Post content & earn content mining yield

placeholder

LittleQueen

#CryptoMarketPullback #CryptoMarketPullback

The crypto market pullback is once again reminding everyone that volatility is not a weakness of this space. It is part of its nature. Every major cycle in digital assets has included periods where prices retreat, confidence is tested, and narratives shift. What matters most during these phases is not the size of the pullback, but how the market behaves while it unfolds.

A pullback is not the same as a collapse. It is a reset. Markets move in waves, and after strong advances or extended optimism, price naturally searches for balance. This process cle

The crypto market pullback is once again reminding everyone that volatility is not a weakness of this space. It is part of its nature. Every major cycle in digital assets has included periods where prices retreat, confidence is tested, and narratives shift. What matters most during these phases is not the size of the pullback, but how the market behaves while it unfolds.

A pullback is not the same as a collapse. It is a reset. Markets move in waves, and after strong advances or extended optimism, price naturally searches for balance. This process cle

BTC-2,97%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊【$STRK Signal】Short Position + Weak Consolidation Awaiting Breakdown

$STRK is consolidating weakly near a key support level, showing a continuation of the downtrend.

🎯 Direction: Short

Market Logic: The price is oscillating narrowly around 0.0495, but the 4H chart has closed below the previous low consecutively, indicating a weakening structure. Key data points to a bearish dominance: Taker Volume shows persistent active selling, the funding rate is negative indicating a cost advantage for shorts, and the buy/sell ratio remains below 0.5, confirming a lack of active buying interest in the m

View Original$STRK is consolidating weakly near a key support level, showing a continuation of the downtrend.

🎯 Direction: Short

Market Logic: The price is oscillating narrowly around 0.0495, but the 4H chart has closed below the previous low consecutively, indicating a weakening structure. Key data points to a bearish dominance: Taker Volume shows persistent active selling, the funding rate is negative indicating a cost advantage for shorts, and the buy/sell ratio remains below 0.5, confirming a lack of active buying interest in the m

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? A Smart Investor’s Dilemma in Uncertain Markets

Market pullbacks always revive one big question among investors: Is this the right time to buy the dip, or should we wait for more clarity? With volatility dominating both traditional and crypto markets, the decision is far from simple. Understanding market context, risk tolerance, and strategy is crucial before making a move.

Buying the dip has long been considered a proven strategy. The idea is simple: when prices fall due to fear or temporary uncertainty, long-term investors step in to accumulate assets at discounted level

Market pullbacks always revive one big question among investors: Is this the right time to buy the dip, or should we wait for more clarity? With volatility dominating both traditional and crypto markets, the decision is far from simple. Understanding market context, risk tolerance, and strategy is crucial before making a move.

Buying the dip has long been considered a proven strategy. The idea is simple: when prices fall due to fear or temporary uncertainty, long-term investors step in to accumulate assets at discounted level

- Reward

- like

- Comment

- Repost

- Share

特斯马

TSM

Created By@NorthWarm

Listing Progress

100.00%

MC:

$15.8K

Create My Token

Crypto Winter: The era when legends are born amidst the coldest times

View Original- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? Crypto Trading Risks

Trading crypto is not as easy as it looks.

Risks You Should Know

- Prices change fast – gains can turn into losses quickly.

- Scams exist – many coins are unsafe or fake.

- Stressful decisions – emotions often lead to mistakes.

- Security problems – hacks and exchange failures can cost you money.

Stay Careful

Always learn first, set clear limits, and only invest what you can afford to lose.

---

👉 For more simple tips and honest crypto education, follow our account and stay safe in the market!

Trading crypto is not as easy as it looks.

Risks You Should Know

- Prices change fast – gains can turn into losses quickly.

- Scams exist – many coins are unsafe or fake.

- Stressful decisions – emotions often lead to mistakes.

- Security problems – hacks and exchange failures can cost you money.

Stay Careful

Always learn first, set clear limits, and only invest what you can afford to lose.

---

👉 For more simple tips and honest crypto education, follow our account and stay safe in the market!

- Reward

- 1

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF 🌐 Bitwise Files for Spot Uniswap ETF — Bringing DeFi Governance to Traditional Portfolios

On February 5, 2026, Bitwise Asset Management took a landmark step in regulated crypto investment products by filing with the U.S. Securities and Exchange Commission (SEC) for the Bitwise Uniswap ETF. If approved, it would become the world’s first spot exchange-traded fund tracking UNI, the governance token of Uniswap, the largest decentralized exchange (DEX) in the Ethereum ecosystem.

