• App users: Update to version 8.8.0+

• Make sure your account is verified and eligible

• For full instructions and rules: Gate Square Announcement

🚀 Why This Event Is Bigger Than a Giveaway

This is not just about free GT. The Red Packet Rain is strategically designed to:

• Strengthen community engagement — bringing new users into the ecosystem

• Drive ecosystem activity — more posts, discussions, and interactions

• Reward creators and participants — not just random luck

• Encourage long-term retention — build habits that keep users active beyond the campaign

In short: celebration meets strategy.

🎯 Pro Tips to Maximize Your Rewards

Post frequently – every post counts toward rewards

Use trending hashtags – especially Engage with other users – comments, shares, and likes can boost visibility

Track reward pools – early participation is key before caps are reached

Mix content types – text posts, images, and short videos often perform best

Consistency and creativity = maximum reward potential.

📈 Engagement & Community Strategy

• New users: Guaranteed wins build trust and confidence

• Experienced users: Compete on Leaderboard for premium rewards

• Creators: Earn recognition, exclusive collectibles, and visibility

• Everyone benefits: More posts = more GT flowing in the ecosystem

The campaign is designed for exponential engagement — the more active the community, the more fun, visibility, and rewards everyone gets.

💡 Final Thoughts

The $50,000 Red Packet Rain is more than just a New Year giveaway — it’s:

• A community celebration

• A strategy to onboard and engage users

• A chance to earn real crypto rewards instantly

• A platform to showcase creativity and skill

Celebrate. Participate. Earn.

Don’t miss your chance to kick off 2026 with a big win on Gate Square!