Post content & earn content mining yield

placeholder

Market Analisys news and talk

- Reward

- like

- Comment

- Repost

- Share

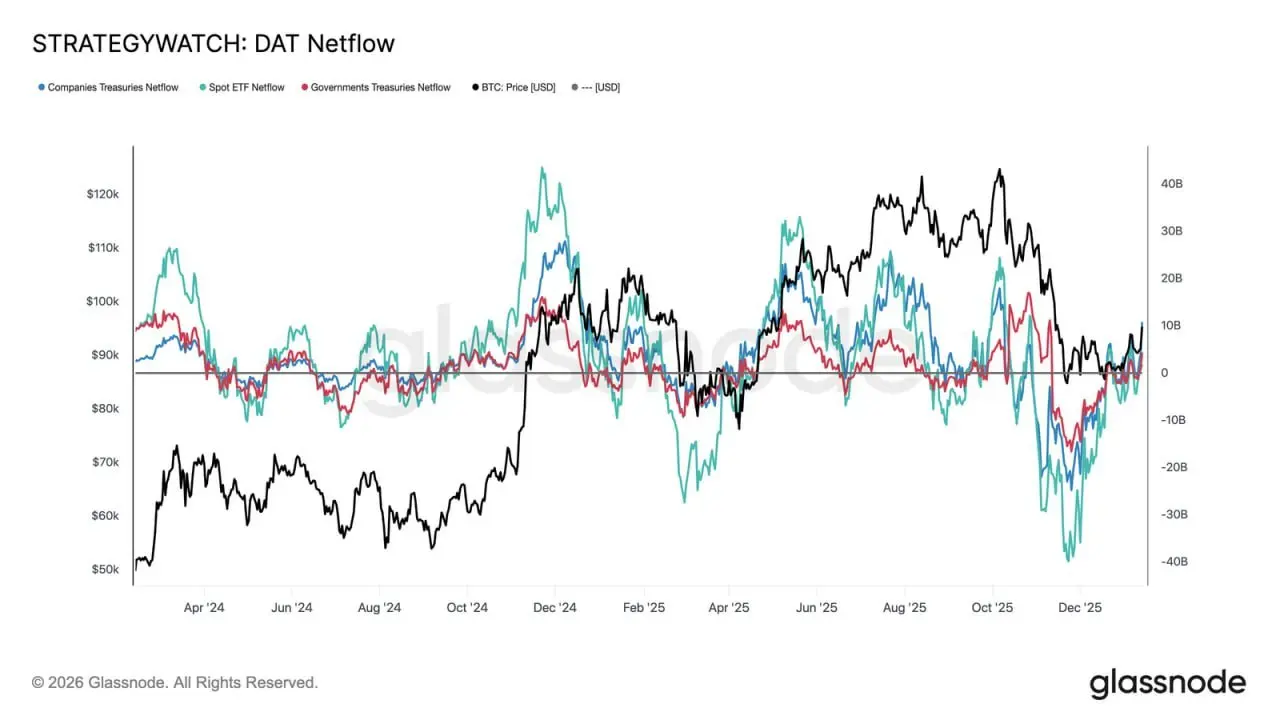

Institutional balance-sheet flows have completed a full reset over recent months. Following heavy outflows across spot ETFs, corporates, and sovereigns, netflows have now stabilized, signaling sell-side exhaustion from long-term structural holders.

Spot ETFs are leading the turn, moving back into positive net inflows and reclaiming their role as the primary marginal buyer. Historically, ETF inflows have accompanied every expansion phase, and their return suggests real-money allocators are rebuilding exposure, not just trading volatility.#WeekendMarketAnalysis

Spot ETFs are leading the turn, moving back into positive net inflows and reclaiming their role as the primary marginal buyer. Historically, ETF inflows have accompanied every expansion phase, and their return suggests real-money allocators are rebuilding exposure, not just trading volatility.#WeekendMarketAnalysis

- Reward

- like

- Comment

- Repost

- Share

cg

CG

Created By@ComeWealth,ComeWealth

Subscription Progress

0.00%

MC:

