Marcinthematrix

No content yet

Marcinthematrix

🚨 BIG: THE XRP LEDGER HAS LAUNCHED A MEMBERS-ONLY DEX TAILORED FOR REGULATED INSTITUTIONS.

The new Permissioned DEX enables compliant, KYC-verified trading directly on XRPL, a move aimed at bridging DeFi infrastructure with institutional requirements.

The new Permissioned DEX enables compliant, KYC-verified trading directly on XRPL, a move aimed at bridging DeFi infrastructure with institutional requirements.

XRP-0,61%

- Reward

- like

- Comment

- Repost

- Share

🇪🇺 HUGE: THE EUROPEAN CENTRAL BANK ADVANCES ITS DIGITAL EURO TIMELINE.

PILOT SET FOR MID-2027.

FULL LAUNCH TARGETED FOR MID-2029, PENDING EU LEGISLATION.

ISN’T THAT A BIT TOO LONG?

PILOT SET FOR MID-2027.

FULL LAUNCH TARGETED FOR MID-2029, PENDING EU LEGISLATION.

ISN’T THAT A BIT TOO LONG?

- Reward

- 2

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🇪🇺 BREAKING: ECB PRESIDENT CHRISTINE LAGARDE WILL RESIGN BEFORE COMPLETING HER 8-YEAR TERM.

Will the next European Central Bank president be crypto-friendly?

Will the next European Central Bank president be crypto-friendly?

- Reward

- 1

- Comment

- Repost

- Share

🚨 BIG: PETER THIEL HAS FULLY EXITED ETHEREUM TREASURY FIRM ETHZILLA AFTER SELLING HIS ENTIRE STAKE.

Strategic rotation or something else?

Strategic rotation or something else?

ETH-0,36%

- Reward

- like

- Comment

- Repost

- Share

🚨🇯🇵 $550 BILLION.

TRUMP JUST GOT JAPAN TO PAY FOR THE RE-INDUSTRIALIZATION OF THE UNITED STATES.

THEY ARE FUNDING LNG IN TEXAS.

THEY ARE FUNDING POWER IN OHIO.

THEY ARE FUNDING MINES IN GEORGIA.

AMERICA ISN'T SENDING MONEY ABROAD. THEY ARE DRAINING GLOBAL CAPITAL INTO AMERICAN SOIL.

THE CAPITAL IS COMING TO THE U.S. 🇺🇸

TRUMP JUST GOT JAPAN TO PAY FOR THE RE-INDUSTRIALIZATION OF THE UNITED STATES.

THEY ARE FUNDING LNG IN TEXAS.

THEY ARE FUNDING POWER IN OHIO.

THEY ARE FUNDING MINES IN GEORGIA.

AMERICA ISN'T SENDING MONEY ABROAD. THEY ARE DRAINING GLOBAL CAPITAL INTO AMERICAN SOIL.

THE CAPITAL IS COMING TO THE U.S. 🇺🇸

- Reward

- 2

- Comment

- Repost

- Share

🚨 YOU LITERALLY CAN’T MAKE THIS UP.

THE DUTCH FINANCE SECRETARY WHO WANTED TO TAX YOUR BITCOIN UNREALIZED GAINS AT 36% JUST RESIGNED.

THE REASON? SHE HAD UNREALIZED CREDENTIALS.

NATHALIE VAN BERKEL CAUGHT FALSIFYING EDUCATIONAL CREDENTIALS ON HER CV.

THESE ARE THE PEOPLE WRITING THE RULES.

THE DUTCH FINANCE SECRETARY WHO WANTED TO TAX YOUR BITCOIN UNREALIZED GAINS AT 36% JUST RESIGNED.

THE REASON? SHE HAD UNREALIZED CREDENTIALS.

NATHALIE VAN BERKEL CAUGHT FALSIFYING EDUCATIONAL CREDENTIALS ON HER CV.

THESE ARE THE PEOPLE WRITING THE RULES.

BTC-0,32%

- Reward

- 2

- Comment

- Repost

- Share

🚨 JUST IN: RIPPLE CEO BRAD GARLINGHOUSE PREDICTS 80% CHANCE CLARITY ACT PASSES BY END OF APRIL.

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: THE U.S. HAS DISCOVERED AN ESTIMATED $1.5 TRILLION LITHIUM DEPOSIT BENEATH AN ANCIENT SUPERVOLCANO IN NEVADA.

THINK EVS, BATTERIES AND ENERGY INDEPENDENCE.

THINK EVS, BATTERIES AND ENERGY INDEPENDENCE.

