PARON

No content yet

Pin

PARON

0

0

Capital Expenditures (CAPEX) in 2026:

Amazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

View OriginalAmazon $200 billion

Meta $185 billion

Microsoft $110 billion

The trio will spend approximately $600 billion, compared to their spending of $350 billion in 2025 and $250 billion in 2024.

The AI frenzy is one of the main reasons for this massive spending!

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

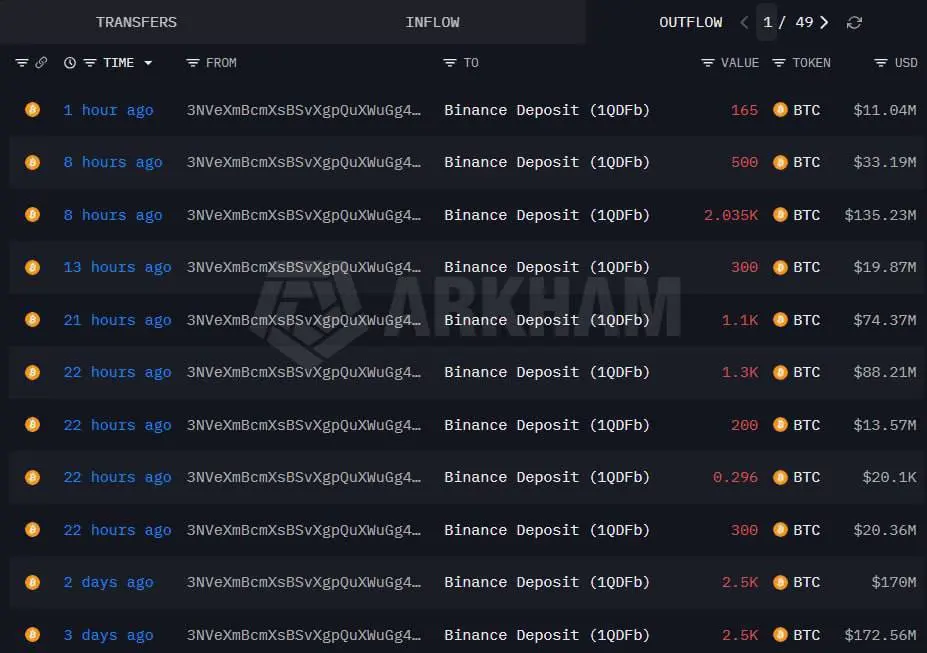

An investor sold 10,700 Bitcoin worth $700 million in just three days

$BTC $BTC $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead

View Original$BTC $BTC $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

Ideas are worth nothing without execution, and the first step is always the hardest.

Most people have great ideas, but they feel overwhelmed by the magnitude of the goal or fear starting. The secret that distinguishes the successful 1% is their ability to turn those big ideas into small, actionable steps. Don’t wait for the perfect moment—start now with the simplest possible step, because success is the accumulation of these small steps.

$ETH BTC $XRP #CelebratingNewYearOnGateSquare

#BuyTheDipOrWaitNow?

View OriginalMost people have great ideas, but they feel overwhelmed by the magnitude of the goal or fear starting. The secret that distinguishes the successful 1% is their ability to turn those big ideas into small, actionable steps. Don’t wait for the perfect moment—start now with the simplest possible step, because success is the accumulation of these small steps.

$ETH BTC $XRP #CelebratingNewYearOnGateSquare

#BuyTheDipOrWaitNow?

MC:$6.47KHolders:5

23.40%

- Reward

- like

- Comment

- Repost

- Share

️ A new study reveals a surprise:

Poverty can be transmitted indirectly through genes!

If parents have a gene linked to depression, their children may face difficulties in studying, earning money, and even paying off debts.

It's not just depression that is inherited, but its consequences as well... including financial problems that may affect future generations.

Scientists confirm that this genetic chain could be more dangerous than we imagine!

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead #GateSpringFestivalHorseRacingEvent

View OriginalPoverty can be transmitted indirectly through genes!

If parents have a gene linked to depression, their children may face difficulties in studying, earning money, and even paying off debts.

It's not just depression that is inherited, but its consequences as well... including financial problems that may affect future generations.

