# BOJRateHikesBackontheTable

23.76K

JPMorgan expects the Bank of Japan to hike rates twice in 2025, pushing policy rates to 1.25% by end-2026. Could shifts in yen liquidity affect crypto risk allocation? Is a yen carry trade unwind back in play?

Yusfirah

#BOJRateHikesBackontheTable

Macro Watch: Bank of Japan, Yen Liquidity, and Crypto Risk Allocation (2025–2026)

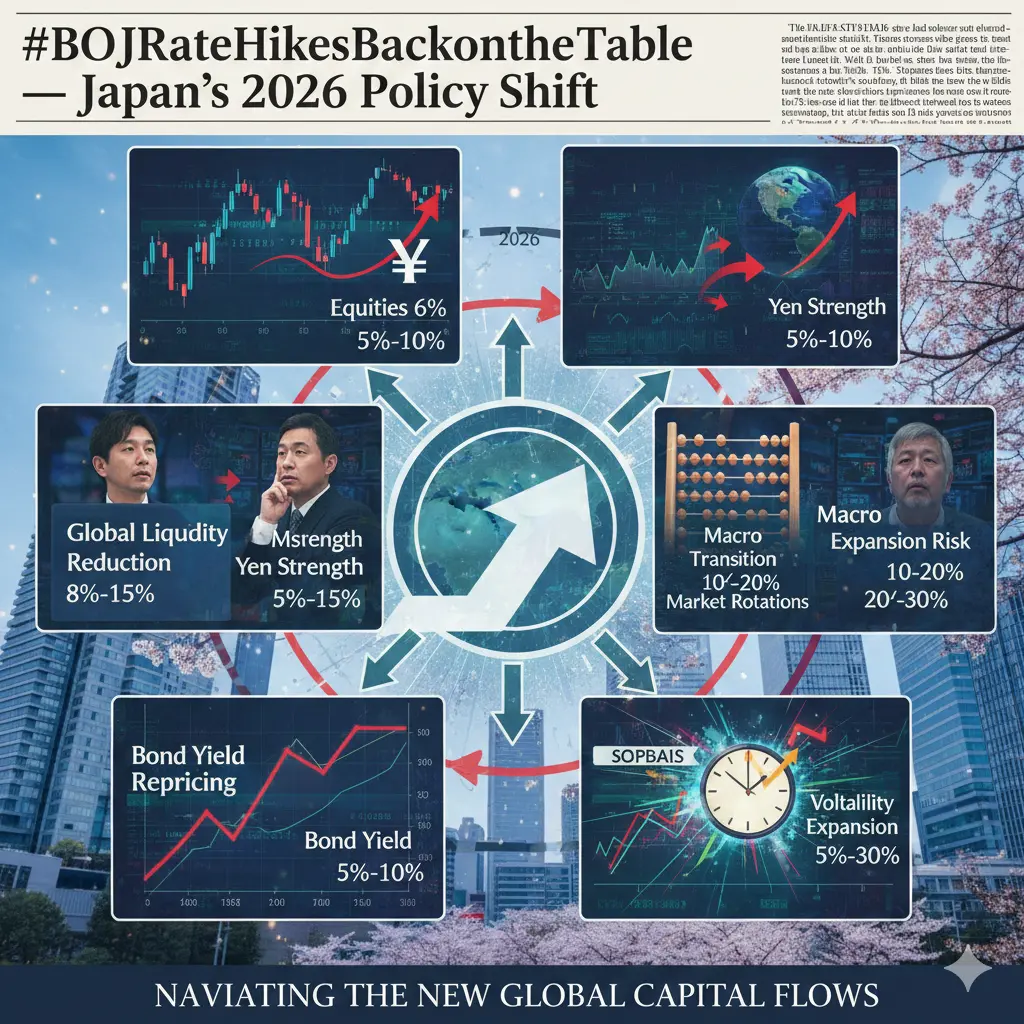

Global markets may be underestimating a potential macro shift unfolding in Japan. According to JPMorgan, the Bank of Japan is expected to raise interest rates twice in 2025, with policy rates potentially reaching around 1.25% by the end of 2026. If realized, this would represent one of the most meaningful transitions in Japanese monetary policy in decades, marking a clear departure from the era of ultra-loose conditions and negative real rates.

For global risk assets, this is not a lo

Macro Watch: Bank of Japan, Yen Liquidity, and Crypto Risk Allocation (2025–2026)

Global markets may be underestimating a potential macro shift unfolding in Japan. According to JPMorgan, the Bank of Japan is expected to raise interest rates twice in 2025, with policy rates potentially reaching around 1.25% by the end of 2026. If realized, this would represent one of the most meaningful transitions in Japanese monetary policy in decades, marking a clear departure from the era of ultra-loose conditions and negative real rates.

