VernacularBlockchain

No content yet

VernacularBlockchain

The Dawn of Ethereum

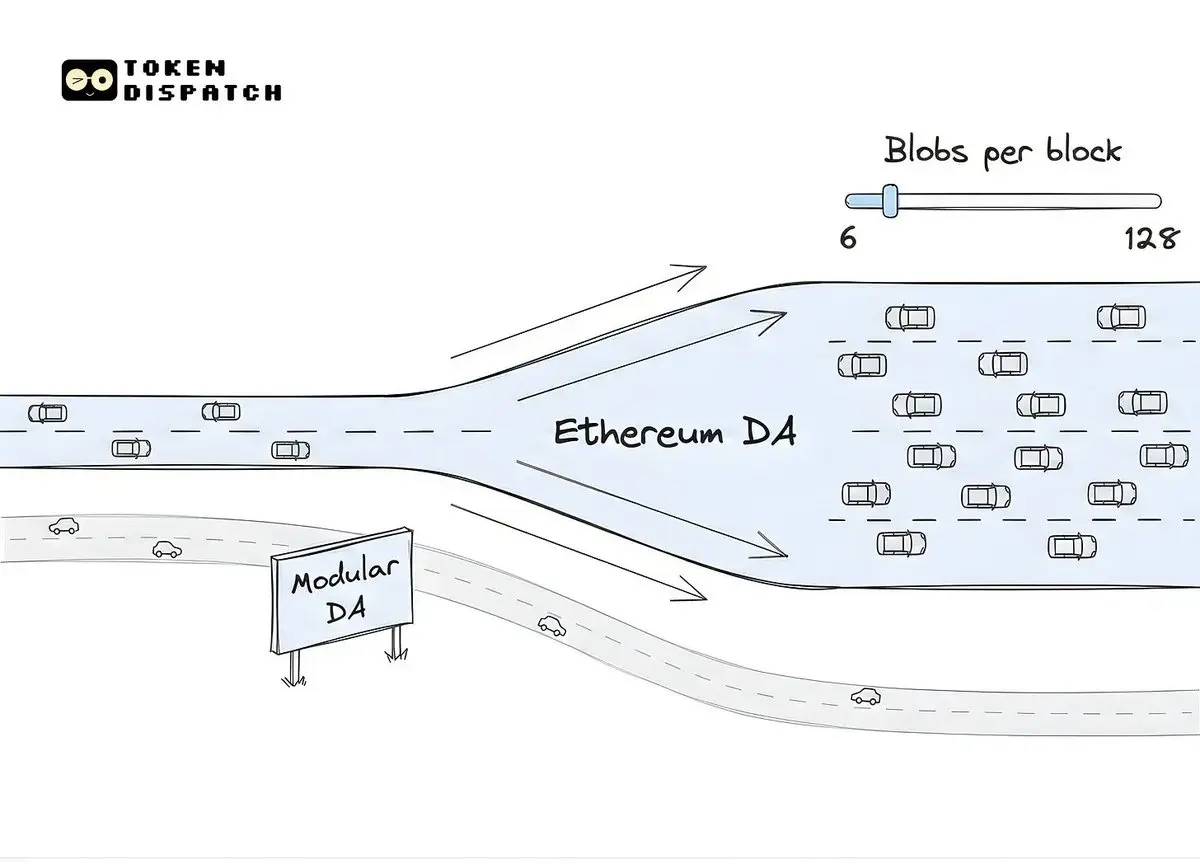

[Plain Language Guide] Ethereum's Fusaka upgrade (December 7, 2025) marks a powerful rebuttal to the narrative of "non-scalability." Following Dencun's reduction of Rollup costs, Fusaka introduces PeerDAS technology, which, through efficient data availability sampling, significantly increases Ethereum's blob capacity. The target is to reach 128 blobs per block (16MB), surpassing the current capacity of modular DA solutions like Celestia.

