Trade

Basic

Futures

Futures

Hundreds of contracts settled in USDT or BTC

TradFi

Gold

Trade global traditional assets with USDT in one place

Options

Hot

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

New

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Affiliate

Enjoy exclusive commissions and earn high returns

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

TradFi

Connect stocks, metals, commodities, forex, and indices

Asset Management

New

One‑stop asset management solution

Institutional

New

Professional digital asset solutions for institutions

OTC Bank Transfer

Deposit and withdraw fiat

Broker Program

Generous API rebate mechanisms

Gate Vault

Keep your assets secure

AI Trading "Overlooked Risks": What if Massive Capital Expenditures Can't Be Spent

The story of AI is evolving from “software consuming the world” to “hardware being stuck by the world.”

In the highly polarized American political environment, almost no issues can unite far-left Senator Bernie Sanders and far-right Governor Ron DeSantis—except for “curbing data centers.”

This is not only a political spectacle in Washington but also a brutal “physical correction” facing Wall Street. As Silicon Valley giants wave checks more expensive than the “Apollo Moon Landing” program, attempting to sustain AI prosperity through massive compute power, they hit a high wall built by political and physical grid limits.

Legislators in New York have also proposed bills to suspend the construction and operation of new data centers for at least three years. New York is at least the sixth state considering a pause on new data center development.

In short, from community protests in Florida to regulatory halts on Texas’s power grid, an overlooked market risk is rapidly intensifying: If the physical grid cannot connect or the political environment refuses, the hundreds of billions of dollars in capital expenditure already factored into valuation models may simply be “unspendable.”

When Sanders and DeSantis Conspire

Sanders and DeSantis are at odds on most issues, but they have reached a rare consensus on the surge of data centers: we must hit the brakes.

This bipartisan “joint” hostility stems from the American public’s firsthand pain from “AI side effects.” Across the U.S., the nonstop low-frequency noise from data centers disturbs nearby communities; the huge cooling demands strain local water resources; residents and small businesses face soaring electricity bills, and public protests grow louder.

DeSantis’s sharp turnaround reflects this political shift most vividly. Just last June (2025), he signed a major tax relief bill extending data center tax credits from 2027 to 2037. However, facing rising public protests, DeSantis quickly changed course.

“We don’t want to subsidize technologies that will replace human experience,” DeSantis said at a recent roundtable. He called for an “AI Rights Act” and supported legislation requiring data centers to pay their full water and electricity costs. He emphasized that local communities shouldn’t pay the price for the expansion of these “wealthiest companies in human history”—“you shouldn’t pay a dime more.”

This rhetoric is identical to Sanders’s. Previously, Sanders issued a report warning that if decisions are made solely by billionaires focused only on short-term profits, technology will fail to improve workers’ lives. He explicitly called on Congress to pass a bill to pause new data center construction: “I believe we need to slow down this process.”

Politically astute legislators are following suit. States like Arizona, Georgia, and Virginia are pushing bills to cancel tax incentives or prohibit signing nondisclosure agreements (NDAs) that hide details from the public; meanwhile, in Georgia, Oklahoma, and Vermont, legislators are even proposing to directly halt new projects (Moratoriums), as suggested by Sanders.

For tech giants, the era of “red carpet” investment incentives has ended.

Can Massive Capital Expenditures Be Spent?

If political resistance is a “soft constraint,” then the bottleneck of the physical grid is a more deadly “hard wall.” Wall Street is currently facing a troubling logical paradox: Does the market truly believe that the approximately $600 billion in capital expenditure expected in 2026 will materialize?

According to the latest data, just Microsoft, Meta, Amazon, and Google’s AI infrastructure spending plans this year total a staggering $670 billion.

In terms of the proportion of U.S. GDP, this scale surpasses the “Apollo Moon Landing” in the 1960s and the “Interstate Highway System” in the 1970s, second only to the 1803 Louisiana Purchase. Amazon alone plans to increase capital expenditure by nearly 60% this year to $200 billion.

Most of this massive funding will go toward building data centers, which require enormous energy. According to BloombergNEF’s forecast, by 2035, data center energy demand will double, skyrocketing from 34.7 GW in 2024 to 106 GW—equivalent to the electricity consumption of 80 million homes.

