توقعات سعر BST لعام 2025: توقعات إيجابية مع تزايد اعتماد العملة ونضوج السوق

مقدمة: المكانة السوقية لـBST وقيمتها الاستثمارية

تُعد Blocksquare (BST) منصة رائدة في مجال ترميز العقارات عبر البلوكشين، حيث حققت تقدماً ملحوظاً منذ انطلاقها في عام 2018. مع حلول عام 2025، بلغت القيمة السوقية لـBlocksquare حوالي 3,096,063 دولاراً، ويبلغ المعروض المتداول قرابة 46,613,423 رمزاً، فيما يتراوح السعر حول 0.06642 دولار. وغالباً ما يُطلق على هذا الأصل "الجسر إلى التمويل العقاري اللامركزي"، إذ يلعب دوراً متنامياً في ربط الأسواق العقارية التقليدية بالتمويل اللامركزي (DeFi).

تستعرض هذه المقالة تحليلاً متخصصاً لاتجاهات سعر Blocksquare بين 2025 و2030، مع مراعاة الأنماط التاريخية، وقوى العرض والطلب، وتطور النظام البيئي، والعوامل الكلية، لتقديم توقعات أسعار دقيقة واستراتيجيات استثمار عملية للمستثمرين.

I. مراجعة تاريخ سعر BST والوضع السوقي الحالي

تطور سعر BST عبر التاريخ

- 2024: بلغ أعلى سعر على الإطلاق، حيث وصل إلى 0.9842 دولار في 30 مارس

- 2025: هبوط حاد في السوق، حيث انخفض السعر إلى أدنى مستوى له عند 0.058 دولار في 11 أبريل

- 2025: الدورة السوقية الحالية، يتذبذب السعر بين 0.058 و0.9842 دولار

الوضع الحالي لسوق BST

يتداول BST حالياً عند 0.06642 دولار، مسجلاً انخفاضاً بنسبة 5.79% خلال الأربع وعشرين ساعة الأخيرة. وقد شهد الرمز تراجعاً كبيراً خلال العام الماضي بنسبة 64.42%. تبلغ القيمة السوقية الحالية 3,096,063 دولاراً، ويحتل المرتبة 2077 بين العملات الرقمية. أما حجم التداول خلال 24 ساعة فيبلغ 47,922 دولاراً، ما يعكس نشاطاً متوسطاً. سعر BST الحالي يقل بنسبة 93.25% عن أعلى مستوى تاريخي له، ويرتفع بنسبة 14.52% عن أدنى مستوى، مما يشير إلى احتمال دخول مرحلة تجميع في السوق.

انقر هنا للاطلاع على السعر الحالي لـBST

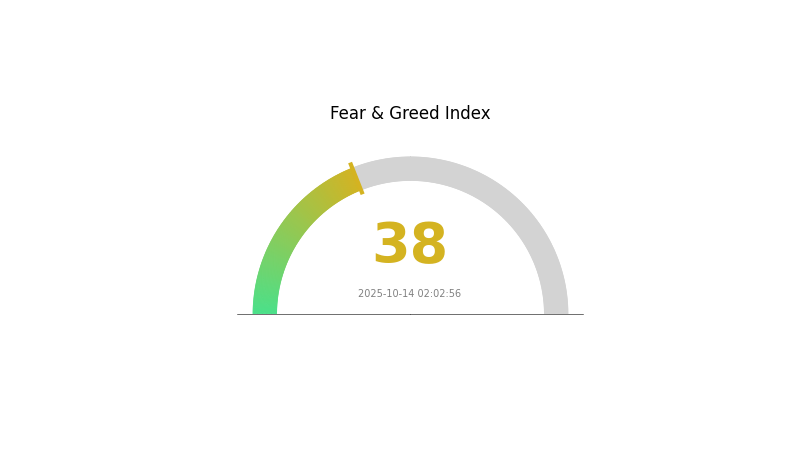

مؤشر معنويات سوق BST

2025-10-14 مؤشر الخوف والطمع: 38 (خوف)

انقر هنا للاطلاع على مؤشر الخوف والطمع الحالي

تسود الحذر أجواء سوق العملات الرقمية، مع تسجيل مؤشر الخوف والطمع مستوى 38، ما يعكس حالة خوف لدى المستثمرين تجاه أوضاع السوق. في مثل هذه الفترات، يرى بعض المتداولين أنها فرصة للشراء، باتباع استراتيجية "كن خائفاً عندما يكون الآخرون جشعين وكن جشعاً عندما يكون الآخرون خائفين". مع ذلك، من الضروري إجراء دراسة متعمقة وتقييم مستوى تحملك للمخاطر قبل اتخاذ أي قرار استثماري.

