# 監管環境改善預期升溫,ETH Staking 板塊或成最大受益者近期,隨着川普強勢回歸政壇,市場開始熱議美國證券交易委員會(SEC)主席 Gary Gensler 可能離職的傳言。這一預期引發了對加密貨幣監管環境可能改善的討論。在這種背景下,ETH Staking 板塊很可能成爲直接受益的領域,其中龍頭項目 Lido 有望擺脫當前的價格困境。## Lido 的監管困境回顧Lido 作爲 ETH Staking 賽道的領軍項目,通過非托管技術服務幫助用戶參與以太坊 PoS 並獲取收益,同時降低了技術門檻和資金門檻。該項目曾經歷三輪融資,共籌集 1.7 億美元。自 2022 年上線以來,Lido 憑藉先發優勢,市場佔有率一直保持在 30% 左右。截至目前,數據顯示 Lido 仍維持 27% 的市場份額,表明其業務需求依然強勁。然而,Lido 目前面臨的價格低迷主要源於 2023 年底爆發的一起訴訟案。當時,一位名爲 Andrew Samuels 的個人在美國加利福尼亞北區聯邦地區法院對 Lido DAO 提起訴訟,指控其未經註冊向公衆出售 LDO 代幣,違反了《1933 年證券法》的規定。這一訴訟不僅涉及 Lido DAO,還包括其主要投資人。訴訟案的進展對 LDO 價格產生了顯著影響。2024 年 4 月 10 日,法院確定受理該案。隨後,原告方要求對 Lido DAO 宣告缺席,迫使 Lido DAO 不得不聘請律師應訴。這一系列事件引發了投資者的避險情緒,導致 LDO 價格持續承壓。## stETH 的證券屬性爭議除了上述訴訟,SEC 在 2024 年 6 月對 Consensys Software Inc. 提起的訴訟也對 Lido 產生了影響。SEC 指控 Consensys 通過其 MetaMask Staking 服務從事未註冊的證券發行和銷售,其中涉及 Lido 的 stETH 代幣。這些案件的核心爭議在於 stETH 是否屬於證券。美國法律通常使用"豪威測試"來判斷某種交易或工具是否構成證券。該測試包括四個標準:投資資金、共同企業、預期利潤和他人努力。然而,加密貨幣行業對此持不同觀點。例如,某交易平台認爲 ETH Staking 業務並不符合豪威測試的四個要素,因此不應被視爲證券交易。他們認爲,質押過程中用戶保留資產所有權,沒有共同企業,質押獎勵類似於勞動所得,且不依賴他人管理努力。## Lido 未來發展值得關注考慮到以下幾點,Lido 的後續發展值得密切關注:1. 當前價格壓力主要來自監管不確定性,而非業務表現不佳。2. ETH 已被定義爲商品,相關討論空間較大。3. ETH ETF 獲批後,可能會有更多資源投入推動相關業務發展。4. 相關訴訟的法律成本相對較小,影響可控。綜上所述,隨着監管環境可能改善的預期升溫,Lido 的發展前景值得投資者持續關注。

監管環境或改善 ETH Staking龍頭Lido有望突破困境

監管環境改善預期升溫,ETH Staking 板塊或成最大受益者

近期,隨着川普強勢回歸政壇,市場開始熱議美國證券交易委員會(SEC)主席 Gary Gensler 可能離職的傳言。這一預期引發了對加密貨幣監管環境可能改善的討論。在這種背景下,ETH Staking 板塊很可能成爲直接受益的領域,其中龍頭項目 Lido 有望擺脫當前的價格困境。