This upgrade achieves large-scale scalability without sacrificing decentralization, greatly improving the economic model and user experie

View Original[Plain Language Guide] Ethereum's Fusaka upgrade (December 7, 2025) marks a powerful rebuttal to the narrative of "non-scalability." Following Dencun's reduction of Rollup costs, Fusaka introduces PeerDAS technology, which, through efficient data availability sampling, significantly increases Ethereum's blob capacity. The target is to reach 128 blobs per block (16MB), surpassing the current capacity of modular DA solutions like Celestia.

This upgrade achieves large-scale scalability without sacrificing decentralization, greatly improving the economic model and user experie

- Reward

- like

- Comment

- Repost

- Share

Don’t rush to sell!

[Plain Language Guide] This article refutes the claim that the current cryptocurrency downturn is caused by panic from yen carry trade unwinding. The author points out that yen leverage has dropped significantly, and most market leverage was cleared out in August.

The real driving force behind the decline is mechanical: as we enter December, institutional adjustments for risk resetting and tax loss harvesting have automatically triggered selling. As long as Bitcoin holds the key $80,000 - $82,000 level, the long-term structure remains excessive. This week’s Powell remarks a

[Plain Language Guide] This article refutes the claim that the current cryptocurrency downturn is caused by panic from yen carry trade unwinding. The author points out that yen leverage has dropped significantly, and most market leverage was cleared out in August.

The real driving force behind the decline is mechanical: as we enter December, institutional adjustments for risk resetting and tax loss harvesting have automatically triggered selling. As long as Bitcoin holds the key $80,000 - $82,000 level, the long-term structure remains excessive. This week’s Powell remarks a

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share

Crypto Agents Are the Next Major Trend

[Plain Language Guide] Since the DeFi boom in 2020, the crypto industry has yet to experience a true influx of mass users. The author of this article suggests that AI agents (Agents) will be the next major breakthrough, as they address the pain points of complex DeFi user experiences.

By automating complex on-chain operations and strategies, AI Agents can simplify stablecoin yields (such as 15% APY), complex trades, and prediction bets. The article details the top projects in the AgentFi space, such as ZyfAI and HeyAnonai, and points out that round-the-cl

View Original[Plain Language Guide] Since the DeFi boom in 2020, the crypto industry has yet to experience a true influx of mass users. The author of this article suggests that AI agents (Agents) will be the next major breakthrough, as they address the pain points of complex DeFi user experiences.

By automating complex on-chain operations and strategies, AI Agents can simplify stablecoin yields (such as 15% APY), complex trades, and prediction bets. The article details the top projects in the AgentFi space, such as ZyfAI and HeyAnonai, and points out that round-the-cl

- Reward

- like

- Comment

- Repost

- Share

Towards New Scale: Ethereum's Fusaka Upgrade

[Plain Language Guide] Ethereum’s Fusaka hard fork will be activated on December 3, 2025, marking a key step in network scaling. This upgrade enhances data availability through PeerDAS (EIP-7594), increasing Blob capacity by several times and significantly reducing Layer-2 Rollup transaction costs.

Additionally, it will raise the L1 gas limit to 60M, enhancing mainnet throughput. Fusaka also enables flexible Blob adjustments via the BPO fork and introduces secp256r1 support to optimize user experience. Overall, Fusaka brings greater scalability and

[Plain Language Guide] Ethereum’s Fusaka hard fork will be activated on December 3, 2025, marking a key step in network scaling. This upgrade enhances data availability through PeerDAS (EIP-7594), increasing Blob capacity by several times and significantly reducing Layer-2 Rollup transaction costs.

Additionally, it will raise the L1 gas limit to 60M, enhancing mainnet throughput. Fusaka also enables flexible Blob adjustments via the BPO fork and introduces secp256r1 support to optimize user experience. Overall, Fusaka brings greater scalability and

ETH-0.43%

- Reward

- like

- Comment

- Repost

- Share

Ethereum at Ten: From Idealism to Pragmatism

[Plain Language Guide] This report analyzes Ethereum's fundamental transformation from 2015 to 2025. After Devconnect in 2025, Ethereum no longer regards decentralization as the ultimate goal, but rather as a tool to achieve practical objectives such as global finance and risk reduction.