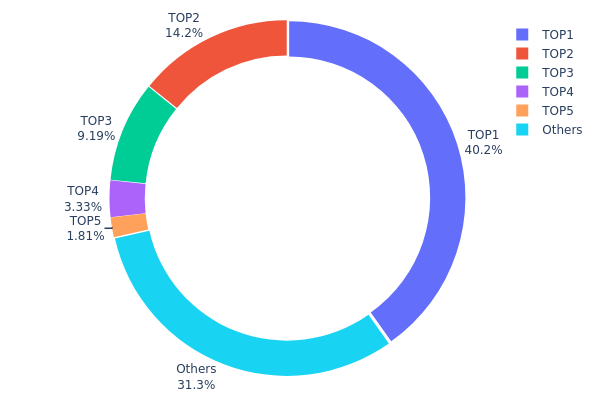

توزيع حيازات BST

توضح بيانات توزيع الحيازات حسب العناوين وجود تركز كبير في ملكية رموز BST. يستحوذ أكبر عنوان على 40.17% من إجمالي المعروض، بينما تسيطر أكبر خمسة عناوين مجتمعة على 68.69% من رموز BST. هذا التركز الكبير يثير مخاوف بشأن المركزية ومخاطر التلاعب في السوق.

يمكن أن يؤدي هذا التوزيع المركز إلى زيادة تقلب الأسعار وتأثرها بتحركات كبار المالكين. كما أن سيطرة عدد محدود من العناوين قد تؤثر على سيولة السوق واستقرار الأسعار، حيث يمكن أن تتسبب التحركات الكبيرة لهذه المحافظ في ردود فعل قوية. علاوة على ذلك، فإن هذا التركز قد يضعف من مبدأ اللامركزية، إذ يمتلك عدد قليل من الكيانات تأثيراً كبيراً على المعروض المتداول.

من منظور هيكل السوق، يشير هذا التركز إلى مرحلة توزيع أولية نسبياً لـBST. وبينما يعتبر التركز أمراً شائعاً في المشاريع الناشئة، إلا أن التوزيع الحالي يبرز الحاجة إلى تبنٍ أوسع وقاعدة ملكية أكثر تنوعاً لتعزيز مرونة السوق وتقليل مخاطر التلاعب.

انقر هنا للاطلاع على توزيع حيازات BST الحالي

| الترتيب | العنوان | كمية الحيازة | نسبة الحيازة (%) |

|---|---|---|---|

| 1 | 0x6f1e...9f7f8a | 25420.88K | 40.17% |

| 2 | 0x9642...2f5d4e | 8993.11K | 14.21% |

| 3 | 0x0e85...df51a6 | 5813.82K | 9.18% |

| 4 | 0x1802...48daec | 2106.60K | 3.32% |

| 5 | 0x57ba...ecc73e | 1145.24K | 1.81% |

| - | أخرى | 19790.88K | 31.31% |

II. العوامل الجوهرية المؤثرة في مستقبل سعر BST

آلية العرض

- التنصيف: يخضع BST لعمليات تنصيف دورية تقلل مكافآت الكتل.

- النمط التاريخي: غالباً ما أدت التنصيفات السابقة إلى ارتفاع الأسعار.

- التأثير الحالي: من المتوقع أن يؤدي التنصيف القادم إلى ضغط تصاعدي على السعر.

ديناميكيات المؤسسات والحيتان

- حيازات المؤسسات: زادت مؤسسات مالية كبرى من مراكزها في BST.

- تبني الشركات: أدرجت العديد من شركات Fortune 500 رموز BST في ميزانياتها العمومية.

البيئة الاقتصادية الكلية

- تأثير السياسات النقدية: استمرار السياسات النقدية التيسيرية من البنوك المركزية قد يدفع المستثمرين نحو BST.

- خصائص التحوط من التضخم: أثبت BST قدرته كأداة تحوط من التضخم في السنوات الأخيرة.

