# MajorStockIndexesPlunge

16.37K

U.S. stocks closed lower as risk appetite weakened, with crypto stocks also under pressure. Strategy (MSTR) fell over 7% in one day. How are you managing risk or finding opportunities in this pullback?

MrFlower_XingChen

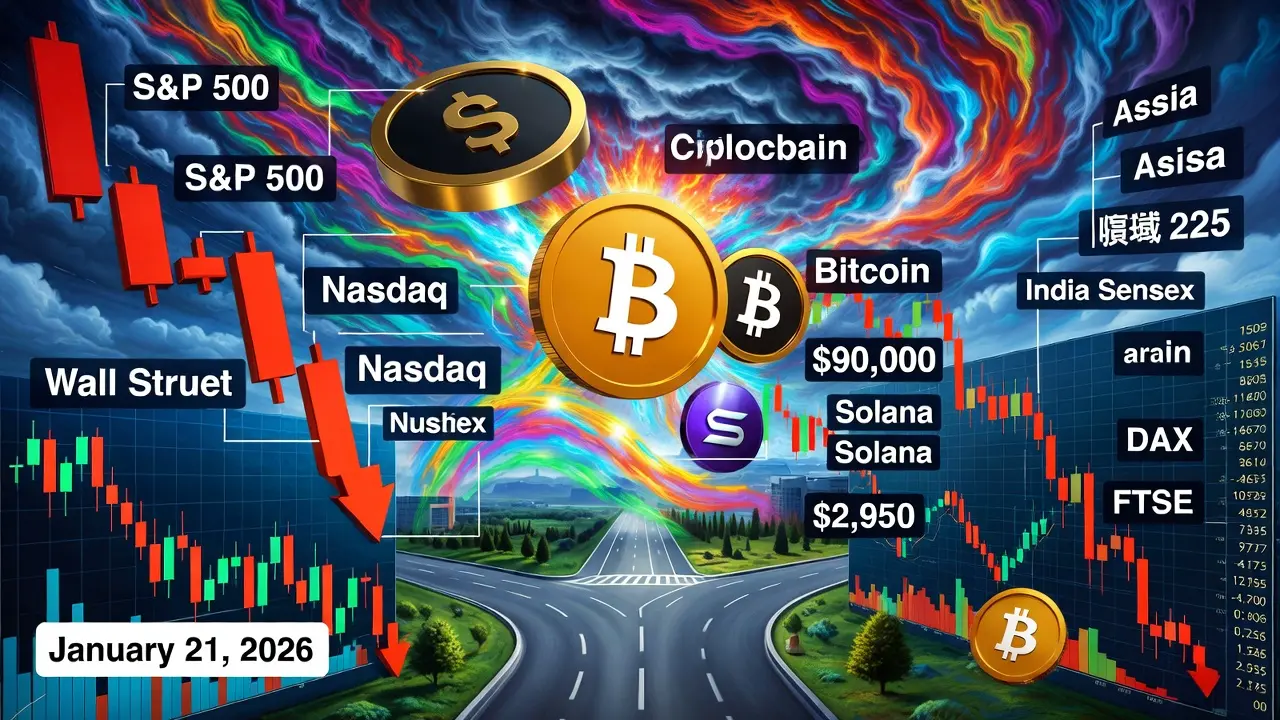

#MajorStockIndexesPlunge Global equity markets are facing a sharp wave of selling as major stock indexes across the world plunge simultaneously, signaling a sudden shift in investor sentiment. What began as localized weakness has rapidly transformed into a broad risk-off movement, pulling down U.S., European, and Asian markets together. The scale and speed of the decline suggest deeper concerns than short-term profit-taking.

