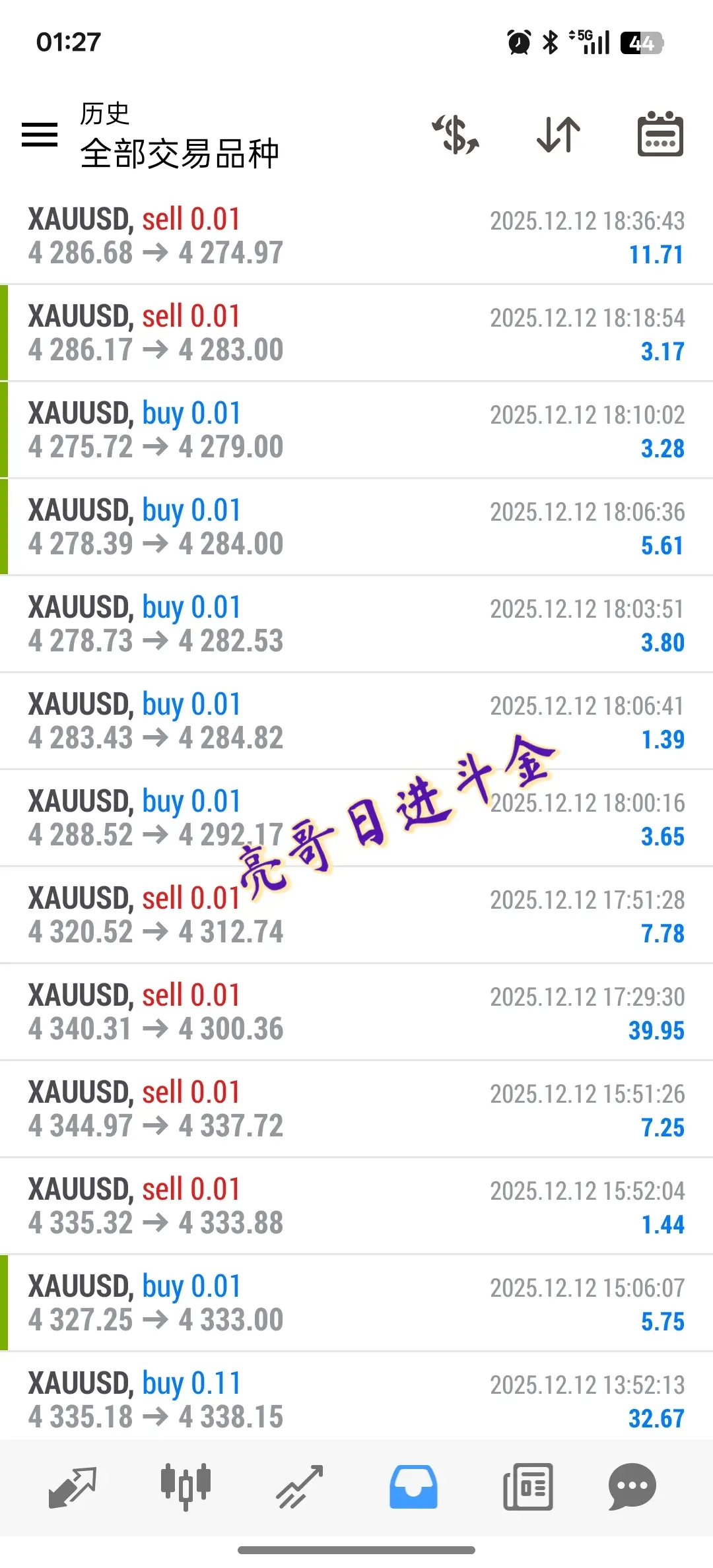

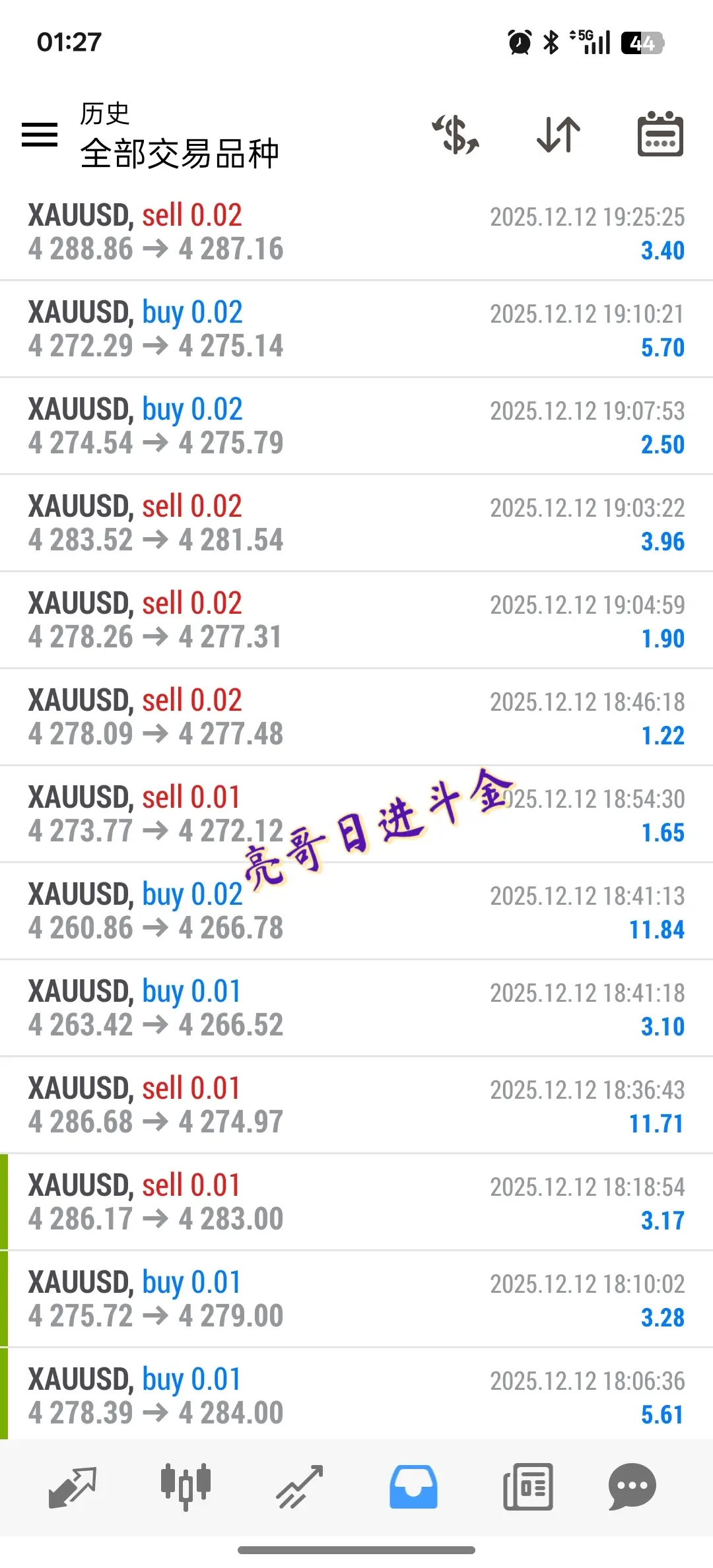

亮哥日进斗金

No content yet

亮哥日进斗金

The best recognition for Brother Liang is genuine feedback from fans and friends! Even with fewer bullets, as long as the strength is in place and execution is solid, you can still keep winning and turning the tide all the way!

View Original

- Reward

- 2

- Comment

- Repost

- Share

Spot gold breaks through the 4300 level, intraday increase of 0.67%

Today’s gold performance is strong, with spot gold (XAU) continuing to rise during the trading session, currently at 4308.19, up 28.57 from the previous day ⬆️ 0.67%, successfully breaking through the 4300 psychological barrier.

Gold prices gradually rose in the afternoon, closing above 4300. The current trend shows that the bulls are in control, with a continuous upward momentum on the daily chart.

On the technical side, gold has broken through the recent consolidation upper boundary. If it stabilizes above 4300, the next res

View OriginalToday’s gold performance is strong, with spot gold (XAU) continuing to rise during the trading session, currently at 4308.19, up 28.57 from the previous day ⬆️ 0.67%, successfully breaking through the 4300 psychological barrier.

Gold prices gradually rose in the afternoon, closing above 4300. The current trend shows that the bulls are in control, with a continuous upward momentum on the daily chart.

On the technical side, gold has broken through the recent consolidation upper boundary. If it stabilizes above 4300, the next res

- Reward

- 1

- Comment

- Repost

- Share

Enjoy the process of the gradual growth of bullets, which can be described in two words - comfortable!

View Original

- Reward

- 1

- Comment

- Repost

- Share

The Federal Reserve announces a third consecutive rate cut, indicating a shift in policy

On the 10th local time, the Federal Reserve announced a further 25 basis point reduction, bringing the federal funds rate target range to 3.5%-3.75%. This is the third rate cut since September, with a total reduction of 175 basis points in this cycle.

