# CryptoMarketStructureUpdate

18.08K

Luna_Star

#CryptoMarketStructureUpdate

The crypto market continues to evolve at a rapid pace, and today’s structural update highlights both the resilience and fragility within the ecosystem. Price swings, liquidity shifts, and changing participant behavior are reshaping the way traders and investors approach risk. Understanding market structure isn’t just about charts it’s about flows, sentiment, network activity, and regulatory signals all converging to influence asset performance.

From a macro perspective, the market has entered a phase of selective rotation. High-cap coins, certain DeFi protocols,

The crypto market continues to evolve at a rapid pace, and today’s structural update highlights both the resilience and fragility within the ecosystem. Price swings, liquidity shifts, and changing participant behavior are reshaping the way traders and investors approach risk. Understanding market structure isn’t just about charts it’s about flows, sentiment, network activity, and regulatory signals all converging to influence asset performance.

From a macro perspective, the market has entered a phase of selective rotation. High-cap coins, certain DeFi protocols,

DEFI-4,2%

- Reward

- 4

- 5

- Repost

- Share

HighAmbition :

:

HODL Tight 💪View More

#CryptoMarketStructureUpdate

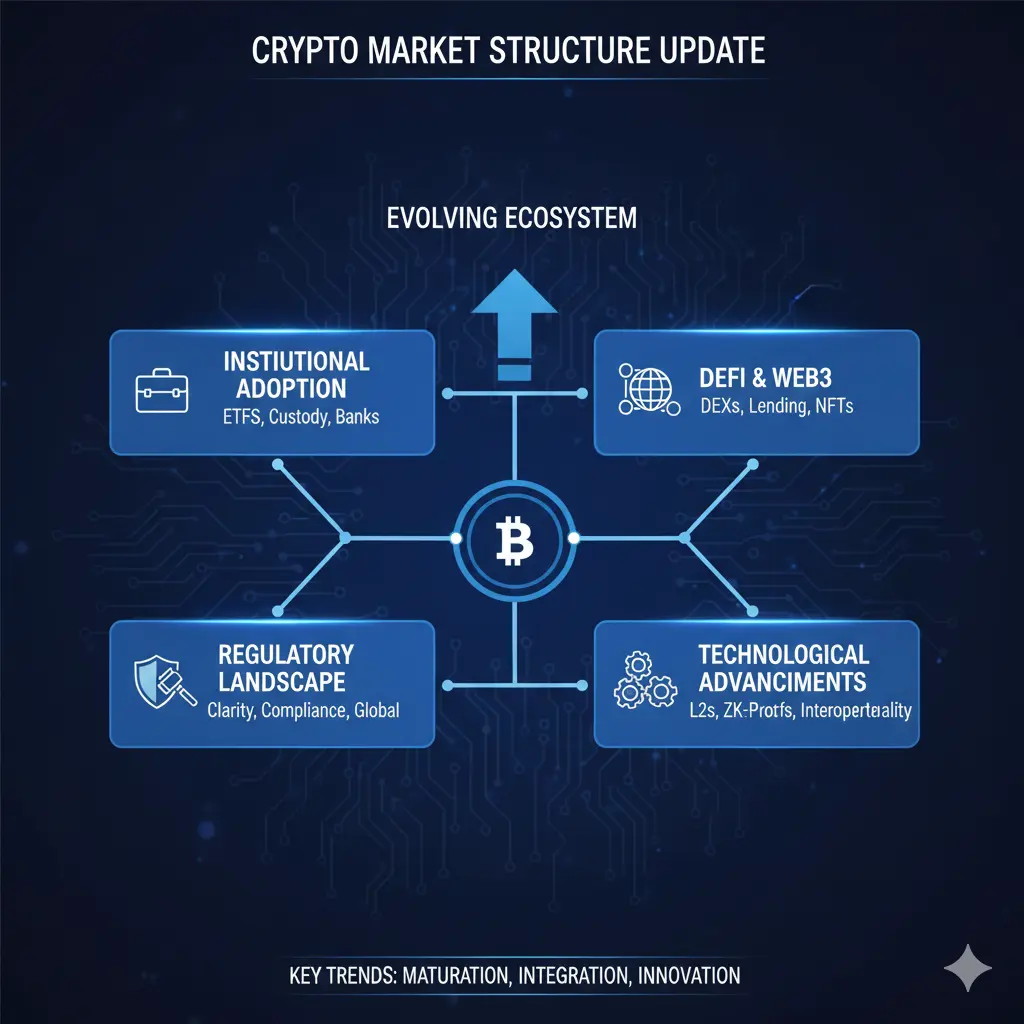

Crypto Market Structure Update

The crypto market structure is going through a critical transition phase. After years of extreme volatility driven by leverage hype cycles and sudden liquidity injections the market is slowly maturing. This update focuses on how structure liquidity and behavior are evolving and what it means for traders investors and long term participants.

Current Market Structure Overview

At present the crypto market is moving within a broad consolidation range. Bitcoin continues to act as the structural anchor for the entire market while altcoins

Crypto Market Structure Update

The crypto market structure is going through a critical transition phase. After years of extreme volatility driven by leverage hype cycles and sudden liquidity injections the market is slowly maturing. This update focuses on how structure liquidity and behavior are evolving and what it means for traders investors and long term participants.

Current Market Structure Overview

At present the crypto market is moving within a broad consolidation range. Bitcoin continues to act as the structural anchor for the entire market while altcoins

BTC-2,62%

- Reward

- 4

- 7

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Hold on tight, we're about to take off 🛫View More

