Post content & earn content mining yield

placeholder

MrFlower_

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=VLJMB14JUQ&ref_type=132

- Reward

- 2

- 2

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLVAAAXWAQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VQRGVVKOBW

View Original

- Reward

- like

- Comment

- Repost

- Share

MYJB

蚂蚁金币

Created By@MunanYiBufan

Listing Progress

100.00%

MC:

$4.23K

Create My Token

Prediction markets continue to be the hot narrative right now with very little separating #Kalshi and #Polymarket.

- Reward

- like

- Comment

- Repost

- Share

Those with small risk tolerance will reduce their positions to protect capital; volatility will pick up later.

View Original

- Reward

- 1

- 8

- Repost

- Share

YaoBuyi'sWorryAndSorrowYao :

:

Thank you, senior. Now I can treat myself to a chicken leg.View More

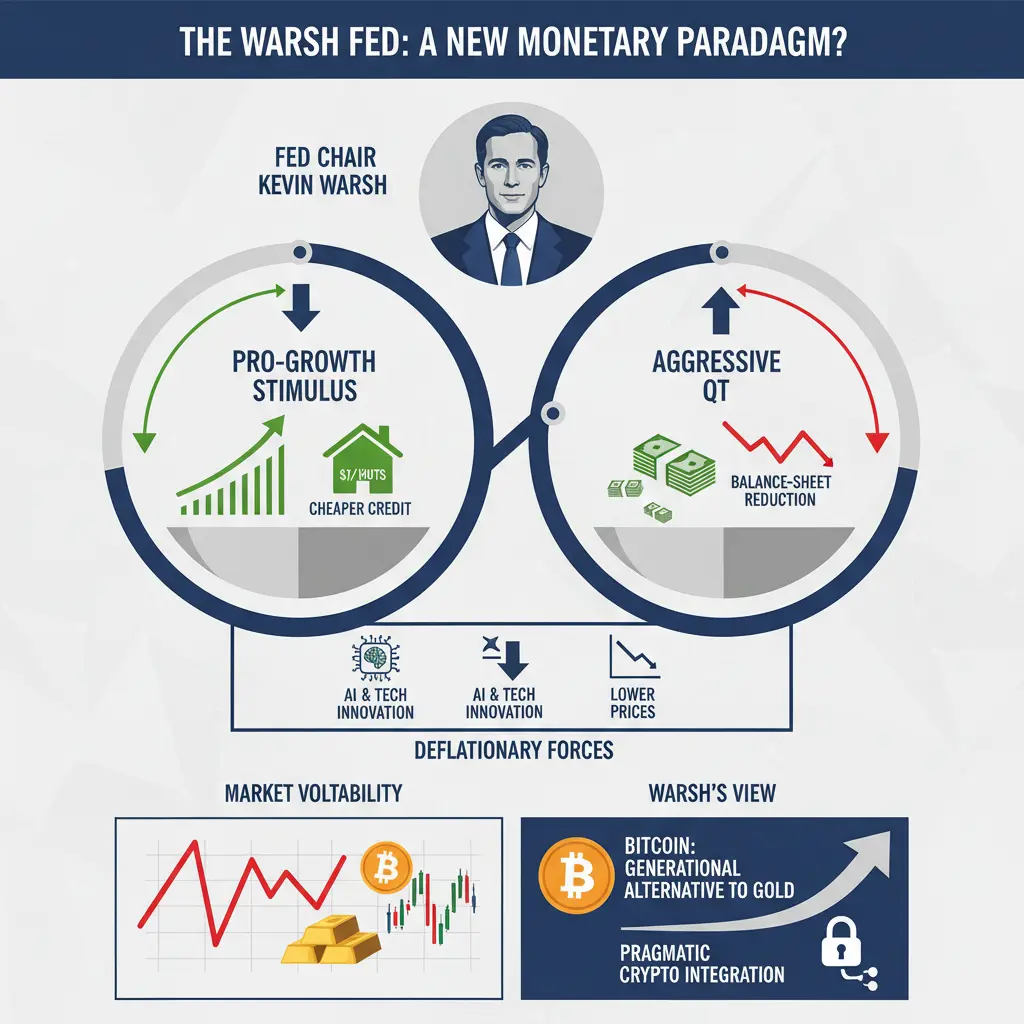

#WalshOnFedPolicy — A Potential Regime Shift at the Federal Reserve

President Trump’s nomination of Kevin Warsh as the next Fed Chair marks a possible turning point in U.S. monetary policy. A former Fed Governor during the 2008 crisis, Warsh was once a staunch inflation hawk. Today, his stance has evolved into a unique and potentially disruptive mix: rate cuts to support growth, paired with aggressive balance-sheet reduction to restore discipline.