Strategic restructuring focuses on three core foundations: doubling the Gas Limit to 60 million, PeerDAS scaling, and EIL. Through these incremental engineering improvements, Ethereum is maturing from a philosophical project into institutional-grade infrastructure c

[Plain Language Guide] This report analyzes Ethereum's fundamental transformation from 2015 to 2025. After Devconnect in 2025, Ethereum no longer regards decentralization as the ultimate goal, but rather as a tool to achieve practical objectives such as global finance and risk reduction.

Strategic restructuring focuses on three core foundations: doubling the Gas Limit to 60 million, PeerDAS scaling, and EIL. Through these incremental engineering improvements, Ethereum is maturing from a philosophical project into institutional-grade infrastructure c

ETH-0.43%

- Reward

- like

- Comment

- Repost

- Share

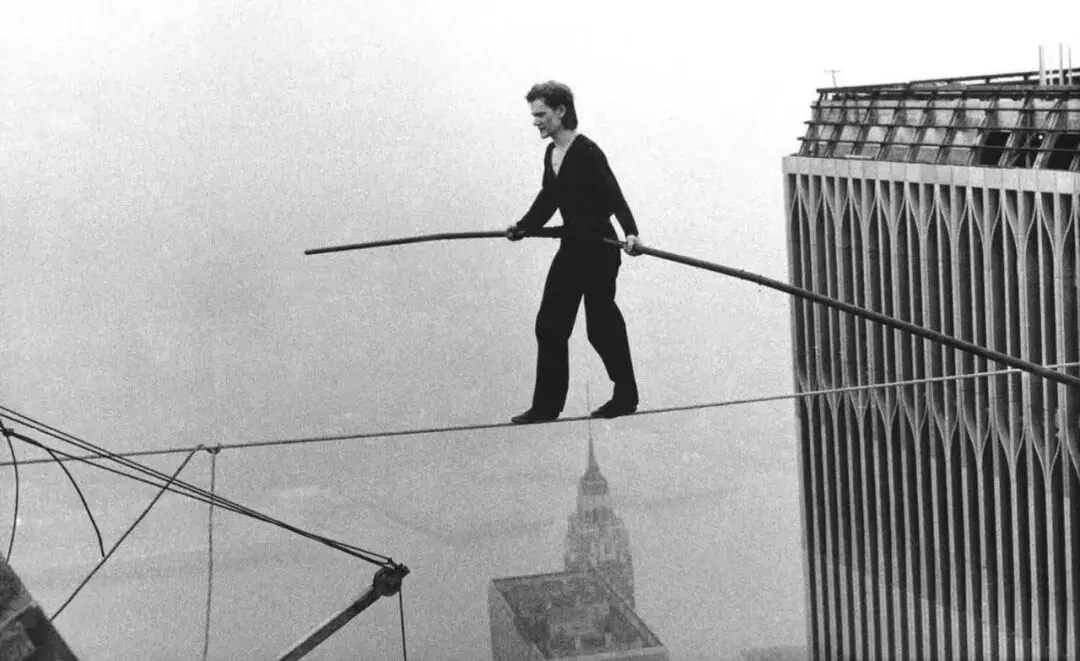

184 billion dollars of Tether is walking a tightrope

【Plain Language Introduction】Tether with a market capitalization of $184 billion (USDT) is facing three major challenges:

Risk: S&P downgraded its rating to the lowest "weak" level, warning that high-risk assets (Bitcoin, gold) account for 24% of total reserves. Arthur Hayes warns that high-risk assets could drop by 30%, potentially wiping out equity buffers.

Moral hazard: Accusations that USDT has become the preferred tool for money laundering and fraud in Southeast Asia.

Geopolitical risks: The global trade development of USDT has become t

【Plain Language Introduction】Tether with a market capitalization of $184 billion (USDT) is facing three major challenges:

Risk: S&P downgraded its rating to the lowest "weak" level, warning that high-risk assets (Bitcoin, gold) account for 24% of total reserves. Arthur Hayes warns that high-risk assets could drop by 30%, potentially wiping out equity buffers.

Moral hazard: Accusations that USDT has become the preferred tool for money laundering and fraud in Southeast Asia.

