#DeepCreationCamp Crypto Market Rebounds: A Forward-Looking Structural Outlook for the Next Expansion Phase

The cryptocurrency market has entered a renewed recovery phase marked by improving liquidity conditions, strengthening institutional flows, and expanding ecosystem activity. After a prolonged consolidation period characterized by cautious capital allocation and risk reduction, digital assets are once again demonstrating resilience. However, the current rebound differs structurally from prior speculative rallies. It is increasingly driven by infrastructure maturity, regulatory clarity in key regions, and cross-sector integration with emerging technologies.

At the core of this recovery lies the leadership of Bitcoin and Ethereum, which continue to function as liquidity anchors for the broader market. Bitcoin’s dominance has stabilized while Ethereum’s ecosystem expansion in decentralized finance and staking participation reflects renewed network utilization. Rather than isolated price spikes, the current movement suggests coordinated capital rotation across high-quality digital assets.

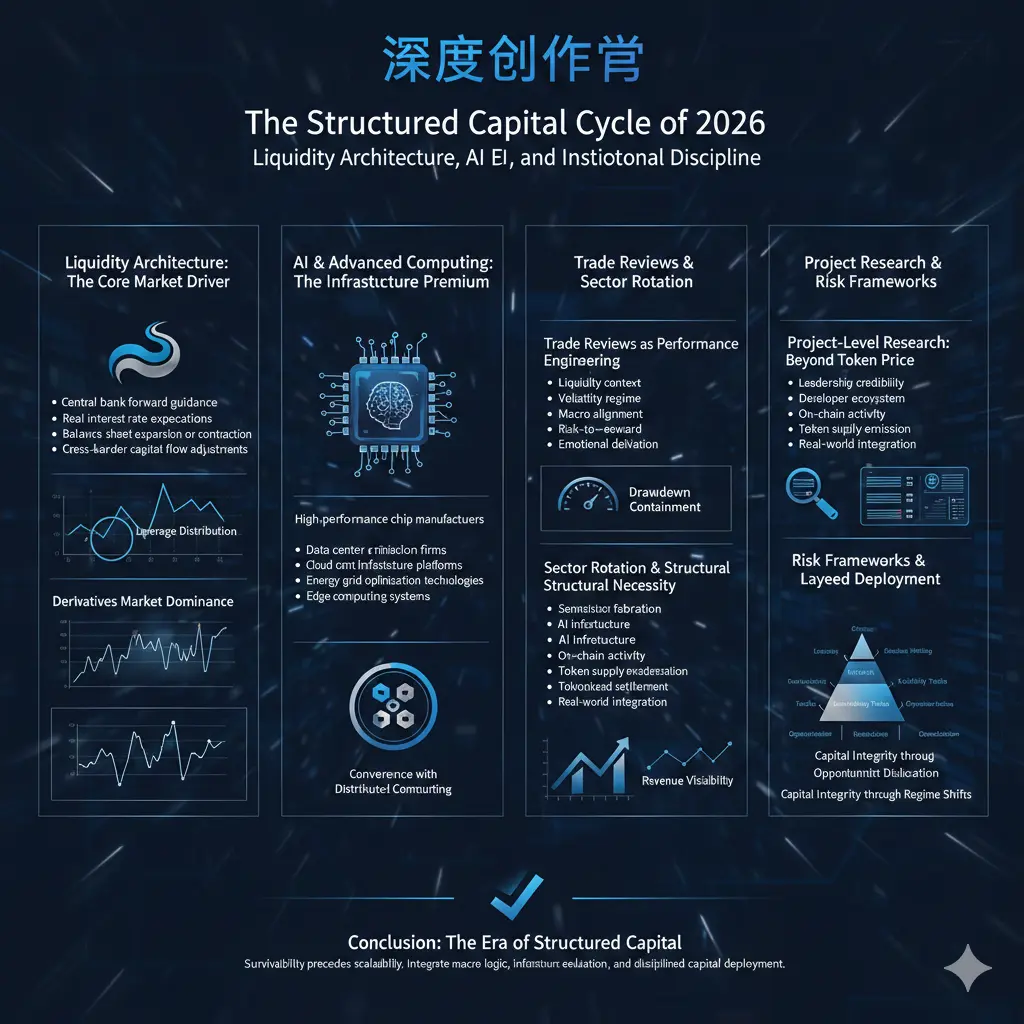

Macroeconomic stabilization remains a central catalyst. Moderating inflation trends across major economies and reduced volatility in sovereign bond markets have eased systemic pressure on risk assets. As real yields stabilize and expectations of aggressive monetary tightening diminish, portfolio managers are gradually increasing exposure to alternative growth instruments. Digital assets, historically classified as high-beta macro-sensitive assets, tend to outperform during early risk-on transitions. The present rebound aligns with this macro rotation dynamic.