The filing, submitted under Form S-1, outlines a simple, regulator-friendly structure. The ET

On February 5, 2026, Bitwise Asset Management took a landmark step in regulated crypto investment products by filing with the U.S. Securities and Exchange Commission (SEC) for the Bitwise Uniswap ETF. If approved, it would become the world’s first spot exchange-traded fund tracking UNI, the governance token of Uniswap, the largest decentralized exchange (DEX) in the Ethereum ecosystem.

The filing, submitted under Form S-1, outlines a simple, regulator-friendly structure. The ET

- Reward

- 2

- Comment

- Repost

- Share

High Volatility in BTC/ETH/SOL —washout or trend reversal

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$ETH 1-Hour timeframe shows a strong rebound followed by consolidation at high levels, with prices trading above the key resistance zone, indicating a stable short-term bullish pattern.

Ethereum Holy Operation Core Strategy:

Primarily buy on dips, cautiously chase shorts during sharp rallies.

Specific Trading Plan:

Bearish Strategy

Rebound Shorting: When prices rebound to the 2120-2150 resistance zone and show signs of stalling with a doji or similar candle, initiate partial shorts | Target: 30-120 points+

Breakdown Short: When prices break below the 2000 support level, follow the trend and sh

Ethereum Holy Operation Core Strategy:

Primarily buy on dips, cautiously chase shorts during sharp rallies.

Specific Trading Plan:

Bearish Strategy

Rebound Shorting: When prices rebound to the 2120-2150 resistance zone and show signs of stalling with a doji or similar candle, initiate partial shorts | Target: 30-120 points+

Breakdown Short: When prices break below the 2000 support level, follow the trend and sh

ETH-1,36%

- Reward

- like

- Comment

- Repost

- Share

$SIREN #BuyTheDipOrWaitNow? Here is a comprehensive, in-depth K-line analysis of the SIREN/USDT perpetual futures chart.

The analysis covers the current technical setup, indicator readings, and multiple potential future scenarios.

1. Current Chart Overview & Context

· Instrument: SIRENUSDT Perpetual Futures.

· Current Price: 0.25718 USDT.

· Extreme Short-Term Move: The chart displays a massive +179.97% surge. This indicates a highly volatile, likely news-driven or breakout event, moving from a very low base (potentially around 0.09).

· Visible Candles: The chart shows a sharp rally, a pullba

The analysis covers the current technical setup, indicator readings, and multiple potential future scenarios.

1. Current Chart Overview & Context

· Instrument: SIRENUSDT Perpetual Futures.

· Current Price: 0.25718 USDT.

· Extreme Short-Term Move: The chart displays a massive +179.97% surge. This indicates a highly volatile, likely news-driven or breakout event, moving from a very low base (potentially around 0.09).

· Visible Candles: The chart shows a sharp rally, a pullba

SIREN207,16%

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? Markets got hit hard today. Bitcoin slipped below $60K, U.S. stocks weakened, gold pulled back, and silver crashed sharply.

So the real question is: is this the bottom… or just another leg down?

In my view, this move is driven by macro pressure and liquidity stress. When leverage unwinds and risk appetite disappears, everything sells off together — crypto, stocks, and even metals.

Am I rushing to bottom-fish? No.

Strong bottoms usually come with stabilization, volume confirmation, and failed sell-offs, not pure panic.

Recently, I’ve stayed defensive, avoided overexposure,

So the real question is: is this the bottom… or just another leg down?

In my view, this move is driven by macro pressure and liquidity stress. When leverage unwinds and risk appetite disappears, everything sells off together — crypto, stocks, and even metals.

Am I rushing to bottom-fish? No.

Strong bottoms usually come with stabilization, volume confirmation, and failed sell-offs, not pure panic.

Recently, I’ve stayed defensive, avoided overexposure,

BTC-2,97%

- Reward

- 1

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? $SOL Update — Buy the Dip or Wait? 🚀💧

SOL is consolidating between $84.20 – $89.21, indecision visible across 4H, 1H, and 15-min charts.

Key Levels:

Resistance: 89.21 – 89.46

Support: 84.20 – 84.31

Midline Balance: 86.88

Scenarios:

Bullish Break >88.59 → Target 89.21+ / Stop <87.30

Bearish Break <86.86 → Target 85.50 / Stop >88.18

Range Bounce → Trade near 84.20 / Reject near 89.21

Watch volume spikes, MACD crossovers, and reaction at key order blocks (84.20–84.82 & 88.59–89.21).

Patience and confirmation > chasing moves. 📊

SOL is consolidating between $84.20 – $89.21, indecision visible across 4H, 1H, and 15-min charts.