The Fed Chair stated that the current interest rate level has become balanced, and there is limited room for further adjustments. Market analysts believe that this statement may signal that the current adjustment cycle is nearing its end. The decision-making

View OriginalOn the 10th local time, the Federal Reserve announced a further 25 basis point reduction, bringing the federal funds rate target range to 3.5%-3.75%. This is the third rate cut since September, with a total reduction of 175 basis points in this cycle.

The Fed Chair stated that the current interest rate level has become balanced, and there is limited room for further adjustments. Market analysts believe that this statement may signal that the current adjustment cycle is nearing its end. The decision-making

- Reward

- like

- Comment

- Repost

- Share

December 12, Friday Today’s key focus: financial data and events!

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold prices stabilized at high levels after a surge yesterday, and the overall technical structure remains intact. The current price around 4278 can consider a light short position to try short-term shorts, with a target of around 4250. If it falls back to this area and receives effective support, consider reversing and establishing long positions, operating in trend.

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold, after a strong rally last night, also experienced a slight pullback as expected, dropping to 4285 and then down to 4263, a 22-point 📉

View Original

- Reward

- 1

- Comment

- Repost

- Share

Gold, long orders can come to an end, it is not advisable to chase long at this moment, you need to be wary of a pullback! Now the 4278-4285 area can be laid out at high altitudes, and the target is the 4240-4220 area.

View Original

- Reward

- like

- Comment

- Repost

- Share

Gold, stabilized in the 4210-4200 range, with a strong upward move as expected in the evening session, reaching a high of 📈 to 4244, a gain of 40 points!

View Original

- Reward

- like

- Comment

- Repost

- Share

12.11 Afternoon Silver Market Strategy | Exclusive for Liang Ge

Last night, the Federal Reserve cut interest rates by 25 basis points and launched balance sheet expansion, triggering a fierce market reaction—silver first tested the bottom at 60.07, then strongly surged to a record high of 62.86. The daily chart closed with a large bullish candlestick with a lower shadow, firmly holding above the 61.8 level.

The current market has entered a critical phase of “benefits realization and bulls vs. bears struggle.” On one hand, there are “rare disagreements” within the Fed about future policy paths,

View OriginalLast night, the Federal Reserve cut interest rates by 25 basis points and launched balance sheet expansion, triggering a fierce market reaction—silver first tested the bottom at 60.07, then strongly surged to a record high of 62.86. The daily chart closed with a large bullish candlestick with a lower shadow, firmly holding above the 61.8 level.

The current market has entered a critical phase of “benefits realization and bulls vs. bears struggle.” On one hand, there are “rare disagreements” within the Fed about future policy paths,

- Reward

- like

- Comment

- Repost

- Share

Gold, during the Asian session, short position at the market price of 4240 was precisely hit the target of 4220, resulting in a 20-point profit!