Lido 的監管困境回顧

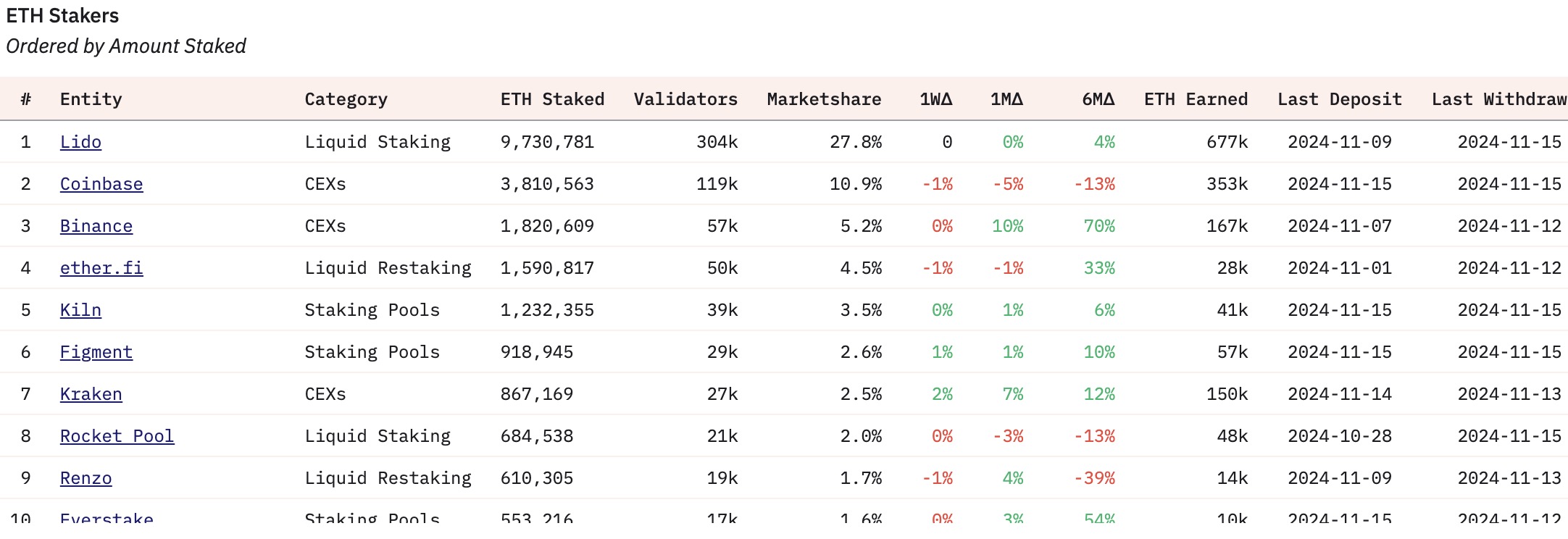

Lido 作爲 ETH Staking 賽道的領軍項目,通過非托管技術服務幫助用戶參與以太坊 PoS 並獲取收益,同時降低了技術門檻和資金門檻。該項目曾經歷三輪融資,共籌集 1.7 億美元。自 2022 年上線以來,Lido 憑藉先發優勢,市場佔有率一直保持在 30% 左右。截至目前,數據顯示 Lido 仍維持 27% 的市場份額,表明其業務需求依然強勁。

