# KaitoYap

5.48K

Andrew8926

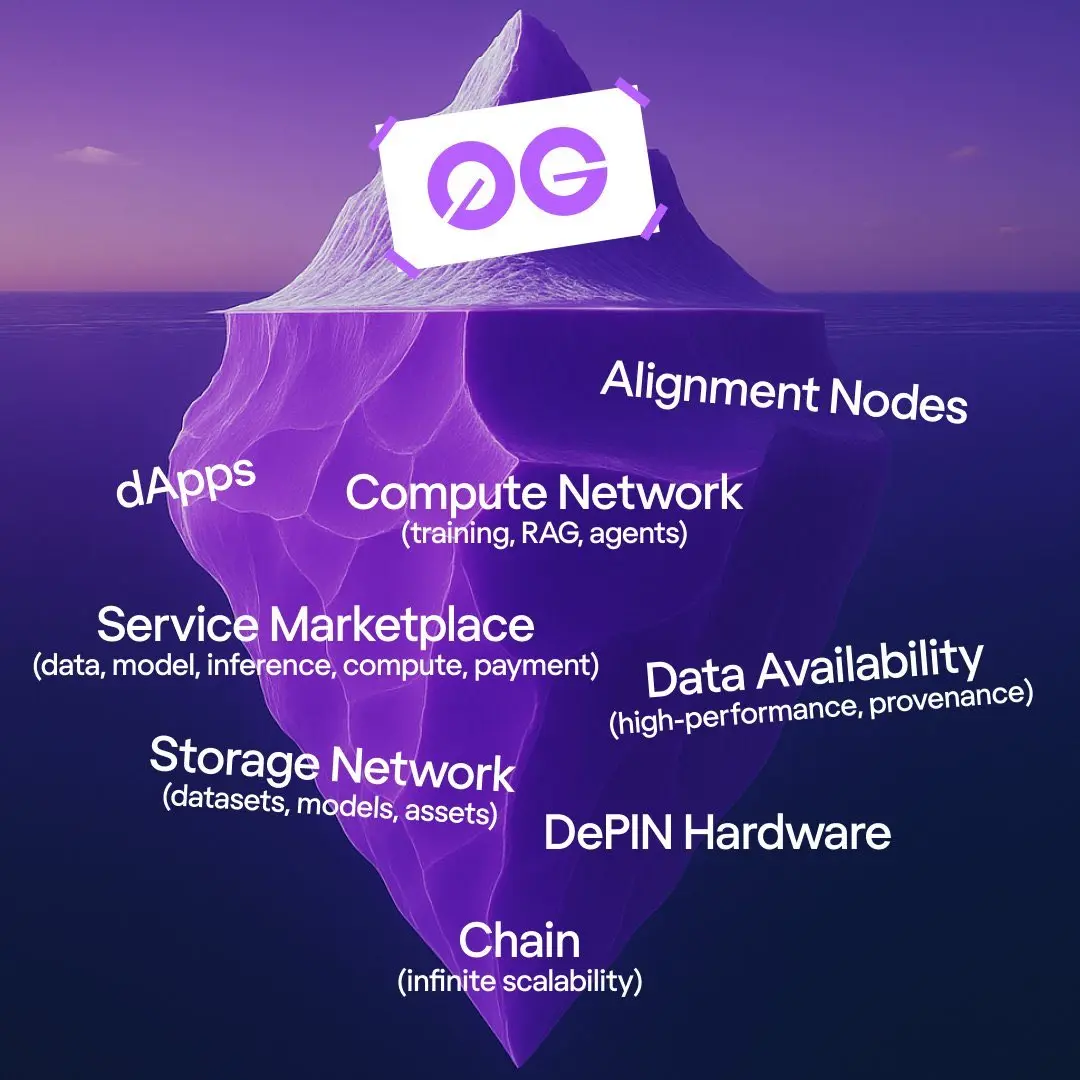

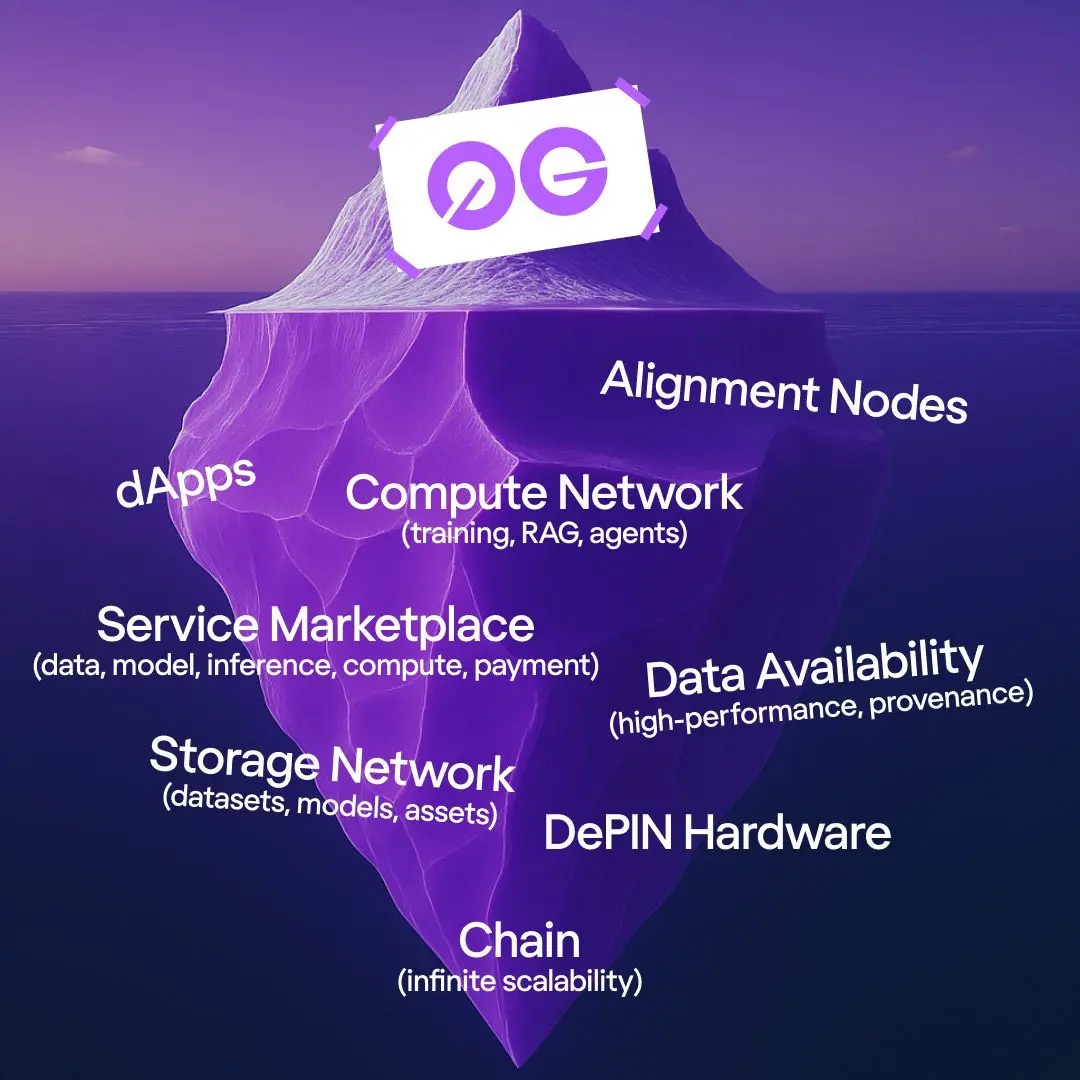

At the intersection of AI and Blockchain, @0G_labs is quietly laying the foundational infrastructure for the future. Since its establishment in 2024, its goal has been clear: to provide a complete ecosystem for Decentralization AI, from chain to computation, from storage to governance, creating a full-stack solution.