Key Levels:

Resistance: 89.21 – 89.46

Support: 84.20 – 84.31

Midline Balance: 86.88

Scenarios:

Bullish Break >88.59 → Target 89.21+ / Stop <87.30

Bearish Break <86.86 → Target 85.50 / Stop >88.18

Range Bounce → Trade near 84.20 / Reject near 89.21

Watch volume spikes, MACD crossovers, and reaction at key order blocks (84.20–84.82 & 88.59–89.21).

Patience and confirmation > chasing moves. 📊

SOL-1,91%

- Reward

- 1

- Comment

- Repost

- Share

a7x

a7x

Created By@ChairmanGao

Subscription Progress

0.00%

MC:

$0

Create My Token

I am addicted to coffee, what is your favorite cup?

- Reward

- like

- Comment

- Repost

- Share

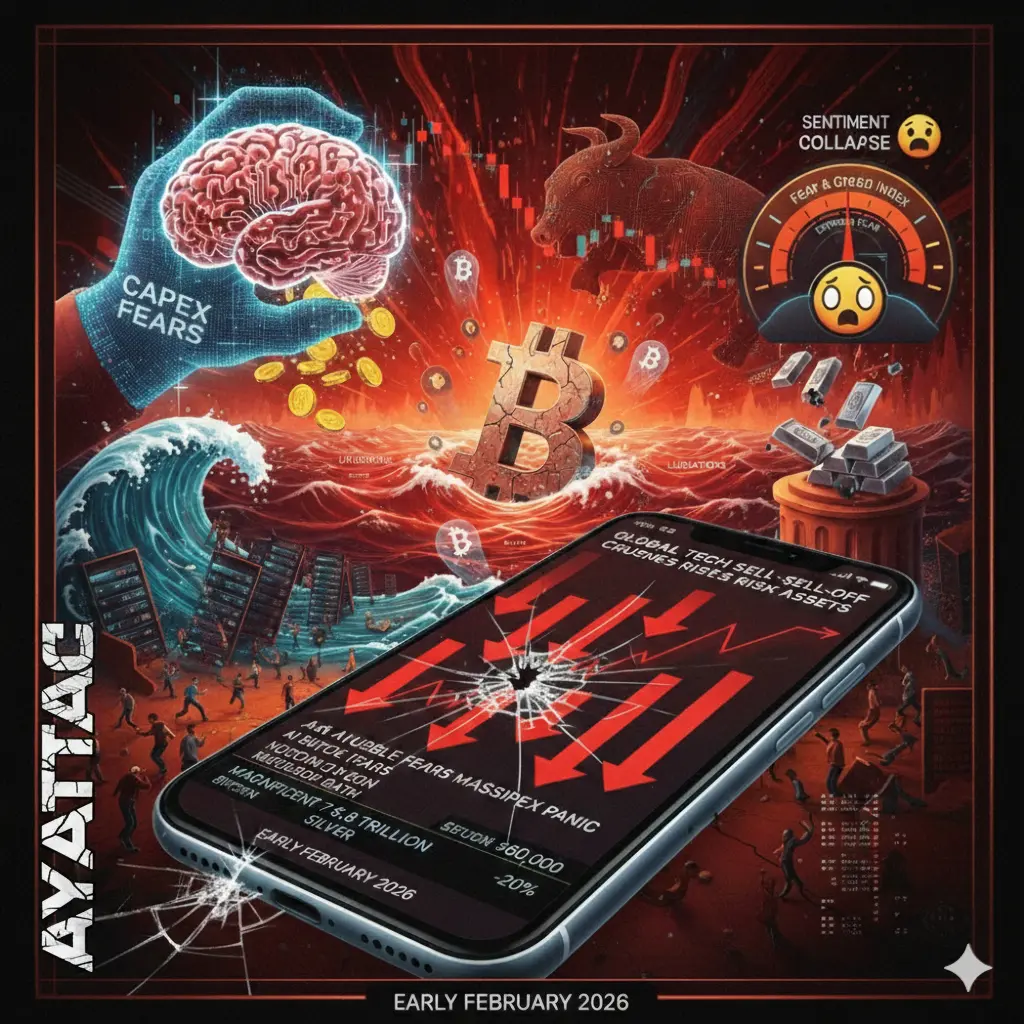

After a volatile start to 2026, investors are reassessing where capital is flowing next.

One trend is becoming increasingly difficult to ignore:

Energy, manufacturing, and defense-related stocks are moving into focus.

