# NextFedChairPredictions

17.65K

Who do you think is the top candidate to become the next Fed Chair, and why? Share your views!

LittleQueen

#NextFedChairPredictions The Decision That Could Define the Direction of Global Markets

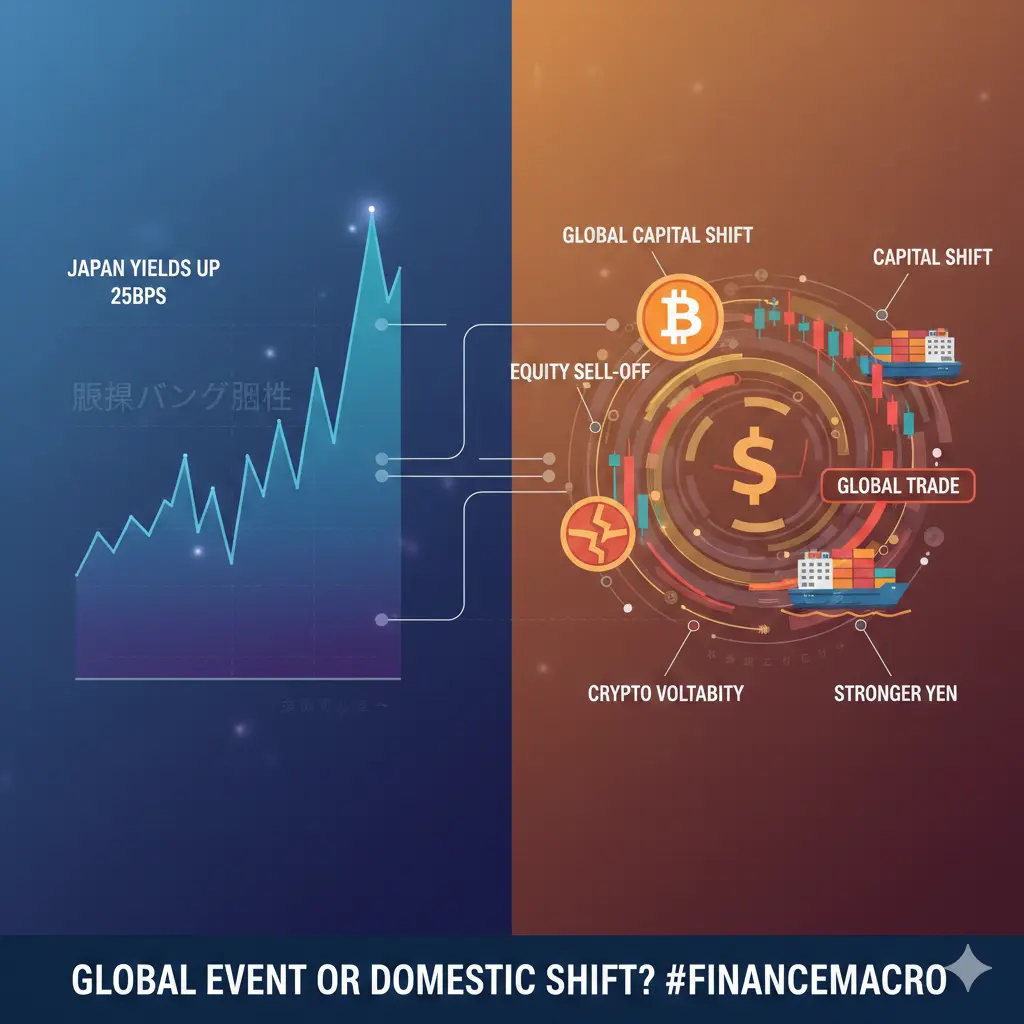

As 2026 unfolds, global financial markets are increasingly centered on one critical question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This decision is far more than a political appointment. It represents control over the world’s most influential central bank — and the tone it sets can reshape capital flows across every asset class.

From U.S. Treasuries to emerging markets and cryptocurrencies, investors are positioning not ar

As 2026 unfolds, global financial markets are increasingly centered on one critical question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This decision is far more than a political appointment. It represents control over the world’s most influential central bank — and the tone it sets can reshape capital flows across every asset class.