The architecture of 0G can be divided into seven core modules: Chain, Storage Network, Service Marketplace, Compute Network, Data Availability, DePIN Hardware, and Alignment Nodes.

Blockchain (Chain) provides unlimited scalability, laying the foundation for future growth in scale;

The architecture of 0G can be divided into seven core modules: Chain, Storage Network, Service Marketplace, Compute Network, Data Availability, DePIN Hardware, and Alignment Nodes.

Blockchain (Chain) provides unlimited scalability, laying the foundation for future growth in scale;

View Original

- Reward

- like

- Comment

- Repost

- Share

Brothers, the rankings have really been heating up these past few days, with the Snapshot approaching, and if you're not careful, you could be overtaken! But to be honest, many people are only focusing on the performance surge of 0G Labs, overlooking an even more explosive piece of news: @0G_labs paired with @symbioticfi feels like it has added a safety plug to 0G, integrating with 0G since the first day of Mainnet launch, filling a crucial gap for the AI public chain.

It is important to know that Symbiotic is a re-staking protocol in the Ethereum ecosystem (similar to EigenLayer), which w

View OriginalIt is important to know that Symbiotic is a re-staking protocol in the Ethereum ecosystem (similar to EigenLayer), which w

- Reward

- like

- Comment

- Repost

- Share

In the wave of Decentralization AI and NFT integration, @0G_labs has launched a new ecosystem—AIverse, a marketplace specifically designed for minting, trading, and collecting intelligent NFTs.

If you are a holder of @OneGravityNFT, there are exclusive early bird benefits here— a total of 1888 holders can be the first to experience AIverse and mint the first batch of iNFT. The initial minting will take place on the 0G Galileo testnet, and after the mainnet goes live, iNFT can be seamlessly migrated to the mainnet, truly achieving asset flow across chains.

iNFT is an NFT type based on the ERC-7

View OriginalIf you are a holder of @OneGravityNFT, there are exclusive early bird benefits here— a total of 1888 holders can be the first to experience AIverse and mint the first batch of iNFT. The initial minting will take place on the 0G Galileo testnet, and after the mainnet goes live, iNFT can be seamlessly migrated to the mainnet, truly achieving asset flow across chains.

iNFT is an NFT type based on the ERC-7

- Reward

- like

- Comment

- Repost

- Share

September and October are golden months; the WLFI leading the charge at the beginning of September was truly a pleasant surprise! There are still many project TGEs coming up later this month, but what I’m really looking forward to is the upcoming @0G_labs. I hope everyone can achieve good results.

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

WLFI0,4%

- Reward

- like

- Comment

- Repost

- Share

Allora has built a decentralized intelligent network that connects 280,000 models (Workers) to enable collaborative learning, mutual verification, and joint evolution. Here, AI is no longer a closed island, but a group of decentralized brains that can self-improve. In medical diagnostics, multi-model reasoning can achieve an accuracy rate of 95%–99%; in DeFi scenarios, they make real-time decisions and predict fluctuations, helping traders to plan more precisely.

More importantly, @AlloraNetwork addresses two major pain points:

🧩 "Black Box" Dilemma: Every inference is recorded on-chain, and

View OriginalMore importantly, @AlloraNetwork addresses two major pain points:

🧩 "Black Box" Dilemma: Every inference is recorded on-chain, and

- Reward

- like

- Comment

- Repost

- Share

September and October are golden months; the WLFI leading the charge at the beginning of September was truly a pleasant surprise! There are still many project TGEs coming up later this month, but what I’m really looking forward to is the upcoming @0G_labs. I hope everyone can achieve good results.

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

0G is not building a product, but rather constructing an entire decentralized AI operating system (deAIOS): from data, computing power, and storage, to models, agents, markets, DePIN hardware, and finally the underlying blockchain and verifiable reasoning. It resembles a complete puzzle, truly "settl

WLFI0,4%

- Reward

- like

- Comment

- Repost

- Share

Suckers' life, no matter how hard it gets, we have to keep going! Let's lift our spirits and continue to enjoy the subsidies in the secondary market. They say that after a black swan event comes a bull run, it feels like this sentence is like giving a long wick candle to a dying person. When will this life come to an end, it's too difficult.