- Reward

- like

- Comment

- Repost

- Share

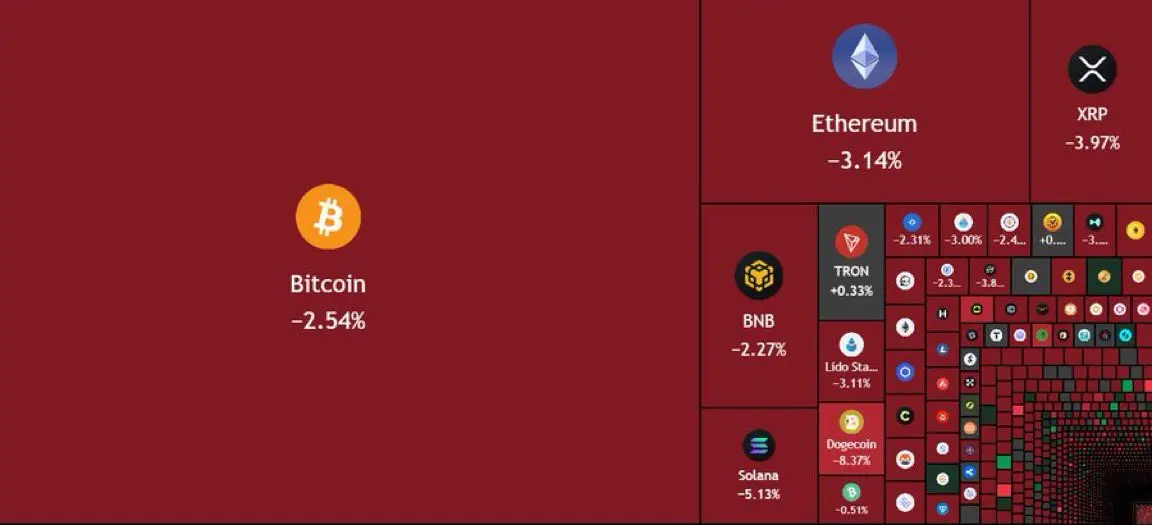

🚨 HUGE: $90,000,000,000 HAS BEEN ERASED FROM THE CRYPTO MARKET IN THE PAST 3 HOURS.

- Reward

- like

- Comment

- Repost

- Share

🇷🇺 HUGE: RUSSIA’S FINANCE MINISTRY SAYS THEIR CRYPTO TURNOVER NOW EXCEEDS $650M PER DAY, OR $130B ANNUALLY.

- Reward

- like

- Comment

- Repost

- Share

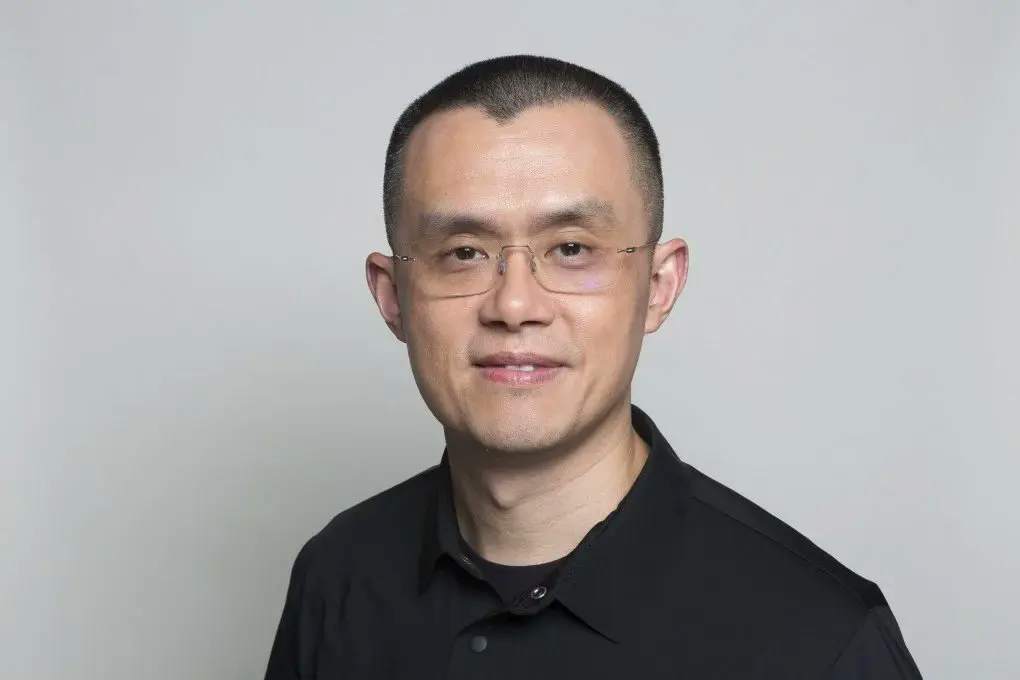

🚨 CZ: THE FINAL HURDLE FOR CRYPTO PAYMENTS ISN’T SPEED OR FEES. IT’S PRIVACY.

Until we build “invisible rails” that protect users and stay compliant, mainstream crypto payments won’t happen.

Do you agree with him?

Until we build “invisible rails” that protect users and stay compliant, mainstream crypto payments won’t happen.

Do you agree with him?

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

🚨 INSANE: 🇺🇸 THE US STOCK MARKET HAS NEVER BEEN THIS EXPENSIVE

The gap between stock prices and actual money supply (M2) just hit a record-breaking 270%.

• We are now +120 points higher than 2022.

• We are +40 points higher than the peak of the Dot-Com Bubble.

• We are +75 points higher than the 2008 Financial Crisis.

While the UK and France sit at a modest ~60% (below pre-covid highs), the US is defying gravity. Even Japan is only back to its 1990s levels.

The market isn't just running ahead of liquidity... it has completely detached from reality.

The gap between stock prices and actual money supply (M2) just hit a record-breaking 270%.

• We are now +120 points higher than 2022.

• We are +40 points higher than the peak of the Dot-Com Bubble.

• We are +75 points higher than the 2008 Financial Crisis.

While the UK and France sit at a modest ~60% (below pre-covid highs), the US is defying gravity. Even Japan is only back to its 1990s levels.

The market isn't just running ahead of liquidity... it has completely detached from reality.

- Reward

- like

- Comment

- Repost

- Share