From U.S. Treasuries to emerging markets and cryptocurrencies, investors are positioning not ar

- Reward

- 3

- 69

- Repost

- Share

YingYue :

:

Happy New Year! 🤑View More

#NextFedChairPredictions

2026: The Fed Reset That Will Shape the Next Decade 🌍

With Jerome Powell’s term ending on May 15, 2026, the global market isn’t just pricing in a new Fed Chair — it’s pricing in a new monetary regime.

This decision won’t only move rates.

It will redefine USD dominance, risk assets, gold, and crypto.

Here’s how markets are positioning 👇

🔍 The Top Contenders (Early 2026)

🥇 Kevin Warsh — Market’s First Choice

Former Fed Governor with strong credibility across Wall Street and Washington.

• Seen as policy-balanced, not ideological

• Supportive of innovation & digital as

2026: The Fed Reset That Will Shape the Next Decade 🌍

With Jerome Powell’s term ending on May 15, 2026, the global market isn’t just pricing in a new Fed Chair — it’s pricing in a new monetary regime.

This decision won’t only move rates.

It will redefine USD dominance, risk assets, gold, and crypto.

Here’s how markets are positioning 👇

🔍 The Top Contenders (Early 2026)

🥇 Kevin Warsh — Market’s First Choice

Former Fed Governor with strong credibility across Wall Street and Washington.

• Seen as policy-balanced, not ideological

• Supportive of innovation & digital as

- Reward

- 10

- 62

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🚀 “Next-level energy here — can feel the momentum building!”View More

