Post content & earn content mining yield

placeholder

Jackie

Historically, the four pullbacks have been 97%, 87%, 84%, and 77%. The retracement from the highest point to the lowest point has become less severe over different periods as confidence has increased. This time, with a peak of 4955.3, the lowest retracement is expected to occur at several points. The starting positions for this bull market are identified as follows: I personally agree that 1783.08 and 1982.12 are the starting points of this bull run, and 2130.79 is also the best level for strategic entry. Wishing everyone good luck.

View Original

- Reward

- 1

- 1

- Repost

- Share

GateUser-a7dfff7d :

:

New Year Wealth Explosion 🤑$FRAX 🔥 *FRAX/USDT Long‑Term Play* 🔥

- *Current Price*: $0.8622 (17.88% 24h gain).

- *Entry*: Buy on a *breakout above $0.9186* (EMA 99 resistance).

- *Target*: *$1.0583–$1.0763* (previous high zone).

- *Stop*: Place at *$0.8397* to protect against reversal.

⚠️ _Tip_: confirm bullish MACD crossover & rising volume before entering long position.

Need a detailed execution plan or risk‑management steps for FRAX/USDT? 📈🚀$FRAX

- *Current Price*: $0.8622 (17.88% 24h gain).

- *Entry*: Buy on a *breakout above $0.9186* (EMA 99 resistance).

- *Target*: *$1.0583–$1.0763* (previous high zone).

- *Stop*: Place at *$0.8397* to protect against reversal.

⚠️ _Tip_: confirm bullish MACD crossover & rising volume before entering long position.