The problem is, the current U.S. power grid simply cannot meet this demand.

This physical constraint has already evolved into a regulatory crisis in Texas. As the second-largest data center hub in the U.S. after Virginia, Texas’s power grid operator ERCOT (Electric Reliability Council of Texas) is implementing an unprecedented “emergency brake” on projects.

ERCOT has proposed to review approximately 8.2 GW of power-consuming projects—equivalent to the output of 8 traditional nuclear reactors. Notably, many of these are projects that have already been approved.

Currently, ERCOT has introduced a review mechanism called “Batch Zero,” planning to evaluate projects in batches to assess their overall impact on the grid. Meta’s energy project manager Katie Bell admits that some projects have been in submission for 18 months and still do not meet the “Batch Zero” standards.

This uncertainty is destroying tech giants’ expansion plans: if the grid cannot connect, data centers cannot be built; if data centers cannot be built, the $670 billion budget cannot be spent; if the money cannot be spent, the anticipated AI compute growth and commercialization will become a bubble.

Wall Street’s Most Crowded Trade: The “Physical Correction”

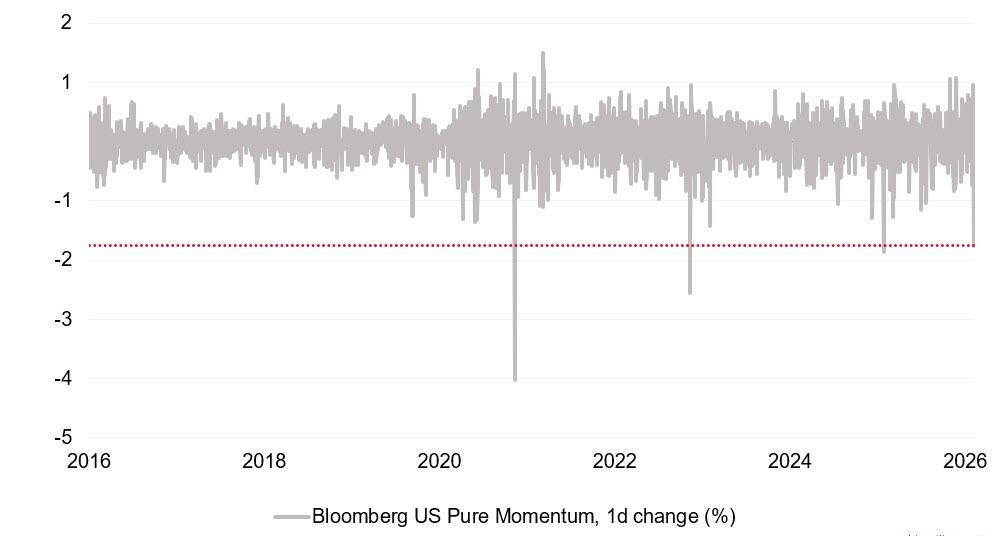

As the risk of “money being unspendable” begins to be priced in, the reaction in financial markets is intense. Recently, U.S. stocks experienced the fourth-largest single-day sell-off of “momentum stocks” in the past decade.

It’s noteworthy that even independent power producers (IPPs) and nuclear energy stocks, previously seen as beneficiaries of the AI boom, have not been spared. The market logic was “AI power shortages benefit power stocks,” but now it has evolved to: if grid connection is blocked, new power demand cannot be monetized.

UBS analysts note that, due to concerns that new loads cannot be contracted with existing generation capacity, giants like Constellation Energy have seen their stock prices plummet—down 27% year-to-date (YTD). The market realizes that without physical grid expansion, mere generation capacity is meaningless.

This panic has led to the rise of “anti-AI trades.” Funds are flowing out of high-beta tech stocks into defensive sectors like chemicals and regional banks. This is a classic “deleveraging” decline driven by quant funds and active managers.

Currently, the market faces a frustrating paradox: either believe the grid can miraculously expand to accommodate that $600 billion Capex, or admit we have hit a physical bottleneck. If the latter, it means no grid expansion, no capital expenditure, no chip demand—ultimately, the valuation bubble of the AI supercycle will burst.

At present, with Sanders and DeSantis’s political encirclement and ERCOT’s physical shutdown, Wall Street seems to be forced to accept the second possibility.

Risk Warning and Disclaimer