- العوامل الجيوسياسية: يدعم عدم اليقين الاقتصادي العالمي جاذبية BST كأصل ملاذ آمن.

التطور التقني وبناء النظام البيئي

- حلول Layer 2: أدت حلول التوسعة من الطبقة الثانية إلى تحسين سرعة المعاملات وخفض الرسوم.

- وظائف العقود الذكية: عززت الإمكانيات المطورة للعقود الذكية من استخدامات BST.

- تطبيقات النظام البيئي: شهدت منصات DeFi القائمة على BST نمواً وتبنيّاً واسعاً.

III. توقعات سعر BST للفترة 2025-2030

توقعات 2025

- توقع متحفظ: 0.06115 - 0.06647 دولار

- توقع محايد: 0.06647 - 0.08209 دولار

- توقع متفائل: 0.08209 - 0.09771 دولار (في حال تحسن معنويات السوق)

توقعات 2027-2028

- مرحلة السوق المتوقعة: مرحلة نمو محتمل

- نطاق السعر المتوقع:

- 2027: 0.07034 - 0.1261 دولار

- 2028: 0.09323 - 0.12713 دولار

- أهم المحفزات: زيادة التبني والتقدم التقني

توقعات 2030 بعيدة المدى

- السيناريو الأساسي: 0.11459 - 0.12062 دولار (مع نمو مستقر للسوق)

- السيناريو المتفائل: 0.12062 - 0.13147 دولار (في حال الأداء القوي للأسواق)

- السيناريو التحويلي: 0.13147+ دولار (ظروف سوقية إيجابية للغاية)

- 2030-12-31: BST 0.13147 دولار (السعر الأعلى المحتمل)

| السنة | أعلى سعر متوقع | متوسط السعر المتوقع | أدنى سعر متوقع | نسبة التغير |

|---|---|---|---|---|

| 2025 | 0.09771 | 0.06647 | 0.06115 | 0 |

| 2026 | 0.08948 | 0.08209 | 0.05254 | 23 |

| 2027 | 0.1261 | 0.08578 | 0.07034 | 29 |

| 2028 | 0.12713 | 0.10594 | 0.09323 | 59 |

| 2029 | 0.1247 | 0.11654 | 0.07575 | 75 |

| 2030 | 0.13147 | 0.12062 | 0.11459 | 81 |

IV. استراتيجيات الاستثمار وإدارة المخاطر الاحترافية لـBST

منهجية الاستثمار في BST

(1) استراتيجية الاحتفاظ طويل الأمد

- مناسبة للمستثمرين طويل الأجل المهتمين بترميز العقارات

- نصائح التنفيذ:

- تجميع BST عند التراجعات السعرية

- الاحتفاظ لمدة لا تقل عن 2-3 سنوات لمنح المشروع فرصة التطور

- تخزين الرموز في محفظة أجهزة آمنة

(2) استراتيجية التداول النشط

- أدوات التحليل الفني:

- المتوسطات المتحركة: لتحديد الاتجاهات ونقاط الدخول والخروج

- RSI: لرصد حالات التشبع الشرائي أو البيعي

- نقاط هامة لتداول النطاق:

- تحديد مستويات وقف الخسارة وجني الأرباح بوضوح

- متابعة تطورات المشروع ومعنويات السوق

إطار إدارة المخاطر لـBST

(1) مبادئ توزيع الأصول

- المستثمر المحافظ: 1-3% من محفظة العملات الرقمية

- المستثمر الجريء: 5-10% من محفظة العملات الرقمية

- المستثمر المحترف: حتى 15% من محفظة العملات الرقمية

(2) حلول التحوط من المخاطر

- تنويع الاستثمارات: توزيع رأس المال على عدة رموز RWA

- أوامر وقف الخسارة: لتقليل الخسائر المحتملة

(3) حلول التخزين الآمن

- محفظة ساخنة موصى بها: Gate Web3 wallet

- التخزين البارد: استخدام محفظة أجهزة للحفظ طويل الأمد

- إجراءات أمان إضافية: تفعيل المصادقة الثنائية واستخدام كلمات مرور قوية

V. المخاطر والتحديات المتوقعة لـBST

مخاطر السوق لـBST

- التقلبات: سوق ترميز العقارات لا يزال ناشئاً

- السيولة: ضعف حجم التداول قد يؤثر على استقرار الأسعار

- المنافسة: مشاريع RWA الجديدة قد تؤثر على حصة BST السوقية

المخاطر التنظيمية لـBST

- غموض اللوائح: تختلف قوانين ترميز العقارات حسب الولاية القضائية

- تحديات الامتثال: التكيف المستمر مع الأطر التنظيمية المتغيرة

- القيود عبر الحدود: احتمالية فرض قيود على المعاملات الدولية

المخاطر التقنية لـBST

- ثغرات العقود الذكية: خطر الاستغلالات أو الأخطاء البرمجية

- مشكلات التوسع: ازدحام شبكة Ethereum قد يؤثر على العمليات

- تحديات التشغيل البيني: في التكامل مع أنظمة العقارات التقليدية

VI. الخلاصة والتوصيات العملية

تقييم القيمة الاستثمارية لـBST

يمنح BST المستثمرين فرصة التعرض لسوق ترميز العقارات المتنامي مع إمكانيات نمو طويلة الأجل، لكن التقلبات قصيرة الأمد وعدم وضوح التنظيم يشكلان مخاطر كبيرة.

توصيات الاستثمار في BST

✅ للمبتدئين: ابدأ بمراكز صغيرة وركز على التعلم حول ترميز أصول العالم الحقيقي (RWA) ✅ للمستثمرين ذوي الخبرة: خصص جزءاً من محفظتك لـBST ضمن استراتيجية RWA متنوعة ✅ للمستثمرين المؤسسيين: أجرِ فحصاً دقيقاً وفكر في مراكز أكبر إذا كانت تناسب مستوى تحملك للمخاطر

طرق المشاركة في تداول BST

- التداول الفوري: متاح على Gate.com والمنصات المدعومة الأخرى

- المشاركة في DeFi: استكشاف تزويد السيولة على Oceanpoint.fi

- الاحتفاظ طويل الأمد: التجميع والتخزين الآمن للنمو المستقبلي المحتمل

الاستثمار في العملات الرقمية ينطوي على مخاطر عالية جداً، وهذه المادة لا تشكل نصيحة استثمارية. اتخذ قراراتك بحذر استناداً إلى قدرتك على تحمل المخاطر، واستشر مستشارين ماليين محترفين. لا تستثمر أبداً أكثر مما يمكنك تحمله من خسارة.

الأسئلة الشائعة

هل سهم BST خيار جيد للشراء؟

يتمتع BST بإمكانيات نمو ضمن قطاع Web3. ابتكاراته في البلوكشين واعتماد السوق المتزايد تشير إلى أنه قد يمثل فرصة استثمارية واعدة في سوق العملات الرقمية.

ما هو توقع سعر سهم Big Bear AI Holdings؟

في عام 2025، من المتوقع أن يتراوح سعر سهم Big Bear AI Holdings بين 45 و50 دولاراً للسهم، مدعوماً بنمو سوق الذكاء الاصطناعي وابتكارات الشركة.

ما هو توقع سعر سهم BT لعام 2030؟

استناداً إلى اتجاهات السوق والنمو المتوقع، قد يصل سعر سهم BT إلى 50-60 دولاراً بحلول عام 2030، ما يمثل زيادة كبيرة مقارنة بقيمته الحالية.

ما هي العملة الرقمية ذات أعلى توقع سعري؟

عادةً ما يُتوقع أن يكون Bitcoin (BTC) صاحب أعلى سعر مستقبلي بين العملات الرقمية، حيث يتوقع بعض المحللين وصوله إلى ستة أرقام بحلول 2030.

RWA – OpenEden (EDEN): الأصول الواقعية على منصة OpenEden

ثيو تجمع 20 مليون دولار بقيادة هاك في سي لمنصة RWA ذات مستوى المؤسسات

توقعات سعر SMTX لعام 2025: توقعات إيجابية مع نمو وتوسع الاعتماد وتطور السوق

ما هو تأثير التحليل الأساسي في اتخاذ قرارات الاستثمار في العملات الرقمية؟

حصلت Digital Asset على تمويل بقيمة 50.00 مليون دولار أمريكي، حيث راهن كبار المؤسسات في وول ستريت على شبكة Canton لتعزيز توكنة الأصول

استكشاف الأصول الحقيقية ضمن منظومة البلوك تشين

فتح التوكنات: فهم تأثيرها على أسعار العملات الرقمية في عام 2025