$0

Create My Token

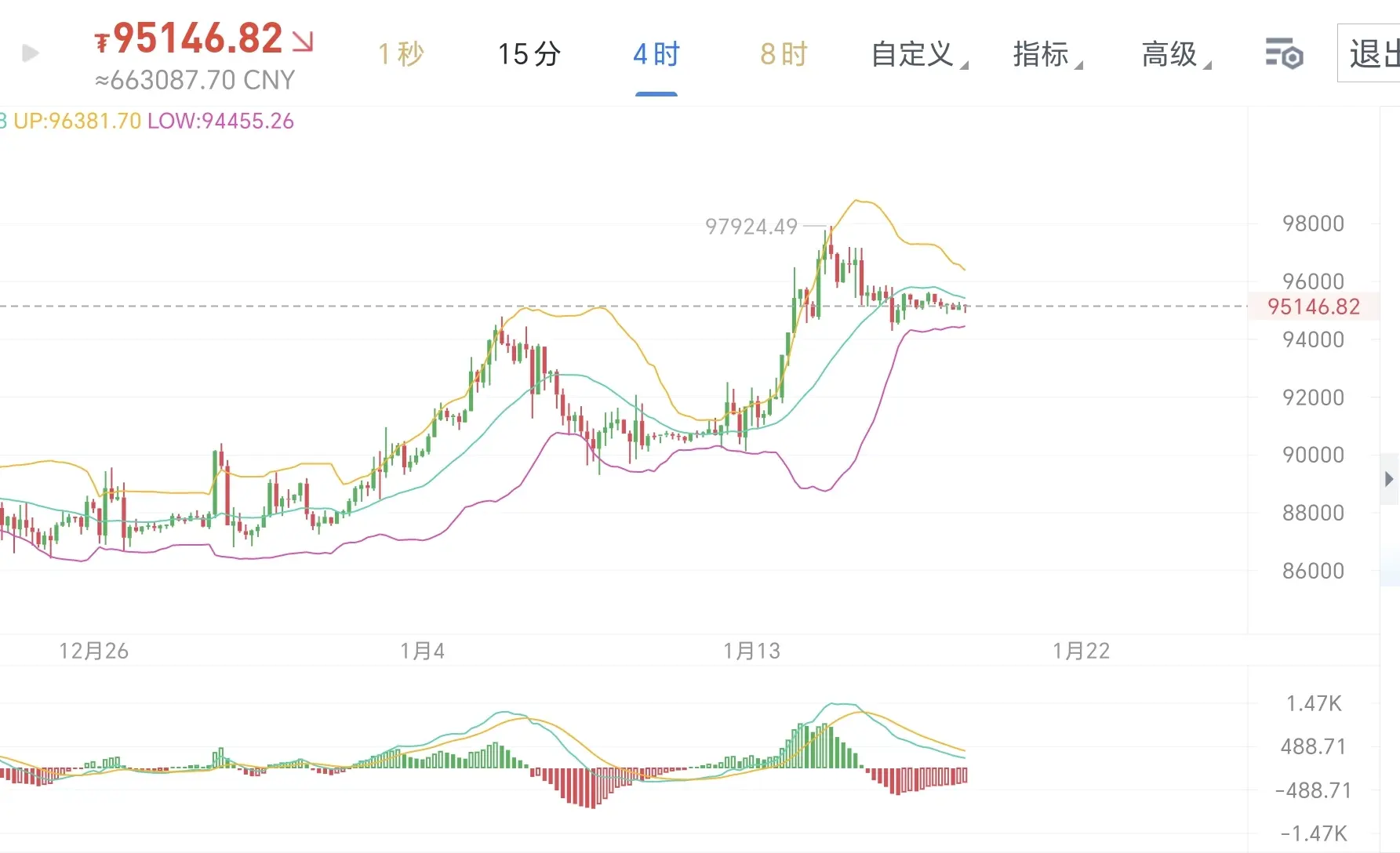

Last week, was the 98,000 rally something many people missed out on?

