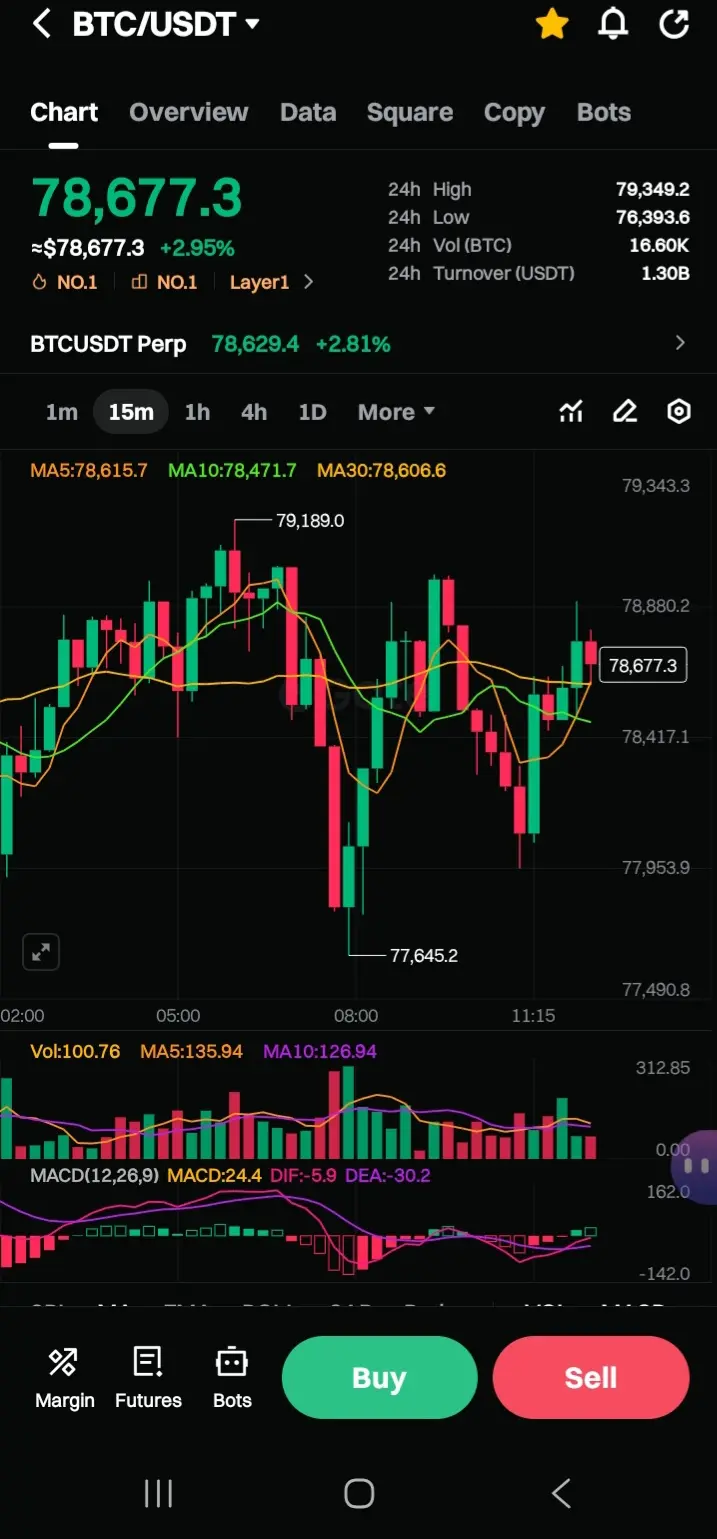

$BTC #BuyTheDipOrWaitNow? BTC/USDT, here is a comprehensive technical analysis:

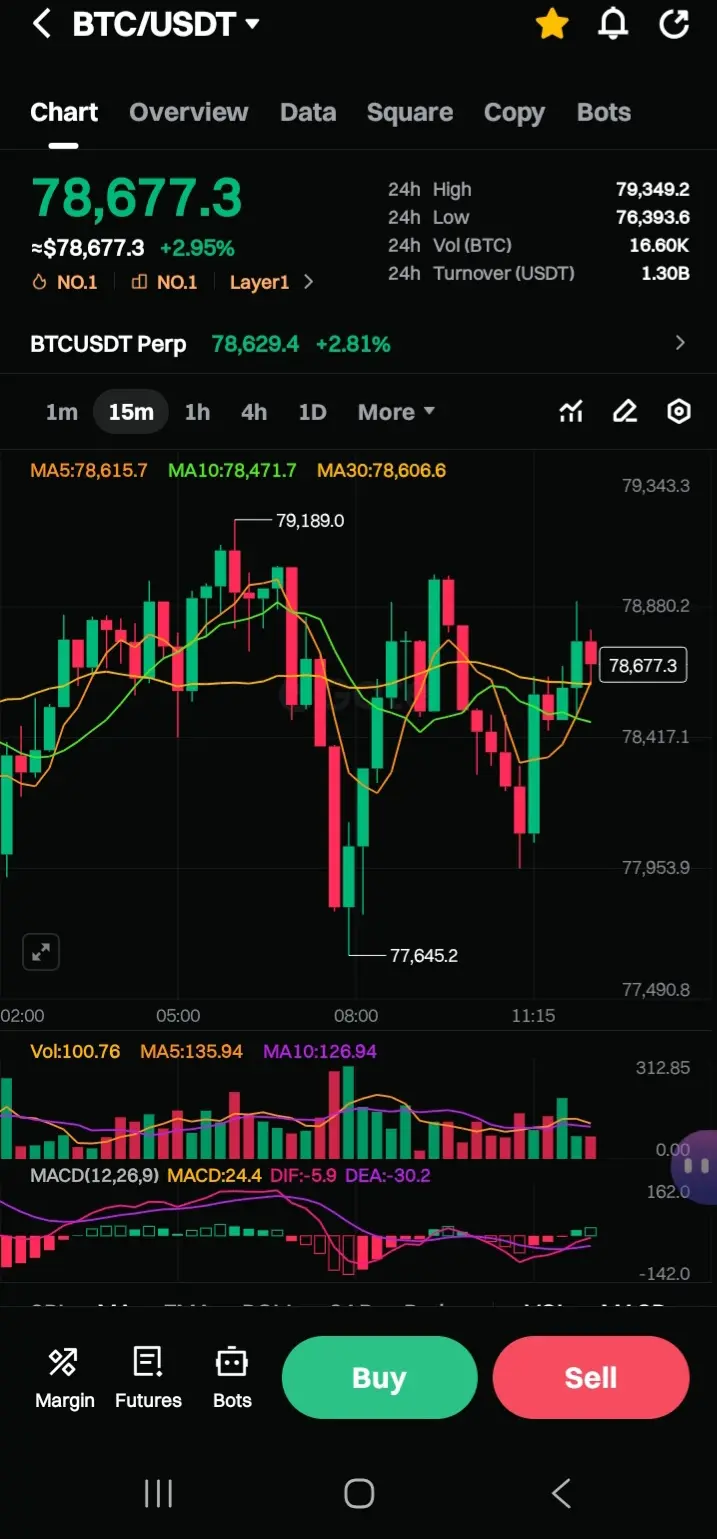

1. Overall Trend & Current Price Action

· Primary Trend: Strongly Bullish. The price is well above the long-term Simple Support & Resistance (SRL) levels shown (56.7K - 85.7K). The recent swing high near 95.4K indicates a powerful upward impulse.

· Current Phase: Consolidation/Short-term Pullback. After the peak (~95.4K), the price has entered a correction phase. It is currently trading at $70,651, which is almost exactly at the middle line (BOLL: 70,520.5) of the Bollinger Bands. This suggests a moment of equilibrium between buyers and sellers after the decline.

2. Key Indicator Analysis

a) Bollinger Bands (20,2):

* Position: Price is at the midline, having fallen from the upper band (UB: 78,888). The bands are wide (UB: 78,888, LB: 62,152), indicating high volatility.

* Interpretation: The midline often acts as dynamic support/resistance. Holding above it could signal a resurgence of bullish momentum. A break below could target the lower band (LB: ~62,152) as the next support.

b) Parabolic SAR (0.02,0.02,0.2):

* Position: The SAR dots are below the price at 63,564.3.