Scientists confirm that this genetic chain could be more dangerous than we imagine!

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead #GateSpringFestivalHorseRacingEvent

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

Warning

I told you before that a collapse is coming, and now it’s happening.

Some people say a major crash could begin within 3 days after new data from the Federal Reserve is released.

The inflation numbers came out: (CPI):

Overall inflation: 2.4% (Less than expected 2.5%)

Core inflation: 2.5% (In line with expectations)

So inflation is decreasing, not increasing.

But the real issue isn’t inflation… the problem is that the economy itself is weakening:

The labor market is deteriorating

Late credit card payments are increasing

Corporate bankruptcies have returned to levels c

View OriginalI told you before that a collapse is coming, and now it’s happening.

Some people say a major crash could begin within 3 days after new data from the Federal Reserve is released.

The inflation numbers came out: (CPI):

Overall inflation: 2.4% (Less than expected 2.5%)

Core inflation: 2.5% (In line with expectations)

So inflation is decreasing, not increasing.

But the real issue isn’t inflation… the problem is that the economy itself is weakening:

The labor market is deteriorating

Late credit card payments are increasing

Corporate bankruptcies have returned to levels c

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

Recently, whales have been accumulating #البيتكوين heavily, as if they are completely confident that a strong upward wave is only a matter of time.

BTC3,89%

- Reward

- 1

- 1

- Repost

- Share

Mhmdqase :

:

Bullish market at its peak 🐂Did you know that over 95% of gold trading is contracts and not physical gold?

Approximately 95% – 98% are futures and derivatives,

and 2% – 5% is actual physical gold only.

Therefore, the idea that it rises strongly and crashes strongly is just a number on the Comex exchange, with less than 3% of contracts ending with physical gold delivery and 97% being closed financially.

$BTC $XRP $SOL

#GateSquare$50KRedPacketGiveaway #NFPBeatsExpectations #GateSpringFestivalHorseRacingEvent

View OriginalApproximately 95% – 98% are futures and derivatives,

and 2% – 5% is actual physical gold only.

Therefore, the idea that it rises strongly and crashes strongly is just a number on the Comex exchange, with less than 3% of contracts ending with physical gold delivery and 97% being closed financially.

$BTC $XRP $SOL

#GateSquare$50KRedPacketGiveaway #NFPBeatsExpectations #GateSpringFestivalHorseRacingEvent

- Reward

- like

- Comment

- Repost

- Share

The #الهولندي House of Representatives approved a 36% tax on unrealized gains for #بيتكوين and cryptocurrencies, allowing only future loss offsets.

Now, the proposal moves to the Senate, where the parties supporting the bill also hold the majority, making final approval almost certain.

Critics warned that this measure could disrupt long-term investment strategies, weaken the power of compound interest, and trigger capital outflows.

Several right-wing parties had previously publicly criticized the bill, but most ultimately voted in favor, citing financial constraints and the costs of delaying

View OriginalNow, the proposal moves to the Senate, where the parties supporting the bill also hold the majority, making final approval almost certain.

Critics warned that this measure could disrupt long-term investment strategies, weaken the power of compound interest, and trigger capital outflows.

Several right-wing parties had previously publicly criticized the bill, but most ultimately voted in favor, citing financial constraints and the costs of delaying

- Reward

- like

- Comment

- Repost

- Share

While everyone is busy talking about traditional market fluctuations,

there's a silent "earthquake" reshuffling the global financial hierarchy.

A company only 5 years old, called Anthropic,

has just successfully raised $30 billion, pushing its market value to $380 billion.

To grasp the scale of the scene:

we're talking about a "startup" that has become today larger than industry giants that have endured for decades,

and it has only 28 companies left on Earth to surpass.

Why are the big players paying these insane amounts?

It's not about a tech "trend," but about the undeniable numbers:

Ex

View Originalthere's a silent "earthquake" reshuffling the global financial hierarchy.

A company only 5 years old, called Anthropic,

has just successfully raised $30 billion, pushing its market value to $380 billion.

To grasp the scale of the scene:

we're talking about a "startup" that has become today larger than industry giants that have endured for decades,

and it has only 28 companies left on Earth to surpass.

Why are the big players paying these insane amounts?