Need a detailed execution plan or risk‑management steps for FRAX/USDT? 📈🚀$FRAX

FRAX17,25%

- Reward

- like

- Comment

- Repost

- Share

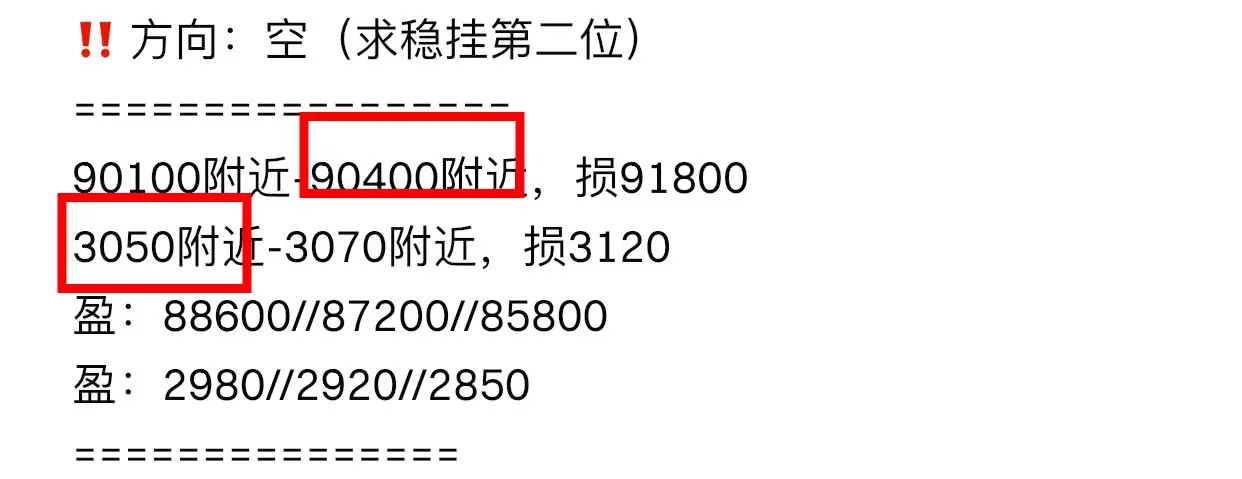

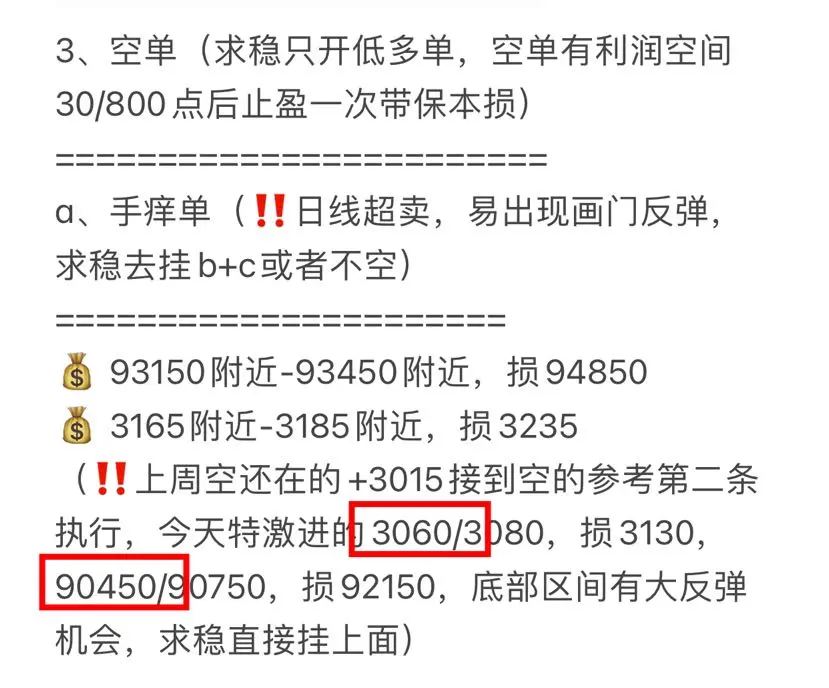

‼️ Guan Peace Wheel, brothers, give U‼️ The night contract/spot order for No. 1 has been updated 👇 In the crypto world, only follow the right people. Thank you all for your support. The New Year 3.8 GT half-price promotion has surpassed 260 people, and tonight it returns to 8 GT‼️ Apple click 👇