Geopolitical risks: The global trade development of USDT has become t

BTC-1.37%

- Reward

- 1

- Comment

- Repost

- Share

Has Bitcoin's "highest indicator" failed?

[Plain Language Introduction] This article discusses the phenomenon where traditional Bitcoin top indicators such as Delta Top and Pi Cycle Top failed to trigger accurately in this cycle, raising doubts in the market.

The core viewpoint suggests that the structure of the Bitcoin market is changing, and the indicators are not "invalidated," but rather need to shift from fixed thresholds to dynamic models. By adjusting the MVRV Z-Score to a 6-month rolling basis and using more responsive dynamic indicators such as the 30-day coin days destroyed and t

[Plain Language Introduction] This article discusses the phenomenon where traditional Bitcoin top indicators such as Delta Top and Pi Cycle Top failed to trigger accurately in this cycle, raising doubts in the market.

The core viewpoint suggests that the structure of the Bitcoin market is changing, and the indicators are not "invalidated," but rather need to shift from fixed thresholds to dynamic models. By adjusting the MVRV Z-Score to a 6-month rolling basis and using more responsive dynamic indicators such as the 30-day coin days destroyed and t

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share

The story of the 500 million USD market rescue: A transnational asset recovery battle

In January 2024, the stablecoin TUSD plummeted due to the "disappearance" of $456 million in reserves, facing a systemic collapse. A decisive injection of $500 million in emergency liquidity stabilized the crisis.

The article reveals that the custodian FDT violated instructions by transferring funds to the private trading company Aria DMCC. After a legal battle spanning Hong Kong, Singapore, and Dubai, the Dubai court issued the first global asset freeze order in the history of cryptocurrency in October 2025,

In January 2024, the stablecoin TUSD plummeted due to the "disappearance" of $456 million in reserves, facing a systemic collapse. A decisive injection of $500 million in emergency liquidity stabilized the crisis.

The article reveals that the custodian FDT violated instructions by transferring funds to the private trading company Aria DMCC. After a legal battle spanning Hong Kong, Singapore, and Dubai, the Dubai court issued the first global asset freeze order in the history of cryptocurrency in October 2025,

TUSD0.02%

- Reward

- like

- Comment

- Repost

- Share

Disrupting a century of finance! How do encryption "Perptual Futures" force TradFi to a dead end?

[Plain Language Guide] Arthur Hayes reflects on his and BitMEX's history of inventing Perpetual Futures and explains how this never-expiring high-leverage encryption derivative is fundamentally disrupting the traditional financial (TradFi) market.

The article points out that perpetual futures combined with a socialized loss guarantee system address the needs of retail investors for high leverage and liquidity. Traditional exchanges (such as SGX, CBOE) are being forced to launch similar product

View Original[Plain Language Guide] Arthur Hayes reflects on his and BitMEX's history of inventing Perpetual Futures and explains how this never-expiring high-leverage encryption derivative is fundamentally disrupting the traditional financial (TradFi) market.

The article points out that perpetual futures combined with a socialized loss guarantee system address the needs of retail investors for high leverage and liquidity. Traditional exchanges (such as SGX, CBOE) are being forced to launch similar product

- Reward

- like

- Comment

- Repost

- Share

When the Internet is Revalued: Interpretation of x402

[Plain Language Guide] Why have small payments in the internet age collectively failed? Because the friction is too great, the costs are too high, and users are too frustrated. Now, the x402 protocol has emerged: it resurrects the HTTP 402 status code that has been dormant for 27 years, combines it with stablecoins, and creates a machine payment track with zero account opening, instant settlement, and minimal costs.

In the future, SaaS will abandon crude subscriptions and switch to a "low base price + pay-per-piece/per-session x402 sudden p

View Original[Plain Language Guide] Why have small payments in the internet age collectively failed? Because the friction is too great, the costs are too high, and users are too frustrated. Now, the x402 protocol has emerged: it resurrects the HTTP 402 status code that has been dormant for 27 years, combines it with stablecoins, and creates a machine payment track with zero account opening, instant settlement, and minimal costs.