For global risk assets, this is not a lo

BTC2,23%

- Reward

- 18

- 9

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

📊 Macro Watch: BOJ, Yen Liquidity & Crypto Risk

JPMorgan expects the Bank of Japan to hike rates twice in 2025, with policy rates potentially reaching 1.25% by end-2026. If this plays out, it could mark a meaningful shift after years of ultra-loose Japanese monetary policy.

🔹 Why the yen matters:

The yen has long funded global risk-taking through the yen carry trade. Rising BOJ rates could tighten yen liquidity and reduce leverage flowing into risk assets.

🔹 Carry trade unwind risk:

If Japanese yields rise and the yen strengthens, leveraged positions funded in yen may unwind. Historically,

JPMorgan expects the Bank of Japan to hike rates twice in 2025, with policy rates potentially reaching 1.25% by end-2026. If this plays out, it could mark a meaningful shift after years of ultra-loose Japanese monetary policy.

🔹 Why the yen matters:

The yen has long funded global risk-taking through the yen carry trade. Rising BOJ rates could tighten yen liquidity and reduce leverage flowing into risk assets.

🔹 Carry trade unwind risk:

If Japanese yields rise and the yen strengthens, leveraged positions funded in yen may unwind. Historically,

BTC2,23%

- Reward

- 16

- 7

- Repost

- Share

Flower89 :

:

Buy To Earn 💎View More

#BOJRateHikesBackOnTheTable

Japan’s era of ultra-loose monetary policy may finally be nearing a turning point.

With inflation proving more persistent and wage growth showing real momentum, Bank of Japan rate hikes are back in focus—a meaningful shift for global markets that have long relied on Japan’s liquidity.

A BOJ policy pivot could: • Strengthen the yen

• Tighten global liquidity conditions

• Create ripple effects across equities, bonds, and crypto

For risk assets, this isn’t just a headline—it’s a volatility catalyst. Macro transitions often bring turbulence before direction becomes clea

Japan’s era of ultra-loose monetary policy may finally be nearing a turning point.

With inflation proving more persistent and wage growth showing real momentum, Bank of Japan rate hikes are back in focus—a meaningful shift for global markets that have long relied on Japan’s liquidity.

A BOJ policy pivot could: • Strengthen the yen

• Tighten global liquidity conditions

• Create ripple effects across equities, bonds, and crypto

For risk assets, this isn’t just a headline—it’s a volatility catalyst. Macro transitions often bring turbulence before direction becomes clea

- Reward

- 2

- Comment

- Repost

- Share

#BOJRateHikesBackontheTable

#BOJRateHikesBackontheTable January 1, 2026

Japan’s Monetary Shift Is Here

As we kick off 2026, the Bank of Japan (BOJ) has made it clear: rate hikes are back on the table. After lifting its key rate to 0.75% in December 2025, the BOJ signals that further tightening could be coming. This move ends decades of ultra-low interest rates and has investors around the globe watching closely.

Impact on the Yen & Japanese Markets:

The yen has reacted sharply, trading near 157/USD, while Japanese Government Bonds (JGBs) see yields climbing above 2% for the first time since t

#BOJRateHikesBackontheTable January 1, 2026

Japan’s Monetary Shift Is Here

As we kick off 2026, the Bank of Japan (BOJ) has made it clear: rate hikes are back on the table. After lifting its key rate to 0.75% in December 2025, the BOJ signals that further tightening could be coming. This move ends decades of ultra-low interest rates and has investors around the globe watching closely.

Impact on the Yen & Japanese Markets:

The yen has reacted sharply, trading near 157/USD, while Japanese Government Bonds (JGBs) see yields climbing above 2% for the first time since t

BTC2,23%

- Reward

- 9

- 9

- Repost

- Share

Ryakpanda :

:

New Year Wealth Explosion 🤑View More

#BOJRateHikesBackontheTable BoJ Policy Shift, Yen Liquidity, Carry Trades, and Bitcoin: Why 2026 Could Be a Volatility Test for BTC

As global markets move into a late-cycle transition phase, attention is increasingly turning to the Bank of Japan (BoJ)—long viewed as the anchor of ultra-easy global liquidity. According to major institutional projections, including JPMorgan’s outlook, the BoJ may implement multiple rate hikes through 2025, potentially lifting policy rates toward 1.25% by the end of 2026. While this level still appears low compared to global peers, the direction of policy marks a

As global markets move into a late-cycle transition phase, attention is increasingly turning to the Bank of Japan (BoJ)—long viewed as the anchor of ultra-easy global liquidity. According to major institutional projections, including JPMorgan’s outlook, the BoJ may implement multiple rate hikes through 2025, potentially lifting policy rates toward 1.25% by the end of 2026. While this level still appears low compared to global peers, the direction of policy marks a

BTC2,23%

- Reward

- 12

- 3

- Repost

- Share

Discovery :

:

Buy To Earn 💎View More

#BOJRateHikesBackontheTable

Japan’s ultra-loose monetary era may finally be shifting.