View Original

- Reward

- like

- Comment

- Repost

- Share

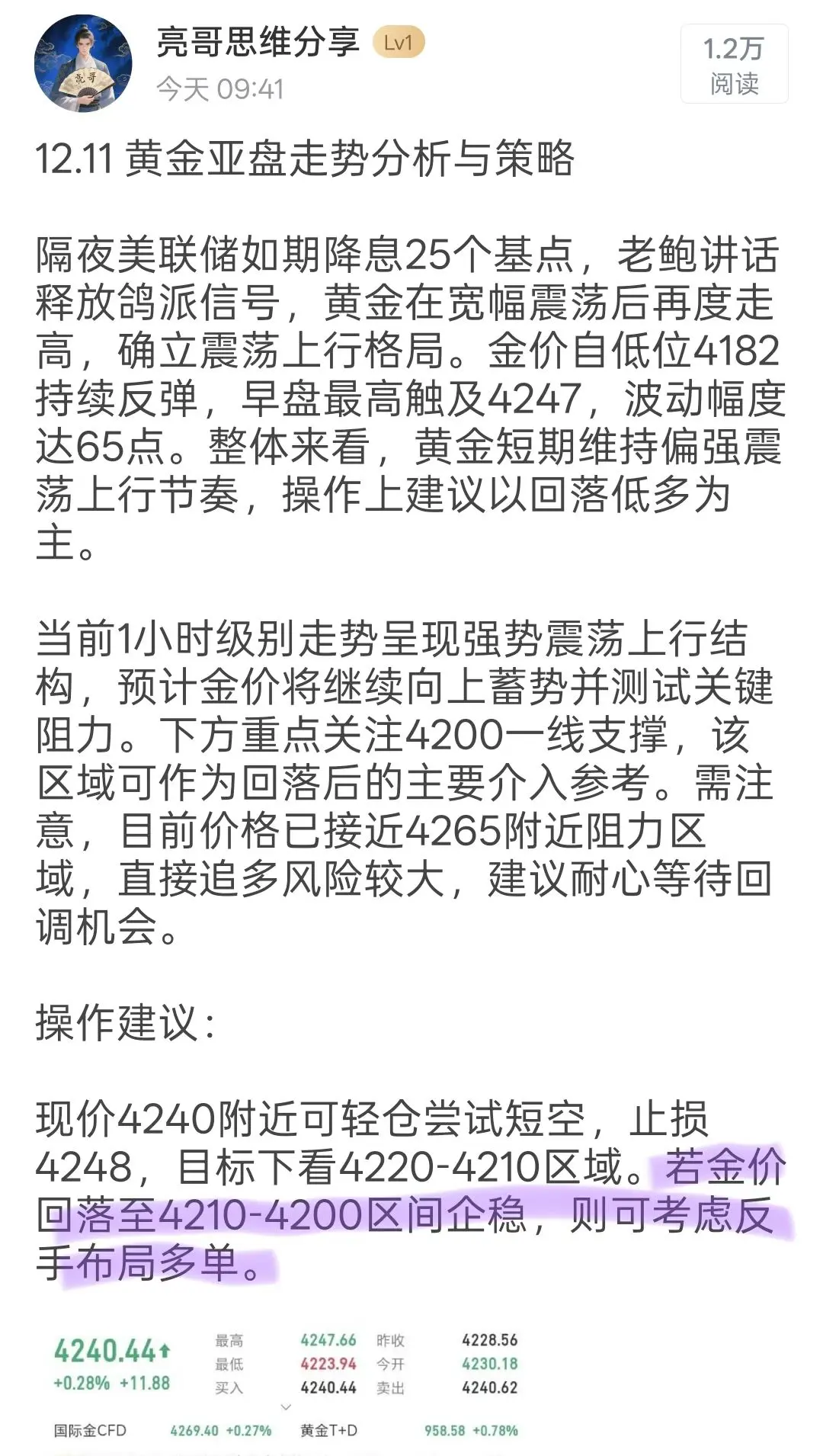

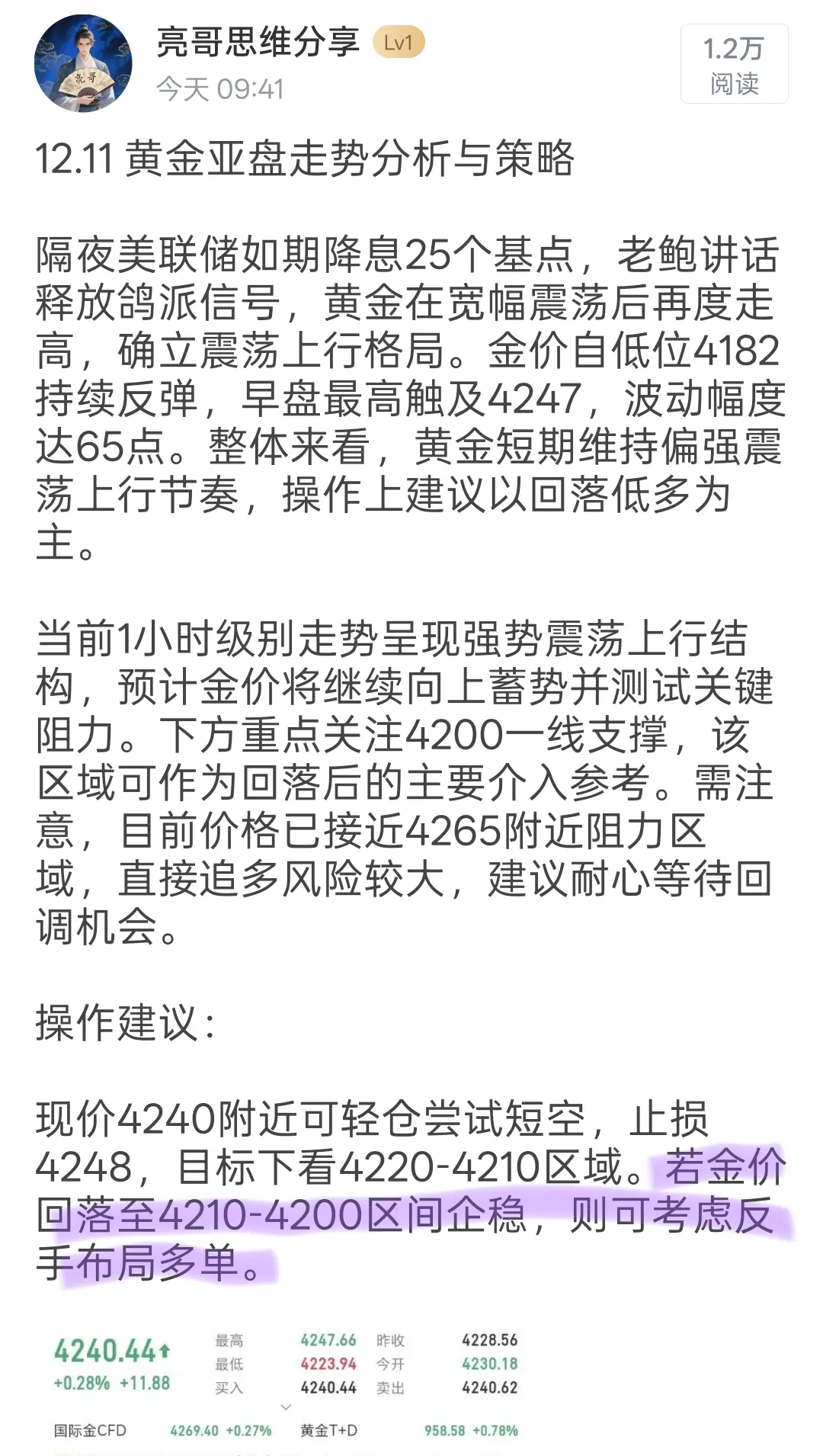

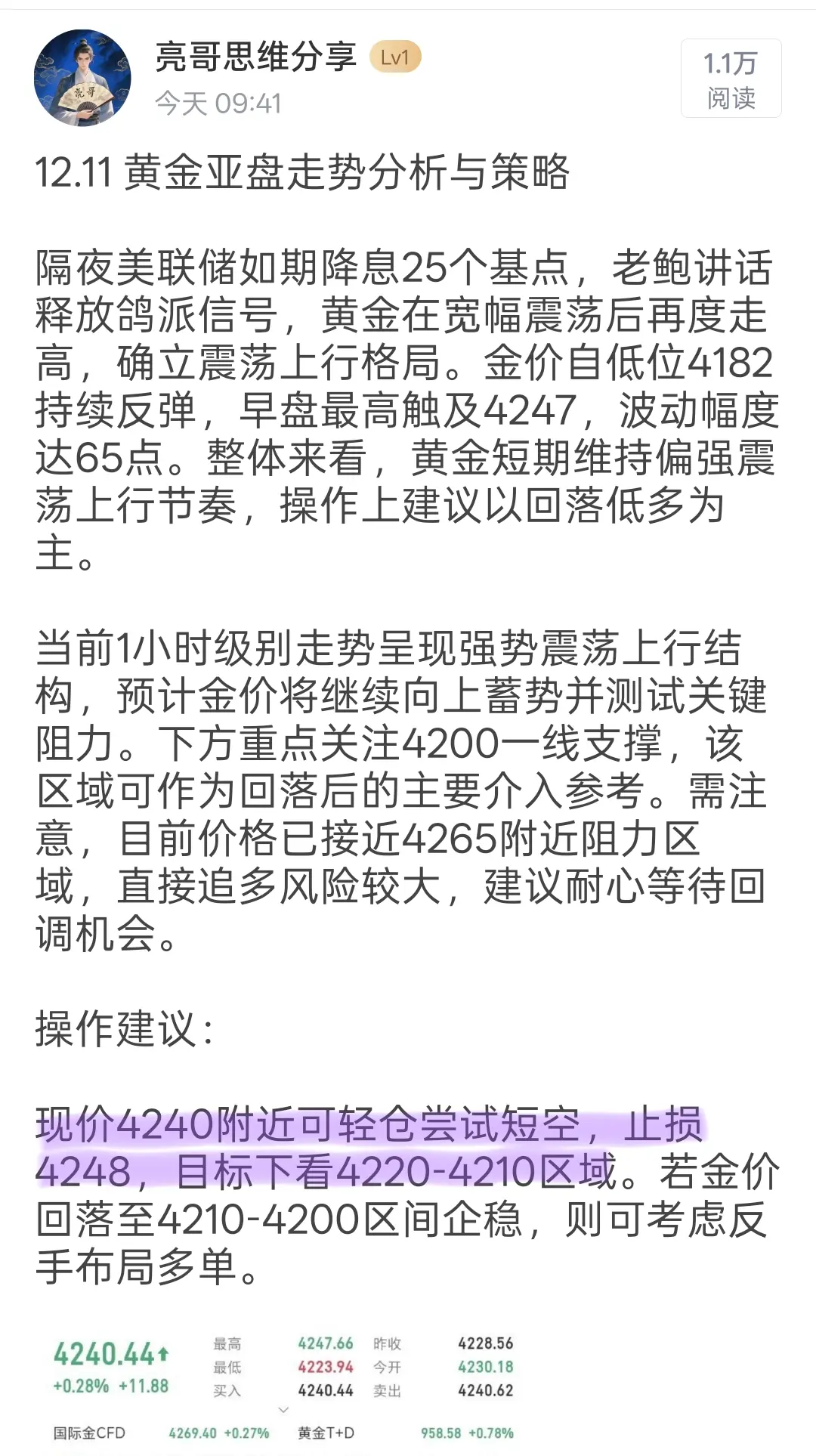

12.11 Gold Asian Session Price Analysis and Strategy

The Federal Reserve cut interest rates by 25 basis points as expected overnight, and Fed Chairman Powell's speech signaled a dovish stance. Gold experienced wide volatility before rallying again, establishing a sideways upward trend. The price rebounded from a low of 4182 and reached a high of 4247 in the early session, with a fluctuation range of 65 points. Overall, short-term gold remains in a relatively strong oscillating upward momentum. It is recommended to mainly buy on dips.

The current 1-hour chart shows a strong oscillating upward s