Warsh now argues that productivity gains driven by AI and technological innovation are structurally deflationary, giving the Fed room to lower inter

President Trump’s nomination of Kevin Warsh as the next Fed Chair marks a possible turning point in U.S. monetary policy. A former Fed Governor during the 2008 crisis, Warsh was once a staunch inflation hawk. Today, his stance has evolved into a unique and potentially disruptive mix: rate cuts to support growth, paired with aggressive balance-sheet reduction to restore discipline.

Warsh now argues that productivity gains driven by AI and technological innovation are structurally deflationary, giving the Fed room to lower inter

BTC-3,98%

- Reward

- 1

- Comment

- Repost

- Share

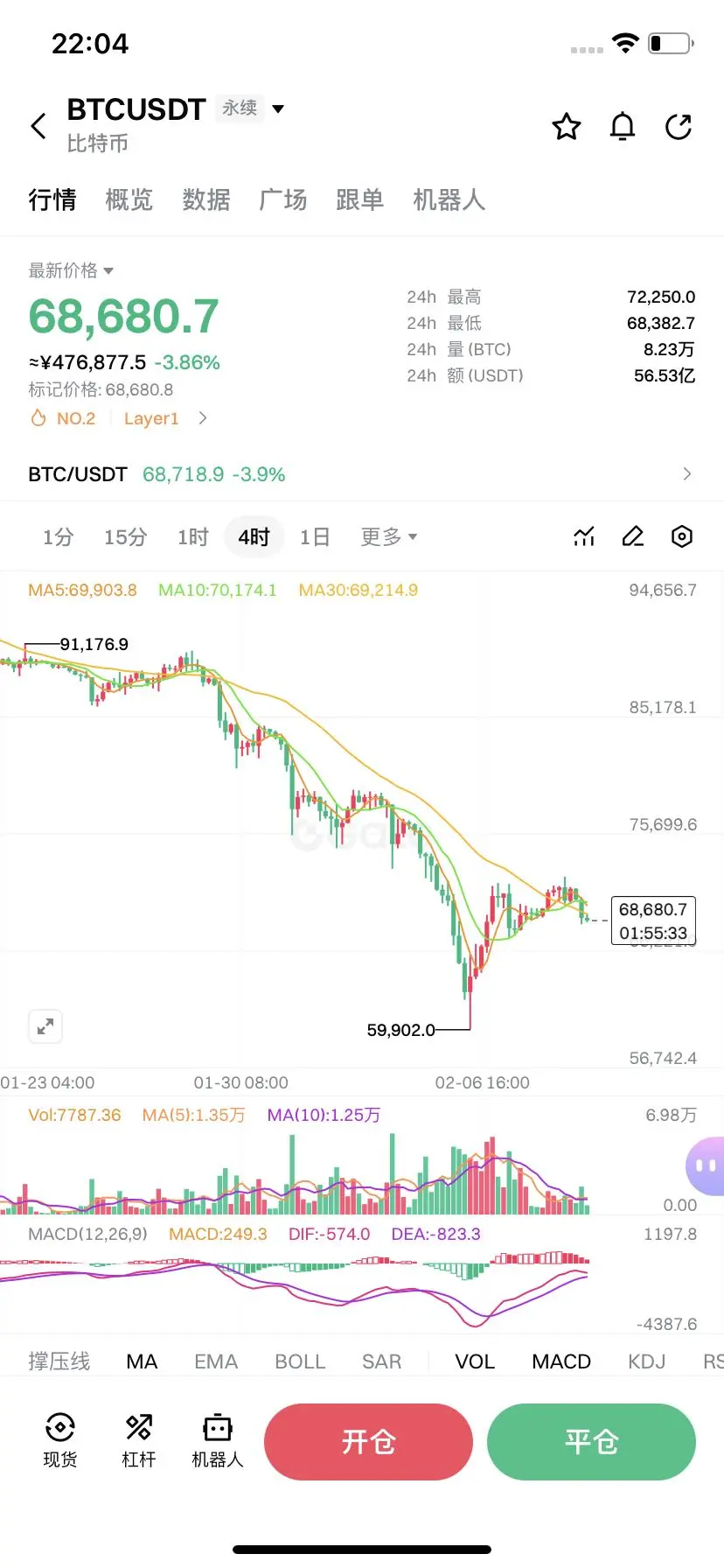

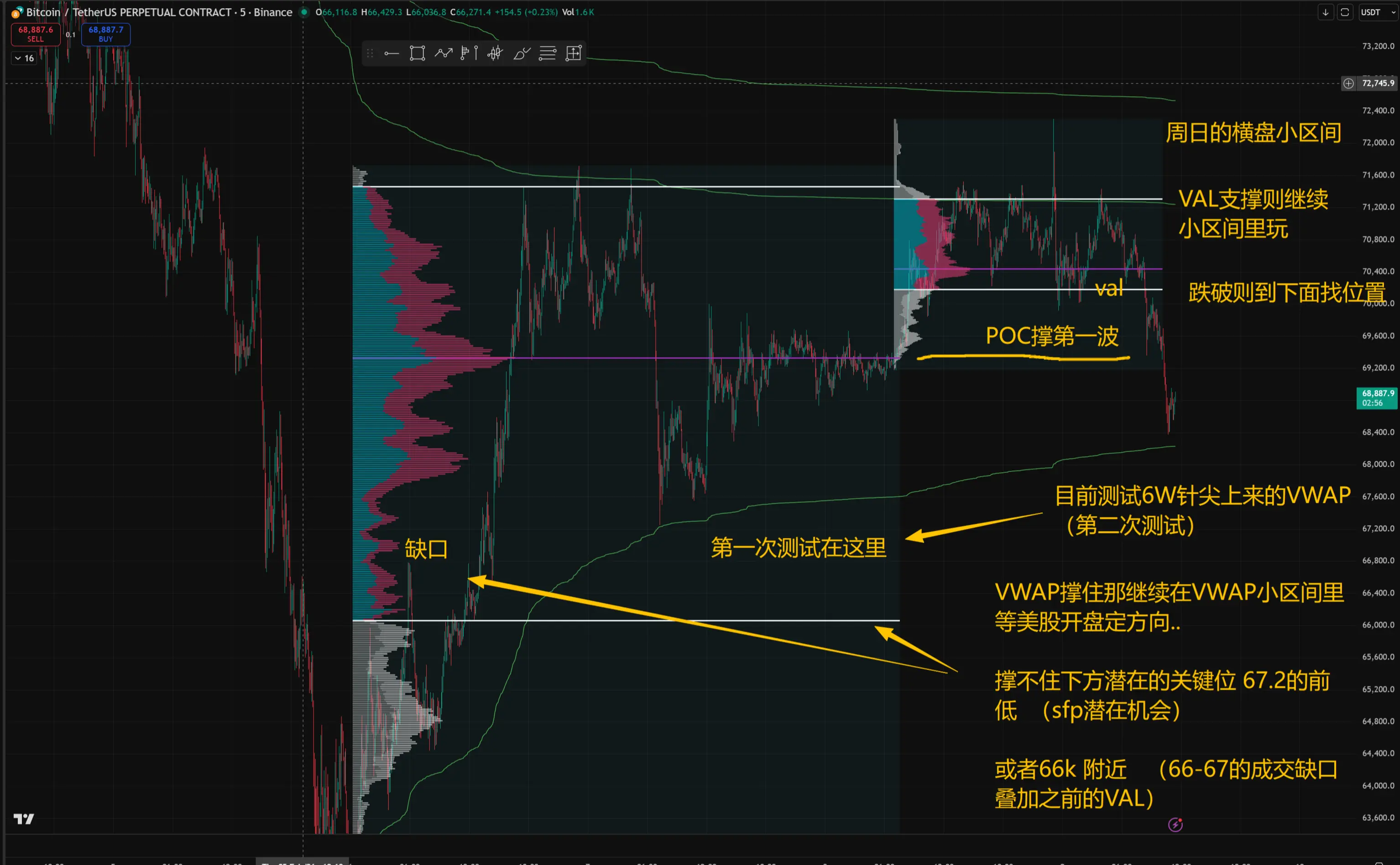

#BTCUSDT – Recovery May Continue

On the four-hour timeframe, Bitcoin's price has surged strongly from around $60,000 and is now consolidating within an ascending triangle pattern, with resistance at the $71,200 - $72,300 level.

