#GlobalTechSell-OffHitsRiskAssets — Crypto in the Crossfire

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

📉 Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressure.

3. Macro Uncertainty

Inflation data and central bank guidance amplify volatility.

Global capital becomes selective, punishing leveraged and speculative markets first.

🔄 Impact on Crypto

BTC, ETH, and large-cap altcoins are short-term correlated with equities.

Altcoins suffer deeper pullbacks due to lower liquidity and higher leverage.

Market rotation favors Bitcoin and stablecoins, as smart money seeks liquidity and safety.

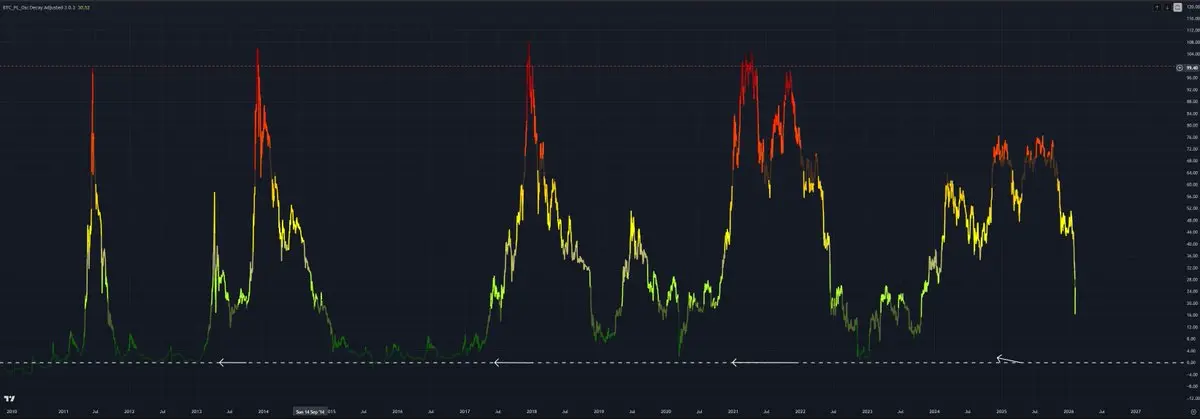

🧠 Market Structure Signals

Crypto is testing key support zones that historically acted as macro pivots.

Liquidity flushes are occurring near clustered retail stop levels.

High-volume reclaim or sustained support will indicate that risk appetite is returning despite macro pressure.

⚠️ Risks to Watch

Prolonged tech weakness could extend crypto corrections beyond short-term support.

Spiking funding rates on leveraged positions may trigger cascade liquidations.

Cross-asset contagion risk: weakness in equities can amplify negative crypto sentiment.

🔑 Key Levels & Indicators

Monitor BTC & ETH support zones for liquidity absorption.

Track volume profiles to see if dips are bought or rejected.

Watch derivatives metrics (funding rates and open interest) to gauge leverage risk or neutralization.

🎯 Strategy for Traders & Investors

Avoid chasing dips in volatile altcoins during tech-led sell-offs.

Scale into high-conviction zones on BTC/ETH with disciplined risk management.

Keep cash reserves ready to capitalize on macro-driven capitulation opportunities.

📌 Bottom Line

The #GlobalTechSell-OffHitsRiskAssets highlights how interconnected crypto is with global markets.

Short-term pain is expected.

Long-term resilience depends on structure, liquidity management, and disciplined strategy.

Risk assets may shake, but those who navigate volatility with discipline capture the next major move.

The recent global tech sell-off isn’t just Nasdaq pain. Its shockwaves are hitting all risk assets, including crypto. Understanding the dynamics is critical for strategic positioning.

📉 Drivers of the Sell-Off

1. Rising Interest Rate Pressure

Growth-oriented, leveraged tech stocks are highly sensitive to rates.

Higher bond yields → future cash flows discounted → valuations decline.

2. Risk-Off Sentiment Spreads

Investors rotate from equities to safe havens: USD, bonds, gold.

Crypto, as a high-beta asset, experiences immediate pressure.

3. Macro Uncertainty

Inflation data and central bank guidance amplify volatility.

Global capital becomes selective, punishing leveraged and speculative markets first.

🔄 Impact on Crypto

BTC, ETH, and large-cap altcoins are short-term correlated with equities.

Altcoins suffer deeper pullbacks due to lower liquidity and higher leverage.

Market rotation favors Bitcoin and stablecoins, as smart money seeks liquidity and safety.

🧠 Market Structure Signals

Crypto is testing key support zones that historically acted as macro pivots.

Liquidity flushes are occurring near clustered retail stop levels.

High-volume reclaim or sustained support will indicate that risk appetite is returning despite macro pressure.

⚠️ Risks to Watch

Prolonged tech weakness could extend crypto corrections beyond short-term support.

Spiking funding rates on leveraged positions may trigger cascade liquidations.

Cross-asset contagion risk: weakness in equities can amplify negative crypto sentiment.

🔑 Key Levels & Indicators

Monitor BTC & ETH support zones for liquidity absorption.

Track volume profiles to see if dips are bought or rejected.

Watch derivatives metrics (funding rates and open interest) to gauge leverage risk or neutralization.

🎯 Strategy for Traders & Investors

Avoid chasing dips in volatile altcoins during tech-led sell-offs.

Scale into high-conviction zones on BTC/ETH with disciplined risk management.

Keep cash reserves ready to capitalize on macro-driven capitulation opportunities.

📌 Bottom Line

The #GlobalTechSell-OffHitsRiskAssets highlights how interconnected crypto is with global markets.

Short-term pain is expected.

Long-term resilience depends on structure, liquidity management, and disciplined strategy.

Risk assets may shake, but those who navigate volatility with discipline capture the next major move.