So don't miss out again this week. Next, everyone can discuss how BTC will move next week. I'll start by sharing my view: look at the four-hour indicator in the chart—it's showing a downward narrowing pattern. A typical engulfing pattern filling the lower gap indicates that next week might see a retest of lower levels. Therefore, I am advising everyone to consider shorting on rebounds today. This is just my personal opinion. Those who read this article can discuss in the comments section #BTC #ETH

View OriginalSo don't miss out again this week. Next, everyone can discuss how BTC will move next week. I'll start by sharing my view: look at the four-hour indicator in the chart—it's showing a downward narrowing pattern. A typical engulfing pattern filling the lower gap indicates that next week might see a retest of lower levels. Therefore, I am advising everyone to consider shorting on rebounds today. This is just my personal opinion. Those who read this article can discuss in the comments section #BTC #ETH

- Reward

- like

- Comment

- Repost

- Share

This the “ICE got me” fit.

- Reward

- like

- Comment

- Repost

- Share

$BNB /USDT BNB is trading around 947 after failing to hold above the 959 area. Buyers pushed hard earlier but sellers came in fast near resistance and cooled momentum. Right now price is floating in a make-or-break zone where a small bounce could restart the climb, otherwise a drop back toward 942-930 can happen if sellers press again. Market feels tense and undecided

$BNB #WeekendMarketAnalysis #GateFunTokenRecommadation #BitMineBoostsETHStaking #CryptoMarketWatch

$BNB #WeekendMarketAnalysis #GateFunTokenRecommadation #BitMineBoostsETHStaking #CryptoMarketWatch

BNB0,3%

- Reward

- 1

- Comment

- Repost

- Share

Fidelity says Wall Street #integration will power crypto's next phase. Institutions are moving from experimentation to deep integration, spot ETFs, tokenized assets, custody solutions, and #blockchain infrastructure are driving real #adoption and capital inflows. #crypto