A breakout above this level could open the door for a price increase toward $84,000.

Join us for more technical analyses, important news, key market events, discussions, and much more – click Follow on our profile page.

#BitcoinBouncesBack

#Bitcoin

#BTC

$BTC

On the four-hour timeframe, Bitcoin's price has surged strongly from around $60,000 and is now consolidating within an ascending triangle pattern, with resistance at the $71,200 - $72,300 level.

A breakout above this level could open the door for a price increase toward $84,000.

Join us for more technical analyses, important news, key market events, discussions, and much more – click Follow on our profile page.

#BitcoinBouncesBack

#Bitcoin

#BTC

$BTC

BTC-3,98%

- Reward

- 1

- 1

- Repost

- Share

BasheerAlgundubi :

:

Breaking this level could open the way for the price to rise toward $84,000.2026 Supercycle:

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VGMWVVHCBA

View Original

- Reward

- like

- Comment

- Repost

- Share

#GateSquareValentineGiveaway 💖

This Valentine’s Day, we’re not just celebrating love, we’re celebrating YOU! 🎁

🎉 Rewards:

Grand Prize: 1 lucky winner gets a Gate Valentine’s Gift Box

Lucky Draw: 50 winners get $10 fee rebate coupon + Gate Red Bull pack

💌 How to Join:

1️⃣ Follow @Gate_Square

2️⃣ Like & Share this post

3️⃣ Tag your crypto-loving friends ❤️

Hurry! Make this Valentine’s Day extra special with Gate Square.

#CryptoLove @Yeasin

$BTC

This Valentine’s Day, we’re not just celebrating love, we’re celebrating YOU! 🎁

🎉 Rewards:

Grand Prize: 1 lucky winner gets a Gate Valentine’s Gift Box

Lucky Draw: 50 winners get $10 fee rebate coupon + Gate Red Bull pack

💌 How to Join:

1️⃣ Follow @Gate_Square

2️⃣ Like & Share this post

3️⃣ Tag your crypto-loving friends ❤️

Hurry! Make this Valentine’s Day extra special with Gate Square.

#CryptoLove @Yeasin

$BTC

BTC-3,98%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

多

多军必胜

Created By@XiaofengTraversesBullAndBear

Subscription Progress

0.00%

MC:

$0

Create My Token

💥 99,598 traders were liquidated, the total liquidations comes in at $344.36 million.

After all that happened since the 10/10 and you are still here trying to leverage trade with 100x...

If you would be this persistent in life fam, then you would be very successful.

Polish Winged Hussars.

After all that happened since the 10/10 and you are still here trying to leverage trade with 100x...

If you would be this persistent in life fam, then you would be very successful.

Polish Winged Hussars.