It's not about a tech "trend," but about the undeniable numbers:

Ex

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

Brazil is Considering Creating a Strategic Bitcoin Reserve and Buying One Million Coins.. Will the Price Rise?

The Brazilian Congress has reintroduced Bill No. 4501 of 2024, which proposes purchasing up to one million Bitcoin to establish a national strategic cryptocurrency reserve.

The bill significantly expands on the previous proposal, stating that the #عاجل.. RESbit( Strategic Bitcoin Sovereign Reserve Fund will be responsible for accumulating the coins over five years, according to Cryptopolitan.

Initially, the bill suggested allocating up to 5% of Brazil's foreign exchange reserves to di

The Brazilian Congress has reintroduced Bill No. 4501 of 2024, which proposes purchasing up to one million Bitcoin to establish a national strategic cryptocurrency reserve.

The bill significantly expands on the previous proposal, stating that the #عاجل.. RESbit( Strategic Bitcoin Sovereign Reserve Fund will be responsible for accumulating the coins over five years, according to Cryptopolitan.

Initially, the bill suggested allocating up to 5% of Brazil's foreign exchange reserves to di

BTC3,89%

MC:$11.7KHolders:12

44.03%

- Reward

- like

- Comment

- Repost

- Share

Only one investment was enough to nearly fill the bankruptcy gap three times.

One of the biggest collapses in crypto history, with a gap of nearly $9 billion, lawsuits, and market-wide bankruptcies.

But amid the wreckage, there was a completely different story.

In 2022, FTX invested $500 million in Anthropic, valuing the company at around $2.5 billion.

Then the collapse happened.

FTX was forced to sell its stake during bankruptcy at a valuation of nearly $18 billion for about $1.5 billion.

Today?

Anthropic is valued at $380 billion after a massive funding round of $30 billion.

If FTX had kept

View OriginalOne of the biggest collapses in crypto history, with a gap of nearly $9 billion, lawsuits, and market-wide bankruptcies.

But amid the wreckage, there was a completely different story.

In 2022, FTX invested $500 million in Anthropic, valuing the company at around $2.5 billion.

Then the collapse happened.

FTX was forced to sell its stake during bankruptcy at a valuation of nearly $18 billion for about $1.5 billion.

Today?

Anthropic is valued at $380 billion after a massive funding round of $30 billion.

If FTX had kept

- Reward

- like

- Comment

- Repost

- Share

Is the US economy on the brink of collapse?

While the media is busy with flashy headlines, an economic "heart attack" is happening quietly right now.

Numbers do not favor anyone,

and what is happening today in the American markets is not just a "correction,"

but the pressure has reached the point of explosion.

We are facing the worst levels of institutional and living crises since the 2008 disaster.

1. The Guillotine of Major Companies

In the last three weeks, 18 major companies have fallen into bankruptcy.

We are talking about billion-dollar companies collapsing at a rate of 6 companies per w

View OriginalWhile the media is busy with flashy headlines, an economic "heart attack" is happening quietly right now.

Numbers do not favor anyone,

and what is happening today in the American markets is not just a "correction,"

but the pressure has reached the point of explosion.

We are facing the worst levels of institutional and living crises since the 2008 disaster.

1. The Guillotine of Major Companies

In the last three weeks, 18 major companies have fallen into bankruptcy.

We are talking about billion-dollar companies collapsing at a rate of 6 companies per w