In the future, SaaS will abandon crude subscriptions and switch to a "low base price + pay-per-piece/per-session x402 sudden p

- Reward

- like

- Comment

- Repost

- Share

Altcoin ETF has exploded, completing in six months the ten-year journey of Bitcoin: a structural transformation is happening in the crypto market.

[Plain Language Guide] By the end of 2025, altcoin ETFs will land on the US stock market at an unprecedented speed. Solana, XRP, Dogecoin, and others will automatically take effect through the SEC-approved "Universal Listing Standards" and cleverly leverage the 8(a) clause for expedited processing.

This "strategic abandonment" by regulators has granted these assets a de facto recognition as non-securities. The Solana ETF even attempted risk allocati

View Original[Plain Language Guide] By the end of 2025, altcoin ETFs will land on the US stock market at an unprecedented speed. Solana, XRP, Dogecoin, and others will automatically take effect through the SEC-approved "Universal Listing Standards" and cleverly leverage the 8(a) clause for expedited processing.

This "strategic abandonment" by regulators has granted these assets a de facto recognition as non-securities. The Solana ETF even attempted risk allocati

- Reward

- like

- 3

- Repost

- Share

Octupushat :

:

So xrp is going to hell, right?View More

Nearly 500 million USD of TUSD reserves has been misappropriated, and the Dubai Digital Economy Court has issued the world's first encryption asset freeze order, freezing all misappropriated assets. Although the vast majority of assets have already been transferred to illiquid assets...

The entire case spans Hong Kong, Singapore, and Dubai. This global asset recovery case is quite challenging, especially when it involves encryption assets, which is a good thing for the entire industry. #TUSD #Crypto

The entire case spans Hong Kong, Singapore, and Dubai. This global asset recovery case is quite challenging, especially when it involves encryption assets, which is a good thing for the entire industry. #TUSD #Crypto

TUSD0.02%

- Reward

- like

- Comment

- Repost

- Share

How much longer can HODL companies last?

[Plain Language Guide] In November 2025, the crypto market crashed, wiping out $1.4 trillion. The hardest hit were Digital Asset Treasury (DAT) companies, once seen as “institutional pioneers.”

A reversal in macro forecasts and geopolitical turmoil broke the reflexivity flywheel of DAT companies. Once share prices trade at a discount (mNAV<1.0), the flywheel turns into a death spiral.

MicroStrategy faces a risk of a $11.6 billion sell-off triggered by MSCI’s explicit removal, while Bitmine is on the brink due to aggressive Ethereum bets and “toxic finan

[Plain Language Guide] In November 2025, the crypto market crashed, wiping out $1.4 trillion. The hardest hit were Digital Asset Treasury (DAT) companies, once seen as “institutional pioneers.”

A reversal in macro forecasts and geopolitical turmoil broke the reflexivity flywheel of DAT companies. Once share prices trade at a discount (mNAV<1.0), the flywheel turns into a death spiral.

MicroStrategy faces a risk of a $11.6 billion sell-off triggered by MSCI’s explicit removal, while Bitmine is on the brink due to aggressive Ethereum bets and “toxic finan

ETH-0.43%

- Reward

- like

- Comment

- Repost

- Share

2025 Crypto Trends Report

[Plain Language Guide] This report frames the growth of the crypto industry through three overlapping S-curves: asset creation, asset accumulation, and asset utilization.

The creation phase (such as Bitcoin, NFTs, and millions of tokens) has already gone from zero to breakthrough. The accumulation phase is currently in its steepest climb, with centralized exchange trading volumes surging, traditional financial debt (like Robinhood), and institutional investors beginning to hold and custody assets in large amounts.

The greatest future opportunity lies in asset utilizat

[Plain Language Guide] This report frames the growth of the crypto industry through three overlapping S-curves: asset creation, asset accumulation, and asset utilization.

The creation phase (such as Bitcoin, NFTs, and millions of tokens) has already gone from zero to breakthrough. The accumulation phase is currently in its steepest climb, with centralized exchange trading volumes surging, traditional financial debt (like Robinhood), and institutional investors beginning to hold and custody assets in large amounts.