- Reward

- like

- Comment

- Repost

- Share

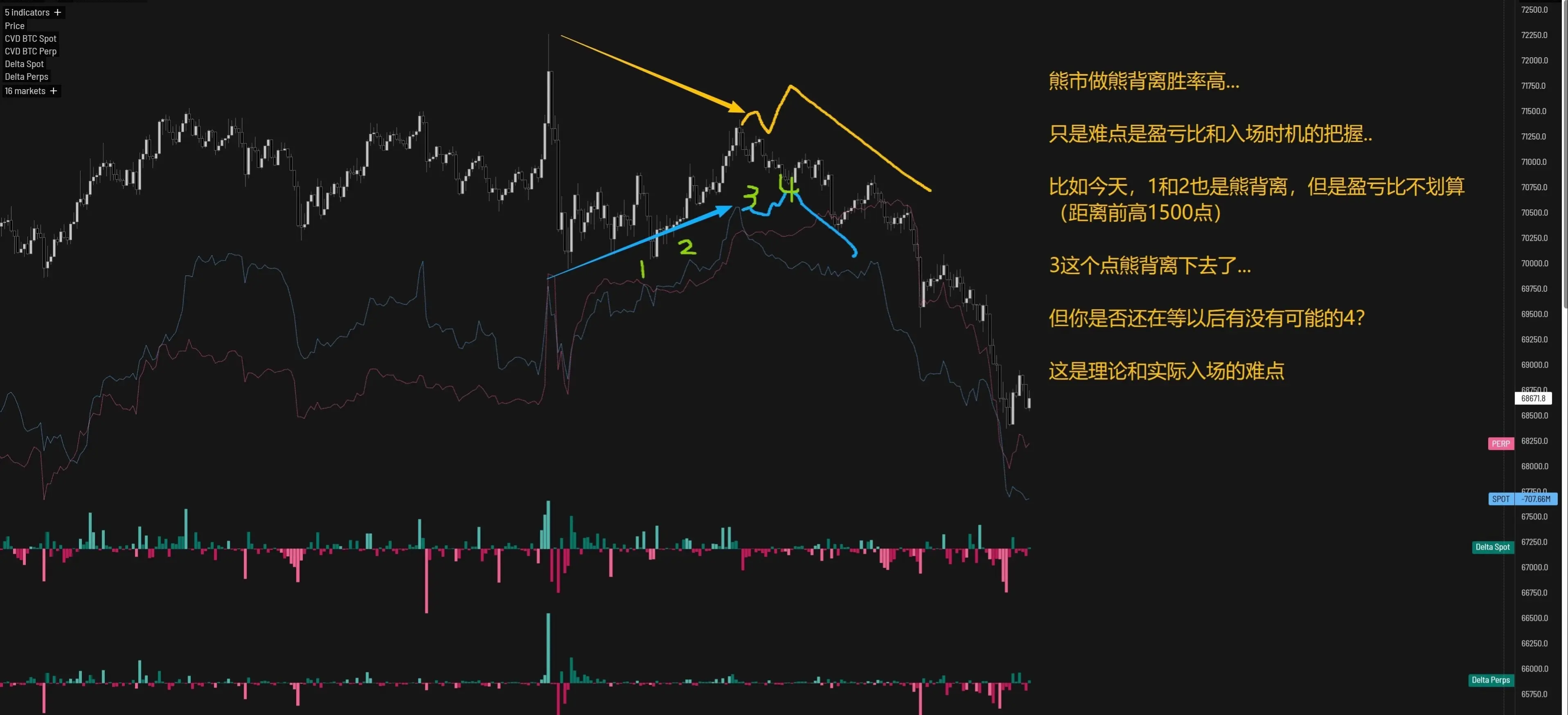

Daily Technical Review (Not involving point-based trading, just a self-review during work)

But first, a reminder: please all small traders follow the aggressive orders previously given, because we don't know how the US stock market will move. If it suddenly spikes and I doubt everything, I sincerely apologize brothers.

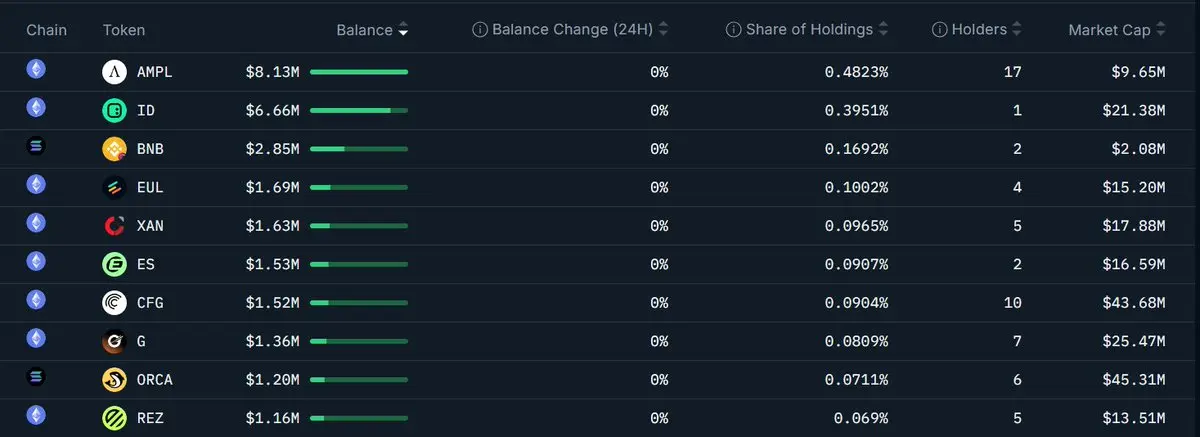

Figure 1: First, look at the capital flow. Today, after the Asian session spot market showed bearish divergence and then turned around...

As previously summarized, in a bear market, trading based on bearish divergence has a high success rate...

That said, the difficulty lies in

But first, a reminder: please all small traders follow the aggressive orders previously given, because we don't know how the US stock market will move. If it suddenly spikes and I doubt everything, I sincerely apologize brothers.