* Interpretation: This confirms the primary uptrend is still technically intact. The SAR provides a trailing support level. A break below $63,564 would be a strong bearish signal, suggesting the trend may have reversed.

c) Moving Averages (MA/EMA):

* The price is above the visualized EMA (76,079.7), which is now acting as resistance. The fact that the current price (~70.6K) is below this EMA suggests short-term weakness.

d) MACD (12,26,9):

* Reading: MACD histogram and lines are positive but have declined significantly from their peaks (MACD: 6188, Signal: 2,964).

* Interpretation: This shows bullish momentum has decelerated sharply. The histogram is still above zero, but the convergence of the MACD and Signal lines suggests the pullback may not be over. A bearish crossover would be a cautionary signal.

3. Support and Resistance Levels

· Immediate Resistance: EMA (~76,080) and the Bollinger Upper Band (~78,888).

· Immediate Support: Bollinger Midline (~70,520) – currently being tested.

· Strong Support Zone: Parabolic SAR (~63,564) and Bollinger Lower Band (~62,152). This confluence forms a critical demand zone.

· Major Resistance: Previous highs near 89,895 and 95,398.

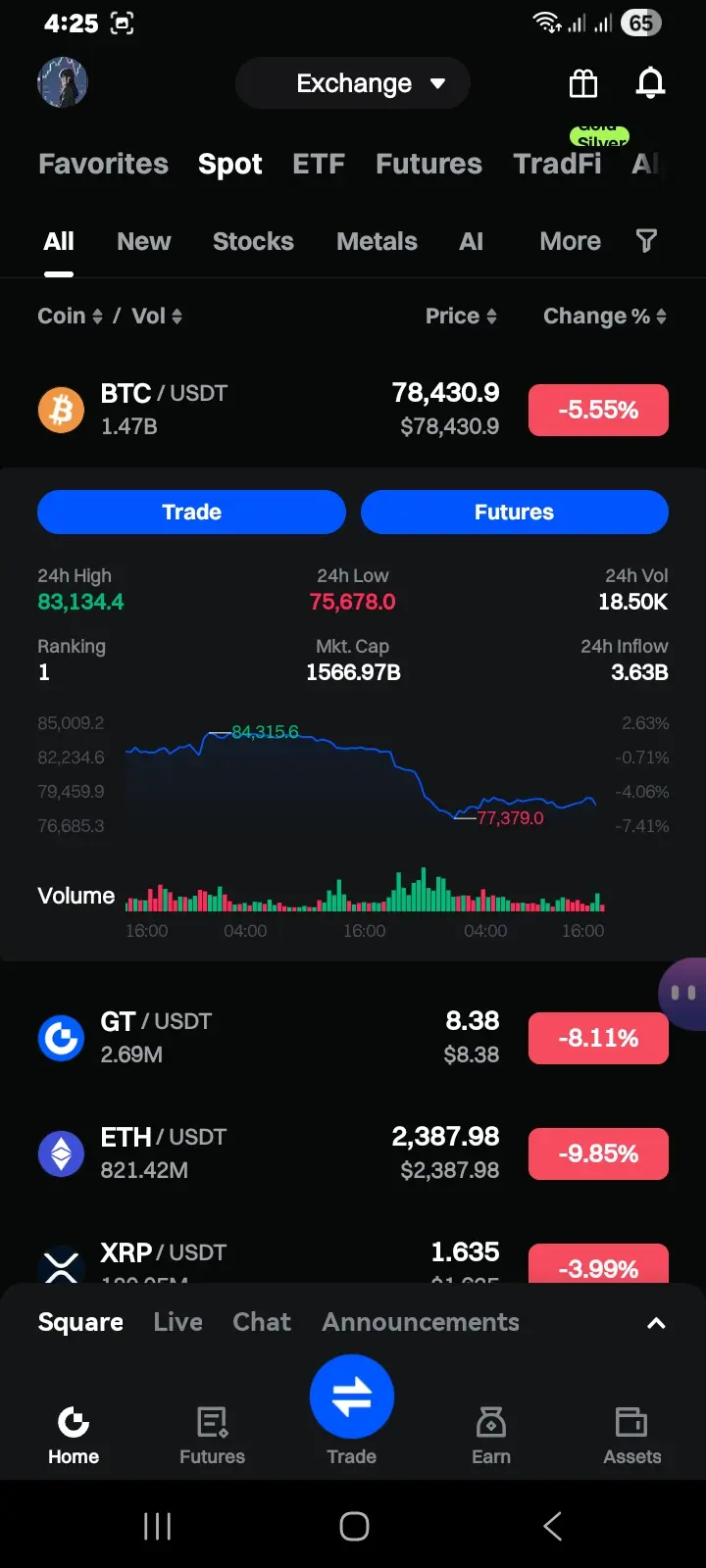

4. Volume & Market Activity

· 24h Volume: 36.66K BTC. Combined with the high 24h Turnover (~$2.49B), this confirms significant institutional or large-scale trading interest is present, typical of a major market trend.