- Reward

- like

- Comment

- Repost

- Share

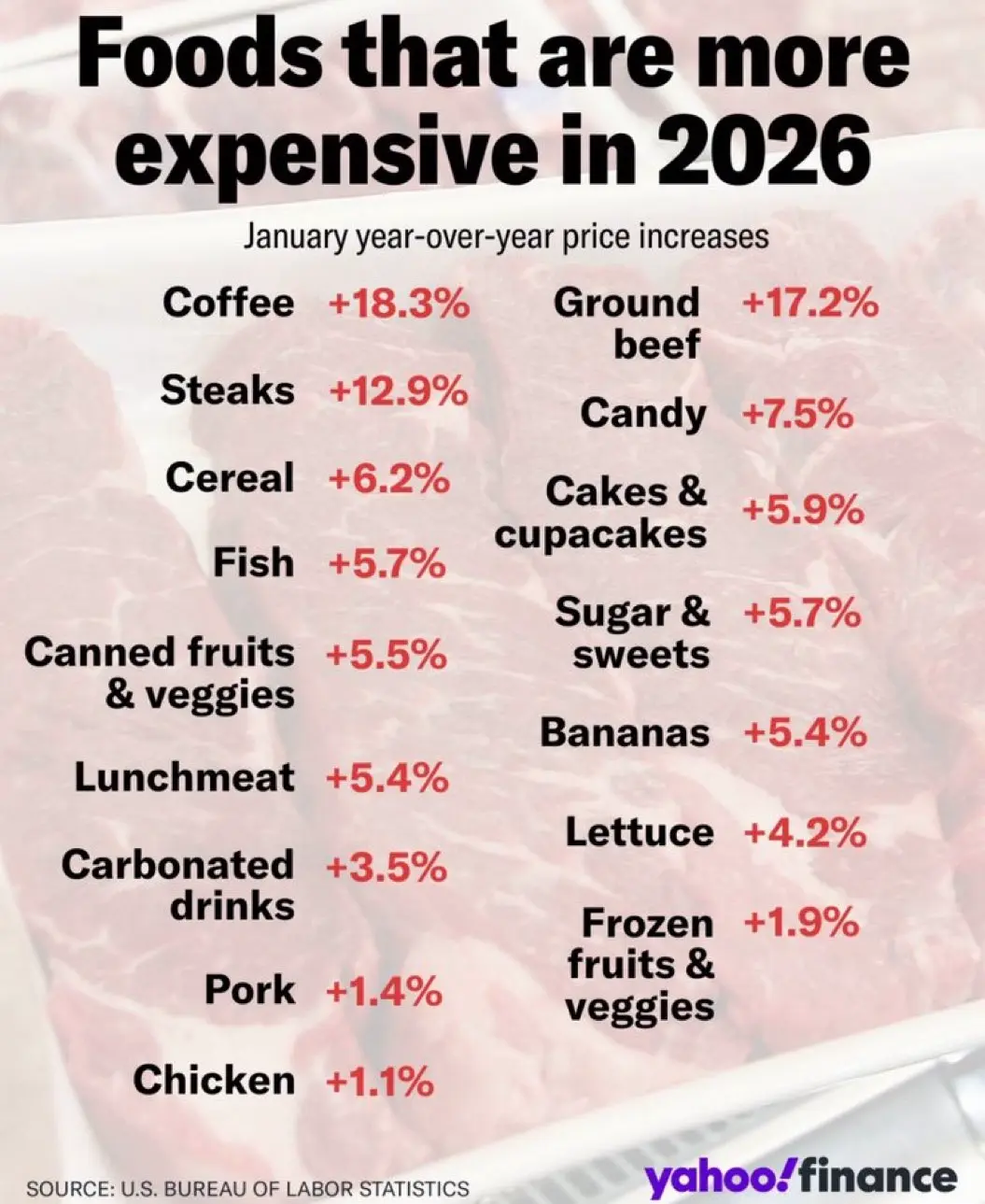

If you think investing is risky,

look at this picture.

Food prices are rising in America by a double-digit percentage of (17.2%, for example, in the case of meats ).

Meaning,

if you leave your money idle in the bank = you lose 17.2% of your money's value annually if you measure your money by what you can buy in meats?

A terrifying number, really!

$BTC

#GateSquare$50KRedPacketGiveaway #CPIDataAhead

#NFPBeatsExpectations #GateSpringFestivalHorseRacingEvent #BuyTheDipOrWaitNow?

look at this picture.

Food prices are rising in America by a double-digit percentage of (17.2%, for example, in the case of meats ).

Meaning,

if you leave your money idle in the bank = you lose 17.2% of your money's value annually if you measure your money by what you can buy in meats?

A terrifying number, really!

$BTC

#GateSquare$50KRedPacketGiveaway #CPIDataAhead

#NFPBeatsExpectations #GateSpringFestivalHorseRacingEvent #BuyTheDipOrWaitNow?

BTC3,89%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$3.6 trillion evaporates in 90 minutes.. What does Russia's return to using the dollar mean and its impact on global markets?