With inflation pressures persisting and wage growth improving, BOJ rate hikes are back on the table, signaling a potential turning point for global markets.

A policy shift from the BOJ could strengthen the yen, impact global liquidity, and create ripple effects across equities, bonds, and crypto markets.

For risk assets, this means traders should stay alert—macro changes often bring volatility before clarity.

As always, macro signals matter. Smart positioning starts with understanding policy moves, not chasin

Japan’s ultra-loose monetary era may finally be shifting.

With inflation pressures persisting and wage growth improving, BOJ rate hikes are back on the table, signaling a potential turning point for global markets.

A policy shift from the BOJ could strengthen the yen, impact global liquidity, and create ripple effects across equities, bonds, and crypto markets.

For risk assets, this means traders should stay alert—macro changes often bring volatility before clarity.

As always, macro signals matter. Smart positioning starts with understanding policy moves, not chasin

- Reward

- 6

- Comment

- Repost

- Share

#BOJRateHikesBackontheTable

#BOJRateHikesBackontheTable

As 2026 progresses, renewed discussions around Bank of Japan rate hikes are becoming a major macro catalyst. After decades of ultra-loose policy, Japan is now facing sustained inflation, improving wage growth, and pressure to normalize monetary conditions. A BOJ rate hike would not remain a domestic event; it would influence yen valuation, global liquidity, bond yields, equities, and crypto markets. Even a modest hike could trigger 2%–5% currency moves, 5%–10% bond repricing, and noticeable shifts in global risk sentiment. Markets are th

#BOJRateHikesBackontheTable

As 2026 progresses, renewed discussions around Bank of Japan rate hikes are becoming a major macro catalyst. After decades of ultra-loose policy, Japan is now facing sustained inflation, improving wage growth, and pressure to normalize monetary conditions. A BOJ rate hike would not remain a domestic event; it would influence yen valuation, global liquidity, bond yields, equities, and crypto markets. Even a modest hike could trigger 2%–5% currency moves, 5%–10% bond repricing, and noticeable shifts in global risk sentiment. Markets are th

- Reward

- 24

- 11

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

Japan has released its CPI data, and it came in below expectations!

📊 Expectation: 2.70%

📉 Actual: 2.00%

Japan's national Consumer Price Index (CPI) data for November 2025 was initially projected at 2.9% headline and 3.0% core. However, the Tokyo CPI data released on December 26, 2025 (approximately today), a leading indicator of the national trend, showed a significant slowdown in December. The headline CPI fell from 2.7% to 2.0%, while the core CPI (excluding fresh food) dropped from 2.8% to 2.3%. The expectation for core was 2.5%, meaning it was below the actual expectation (2.3% vs 2.5%)

📊 Expectation: 2.70%

📉 Actual: 2.00%

Japan's national Consumer Price Index (CPI) data for November 2025 was initially projected at 2.9% headline and 3.0% core. However, the Tokyo CPI data released on December 26, 2025 (approximately today), a leading indicator of the national trend, showed a significant slowdown in December. The headline CPI fell from 2.7% to 2.0%, while the core CPI (excluding fresh food) dropped from 2.8% to 2.3%. The expectation for core was 2.5%, meaning it was below the actual expectation (2.3% vs 2.5%)

- Reward

- 35

- 25

- Repost

- Share

Asiftahsin :

:

Merry Christmas ⛄View More

#BOJRateHikesBackontheTable

BOJRateHikesBackontheTable: How Potential BOJ Rate Changes Could Impact Crypto and My Strategy for 2026

The possibility of Bank of Japan (BOJ) rate hikes returning to the table is a major macroeconomic event that could influence not only traditional financial markets but also crypto assets in 2026. Personally, I am watching this closely because even small adjustments in interest rates in Japan can have ripple effects across global liquidity, investor risk appetite, and crypto market behavior.

Macro Fundamentals & Personal Insights

The BOJ has maintained ultra-low r

BOJRateHikesBackontheTable: How Potential BOJ Rate Changes Could Impact Crypto and My Strategy for 2026

The possibility of Bank of Japan (BOJ) rate hikes returning to the table is a major macroeconomic event that could influence not only traditional financial markets but also crypto assets in 2026. Personally, I am watching this closely because even small adjustments in interest rates in Japan can have ripple effects across global liquidity, investor risk appetite, and crypto market behavior.