https://www.gate.com/zh/profile/ Chan Lang Analysis

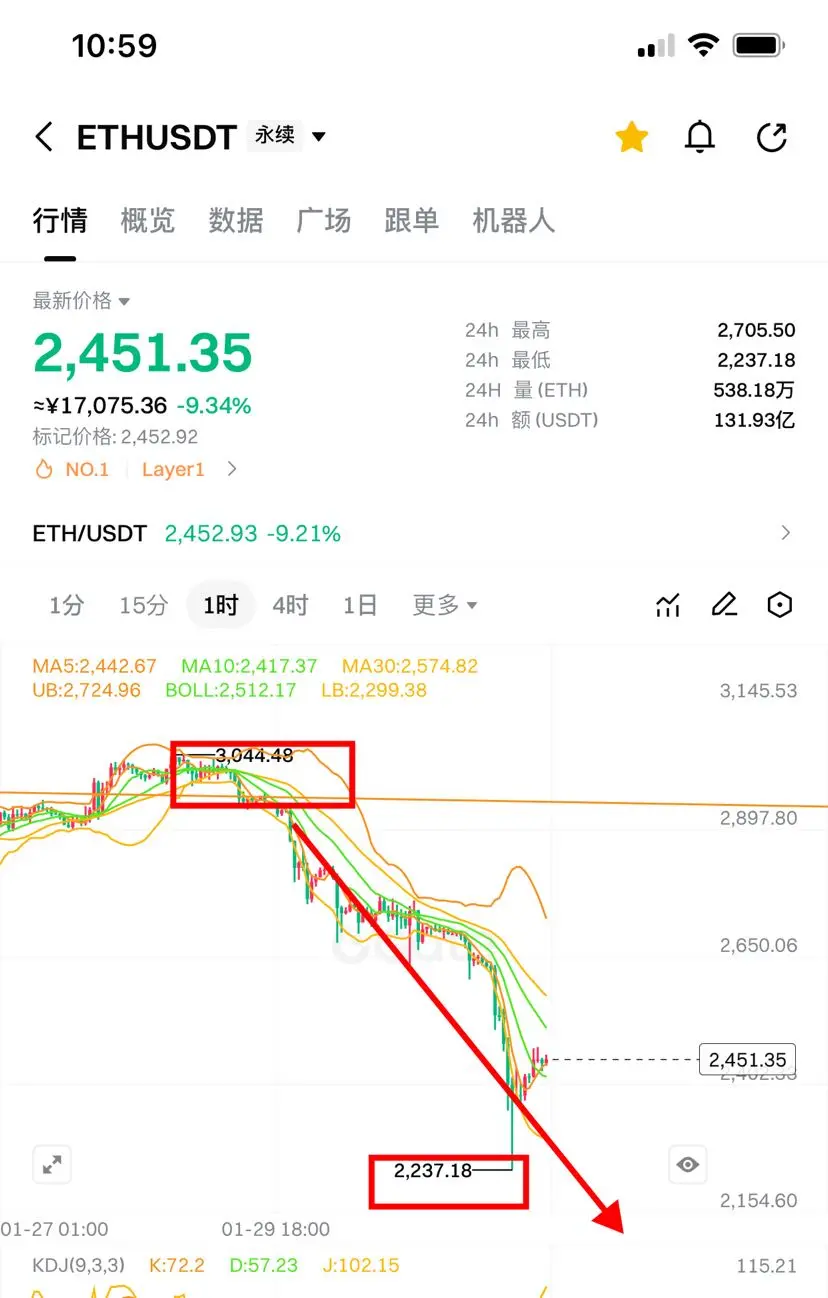

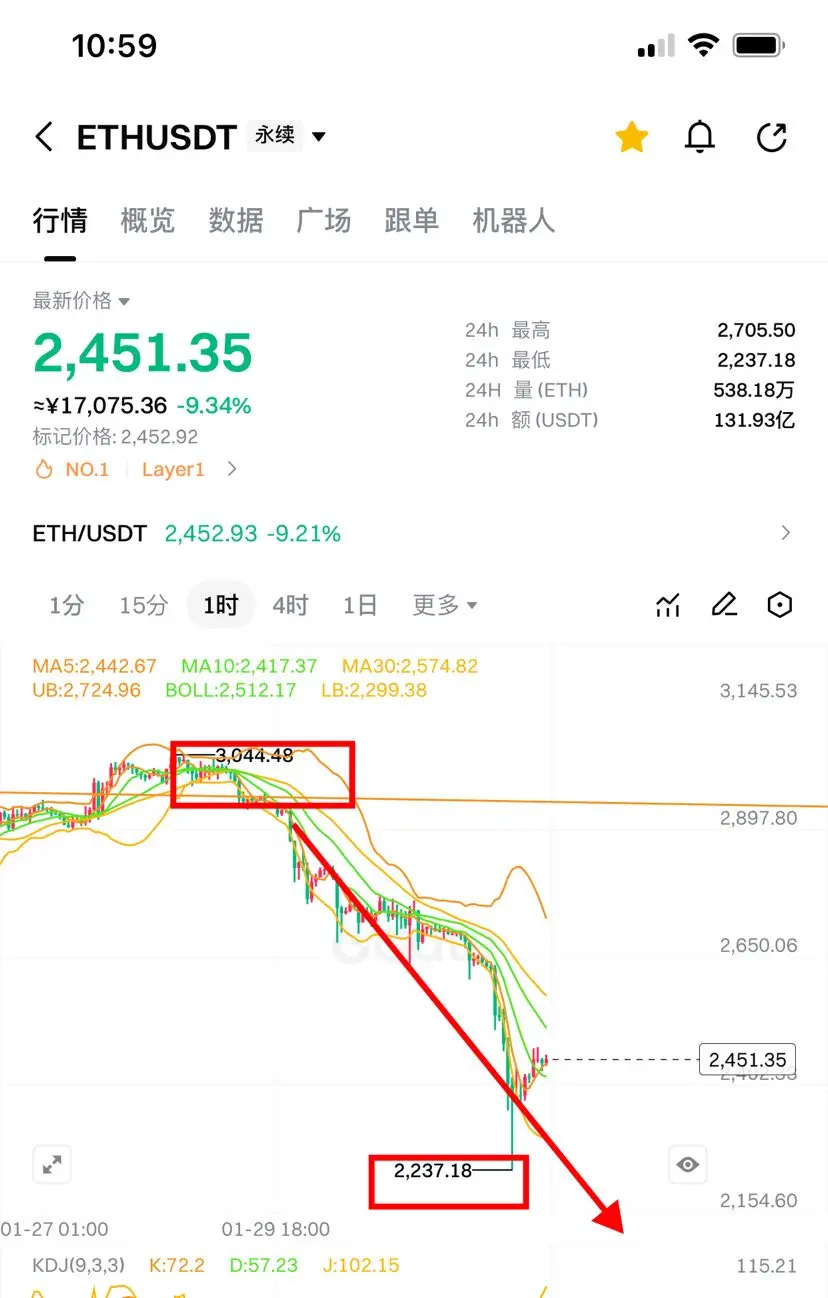

🔥 Recently, over 2 million U have been eaten in a row‼️ Last week, 3400/97800 short + 90800/3005 short, and this Monday, 86000/2785, earning another 300,000 📉 On Wednesday, a reverse position of 3045/90400 short + yesterday 84400 short, now 2235/75

View Originalhttps://www.gate.com/zh/profile/ Chan Lang Analysis

🔥 Recently, over 2 million U have been eaten in a row‼️ Last week, 3400/97800 short + 90800/3005 short, and this Monday, 86000/2785, earning another 300,000 📉 On Wednesday, a reverse position of 3045/90400 short + yesterday 84400 short, now 2235/75

- Reward

- 10

- 10

- Repost

- Share

BigBigBigBigBigBubbleGum :

:

2026 Go Go Go 👊View More

GT

狗头

Created By@HappyFortuneGoddessGirl

Listing Progress

0.00%

MC:

$2.78K

Create My Token

- Reward

- 1

- Comment

- Repost

- Share

The U.S. dollar posted its biggest single day gain since July. triggering a sharp sell.off in gold and silver. Are risk assets facing renewed pressure

- Reward

- 1

- Comment

- Repost

- Share

Hey @grok remove the one with the worst financial strategy

- Reward

- like

- Comment

- Repost

- Share