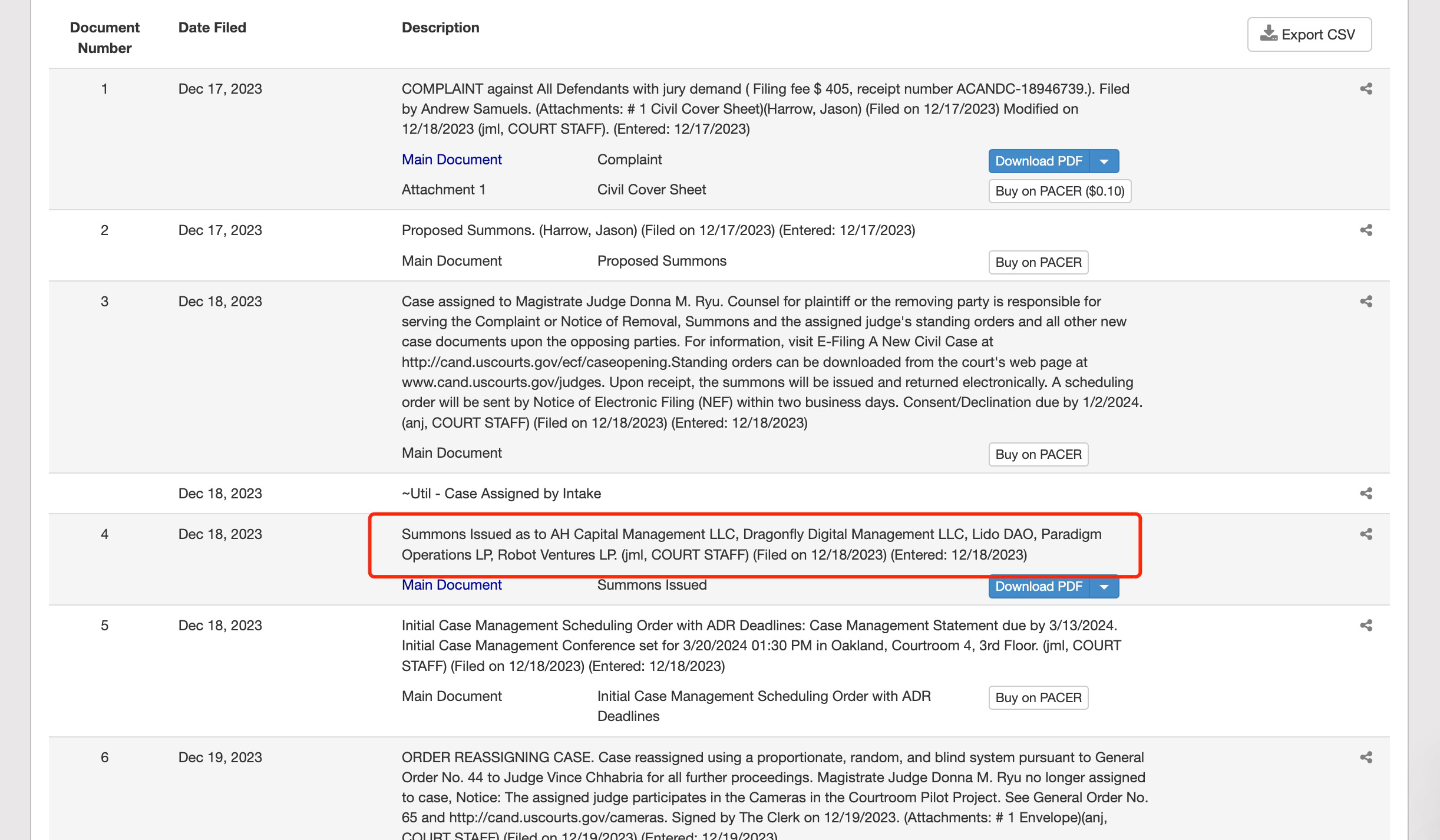

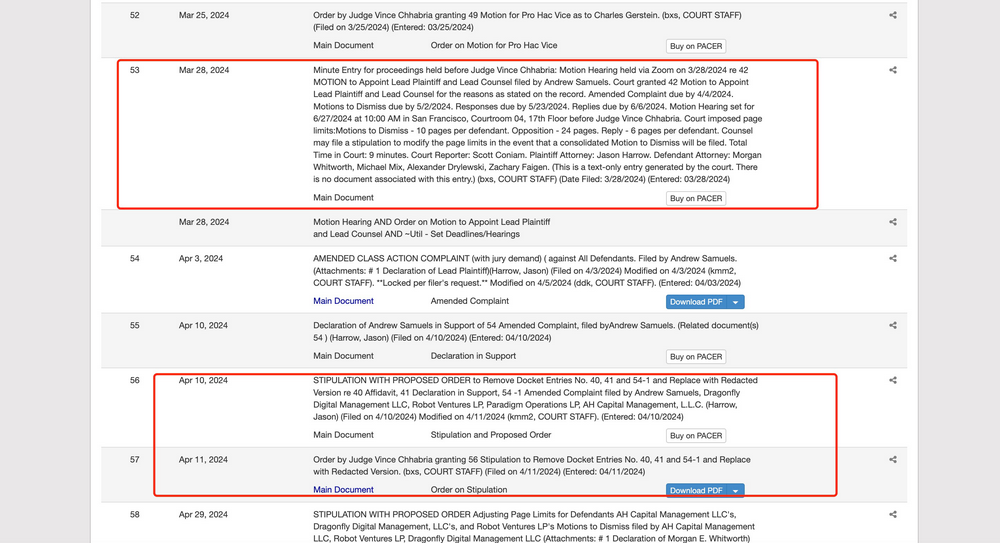

然而,Lido 目前面臨的價格低迷主要源於 2023 年底爆發的一起訴訟案。當時,一位名爲 Andrew Samuels 的個人在美國加利福尼亞北區聯邦地區法院對 Lido DAO 提起訴訟,指控其未經註冊向公衆出售 LDO 代幣,違反了《1933 年證券法》的規定。這一訴訟不僅涉及 Lido DAO,還包括其主要投資人。