Global financial markets experienced a sharp decline, resulting in the disappearance of about $3.6 trillion in market value within just 90 minutes, in one of the fastest downturns the markets have seen recently.

Key losses:

Gold fell by 3.76%, wiping out approximately $1.34 trillion of its market value.

Silver dropped by 8.5%, losing around $400 billion in value.

The S&P 500 index declined by 1%, with losses totaling $620 billion.

The Nasdaq index fell by more than 1.6%

View OriginalGlobal financial markets experienced a sharp decline, resulting in the disappearance of about $3.6 trillion in market value within just 90 minutes, in one of the fastest downturns the markets have seen recently.

Key losses:

Gold fell by 3.76%, wiping out approximately $1.34 trillion of its market value.

Silver dropped by 8.5%, losing around $400 billion in value.

The S&P 500 index declined by 1%, with losses totaling $620 billion.

The Nasdaq index fell by more than 1.6%

- Reward

- like

- Comment

- Repost

- Share

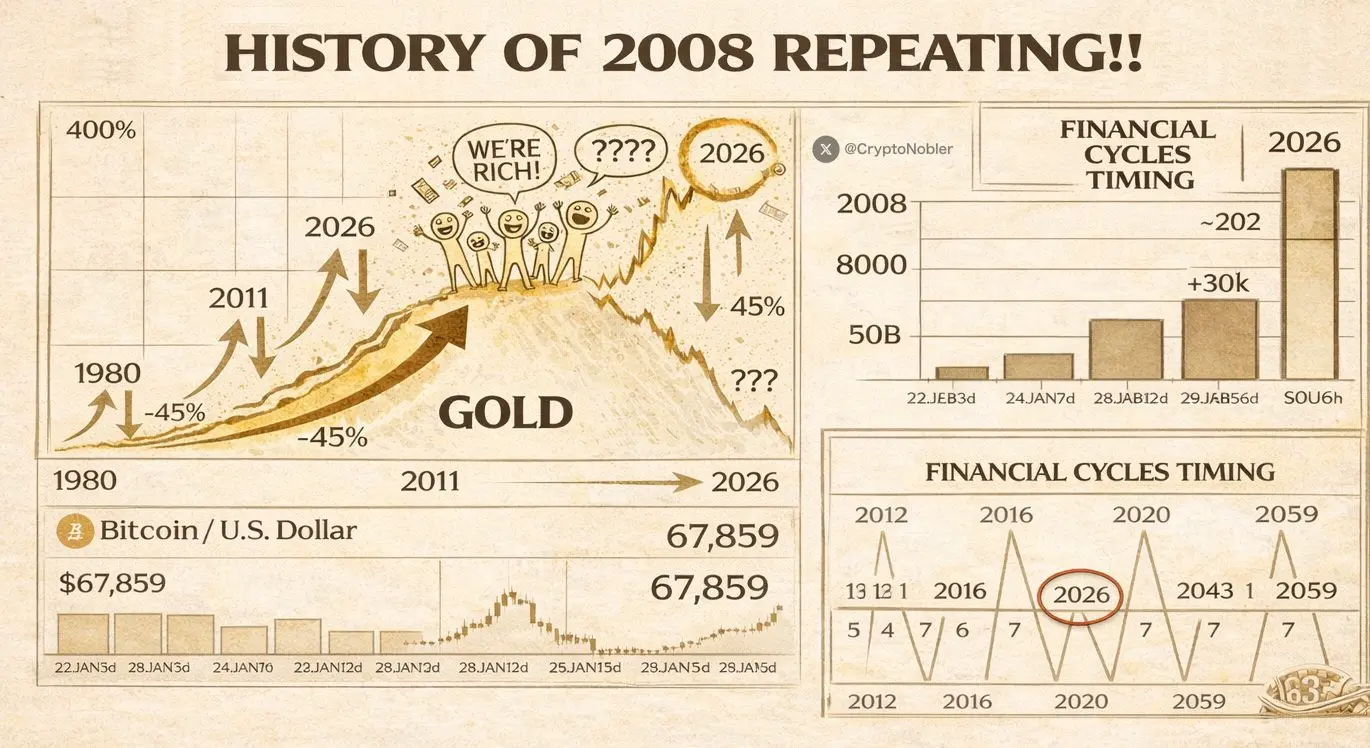

Gold leads the scene... Is Bitcoin about to catch up?