· On-Chart Volume (VOL): Appears elevated during the price decline from the peak, suggesting distribution (selling into strength) occurred. Current volume levels should be watched for a spike on any move towards key support, which could indicate capitulation or renewed buying.

5. Synthesis & Outlook

The chart depicts a healthy bull market correction within a powerful uptrend. The price is finding a temporary balance at the Bollinger midline.

· Bullish Scenario: A strong bounce from the midline (~70.5K) with increasing volume could see a retest of the EMA (~76K) and possibly the upper Bollinger Band. Holding above the SAR (~63.5K) is crucial for the bull case.

· Bearish/Cautionary Scenario: A sustained break below the Bollinger midline, especially on high volume, opens the path for a deeper correction towards the strong support confluence of $62,150 - $63,560. A break below SAR would be a major trend warning.

Conclusion: The trend remains bullish but is undergoing a corrective phase. The key area to watch is $70,500 - $70,650 (Bollinger Midline). A hold here could lead to consolidation or a bounce. A breakdown targets the next major support near $62,150 - $63,560. Traders should watch for volume-confirmed moves at these key levels. The Parabolic SAR at $63,564 is the critical line in the sand for the broader bullish structure.

1. Overall Trend & Current Price Action

· Primary Trend: Strongly Bullish. The price is well above the long-term Simple Support & Resistance (SRL) levels shown (56.7K - 85.7K). The recent swing high near 95.4K indicates a powerful upward impulse.

· Current Phase: Consolidation/Short-term Pullback. After the peak (~95.4K), the price has entered a correction phase. It is currently trading at $70,651, which is almost exactly at the middle line (BOLL: 70,520.5) of the Bollinger Bands. This suggests a moment of equilibrium between buyers and sellers after the decline.

2. Key Indicator Analysis

a) Bollinger Bands (20,2):

* Position: Price is at the midline, having fallen from the upper band (UB: 78,888). The bands are wide (UB: 78,888, LB: 62,152), indicating high volatility.

* Interpretation: The midline often acts as dynamic support/resistance. Holding above it could signal a resurgence of bullish momentum. A break below could target the lower band (LB: ~62,152) as the next support.

b) Parabolic SAR (0.02,0.02,0.2):

* Position: The SAR dots are below the price at 63,564.3.

* Interpretation: This confirms the primary uptrend is still technically intact. The SAR provides a trailing support level. A break below $63,564 would be a strong bearish signal, suggesting the trend may have reversed.

c) Moving Averages (MA/EMA):

* The price is above the visualized EMA (76,079.7), which is now acting as resistance. The fact that the current price (~70.6K) is below this EMA suggests short-term weakness.

d) MACD (12,26,9):

* Reading: MACD histogram and lines are positive but have declined significantly from their peaks (MACD: 6188, Signal: 2,964).

* Interpretation: This shows bullish momentum has decelerated sharply. The histogram is still above zero, but the convergence of the MACD and Signal lines suggests the pullback may not be over. A bearish crossover would be a cautionary signal.

3. Support and Resistance Levels

· Immediate Resistance: EMA (~76,080) and the Bollinger Upper Band (~78,888).

· Immediate Support: Bollinger Midline (~70,520) – currently being tested.

· Strong Support Zone: Parabolic SAR (~63,564) and Bollinger Lower Band (~62,152). This confluence forms a critical demand zone.

· Major Resistance: Previous highs near 89,895 and 95,398.