These sectors sit at the intersection of policy priorities, spending trends, and real economic demand—making them strong candidates to lead as the next phase of the market develops

One trend is becoming increasingly difficult to ignore:

Energy, manufacturing, and defense-related stocks are moving into focus.

These sectors sit at the intersection of policy priorities, spending trends, and real economic demand—making them strong candidates to lead as the next phase of the market develops

- Reward

- 1

- Comment

- Repost

- Share

$USDG $USD1

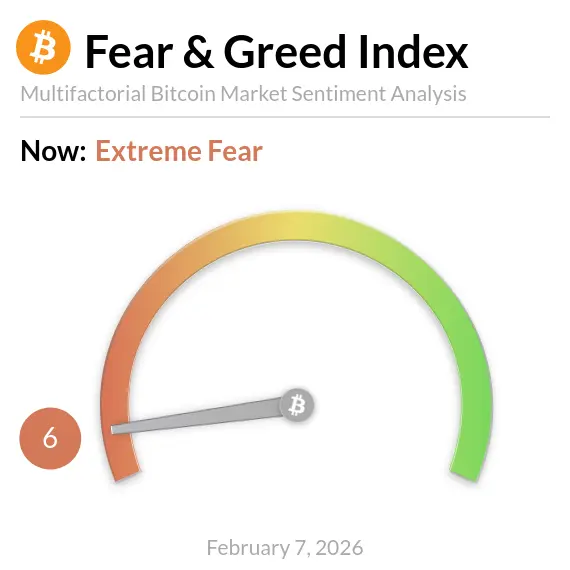

The Bitcoin Fear and Greed Index has reached 6

Currently, from my point of view, the idea is to bounce. Where do I think it will go? As long as Bitcoin stays below $80,000, there’s nothing new, and we’re expecting lower numbers.

If it goes back above $85,000, then I will be very positive!

But until now, there are more very negative signals from my perspective, and even to turn positive again, I’m waiting for $50,000.

The Bitcoin Fear and Greed Index has reached 6

Currently, from my point of view, the idea is to bounce. Where do I think it will go? As long as Bitcoin stays below $80,000, there’s nothing new, and we’re expecting lower numbers.

If it goes back above $85,000, then I will be very positive!

But until now, there are more very negative signals from my perspective, and even to turn positive again, I’m waiting for $50,000.

USDG0,01%

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? 📉 The Anatomy of the Flush

The correlation between Bitcoin and the Nasdaq is currently sitting at a staggering 0.85+, meaning crypto has lost its "digital gold" hedge status and is trading purely as High-Beta Tech.🔍 Why This "V-Recovery" is Deceptive

Friday's 1,200-point Dow surge and the Nasdaq's +2.2% bounce look like a bottom, but keep an eye on these three structural traps:

The Capex Hangover: Even if prices stabilize, Amazon and Alphabet still have to justify $380B+ in combined spending. Until we see revenue growth that matches that spend, any rally might face a "se

The correlation between Bitcoin and the Nasdaq is currently sitting at a staggering 0.85+, meaning crypto has lost its "digital gold" hedge status and is trading purely as High-Beta Tech.🔍 Why This "V-Recovery" is Deceptive

Friday's 1,200-point Dow surge and the Nasdaq's +2.2% bounce look like a bottom, but keep an eye on these three structural traps:

The Capex Hangover: Even if prices stabilize, Amazon and Alphabet still have to justify $380B+ in combined spending. Until we see revenue growth that matches that spend, any rally might face a "se

BTC-2,97%

- Reward

- 1

- 1

- Repost

- Share

HighAmbition :

:

thnxx for sharing information- Reward

- like

- Comment

- Repost

- Share

Is this what you want? Isn't it the shutdown price that concerns miners? It’s coming now~

View Original- Reward

- like

- Comment

- Repost

- Share

BTC Market Analysis

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More148K Popularity

8.75K Popularity

393.48K Popularity

136 Popularity

14.2K Popularity

Hot Gate Fun

View More- MC:$2.37KHolders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreDu Jun: Li Lin will not sell Bitcoin to exchange for Ethereum. His family office is the largest holder of IBIT in Asia.

18 m

Scam Sniffer: In January, there were a total of 4,741 victims of signature-based phishing, with total losses of $6.27 million.

32 m

The Pentagon "Pizza Index" surges, currently at alert level 4

40 m

Project Hunt: Fair Launch and Trading Platform Flap for the past 7 days' top projects with the most new followers

59 m

Project Hunt: Based on Solana, the AMM DEX HumidiFi is the project that has been unfollowed the most by top figures in the past 7 days

59 m

Pin