View OriginalThe Federal Reserve cut interest rates by 25 basis points as expected overnight, and Fed Chairman Powell's speech signaled a dovish stance. Gold experienced wide volatility before rallying again, establishing a sideways upward trend. The price rebounded from a low of 4182 and reached a high of 4247 in the early session, with a fluctuation range of 65 points. Overall, short-term gold remains in a relatively strong oscillating upward momentum. It is recommended to mainly buy on dips.

The current 1-hour chart shows a strong oscillating upward s

- Reward

- like

- Comment

- Repost

- Share

Tonight at 3 a.m., the final interest rate decision of the year. This will be a key factor in the market turning point. Stay tuned!

View Original

- Reward

- like

- Comment

- Repost

- Share

Good morning, everyone! It's Wednesday—stay sharp! The gold market continues to fluctuate in a consolidation rhythm. When will a directional breakout arrive?

Looking back at yesterday, gold prices oscillated repeatedly within the 4170-4220 range. We traded the range by selling high and buying low, and the timing was quite accurate.

This morning, the market opened lower but quickly rebounded from around 4207, now quoting at 4213, once again testing the key resistance at 4220. This level has acted as resistance multiple times this week, and a direct breakout will require a catalyst from news, bu

View OriginalLooking back at yesterday, gold prices oscillated repeatedly within the 4170-4220 range. We traded the range by selling high and buying low, and the timing was quite accurate.

This morning, the market opened lower but quickly rebounded from around 4207, now quoting at 4213, once again testing the key resistance at 4220. This level has acted as resistance multiple times this week, and a direct breakout will require a catalyst from news, bu