If the heart does not die, the way will not be born. For ordinary people, the path to rebirth and success is built day by day through accumulation.

View Original- Reward

- like

- Comment

- Repost

- Share

🔥 Guan Peace, fellow traders, giving you‼️ Unknowingly, this is the third year since I started subscribing, and the number of subscribers has exceeded 280🀄️ The 5.4gt discount is about to end and will revert to 8gt. Friends who subscribe are not fools; if you're not making money, then definitely 😄. You can click on 👇 or copy it to the web browser to subscribe:

https://www.gate.com/zh/profile/ Wave King K God

🔥 Last week 3400/97800 short 2865/87250 big gains

🔥 Late last week 3015/90800 short Monday 2785/86000 more gains

🔥 Wednesday reverse 3045/90400 short + yesterday 84400 short now 223

View Originalhttps://www.gate.com/zh/profile/ Wave King K God

🔥 Last week 3400/97800 short 2865/87250 big gains

🔥 Late last week 3015/90800 short Monday 2785/86000 more gains

🔥 Wednesday reverse 3045/90400 short + yesterday 84400 short now 223

- Reward

- 10

- 10

- Repost

- Share

KeepUpWithTheRhythmOfTheTimes :

:

Hold on tight, we're about to take off 🛫View More

What is up G\'s?

- Reward

- like

- Comment

- Repost

- Share

NYX

LUNA

Created By@SiciliaYaghmur

Subscription Progress

0.00%

MC:

$0

Create My Token

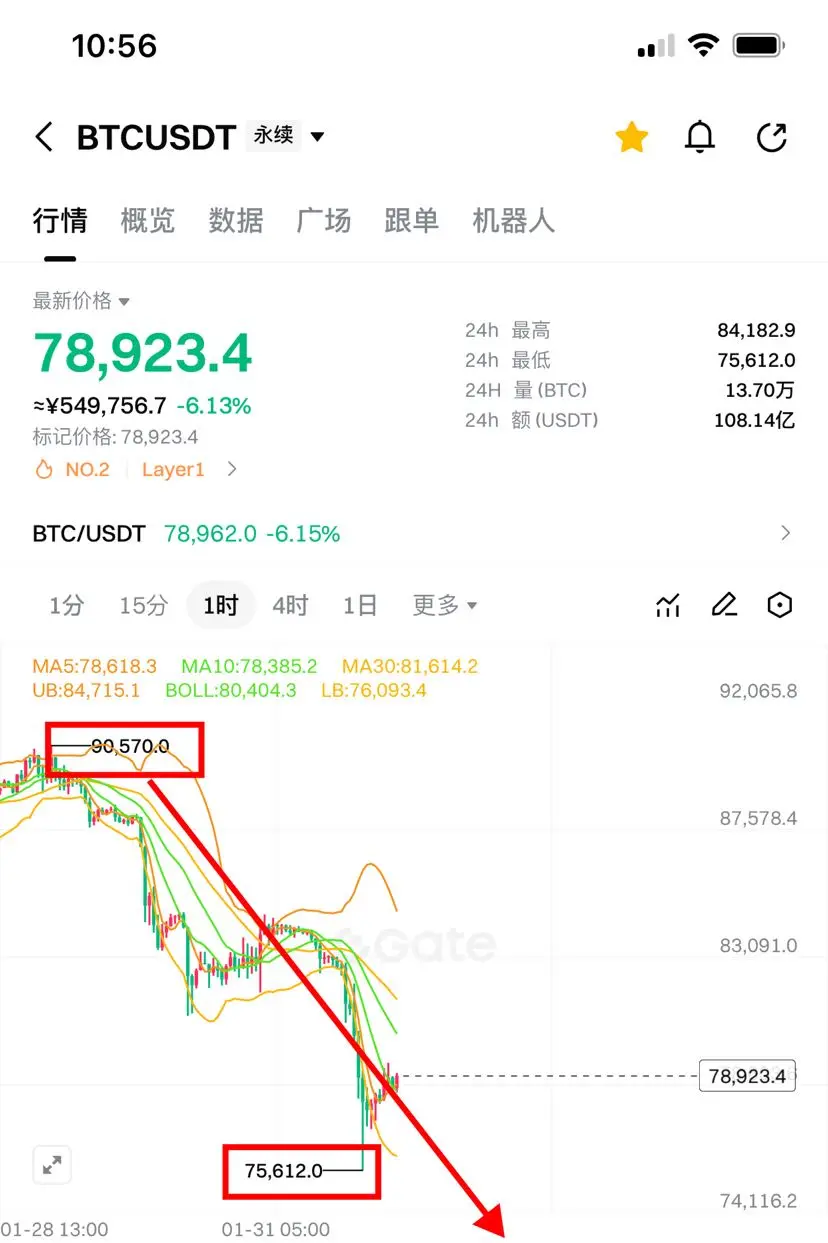

Bitcoin market today does not crash loudly; it weakens gradually, as if giving market participants time to reconsider their positions. This slow decline allows traders to observe and prepare for what might come next, rather than sudden panic selling.

After briefly touching the 79,300 level, Bitcoin failed to maintain its upward momentum. Sellers began to take control, pushing the price down to around 77,000. This was not driven by panic, but rather a well-organized distribution phase— a type of pressure that often appears when the market feels the price has moved too far, too fast.

Currently,

View OriginalAfter briefly touching the 79,300 level, Bitcoin failed to maintain its upward momentum. Sellers began to take control, pushing the price down to around 77,000. This was not driven by panic, but rather a well-organized distribution phase— a type of pressure that often appears when the market feels the price has moved too far, too fast.

Currently,

- Reward

- 1

- Comment

- Repost

- Share

CZ after saying supercycle was canceled because of him

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- 1

- Repost

- Share

LiDongliang :

:

I see that there are bulk positions opened at 2240 and 2200.Here\'s how my call will go tomorrow, It will hit the sky\'s$10M minimum . I put my effort and life to this. My call will melt faces.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

CZ: "The supercycle in crypto might be canceled because the people who criticize what he bought on social media are actually expecting that thing to rise, which usually doesn't happen."

View Original

- Reward

- like

- Comment

- Repost

- Share

Wait asian session never do their own dump ke 😬🤔Ahh it is finished 😂

- Reward

- like

- Comment

- Repost

- Share

“Michael Saylor is going to get liquidated.”

- Reward

- like

- Comment

- Repost

- Share

Load More