History repeats itself, but in different languages each time.

Gold has always been the "compass" that precedes everyone during major shifts in the global financial system.

In 2016, gold rose first, and just a few months later, Bitcoin exploded with a 30-fold increase.

The same scenario repeated in 2019, where gold paved the way with its rise, followed by Bitcoin in an upward wave that continued until 2021.

Today, at the beginning of 2026, we see the scene repeating itself.

Gold recorded new historic highs in 2025, while Bitcoin remains stag

History repeats itself, but in different languages each time.

Gold has always been the "compass" that precedes everyone during major shifts in the global financial system.

In 2016, gold rose first, and just a few months later, Bitcoin exploded with a 30-fold increase.

The same scenario repeated in 2019, where gold paved the way with its rise, followed by Bitcoin in an upward wave that continued until 2021.

Today, at the beginning of 2026, we see the scene repeating itself.

Gold recorded new historic highs in 2025, while Bitcoin remains stag

USDG-0,03%

- Reward

- like

- Comment

- Repost

- Share

Massive Market Crash

Over $3.6 trillion wiped out in 90 minutes.

Gold dropped by 3.76%, with nearly $1.34 trillion of its market value liquidated.

Silver fell by 8.5%, with $400 billion of its market value liquidated.

The S&P 500 index declined by 1%, losing $620 billion.

The Nasdaq index dropped by more than 1.6%, losing $600 billion.

The cryptocurrency market declined by 3%, losing $70 billion.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead #GateSpringFestivalHorseRacingEvent

View OriginalOver $3.6 trillion wiped out in 90 minutes.

Gold dropped by 3.76%, with nearly $1.34 trillion of its market value liquidated.

Silver fell by 8.5%, with $400 billion of its market value liquidated.

The S&P 500 index declined by 1%, losing $620 billion.

The Nasdaq index dropped by more than 1.6%, losing $600 billion.

The cryptocurrency market declined by 3%, losing $70 billion.

$BTC $ETH $SOL

#GateSquare$50KRedPacketGiveaway #CPIDataAhead #GateSpringFestivalHorseRacingEvent

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

World Liberty Financial, the cryptocurrency company affiliated with the Trump family, launches a cross-border currency transfer platform

World Liberty Financial(, a company specializing in cryptocurrencies and linked to former U.S. President Donald Trump’s family, announced plans to launch a new platform for foreign exchange and remittances, aiming to reduce cross-border transfer costs.

The platform will be called World Swap), which will connect users directly to debit cards and bank accounts worldwide, with foreign exchange transactions settled at fees described by the company as a small frac

View OriginalWorld Liberty Financial(, a company specializing in cryptocurrencies and linked to former U.S. President Donald Trump’s family, announced plans to launch a new platform for foreign exchange and remittances, aiming to reduce cross-border transfer costs.

The platform will be called World Swap), which will connect users directly to debit cards and bank accounts worldwide, with foreign exchange transactions settled at fees described by the company as a small frac