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

U.S. markets have led the downturn, with the Dow Jones, S&P 500, and Nasdaq all experiencing heavy losses in a single session. Technology and growth stocks — which had pre

- Reward

- 8

- 36

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

January 20–21, 2026 Stock Market Plunge: Causes, Reactions, and Recovery

Between January 20 and 21, 2026, U.S. and global financial markets experienced a dramatic bout of volatility, triggered by geopolitical tensions and investor uncertainty. This period marked one of the most notable single-day drops for the major U.S. stock indexes in recent months. Here’s a full, detailed breakdown of what happened, why it happened, and what it means for investors and markets going forward.

1. The Day of the Plunge: January 20, 2026

On January 20, 2026, the U.S. stock market suffe

January 20–21, 2026 Stock Market Plunge: Causes, Reactions, and Recovery

Between January 20 and 21, 2026, U.S. and global financial markets experienced a dramatic bout of volatility, triggered by geopolitical tensions and investor uncertainty. This period marked one of the most notable single-day drops for the major U.S. stock indexes in recent months. Here’s a full, detailed breakdown of what happened, why it happened, and what it means for investors and markets going forward.

1. The Day of the Plunge: January 20, 2026

On January 20, 2026, the U.S. stock market suffe

- Reward

- 10

- 17

- Repost

- Share

Crypto_Teacher :

:

Watching Closely 🔍️View More

#MajorStockIndexesPlunge

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

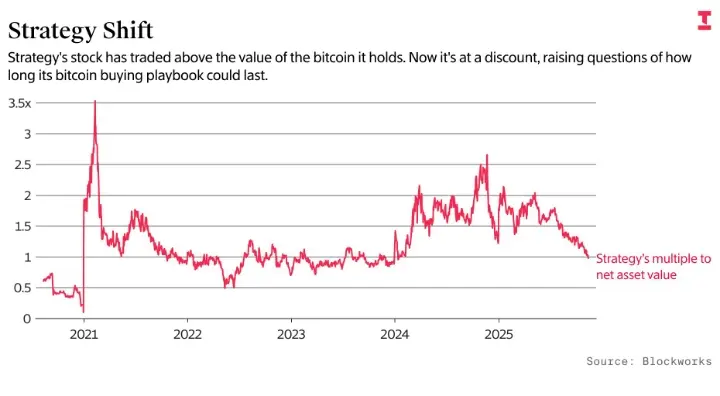

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

- Reward

- 9

- 12

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

📉 🌍 💥 📊 ⚠️ 💣 🌪️ 🧨 💱 🏦 🔻

Major Stock Indexes Plunge — a rapid decline as a test for global markets.

As of January 22, 2026.