Macro Fundamentals & Personal Insights

The BOJ has maintained ultra-low r

- Reward

- 8

- 3

- Repost

- Share

Dear_Princes :

:

hello 👋View More

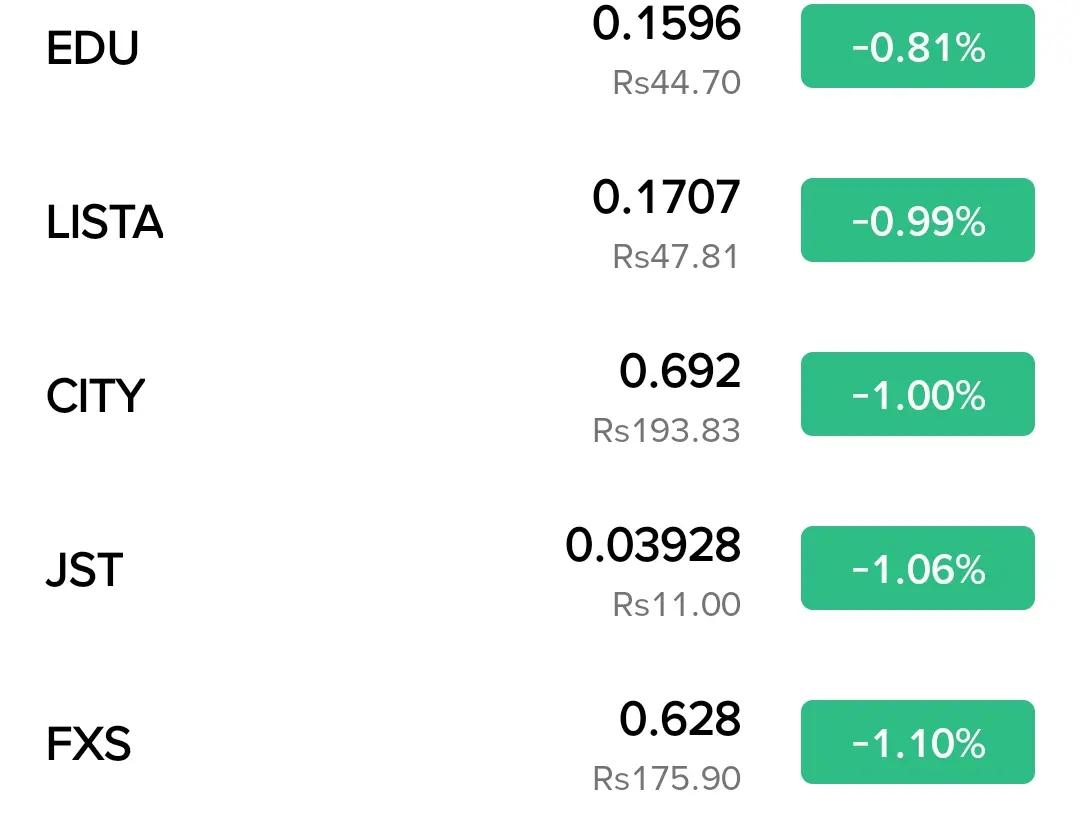

$FXS saw a minor decrease, reflecting cautious market behavior. Despite short-term weakness, the project maintains strong fundamentals within the DeFi ecosystem. Long-term holders are observing price action near key levels, anticipating potential recovery as market sentiment improves.

#BOJRateHikesBackontheTable #2025GateYearEndSummary

#BOJRateHikesBackontheTable #2025GateYearEndSummary

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

94.07K Popularity

10.43K Popularity

9.82K Popularity

56.6K Popularity

5.52K Popularity

265.21K Popularity

264.38K Popularity

17.58K Popularity

6.34K Popularity

5.07K Popularity

5.23K Popularity

5.09K Popularity

5.17K Popularity

33.75K Popularity

News

View MoreBTC 15-minute increase of 0.65%: Macro cooling and large investors adding positions jointly drive a short-term rebound

2 m

Data: If ETH breaks through $2,161, the total liquidation strength of long positions on mainstream CEXs will reach $722 million.

17 m

Roundhill plans to launch six event contract ETFs related to the 2028 U.S. presidential election results

26 m

Punch surged 111.40% after launching Alpha, current price 0.0048092112031334 USDT

30 m

The USDC circulation increased by approximately 2.6 billion tokens in the past 7 days.

30 m

Pin