- Reward

- like

- Comment

- Repost

- Share

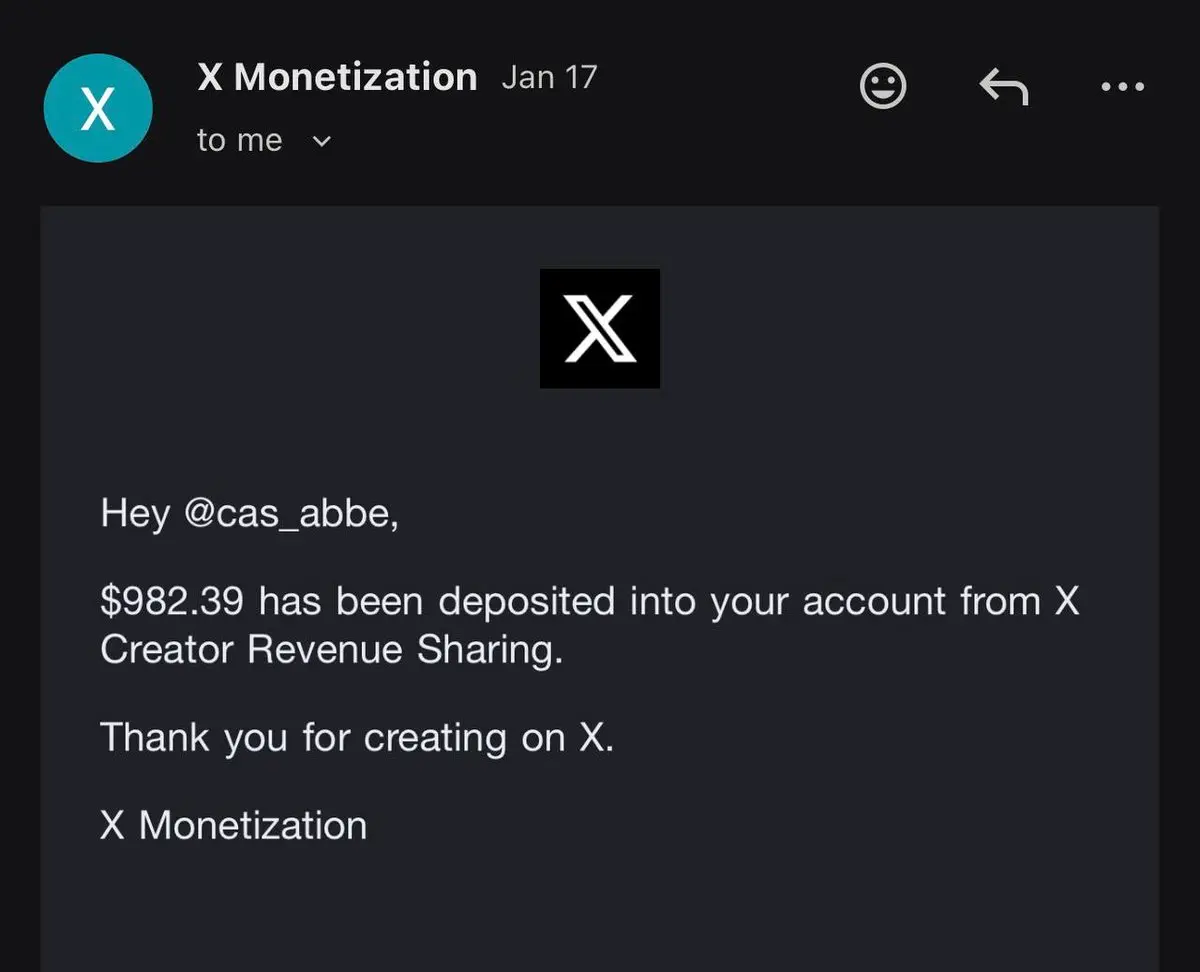

Almost didn’t believe this email at first 😅

Creators getting paid for actually posting now.

If you’re on X and not monetized yet… what’s stopping you?

Be honest..

Did you know X pays creators like this?

Creators getting paid for actually posting now.

If you’re on X and not monetized yet… what’s stopping you?

Be honest..

Did you know X pays creators like this?

- Reward

- like

- 2

- Repost

- Share

ABriefDiscussionOnMakingA :

:

How to do itView More

Publish the strategy across the entire network. Follow along and report, hoping to have friends who follow!

View Original

- Reward

- like

- Comment

- Repost

- Share

#特斯马 community's strength is powerful. Face risks bravely, look forward to the sudden explosion of the hundredfold coin, and let's resolutely wait and迎接 the moment of takeoff!

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 LAST FREE SPOTS:

We start tomorrow! We will give 4 live classes where you will learn how to make money with cryptocurrencies. You will see our method that has helped over +4,000 people.

Reserve your spot with free access:

View OriginalWe start tomorrow! We will give 4 live classes where you will learn how to make money with cryptocurrencies. You will see our method that has helped over +4,000 people.

Reserve your spot with free access:

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$15.22K

Create My Token

$ZEN is consolidating after a strong push, holding above the $12 zone.

As long as $11.95–$12.00 acts as support, structure stays bullish.

A reclaim of $12.40–$12.60 can trigger continuation toward $13+.

Pullbacks with low volume remain constructive.

Momentum favors patience over chasing here. Watch.

#Trading #Gate

As long as $11.95–$12.00 acts as support, structure stays bullish.

A reclaim of $12.40–$12.60 can trigger continuation toward $13+.

Pullbacks with low volume remain constructive.

Momentum favors patience over chasing here. Watch.

#Trading #Gate

- Reward

- 2

- Comment

- Repost

- Share

The BTC OG inside Whale has increased its ETH long Position to $ 736- is market risk appetite rebounding?

- Reward

- 1

- 1

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”- Reward

- 5

- 13

- Repost

- Share

忘年之交斌 :

:

2026 Go Go Go 👊View More

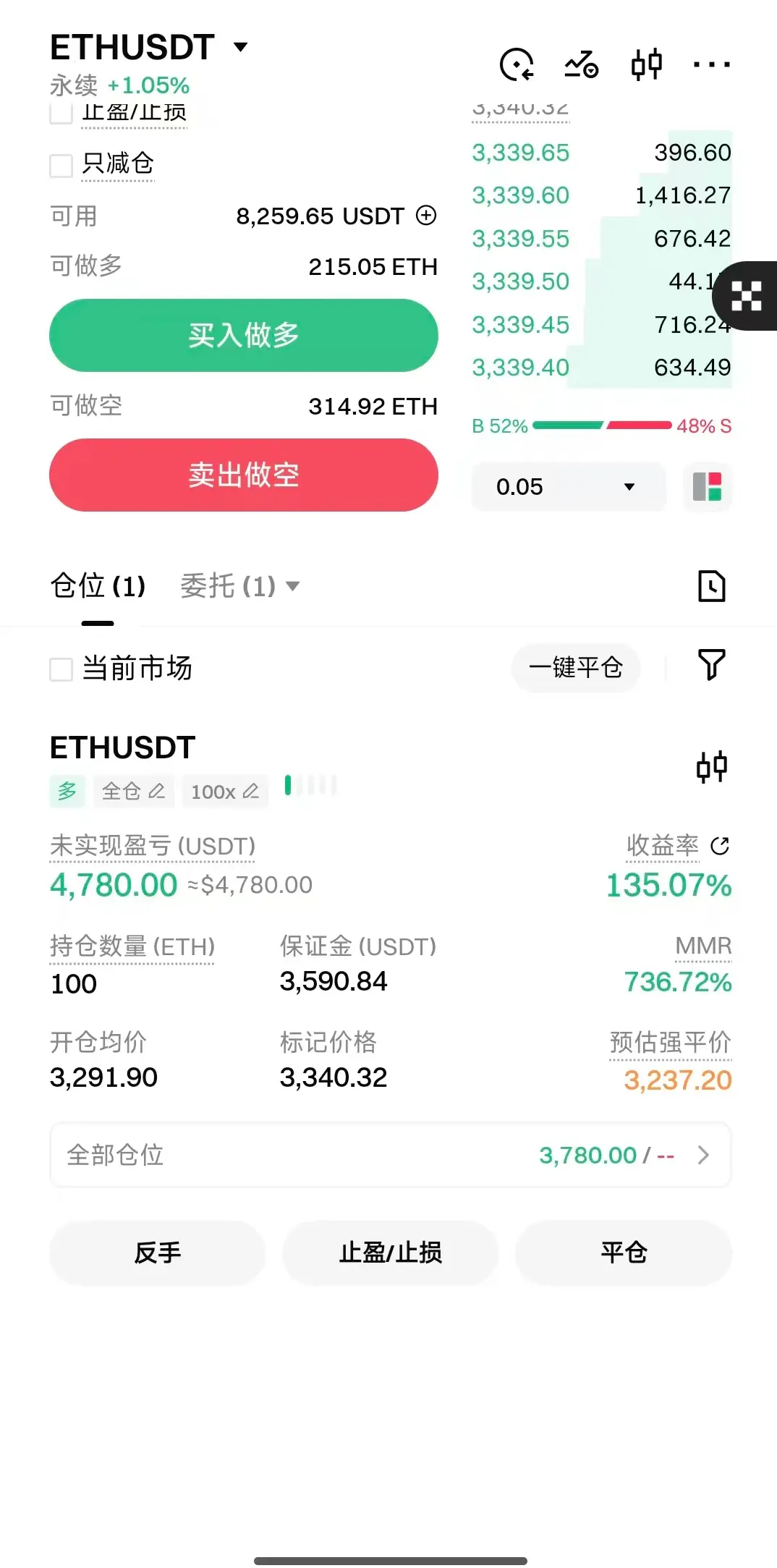

Normally, I should be in a state of fear of heights at this position, but I now have a strong feeling urging me to close my short positions and go ALL IN on long positions. Is this just my illusion?#周末行情分析

View Original

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More23.43K Popularity

18.46K Popularity

30.71K Popularity

11.09K Popularity

9.18K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$3.56KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

News

View MoreFidelity: Wall Street consolidation will drive cryptocurrencies into a new phase

4 m

TRUMP Team-Related Wallet Deposits 381K TRUMP Tokens to CEX

8 m

Fidelity Digital Assets: Integration with Wall Street will drive the next phase of cryptocurrency development

9 m

Meteora's protocol revenue over the past 24 hours surpasses Pump.fun

20 m

In the past 24 hours, the total contract liquidation across the entire network reached $84,225,200, mainly from long positions.

29 m

Pin