The greatest future opportunity lies in asset utilizat

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share

The Digital Empire's Map: Analysis of Tether's Investment Logic and Global Expansion Strategy

[Plain Language Guide] USDT, issued by Tether, leads the market by a wide margin, and its reports symbolize the rise of a massive digital financial empire. This research paper analyzes Tether's recent investments in 20 global companies, revealing its strategic blueprint.

The foundation of Tether's empire lies in: establishing strong trust through Bitcoin and gold; expanding globally by investing in Europe and emerging digital markets; and enhancing accessibility for both retail and institutional users

[Plain Language Guide] USDT, issued by Tether, leads the market by a wide margin, and its reports symbolize the rise of a massive digital financial empire. This research paper analyzes Tether's recent investments in 20 global companies, revealing its strategic blueprint.

The foundation of Tether's empire lies in: establishing strong trust through Bitcoin and gold; expanding globally by investing in Europe and emerging digital markets; and enhancing accessibility for both retail and institutional users

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share

Is Bitcoin in a Correction or Entering a New Bear Market?

[Plain Language Guide] After Bitcoin dropped below sixty thousand ($100,000), the market outlook has turned defensive. The author points out that the probability of retesting the all-time high has fallen below 50%, and the market is entering a transitional phase.

Current analysis indicates a lack of typical panic selling and negative funding rates, suggesting the market has not fully flushed out yet. The key potential bottom area is near the realized price and the 200-week moving average ($50,000s).

It is recommended to adopt a precise

[Plain Language Guide] After Bitcoin dropped below sixty thousand ($100,000), the market outlook has turned defensive. The author points out that the probability of retesting the all-time high has fallen below 50%, and the market is entering a transitional phase.

Current analysis indicates a lack of typical panic selling and negative funding rates, suggesting the market has not fully flushed out yet. The key potential bottom area is near the realized price and the 200-week moving average ($50,000s).

It is recommended to adopt a precise

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share

Vitalik’s Latest Speech: The Three Major Breaths and Solutions of Ethereum L1 Revealed

[Plain Language Introduction] Ethereum is shifting from being a “world computer” focused on general-purpose computation to a “trust-minimized” stack emphasizing privacy protection and efficient verification. Vitalik Buterin outlined this vision at Devconnect.

Ethereum’s L1 faces limitations in privacy and speed, which can only be addressed by introducing EIP-7732, zkVMs (to achieve full nodes on mobile devices), and account abstraction. The long-term goal is to realize a “Lean Ethereum”—a global collaborativ

[Plain Language Introduction] Ethereum is shifting from being a “world computer” focused on general-purpose computation to a “trust-minimized” stack emphasizing privacy protection and efficient verification. Vitalik Buterin outlined this vision at Devconnect.

Ethereum’s L1 faces limitations in privacy and speed, which can only be addressed by introducing EIP-7732, zkVMs (to achieve full nodes on mobile devices), and account abstraction. The long-term goal is to realize a “Lean Ethereum”—a global collaborativ

ETH-0.43%

- Reward

- like

- Comment

- Repost

- Share

Panic index falls to freezing point: is the crypto market's "century bottom" or a "falling knife"?

In November 2025, the Fear and Greed Index fell to 9, hitting a 5-year low, with Bitcoin dropping below 100,000 and reaching 90,900.

Panic stems from the Fed's hawkish stance + record ETF outflows of 2.3 billion + whales selling 810,000 coins, with institutions and the HODL narrative collapsing simultaneously. In reality, it's a major asset transfer: retail investors and mid-sized whales are cutting losses, while super whales and diamond hands are buying aggressively.

History shows th

In November 2025, the Fear and Greed Index fell to 9, hitting a 5-year low, with Bitcoin dropping below 100,000 and reaching 90,900.

Panic stems from the Fed's hawkish stance + record ETF outflows of 2.3 billion + whales selling 810,000 coins, with institutions and the HODL narrative collapsing simultaneously. In reality, it's a major asset transfer: retail investors and mid-sized whales are cutting losses, while super whales and diamond hands are buying aggressively.

History shows th

BTC-1.37%

- Reward

- like

- Comment

- Repost

- Share