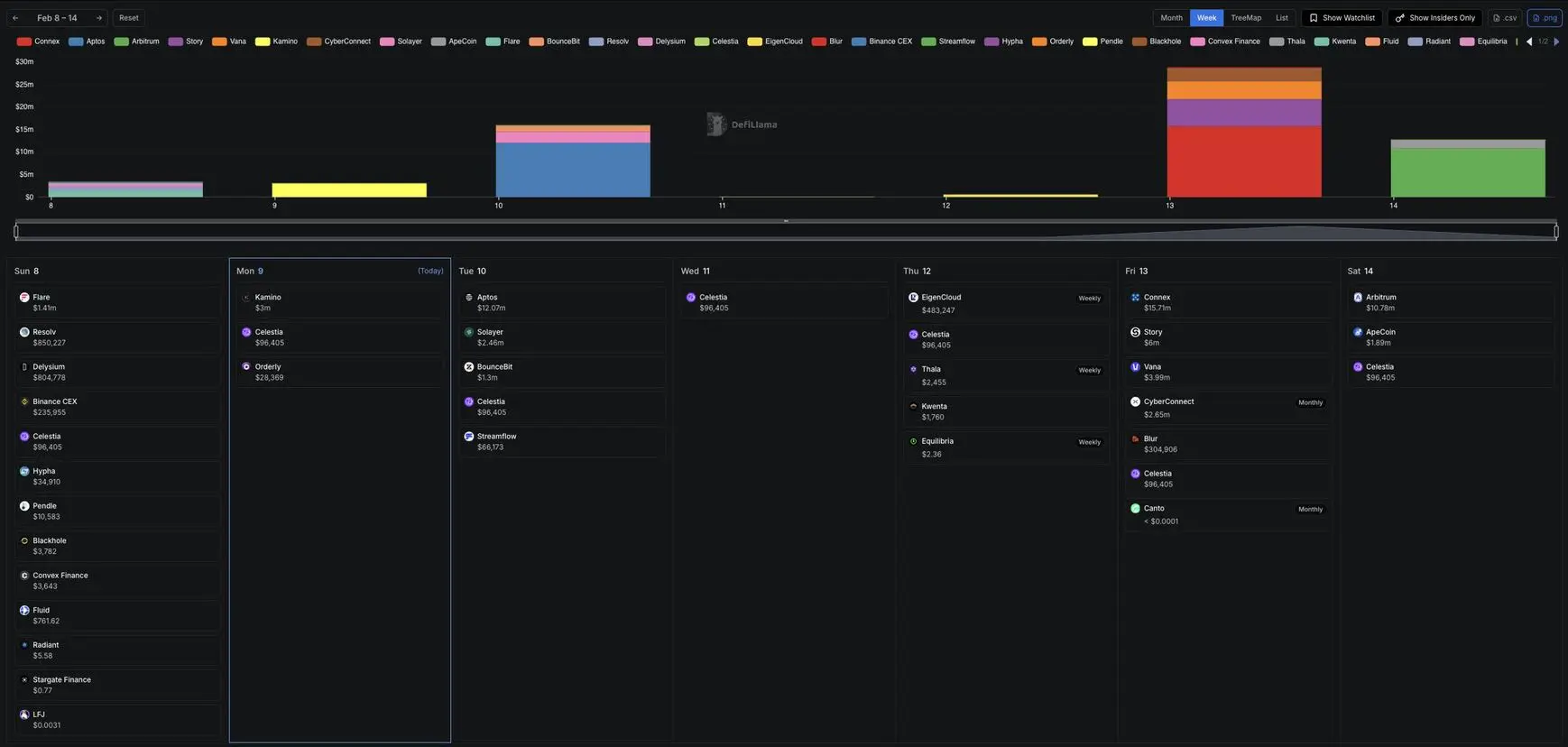

🚨 UPDATE: Over $64M worth of tokens will be unlocked this week, per DefiLlama.

The largest will be $15.71M unlocked by $CONX on February 13.

#BuyTheDipOrWaitNow?

#BitcoinBouncesBack

#BTCMiningDifficultyDrops

#TopCoinsRisingAgainsttheTrend

#CryptoMarketStructureUpdate $BTC

The largest will be $15.71M unlocked by $CONX on February 13.

#BuyTheDipOrWaitNow?

#BitcoinBouncesBack

#BTCMiningDifficultyDrops

#TopCoinsRisingAgainsttheTrend

#CryptoMarketStructureUpdate $BTC

BTC-2,62%

- Reward

- 2

- Comment

- Repost

- Share

#CryptoMarketStructureUpdate

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 1

- Comment

- Repost

- Share

#Bitcoin Sunday Analysis 📉

$BTC is still trading below 72k, with only a few hours left before the weekly candle closes. If we close below this level, Bitcoin officially enters the accumulation zone between 54k and 72k. The daily candle has already closed inside this range. As I mentioned earlier, I expect price to trade within this box for weeks, possibly months.

The 72k level was critical, which is why I opened a long there. My expectation was a bounce leading to a move toward 80k to 85k. That plan failed, and I accept that I was wrong. For any meaningful recovery, Bitcoin must reclaim 72k a

$BTC is still trading below 72k, with only a few hours left before the weekly candle closes. If we close below this level, Bitcoin officially enters the accumulation zone between 54k and 72k. The daily candle has already closed inside this range. As I mentioned earlier, I expect price to trade within this box for weeks, possibly months.

The 72k level was critical, which is why I opened a long there. My expectation was a bounce leading to a move toward 80k to 85k. That plan failed, and I accept that I was wrong. For any meaningful recovery, Bitcoin must reclaim 72k a

BTC-2,62%

- Reward

- 10

- 16

- Repost

- Share

Luna_Star :

:

2026 GOGOGO 👊View More

#CryptoMarketStructureUpdate

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 10

- 11

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#CryptoMarketStructureUpdate

Updates to crypto market structure are reshaping trading landscapes. Regulatory frameworks in the EU and US emphasize transparency, with MiCA enforcing stablecoin rules.

Exchanges adopt advanced surveillance to combat manipulation. Decentralized order books gain traction, reducing centralization risks.

Institutional inflows via ETFs alter liquidity dynamics. This evolution promotes maturity, attracting more capital.

Stay updated on compliance changes; they define the market's next phase.

Updates to crypto market structure are reshaping trading landscapes. Regulatory frameworks in the EU and US emphasize transparency, with MiCA enforcing stablecoin rules.

Exchanges adopt advanced surveillance to combat manipulation. Decentralized order books gain traction, reducing centralization risks.

Institutional inflows via ETFs alter liquidity dynamics. This evolution promotes maturity, attracting more capital.