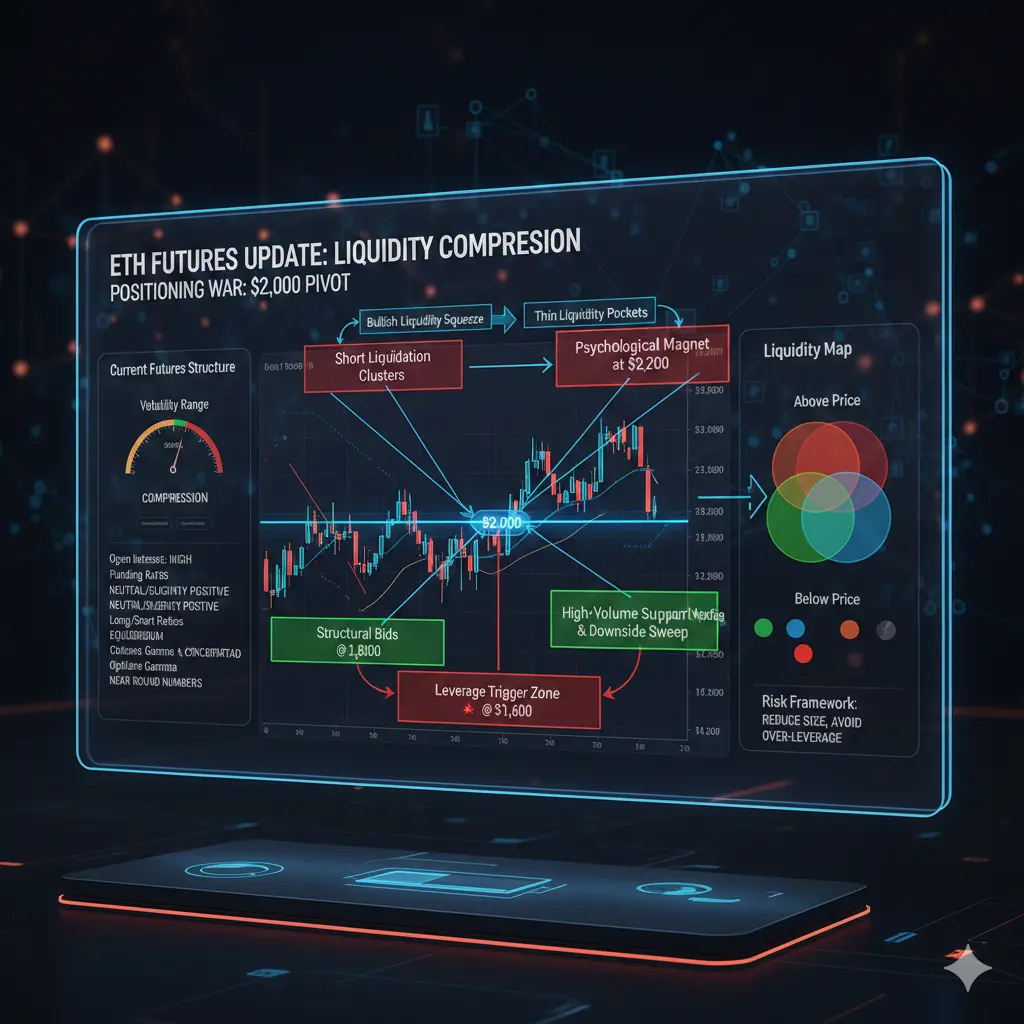

Institutional engagement has also evolved beyond passive accumulation. Spot market volumes are expanding alongside derivatives market depth, indicating more sophisticated positioning strategies. Open interest growth in perpetual and futures contracts reflects renewed participation, yet funding rates remain balanced—suggesting the absence of excessive speculative leverage. This equilibrium reduces the probability of cascade liquidations and supports structurally healthier upward price action.

On-chain fundamentals further validate the recovery narrative. Active wallet growth, cross-chain bridge activity, and total value locked in decentralized finance protocols are trending upward. Increased staking participation signals long-term conviction among holders, effectively reducing circulating supply pressure. Unlike prior cycles dominated by purely narrative-driven tokens, the current phase shows stronger alignment between price appreciation and network utilization metrics.