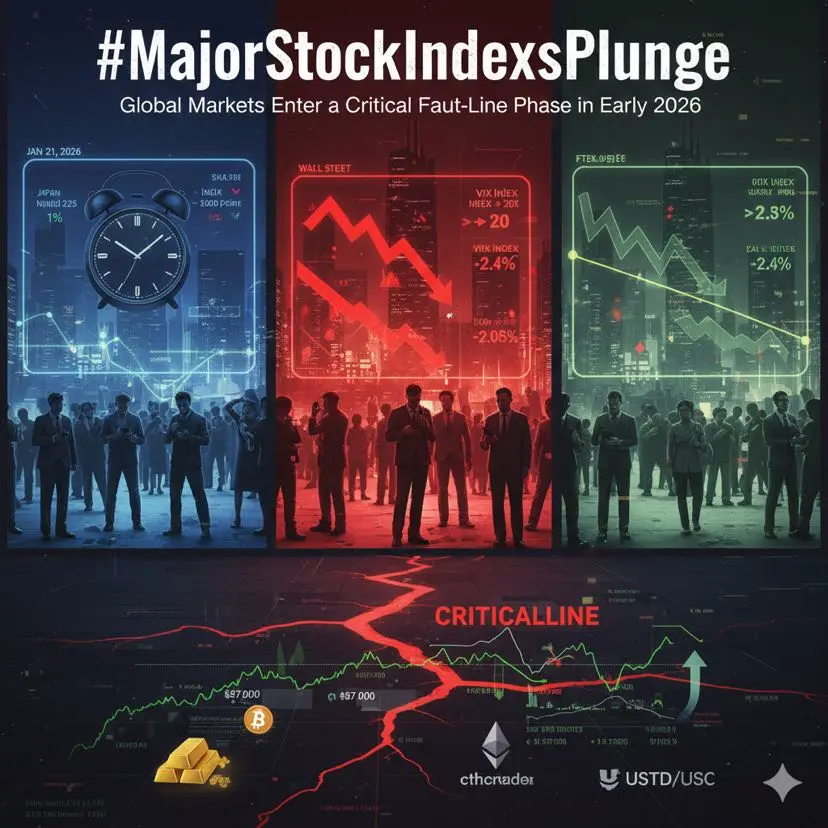

Global financial markets are entering a phase of heightened tension. Recent events have turned a normal correction into a full-scale stress test for investor confidence, liquidity, and macroeconomic resilience. What started with a sharp sell-off in the US quickly spread to Europe and Asia, forming a classic “risk-off” scenario.

1. Overall Market Picture.

Major stock indices demonstrated one of the sharpest single-day declines in recent months. The greatest pressu

View OriginalMajor Stock Indexes Plunge — a rapid decline as a test for global markets.

As of January 22, 2026.

Global financial markets are entering a phase of heightened tension. Recent events have turned a normal correction into a full-scale stress test for investor confidence, liquidity, and macroeconomic resilience. What started with a sharp sell-off in the US quickly spread to Europe and Asia, forming a classic “risk-off” scenario.

1. Overall Market Picture.

Major stock indices demonstrated one of the sharpest single-day declines in recent months. The greatest pressu

- Reward

- 28

- 37

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

- Reward

- 88

- 113

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

#MajorStockIndexesPlunge

As of January 22, 2026, global equity markets have been roiled by one of the most sudden and broad-based sell-offs seen in recent months, with major stock indexes experiencing sharp declines that have jolted investors worldwide. After weeks of buoyant sentiment driven by strong corporate earnings and hopes of easing geopolitical tensions, markets shifted abruptly in response to renewed trade policy concerns, especially heightened tariff rhetoric and uncertainty over international relations, which triggered fresh risk-off trading behavior acros

#MajorStockIndexesPlunge

As of January 22, 2026, global equity markets have been roiled by one of the most sudden and broad-based sell-offs seen in recent months, with major stock indexes experiencing sharp declines that have jolted investors worldwide. After weeks of buoyant sentiment driven by strong corporate earnings and hopes of easing geopolitical tensions, markets shifted abruptly in response to renewed trade policy concerns, especially heightened tariff rhetoric and uncertainty over international relations, which triggered fresh risk-off trading behavior acros

- Reward

- 4

- 5

- Repost

- Share

Falcon_Official :

:

1000x VIbes 🤑View More

#MajorStockIndexesPlunge Global Markets Enter a Fault-Line Moment in Early 2026

Global financial markets are experiencing a full-scale “fault line” rupture as the sell-off that began on Wall Street has spread rapidly across Asia and Europe. Screens across global trading desks turned deep red on January 21, 2026, marking one of the most emotionally charged sessions investors have faced in recent years. This is no routine correction — it is a stress test of confidence, liquidity, and global coordination.

At the core of this shock lies a powerful risk-off wave, triggered by two destabilizing forc

Global financial markets are experiencing a full-scale “fault line” rupture as the sell-off that began on Wall Street has spread rapidly across Asia and Europe. Screens across global trading desks turned deep red on January 21, 2026, marking one of the most emotionally charged sessions investors have faced in recent years. This is no routine correction — it is a stress test of confidence, liquidity, and global coordination.

At the core of this shock lies a powerful risk-off wave, triggered by two destabilizing forc

- Reward

- 13

- 24

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#MajorStockIndexesPlunge

📉 Risk Appetite Fades — Crypto Stocks Under Pressure

U.S. stocks closed lower today as risk sentiment weakened, and crypto-related stocks didn’t escape the pressure. Notably, Strategy (MSTR) fell over 7% in a single session, highlighting the sharp swings in this sector.