- Reward

- like

- Comment

- Repost

- Share

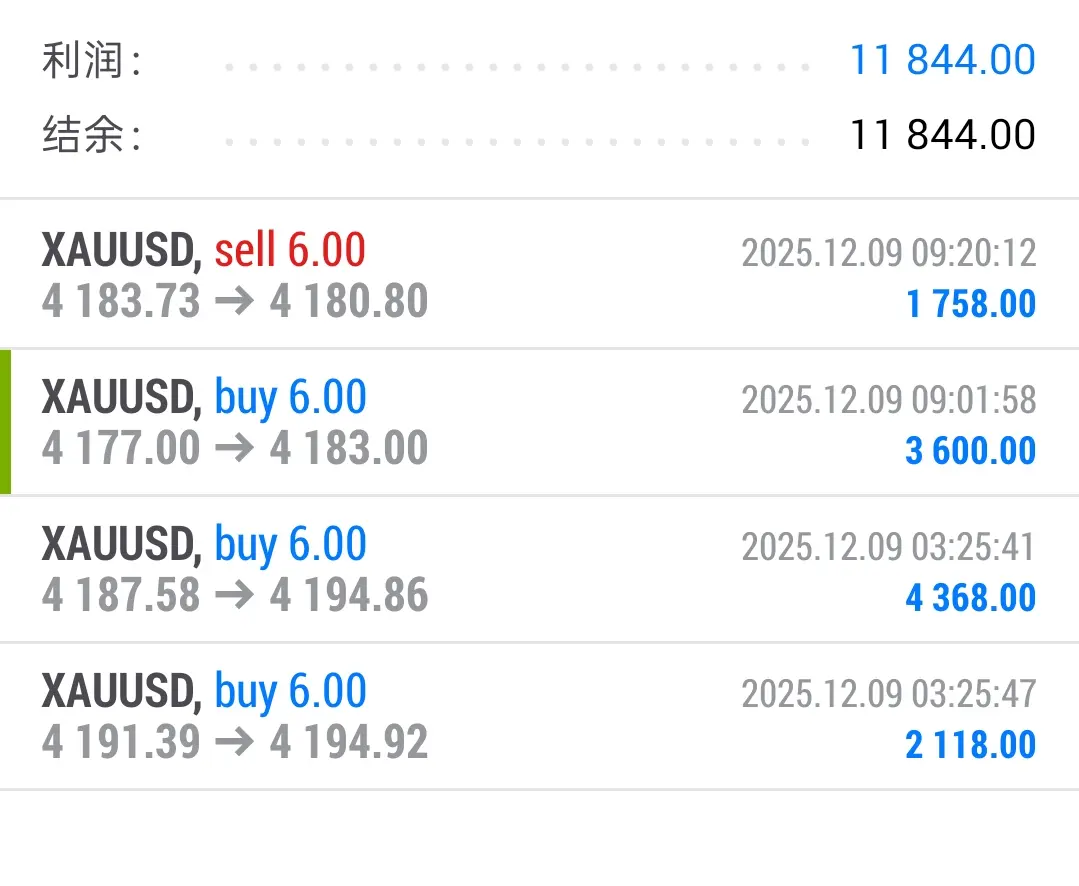

Gold Tuesday, four consecutive wins achieved!

Today was weak with a downward trend, but it didn’t affect Liang's normal performance. Four orders brought in a total profit of $11,844!

View OriginalToday was weak with a downward trend, but it didn’t affect Liang's normal performance. Four orders brought in a total profit of $11,844!

- Reward

- 1

- Comment

- Repost

- Share

12.9 Gold Asian Session Strategy Analysis: Cautious Consolidation Before the Meeting, Key Ranges Determine Direction

I. Core Market Logic: Waiting for Fed Guidance, Cautious Sentiment Dominates

On Monday, gold prices experienced a technical pullback during the Asian session, mainly due to the market being in the “Fed meeting blackout period.” As this week’s crucial rate decision and policy path signals are about to be released, trading sentiment is highly cautious, with most participants choosing to lock in some profits and reduce new positions to avoid uncertainty risk. This has led to a lack

View OriginalI. Core Market Logic: Waiting for Fed Guidance, Cautious Sentiment Dominates

On Monday, gold prices experienced a technical pullback during the Asian session, mainly due to the market being in the “Fed meeting blackout period.” As this week’s crucial rate decision and policy path signals are about to be released, trading sentiment is highly cautious, with most participants choosing to lock in some profits and reduce new positions to avoid uncertainty risk. This has led to a lack

- Reward

- like

- Comment

- Repost

- Share

Golden Tuesday, the early bird gets the worm! Both trades hit take profit, with a total gain of $6,486!