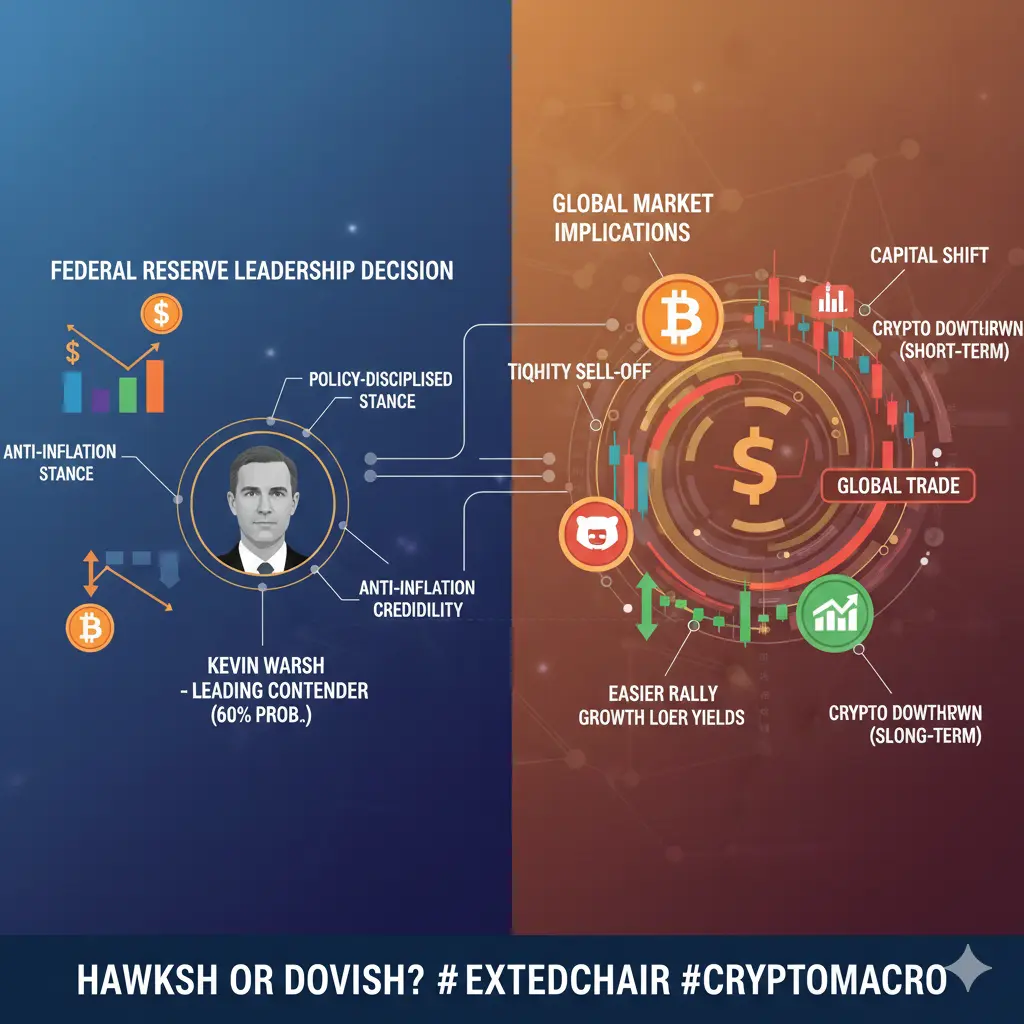

#NextFedChairPredictions As 2026 unfolds, global markets are increasingly focused on a single critical question: who will become the next Chair of the Federal Reserve, and what direction will that leadership impose on global liquidity? This decision goes far beyond politics — it represents the steering wheel of the world’s most influential central bank. Every asset class, from U.S. bonds to emerging markets and cryptocurrencies, is positioned around expectations tied to this outcome.

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

Recent speculation suggests Kevin Warsh has emerged as a leading contender, with market-implied odds reportedly

- Reward

- 9

- 28

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#NextFedChairPredictions The Decision That Could Define Markets in 2026

As 2026 unfolds, global financial markets are increasingly focused on who will become the next Chair of the U.S. Federal Reserve — a decision that could steer the direction of liquidity, interest rates, and risk pricing across asset classes. This leadership change is not merely a political appointment; it represents a pivotal moment for monetary policy that affects everything from bond yields to cryptocurrencies.

At the center of speculation is the narrowing pool of candidates being evaluated by the White House, with Kevin

As 2026 unfolds, global financial markets are increasingly focused on who will become the next Chair of the U.S. Federal Reserve — a decision that could steer the direction of liquidity, interest rates, and risk pricing across asset classes. This leadership change is not merely a political appointment; it represents a pivotal moment for monetary policy that affects everything from bond yields to cryptocurrencies.

At the center of speculation is the narrowing pool of candidates being evaluated by the White House, with Kevin

BTC-3,24%

- Reward

- 17

- 40

- Repost

- Share

Nazdej :

:

2026 GOGOGO 👊View More

#NextFedChairPredictions The Decision That Could Define Market Direction

As 2026 unfolds, global market attention is increasingly focused on one critical question: who will be appointed as the next Chair of the Federal Reserve, and how will their leadership shape the trajectory of global liquidity and risk sentiment? This decision is far more consequential than a political nomination; it represents control over the world’s most influential central bank, whose policy decisions ripple across every asset class. From U.S. Treasuries and equities to emerging market debt and cryptocurrencies, trader

As 2026 unfolds, global market attention is increasingly focused on one critical question: who will be appointed as the next Chair of the Federal Reserve, and how will their leadership shape the trajectory of global liquidity and risk sentiment? This decision is far more consequential than a political nomination; it represents control over the world’s most influential central bank, whose policy decisions ripple across every asset class. From U.S. Treasuries and equities to emerging market debt and cryptocurrencies, trader

- Reward

- 12

- 23

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

The probability of a "moderate candidate" increases amid rising political factors

Against the backdrop of the US election cycle and intensified bipartisan rivalry, the selection of the Federal Reserve Chair is no longer just a professional matter but also a political balancing act. Extreme hawks may trigger issues related to employment and debt, while extreme doves could be accused of tolerating inflation. Therefore, a "moderate candidate" is more likely to gain consensus. Such candidates typically have a complete resume, relatively moderate stances, emphasizing long-term anti-inflation goals