MC:$9.75KHolders:2

37.46%

- Reward

- like

- Comment

- Repost

- Share

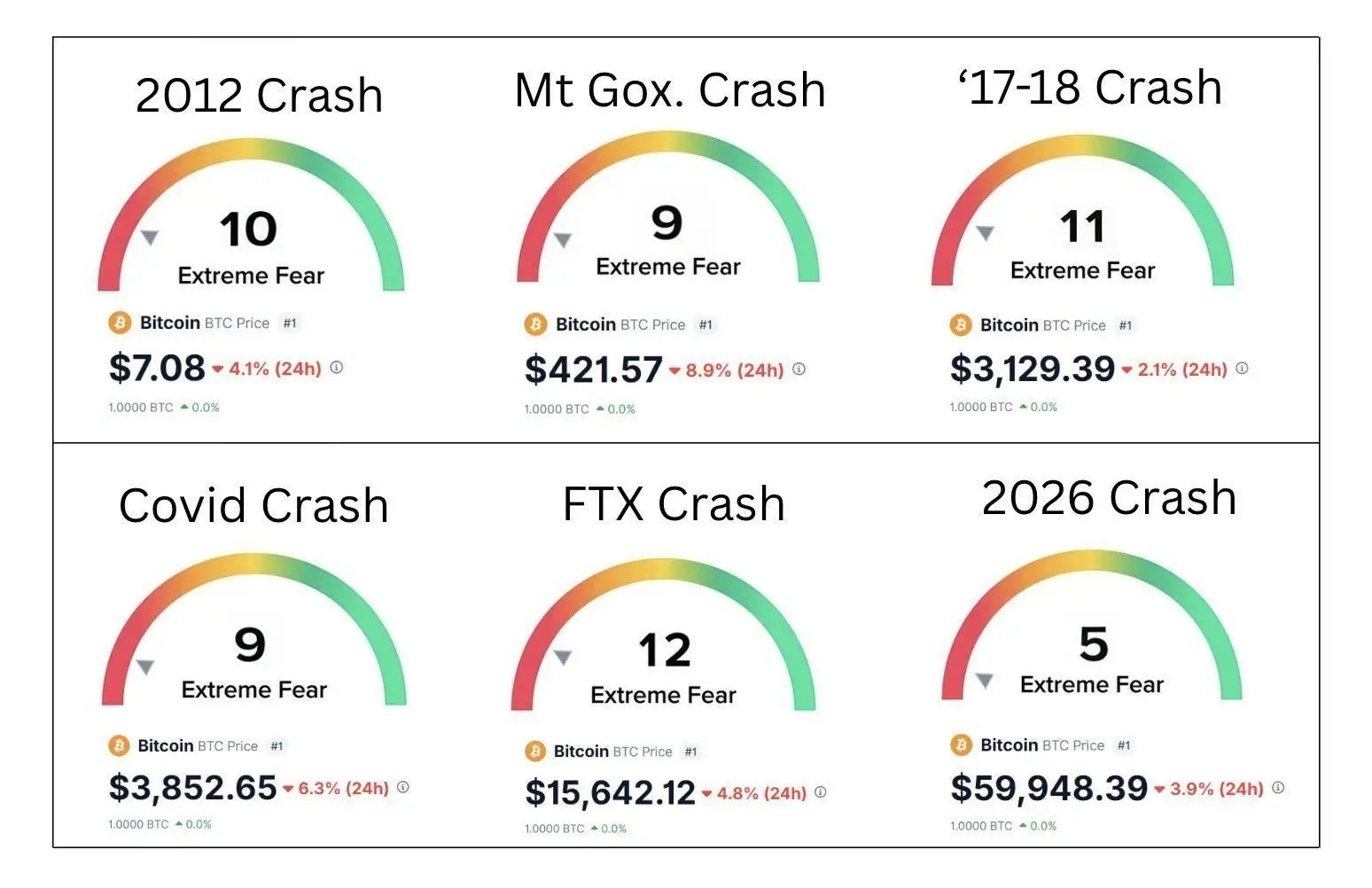

Extreme fear has always been a sign of opportunity

Look at the history:

2012 crash, Mt. Gox crisis, the 2017–2018 bear market, the COVID-19 pandemic, the FTX collapse…

All of these marked the “Extreme Fear” index.

Back then, Bitcoin was at:

$7, $400, $3,000, $15,000…

And each time, it seemed like the end.

And today?

We are again in the extreme fear zone.

But the difference is fundamental:

• The network is stronger

• Institutions are present

• ETF funds are available

• Countries are mining

• Infrastructure is deeper than ever

📊 Historically, fear peaks at the lows because positions are washed

View OriginalLook at the history:

2012 crash, Mt. Gox crisis, the 2017–2018 bear market, the COVID-19 pandemic, the FTX collapse…

All of these marked the “Extreme Fear” index.

Back then, Bitcoin was at:

$7, $400, $3,000, $15,000…

And each time, it seemed like the end.

And today?

We are again in the extreme fear zone.

But the difference is fundamental:

• The network is stronger

• Institutions are present

• ETF funds are available

• Countries are mining

• Infrastructure is deeper than ever

📊 Historically, fear peaks at the lows because positions are washed

MC:$9.75KHolders:2

37.46%

- Reward

- 1

- Comment

- Repost

- Share