Figure 1: First, look at the capital flow. Today, after the Asian session spot market showed bearish divergence and then turned around...

As previously summarized, in a bear market, trading based on bearish divergence has a high success rate...

That said, the difficulty lies in

SFP-3,16%

- Reward

- 1

- Comment

- Repost

- Share

Definitely not a good idea to be trading now as even smart money is being very careful.

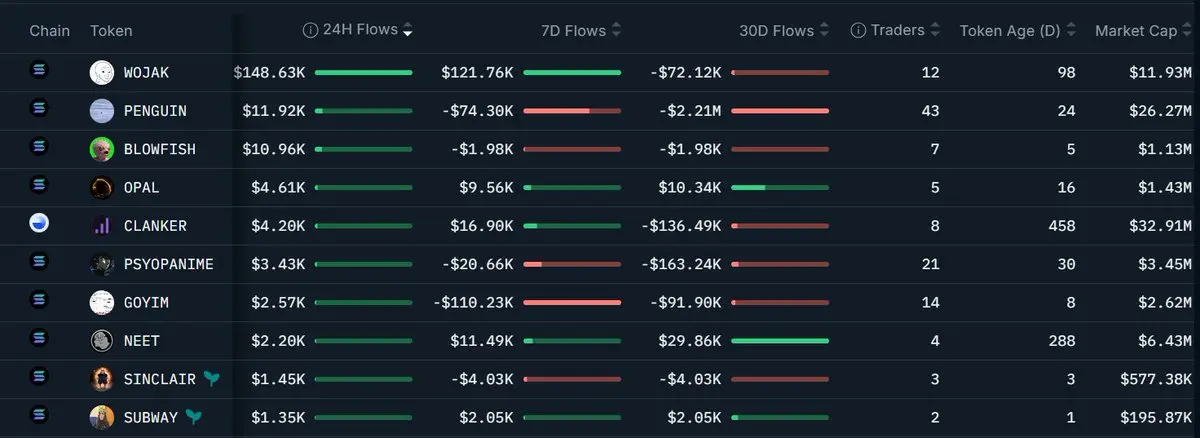

We see below (Image 1) that $WOJAK is the only token with a significant inflow of smart money in the past 24 hours, with a 24h inflow of ~$148k and a 7d inflow of ~$122k.

Looking at the general condition of the market, this is very interesting and definitely worth looking into.

Just after it is $PENGUIN with only ~$12k inflow and an outflow of ~$74k in the last 7d.

$BLOWFISH is next in line ($1Ok inflow), but everything else has an inflow below $5k, which is an indicator of a dry market. If you'll be buyin

We see below (Image 1) that $WOJAK is the only token with a significant inflow of smart money in the past 24 hours, with a 24h inflow of ~$148k and a 7d inflow of ~$122k.

Looking at the general condition of the market, this is very interesting and definitely worth looking into.

Just after it is $PENGUIN with only ~$12k inflow and an outflow of ~$74k in the last 7d.

$BLOWFISH is next in line ($1Ok inflow), but everything else has an inflow below $5k, which is an indicator of a dry market. If you'll be buyin

PENGUIN-4,85%

- Reward

- like

- Comment

- Repost

- Share

$DXY

The Dollar looks weak af. I just noticed that it's still holding inside this old range I marked years ago, but it also looks like it wants to break down further at any point. Still waiting for this shaded squeeze to move.

The Dollar looks weak af. I just noticed that it's still holding inside this old range I marked years ago, but it also looks like it wants to break down further at any point. Still waiting for this shaded squeeze to move.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLIRULTBUQ

View Original

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More184.92K Popularity

45.09K Popularity

7.03K Popularity

4.67K Popularity

3.78K Popularity

News

View MoreU.S. stocks open lower, Dow Jones down 0.14%, Google's parent company plans to issue bonds to raise $15 billion

6 m

A certain whale's two "buy high, sell low" ETH transactions resulted in a loss of over $370,000

18 m

Data: 27,082.47 SOL has been transferred out from Wintermute, with a total value of approximately $2.27 million USD.

18 m

CertiK: 72 confirmed cases of crypto "wrench attacks" in 2025, a 75% increase in incidents year-over-year

22 m

Privacy stablecoin project Zoth completes strategic funding, with participation from Pudgy Penguins CEO and others

24 m

Pin