View Original

- Reward

- like

- Comment

- Repost

- Share

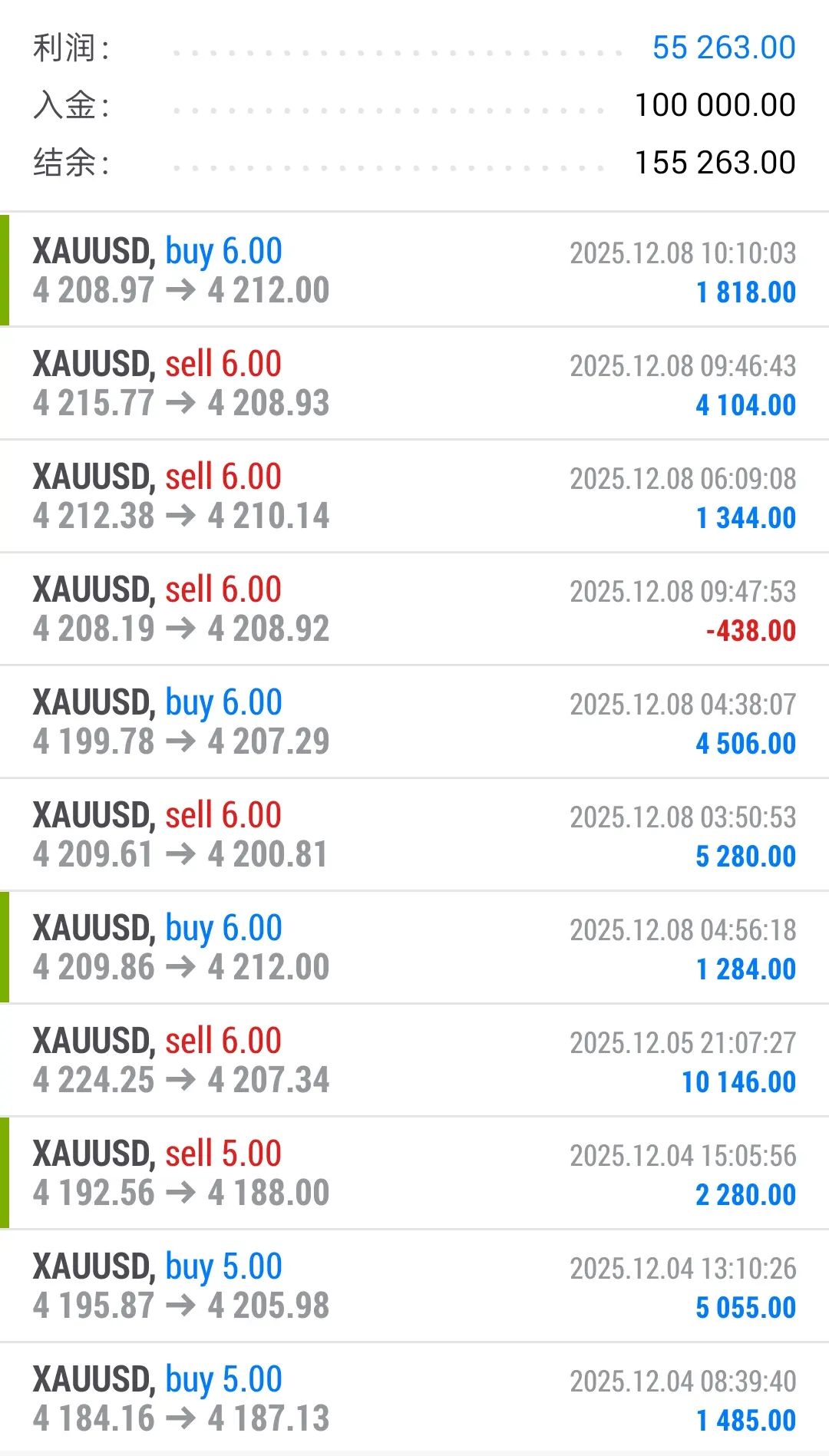

Since last Tuesday, I've started venturing into gold, and so far I've made $55,000 overall! This is the allure of gold—no fees, what you earn is what you get, allowing you to maximize your returns!

View Original

- Reward

- like

- Comment

- Repost

- Share

Preview of Three Major Global Market Events in December:

1. Federal Reserve Interest Rate Decision (December 11)

The market's expectation for a rate cut has risen to 87%. If there is a shift in policy direction, it could trigger significant volatility in global asset prices.

2. Bank of Japan Policy Meeting (December 19)

The market is watching whether it will start a rate hike cycle. If there is a shift in monetary policy, it could lead to further tightening of global liquidity.

3. BTC Annual Options Expiry (December 26)

A massive amount of options with a notional value of about $23 billion wil

1. Federal Reserve Interest Rate Decision (December 11)

The market's expectation for a rate cut has risen to 87%. If there is a shift in policy direction, it could trigger significant volatility in global asset prices.

2. Bank of Japan Policy Meeting (December 19)

The market is watching whether it will start a rate hike cycle. If there is a shift in monetary policy, it could lead to further tightening of global liquidity.

3. BTC Annual Options Expiry (December 26)

A massive amount of options with a notional value of about $23 billion wil

BTC-2.89%

- Reward

- like

- Comment

- Repost

- Share