View OriginalAgainst the backdrop of the US election cycle and intensified bipartisan rivalry, the selection of the Federal Reserve Chair is no longer just a professional matter but also a political balancing act. Extreme hawks may trigger issues related to employment and debt, while extreme doves could be accused of tolerating inflation. Therefore, a "moderate candidate" is more likely to gain consensus. Such candidates typically have a complete resume, relatively moderate stances, emphasizing long-term anti-inflation goals

- Reward

- 3

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

The "Institutional" camp continuing its steady and prudent approach remains the optimal solution

From the current stage of the US economy and financial markets, the choice of Federal Reserve Chair is more likely to lean towards "Institutional" and "Prudent" rather than radical reformers. The high interest rate cycle is nearing its end, but the decline in inflation is not smooth, and fiscal deficits, debt levels, and geopolitical risks remain high. In this context, both the White House and the markets need a Chairperson who will not create additional uncertainties. Institutional officials typic

View OriginalFrom the current stage of the US economy and financial markets, the choice of Federal Reserve Chair is more likely to lean towards "Institutional" and "Prudent" rather than radical reformers. The high interest rate cycle is nearing its end, but the decline in inflation is not smooth, and fiscal deficits, debt levels, and geopolitical risks remain high. In this context, both the White House and the markets need a Chairperson who will not create additional uncertainties. Institutional officials typic

- Reward

- 4

- 3

- Repost

- Share

Ryakpanda :

:

2026 Go Go Go 👊View More

#NextFedChairPredictions 🔥

As the calendar steadily advances toward May 2026, the approaching end of Jerome Powell’s term as Chair of the U.S. Federal Reserve is becoming one of the most closely watched macro events in global finance. This is not merely a change in leadership title; it represents a potential turning point for monetary policy, inflation management, financial stability, and global capital flows. For markets that operate on expectations rather than certainties, the question of who leads the Fed next matters almost as much as what policies they may pursue.

Across trading desks, p

As the calendar steadily advances toward May 2026, the approaching end of Jerome Powell’s term as Chair of the U.S. Federal Reserve is becoming one of the most closely watched macro events in global finance. This is not merely a change in leadership title; it represents a potential turning point for monetary policy, inflation management, financial stability, and global capital flows. For markets that operate on expectations rather than certainties, the question of who leads the Fed next matters almost as much as what policies they may pursue.