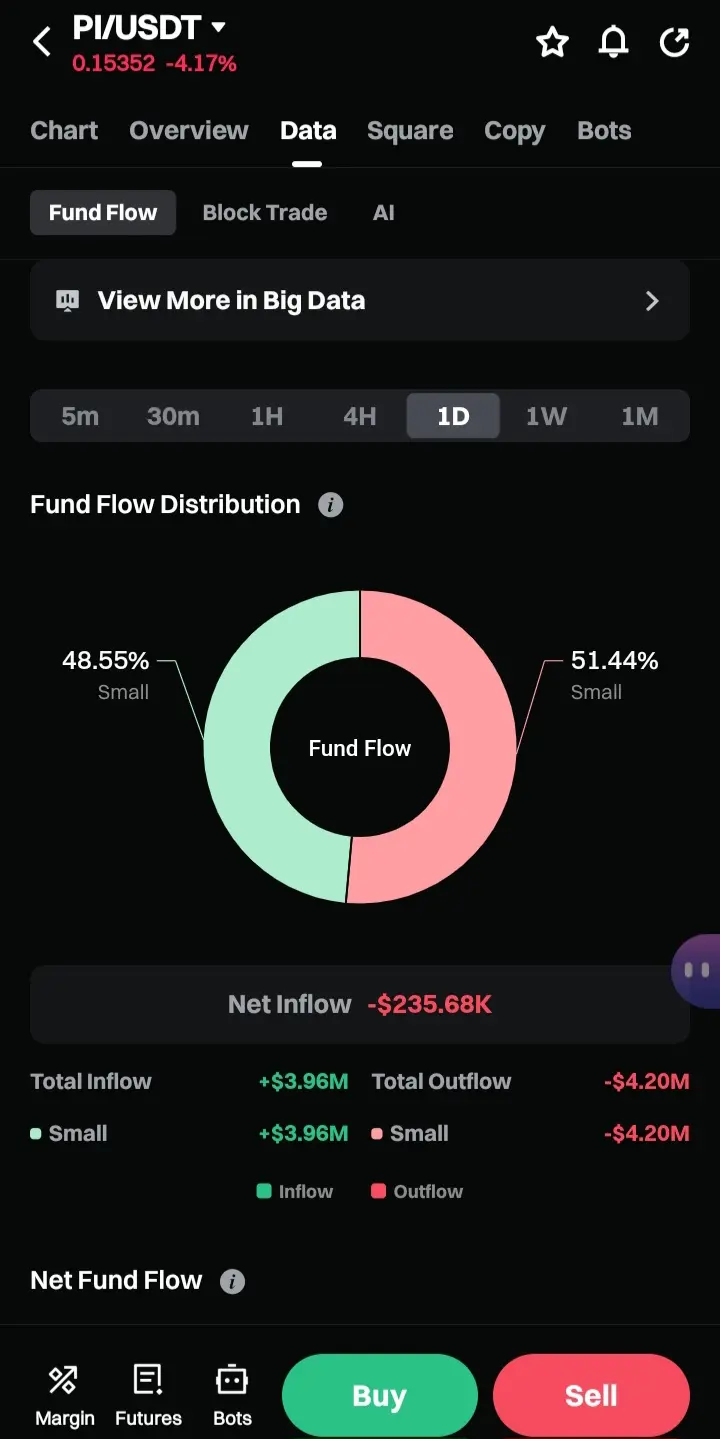

4. Volume & Market Activity

· 24h Volume: 36.66K BTC. Combined with the high 24h Turnover (~$2.49B), this confirms significant institutional or large-scale trading interest is present, typical of a major market trend.

· On-Chart Volume (VOL): Appears elevated during the price decline from the peak, suggesting distribution (selling into strength) occurred. Current volume levels should be watched for a spike on any move towards key support, which could indicate capitulation or renewed buying.

5. Synthesis & Outlook

The chart depicts a healthy bull market correction within a powerful uptrend. The price is finding a temporary balance at the Bollinger midline.

· Bullish Scenario: A strong bounce from the midline (~70.5K) with increasing volume could see a retest of the EMA (~76K) and possibly the upper Bollinger Band. Holding above the SAR (~63.5K) is crucial for the bull case.

· Bearish/Cautionary Scenario: A sustained break below the Bollinger midline, especially on high volume, opens the path for a deeper correction towards the strong support confluence of $62,150 - $63,560. A break below SAR would be a major trend warning.

Conclusion: The trend remains bullish but is undergoing a corrective phase. The key area to watch is $70,500 - $70,650 (Bollinger Midline). A hold here could lead to consolidation or a bounce. A breakdown targets the next major support near $62,150 - $63,560. Traders should watch for volume-confirmed moves at these key levels. The Parabolic SAR at $63,564 is the critical line in the sand for the broader bullish structure.