Stay updated on compliance changes; they define the market's next phase.

- Reward

- 24

- 35

- Repost

- Share

GateUser-68291371 :

:

Vibe at 1000x 🤑View More

#CryptoMarketStructureUpdate

Crypto Market Structure Update , Capital Flows, and Strategic Implications February 2026

The crypto market in February 2026 is navigating a complex and evolving structure characterized by divergent asset behavior, macro-driven volatility, and selective capital rotation. While Bitcoin has experienced significant downward pressure, falling below $65,000 from prior highs near $70,000, and Ethereum shows signs of stress amid network congestion and rising gas costs, certain altcoins, Layer 2 protocols, and utility-driven tokens are demonstrating resilience. Understand

Crypto Market Structure Update , Capital Flows, and Strategic Implications February 2026

The crypto market in February 2026 is navigating a complex and evolving structure characterized by divergent asset behavior, macro-driven volatility, and selective capital rotation. While Bitcoin has experienced significant downward pressure, falling below $65,000 from prior highs near $70,000, and Ethereum shows signs of stress amid network congestion and rising gas costs, certain altcoins, Layer 2 protocols, and utility-driven tokens are demonstrating resilience. Understand

- Reward

- 10

- 10

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

#CryptoMarketStructureUpdate

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

1. Overall Trend Framework

The crypto market remains in a broader corrective phase, where prices are generally pulling back from recent highs. This doesn’t automatically mean a full bear trend, but it does reflect persistent selling pressure and shifting sentiment.

Within this structure:

Tops are being lowered in many assets

Pullbacks are deeper and longer than typical intra‑trend retracements

Support zones are being tested multiple times

This kind of structure suggests near‑term uncertainty and a market waiting for clear directional confirmation.

2. Support & Res

- Reward

- 18

- 26

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊View More

#CryptoMarketStructureUpdate

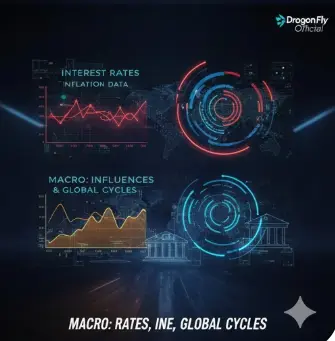

Crypto markets continue to evolve, and understanding their structure is more important than ever. From Dragon Fly Official’s perspective, market behavior in Bitcoin, Ethereum, and major altcoins is no longer driven solely by headlines or speculation. Instead, macro liquidity, trading flows, and structural dynamics are shaping both short-term volatility and medium-term trends.

Bitcoin and Ethereum are currently moving within clearly defined liquidity zones. Support and resistance levels are not just technical lines; they represent areas where capital accumulates or

Crypto markets continue to evolve, and understanding their structure is more important than ever. From Dragon Fly Official’s perspective, market behavior in Bitcoin, Ethereum, and major altcoins is no longer driven solely by headlines or speculation. Instead, macro liquidity, trading flows, and structural dynamics are shaping both short-term volatility and medium-term trends.

Bitcoin and Ethereum are currently moving within clearly defined liquidity zones. Support and resistance levels are not just technical lines; they represent areas where capital accumulates or

- Reward

- 5

- 5

- Repost

- Share

Lock_433 :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

185.74K Popularity

45.63K Popularity

8.06K Popularity

5.39K Popularity

3.87K Popularity

2.88K Popularity

4.07K Popularity

133 Popularity

13.96K Popularity

3.54K Popularity

2.26K Popularity

2.03K Popularity

71.08K Popularity

18.08K Popularity

37.52K Popularity

News

View MoreSky Protocol repurchased 31 million SKY tokens last week

8 m

Data: 44,600 SOL transferred from an anonymous address, routed through a relay, and then flowed into another anonymous address

10 m

Bitmine disclosed that it has pledged 2,897,459 ETH, valued at $6.2 billion.

16 m

Farcaster co-founder Varun Srinivasan announces joining the stablecoin chain Tempo

26 m

U.S. stocks open lower, Dow Jones down 0.14%, Google's parent company plans to issue bonds to raise $15 billion

47 m

Pin