Across trading desks, p

- Reward

- 3

- 15

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊View More

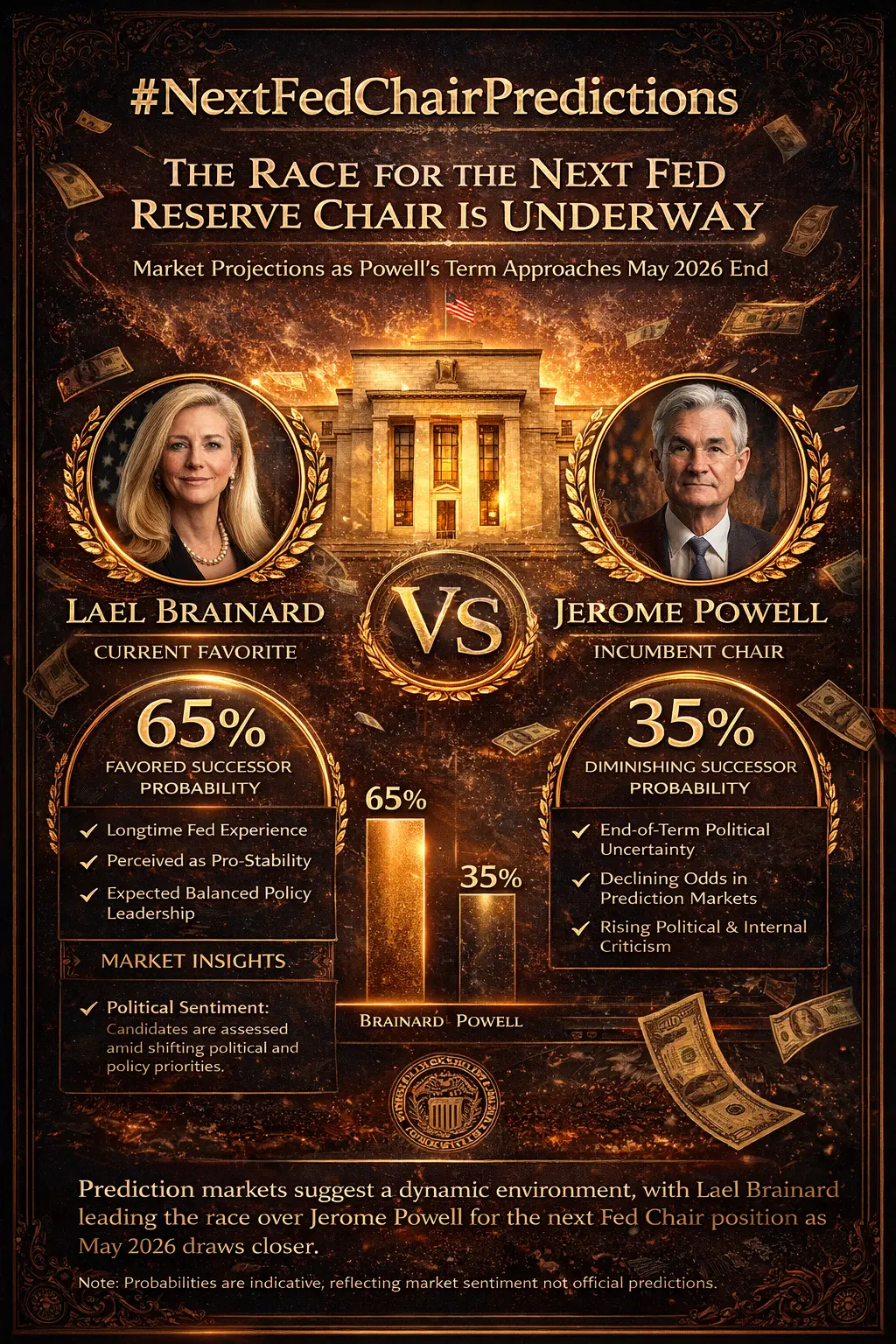

#NextFedChairPredictions

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 end, attention is shifting to who will step into this pivotal role. This transition isn’t just about a new face — it could reshape U.S. interest rates, influence inflation expectations, and impact global markets for years. Traders, investors, and policymakers are tracking every signal, making #NextFedChairPredictions one of the most closely watched topics in finance today.

