Why Crypto Can't Build Anything Long-Term

Most crypto founders I know are working on their third pivot by now.

Same people building NFT platforms in 2021 pivoted to defi yields in 2022 then to AI agents in 2023/24, now they’re working on whatever’s trending this quarter (perhaps prediction markets?)

They’re not wrong to pivot. In many ways, they’re playing the game correctly. The problem is, the game itself makes building anything that lasts structurally impossible.

The 18-Month Product Cycle

Narrative appears → capital comes in → everybody pivots → builds up for 6-9 months → narrative dies → pivot again.

This cycle used to be 3-4 years (during ICO era). Then 2 years. Now it’s 18 months if you’re lucky.

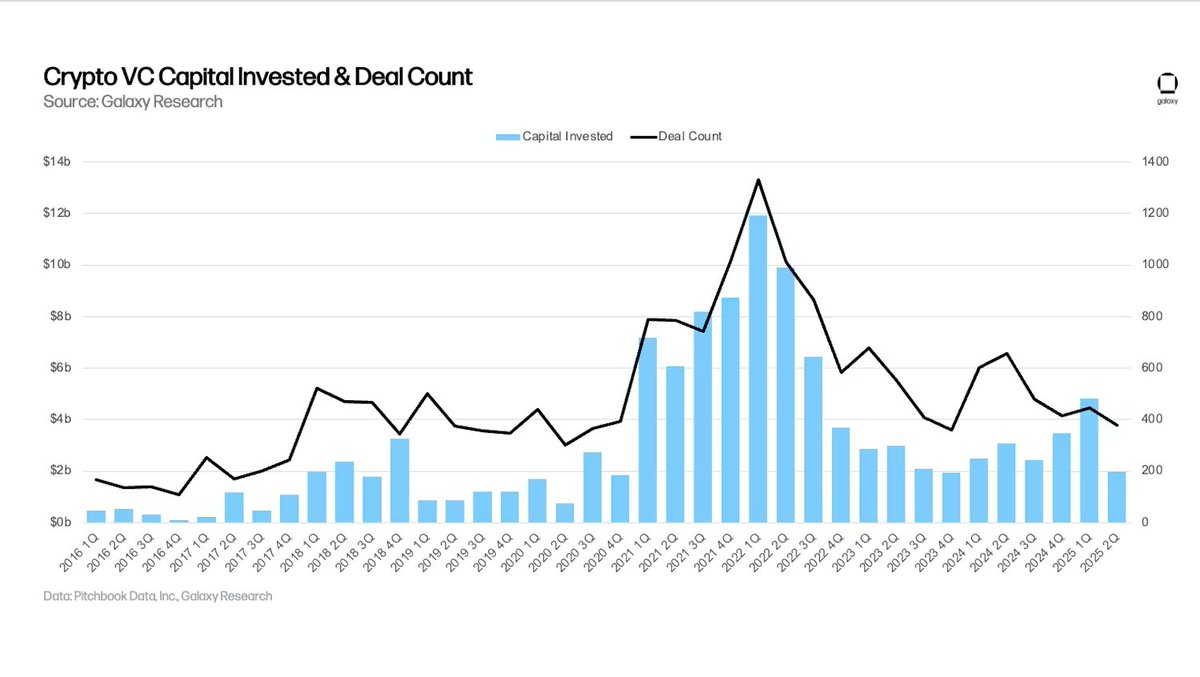

Crypto venture funding dropped nearly 60% in just one quarter (Q2 2025), squeezing the time and money founders have to build before the next trend forces another pivot.

The problem is, you can’t build anything meaningful in 18 months. Real infrastructure takes at least 3-5 years. Real product-market fit requires iteration over years, not quarters.

But if you are still working on last year’s narrative, you’re dead money. Investors ghost you. Users leave. Some investors even force you to catch the current narrative. And your team starts interviewing at whatever project just raised on this quarter’s hot narrative.

Sunk Cost Fallacy as Survival Mechanism

Traditional business advice: don’t fall for sunk cost fallacy. If something isn’t working, pivot.

Crypto took that and did sunk-cost-maxxing.

Now nobody stays with anything long enough to know if it works. First sign of resistance: pivot. Slow user growth: pivot. Fundraising getting hard: pivot.

Every founder makes this calculation:

- Continue developing the current product, it may work out in 2-3 years. If you are lucky, you may get another round of financing.

- Pivot to hot narrative: raise immediately, show paper gains, exit before anyone realizes it doesn’t work.

Option B wins most of the time.

The Halting Problem

Very few crypto projects actually finish what they are building.

Most projects are always in “almost there” mode. Always one more feature away from product-market fit.

They never get there because halfway through, the narrative shifts, and all of a sudden finishing up your DeFi protocol means nothing anymore, as everyone’s talking about AI agents.

The market punishes finishing. A finished product has known limitations. An “almost finished” product still has infinite potential.

Capital Follows Attention, Not Completion

What actually gets funded: New storyline - no product: $50M raised

- Narrative with working product established; struggling to raise $5M

- Old narrative w/product and real users: can’t raise at all

VCs don’t fund products, they fund attention. And attention flows to new narratives, not finished old ones. Most teams are just narrativemaxxing at this point - optimizing purely for whatever story raises capital, zero regard for what they’re actually building. Finishing is limiting yourself. Not finishing is keeping your options open.

The Team Retention

Your best developer gets offered 2x to go work on the hot new narrative project. Your marketing lead gets poached by whatever just raised a hundred million.

You can’t compete because you pivoted away from the hot narrative six months ago, when you decided to actually finish what you started.

No one wants to work at the boring stable project. They want the chaotic, overfunded, probably going to implode but might 10x project.

The User Attention Span

Crypto users are using your product because it is new, because everyone is talking about it, because there might be an airdrop.

The second the narrative moves, they leave. Doesn’t matter if your product got better. Doesn’t matter if you added features they asked for.

You cannot build sustainable products for unsustainable users.

We all know founders who have pivoted so many times they forgot what they originally wanted to build.

Decentralized social network → NFT marketplace → defi aggregator → gaming infrastructure → AI agents → Prediction markets. Pivoting stopped being strategy. It became the whole business model.

The Infrastructure Paradox

The things that last in crypto are mostly things built before anyone cared about crypto.

Bitcoin was built when nobody was watching, no VCs, no token launches. Ethereum was built before the mania over ICOs, before anyone knew what smart contracts would become.

Most things built during a hype cycle die with that cycle. Things built between cycles have a better chance.

But nobody builds between the cycles because there is no funding, no attention, and no exit liquidity.

Why This Doesn’t Change

Token-based incentivization creates liquid exit opportunities. As long as the founders and investors can exit before the products mature, they will.

Information travels faster than construction. By the time you’re done, everybody knows if it worked. The whole value proposition of crypto is going fast. Asking crypto to build slowly is asking it to become something it is not.

That would mean if you take 3 years building it, someone else copies your idea and ships in 3 months with worse code but better marketing. And they win.

So, what now?

Crypto struggles to build anything long-term because it’s structurally opposed to long-term thinking.

You can be a principled founder who refuses to pivot, who stays committed to the original vision, who builds for years instead of months. You’ll probably also be broke, forgotten, and replaced by someone who pivoted three times in the time it took you to ship v1.

The market doesn’t reward finishing. It rewards starting new things. Over and over. Maybe crypto’s real innovation isn’t the technology; maybe it’s figuring out how to extract maximum value from minimum completion. Perhaps the product is the pivot.

Disclaimer:

- This article is reprinted from [therosieum]. All copyrights belong to the original author [therosieum]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?