🔍 What’s Driving the Move?

1️⃣ Macro caution: Rising trade concerns, rate expectations, and global uncertainty are weighing on risk assets.

2️⃣ Crypto correlation: Stocks tied to Bitcoin and other crypto are still high-beta — when BTC pulls back, these names often follow.

3️⃣ Positioning unwind: Shor

📉 Risk Appetite Fades — Crypto Stocks Under Pressure

U.S. stocks closed lower today as risk sentiment weakened, and crypto-related stocks didn’t escape the pressure. Notably, Strategy (MSTR) fell over 7% in a single session, highlighting the sharp swings in this sector.

🔍 What’s Driving the Move?

1️⃣ Macro caution: Rising trade concerns, rate expectations, and global uncertainty are weighing on risk assets.

2️⃣ Crypto correlation: Stocks tied to Bitcoin and other crypto are still high-beta — when BTC pulls back, these names often follow.

3️⃣ Positioning unwind: Shor

BTC1.95%

- Reward

- 19

- 15

- Repost

- Share

Flower89 :

:

Happy New Year! 🤑View More

#MajorStockIndexesPlunge

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

- Reward

- 5

- 7

- Repost

- Share

Peacefulheart :

:

HODL Tight 💪View More

#MajorStockIndexesPlunge

Markets pulled back today and the message was clear: risk is being repriced.

U.S. stocks closed lower as risk appetite faded, and crypto-linked equities took the hit first. Strategy (MSTR) dropped more than 7% in a single session, showing how fast leverage and sentiment can flip when conditions tighten.

This move wasn’t about one stock. It was about positioning.

When rates stay elevated, bond volatility rises, and macro uncertainty builds, investors stop chasing upside and start protecting capital. Crypto equities feel this pressure more than spot assets because they

Markets pulled back today and the message was clear: risk is being repriced.

U.S. stocks closed lower as risk appetite faded, and crypto-linked equities took the hit first. Strategy (MSTR) dropped more than 7% in a single session, showing how fast leverage and sentiment can flip when conditions tighten.

This move wasn’t about one stock. It was about positioning.

When rates stay elevated, bond volatility rises, and macro uncertainty builds, investors stop chasing upside and start protecting capital. Crypto equities feel this pressure more than spot assets because they

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 18

- 11

- Repost

- Share

Flower89 :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

20.12K Popularity

98K Popularity

70.2K Popularity

20.16K Popularity

38.99K Popularity

32.99K Popularity

24.09K Popularity

97.59K Popularity

63.9K Popularity

33.22K Popularity

23.49K Popularity

11.95K Popularity

145.98K Popularity

33.33K Popularity

172.9K Popularity

News

View MoreThe three major U.S. stock indices closed higher, with Apple rising nearly 3%

1 h

The US Dollar Index fell 0.57%, closing at 97.035

1 h

Data: 743.09 BTC transferred from an anonymous address, worth approximately $644 million

2 h

Data: 35,245,600 SKY tokens transferred from an anonymous address to Galaxy Digital, worth approximately $2,316,500.

3 h

Data: 113.94 BTC transferred out from Cumberland DRW, then relayed through an intermediary before being sent to another anonymous address

3 h

Pin

📊 2 Altcoins to Watch In The Final Week Of January 2026

The crypto market took a turn for the worse in the last few days and while the macro financial conditions are showing signs of improvement. Nevertheless, altcoins are leaning more on the external network developments to turn for the better.

🔸 Hedera ($HBAR )

HBAR trades near $0.1058 at the time of writing, extending a downtrend that began more than three months ago. Persistent bearish market conditions have slowed Hedera’s growth. Price action remains under pressure, reflecting cautious sentiment as investors assess whether the prolongeGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889