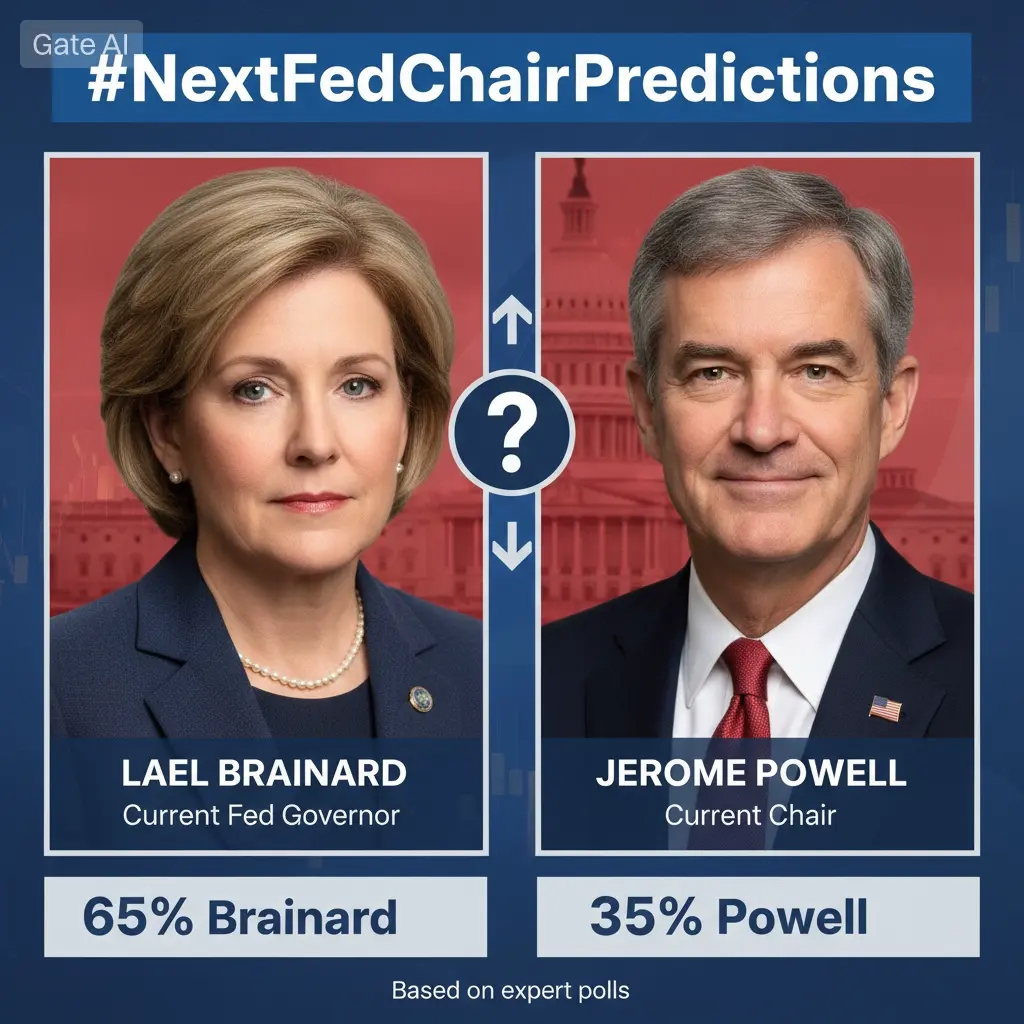

🥇 Lael Brainard Emerges as Frontrunner (~65%)

🌟 Lael Brainard, the current Vice Chair and long-serving Fed Governor, is lea

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 end, attention is shifting to who will step into this pivotal role. This transition isn’t just about a new face — it could reshape U.S. interest rates, influence inflation expectations, and impact global markets for years. Traders, investors, and policymakers are tracking every signal, making #NextFedChairPredictions one of the most closely watched topics in finance today.

🥇 Lael Brainard Emerges as Frontrunner (~65%)

🌟 Lael Brainard, the current Vice Chair and long-serving Fed Governor, is lea

- Reward

- 5

- 8

- Repost

- Share

HighAmbition :

:

Buy To Earn 💎View More

🏛️#NextFedChairPredictions

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 expiration, markets, traders, and policymakers are intensely focused on who will succeed him. This leadership transition isn’t just about personnel it could shape the future of interest rates, inflation expectations, and global financial conditions for years to come.

In the current prediction landscape, Lael Brainard is being perceived as the favorite, with roughly a ~65% probability, while Jerome Powell’s chances are significantly lower at around ~35% according to prevailing sentiment and ma

As Jerome Powell’s term as Federal Reserve Chair approaches its May 2026 expiration, markets, traders, and policymakers are intensely focused on who will succeed him. This leadership transition isn’t just about personnel it could shape the future of interest rates, inflation expectations, and global financial conditions for years to come.

In the current prediction landscape, Lael Brainard is being perceived as the favorite, with roughly a ~65% probability, while Jerome Powell’s chances are significantly lower at around ~35% according to prevailing sentiment and ma

- Reward

- 13

- 23

- Repost

- Share

repanzal :

:

Buy To Earn 💎View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

74.62K Popularity

48.04K Popularity

39.39K Popularity

16.55K Popularity

30.32K Popularity

21.91K Popularity

17.95K Popularity

88.4K Popularity

58.11K Popularity

28.06K Popularity

17.65K Popularity

6.33K Popularity

262.17K Popularity

27.29K Popularity

184.76K Popularity

News

View MorePin