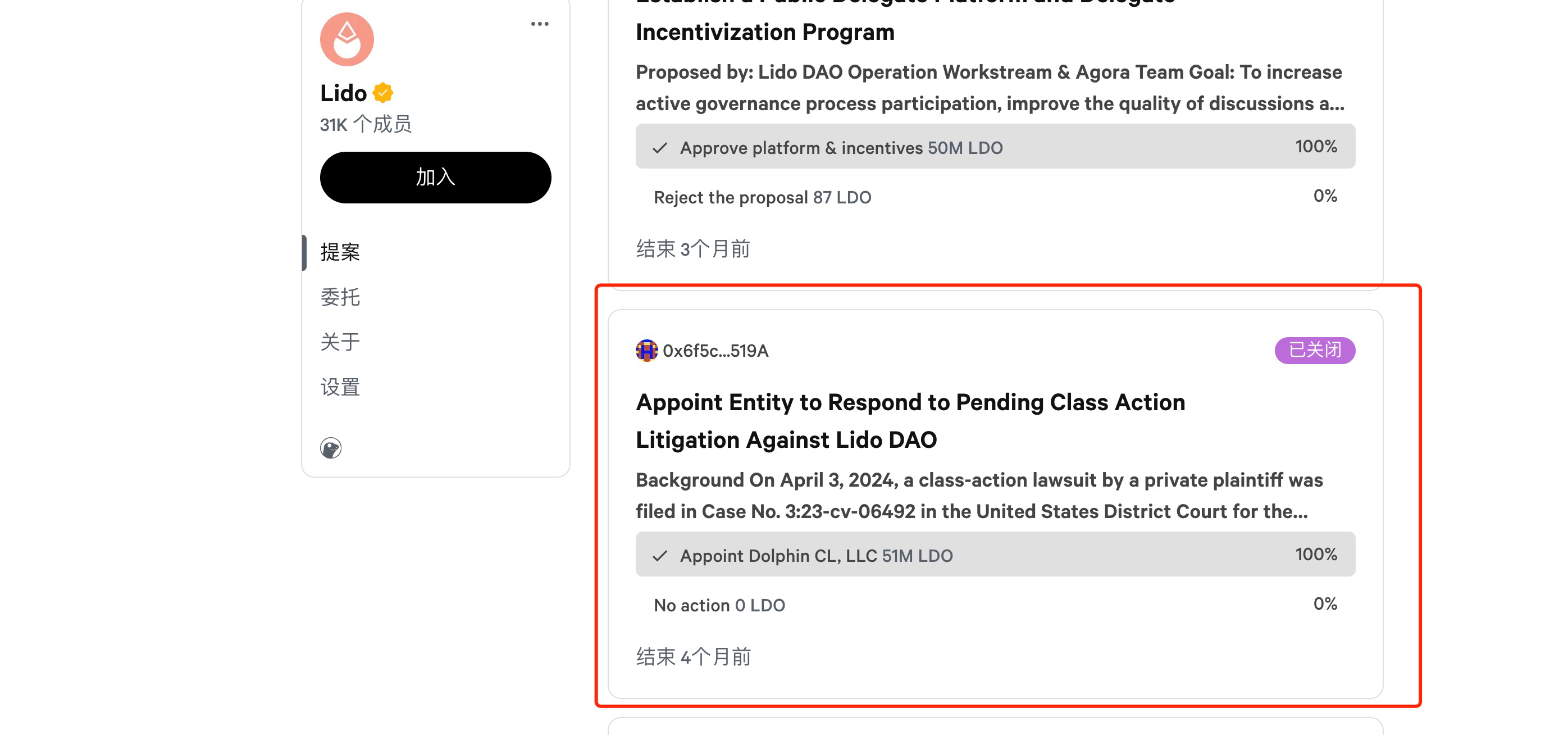

訴訟案的進展對 LDO 價格產生了顯著影響。2024 年 4 月 10 日,法院確定受理該案。隨後,原告方要求對 Lido DAO 宣告缺席,迫使 Lido DAO 不得不聘請律師應訴。這一系列事件引發了投資者的避險情緒,導致 LDO 價格持續承壓。

stETH 的證券屬性爭議

除了上述訴訟,SEC 在 2024 年 6 月對 Consensys Software Inc. 提起的訴訟也對 Lido 產生了影響。SEC 指控 Consensys 通過其 MetaMask Staking 服務從事未註冊的證券發行和銷售,其中涉及 Lido 的 stETH 代幣。

這些案件的核心爭議在於 stETH 是否屬於證券。美國法律通常使用"豪威測試"來判斷某種交易或工具是否構成證券。該測試包括四個標準:投資資金、共同企業、預期利潤和他人努力。

然而,加密貨幣行業對此持不同觀點。例如,某交易平台認爲 ETH Staking 業務並不符合豪威測試的四個要素,因此不應被視爲證券交易。他們認爲,質押過程中用戶保留資產所有權,沒有共同企業,質押獎勵類似於勞動所得,且不依賴他人管理努力。

Lido 未來發展值得關注

考慮到以下幾點,Lido 的後續發展值得密切關注:

當前價格壓力主要來自監管不確定性,而非業務表現不佳。

ETH 已被定義爲商品,相關討論空間較大。

ETH ETF 獲批後,可能會有更多資源投入推動相關業務發展。

相關訴訟的法律成本相對較小,影響可控。

綜上所述,隨着監管環境可能改善的預期升溫,Lido 的發展前景值得投資者持續關注。