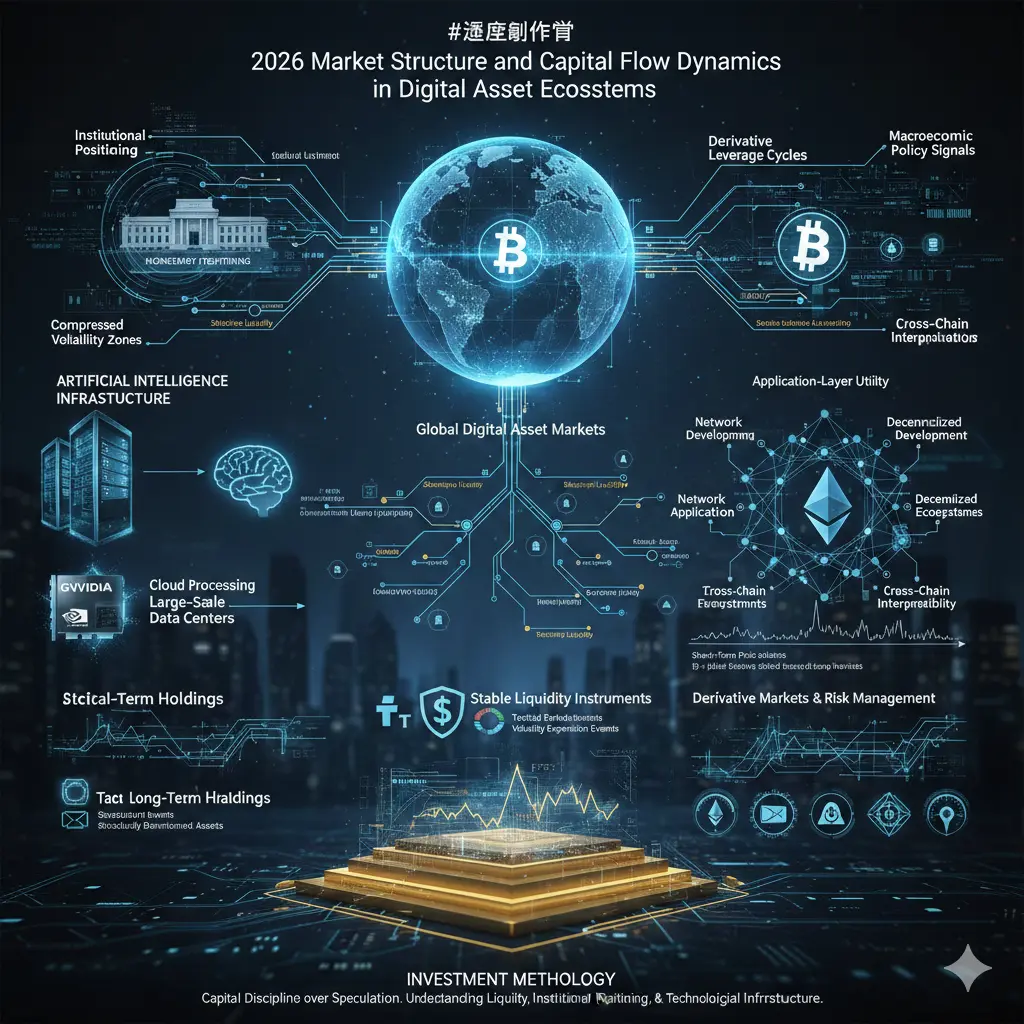

Sector rotation dynamics are becoming increasingly visible. In early recovery stages, large-cap assets typically outperform due to their liquidity and perceived safety. As confidence builds, capital flows toward infrastructure protocols, layer-two scalability solutions, and application-layer ecosystems. Emerging integration between blockchain infrastructure and artificial intelligence-based automation tools is also shaping new investment theses. Additionally, tokenization frameworks are expanding the real-world asset narrative, creating new bridges between traditional finance and decentralized systems.

Regulatory developments are contributing to improved market structure. Increased compliance frameworks and clearer digital asset classifications in major financial jurisdictions are reducing long-term uncertainty. Institutional custodial services, regulated trading venues, and enhanced reporting standards are strengthening market integrity. While regulatory shifts remain a variable risk factor, the broader trend suggests gradual normalization rather than systemic suppression.

Retail sentiment, while improving, has not yet reached euphoric extremes. Social metrics and search trends indicate cautious optimism rather than speculative mania. This measured participation often characterizes sustainable accumulation phases. Historically, durable bull cycles emerge when retail adoption expands alongside institutional capital rather than preceding it.

Looking forward, the sustainability of the rebound will depend on several structural pillars: continued macro stability, steady stablecoin supply growth, consistent developer activity, and ecosystem innovation. If venture capital deployment accelerates and technological advancements translate into real economic utility, the market could transition from recovery into a broader expansion cycle.

However, risks remain. Liquidity contraction, unexpected monetary tightening, or regulatory shocks could disrupt momentum. Digital assets remain inherently volatile, and risk management remains essential even during constructive phases.

In strategic terms, the current crypto market rebound reflects more than short-term relief. It represents a recalibration of capital flows within a maturing ecosystem. The interplay between macro conditions, institutional frameworks, derivatives balance, and network fundamentals suggests a structurally healthier environment compared to previous speculative surges.

As the digital asset landscape evolves, this phase may ultimately serve as a transitional foundation for the next innovation-driven cycle—one defined not solely by price expansion, but by deeper integration of blockchain infrastructure into global financial and technological systems.

#DeepDiveCreatorCamp