In today's rapidly developing decentralized finance and artificial intelligence, @AlloraNetwork is redefining smart finance in a whole new way. By combining traditional machine learning with large language models (LLM) and avoiding biases f

View OriginalIn today's rapidly developing decentralized finance and artificial intelligence, @AlloraNetwork is redefining smart finance in a whole new way. By combining traditional machine learning with large language models (LLM) and avoiding biases f

- Reward

- 1

- Comment

- Repost

- Share

Yesterday I received the third paycheck from Zui Lu, which comes from Galaxy, so this month's minimum guarantee is finally here. Today, there is also the yap rewards from @defidotapp. I checked last night and there are over ten thousand, so it wasn't in vain! Next, I will focus on @AlloraNetwork.

In the vast ocean of AI, the Forge Builder Kit is like a highway that leads directly to the core of @AlloraNetwork. It provides machine learning engineers with an almost hassle-free VIP lane, allowing you to easily upload models and contribute your efforts in this decentralized intelligent net

In the vast ocean of AI, the Forge Builder Kit is like a highway that leads directly to the core of @AlloraNetwork. It provides machine learning engineers with an almost hassle-free VIP lane, allowing you to easily upload models and contribute your efforts in this decentralized intelligent net

RWA-4,87%

- Reward

- like

- Comment

- Repost

- Share

#Irys has received a major update, and recently the official announcement revealed optimizations to its Hybrid Consensus (PoW+PoS).

This means that storage costs are reduced by at least 70% compared to traditional blockchains, verification times are shortened to an average of 2 seconds, and security is increased by 15%.

The introduction of IrysVM has improved data computation efficiency by 30%, accelerating the expansion of data programmability.

As the first programmable data chain, continuously building AI's collaborative operations, currently

Also reached strategic cooperation with mult

View OriginalThis means that storage costs are reduced by at least 70% compared to traditional blockchains, verification times are shortened to an average of 2 seconds, and security is increased by 15%.

The introduction of IrysVM has improved data computation efficiency by 30%, accelerating the expansion of data programmability.

As the first programmable data chain, continuously building AI's collaborative operations, currently

Also reached strategic cooperation with mult

- Reward

- like

- Comment

- Repost

- Share

#Irys has welcomed a major update, recently the official announced the optimization of its Hybrid Consensus mechanism (PoW+PoS)

This means that storage costs are reduced by at least about 70% compared to traditional blockchains, verification time is shortened to an average of 2 seconds, and security is improved by 15%.

The introduction of IrysVM has increased data computation efficiency by 30%, accelerating the expansion of data programmability.

As the first programmable data chain, continuously building collaborative operations for AI, currently

also reached strategic cooperation with severa

This means that storage costs are reduced by at least about 70% compared to traditional blockchains, verification time is shortened to an average of 2 seconds, and security is improved by 15%.

The introduction of IrysVM has increased data computation efficiency by 30%, accelerating the expansion of data programmability.

As the first programmable data chain, continuously building collaborative operations for AI, currently

also reached strategic cooperation with severa

ETH-4,15%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

2.3K Popularity

4.74K Popularity

24.41K Popularity

11.28K Popularity

146.78K Popularity

10.71K Popularity

2.99K Popularity

4.58K Popularity

99.06K Popularity

51.98K Popularity

125.48K Popularity

395.85K Popularity

234.41K Popularity

4.59K Popularity

281.66K Popularity

News

View MoreOptimism proposes to use 50% of Superchain revenue to buy back OP

2 m

Bessent once again calls on the Federal Reserve, advocating for interest rate cuts to support Trump's new policies

30 m

The S&P 500, Nasdaq, and Dow Jones indices all opened lower.

30 m

U.S. stocks open, Dow Jones down 0.3%

32 m

U.S. stocks open lower, Dow Jones down 0.3%, defense stocks mostly rise

33 m

Pin