What is MYX Finance (MYX)? A Deep Dive into Its Features and Investment Potential

What Is MYX Finance?

(Source: MYX_Finance)

Decentralized perpetual trading platforms have rapidly risen to prominence in the crypto derivatives market over the past few years. MYX Finance (MYX) is a notable innovator in this space, leveraging cutting-edge technology and tokenomics to distinguish itself. More than just a decentralized exchange, MYX Finance introduces its proprietary Matching Pool Mechanism (MPM), enabling an on-chain trading experience with near-zero slippage. This mechanism fosters efficient and transparent interactions between traders and liquidity providers.

Core Innovations of MYX Finance

Most decentralized perpetual platforms rely on order books or Automated Market Maker (AMM) models, which frequently encounter issues like fragmented liquidity, high slippage, and inefficient capital usage. MYX Finance addresses these challenges with its Matching Pool Mechanism (MPM), which automatically pairs long and short positions.

- Zero Slippage: MPM instantly matches long and short positions, eliminating price impact during trades.

- Superior Capital Efficiency: In balanced markets, capital utilization can reach up to 125x, far surpassing the norms of conventional DeFi derivatives.

- Liquidity Pool as Counterparty: When market positions are skewed, the liquidity pool temporarily takes on the opposite side, later transferring it to a matching trader.

This architecture accelerates trade execution and allows liquidity providers to maximize capital efficiency, generating yields through funding rates and market dynamics.

Trading Specifications and Highlights

MYX Finance uses USDC for margin and settlement and supports multiple trading modes. Fully decentralized and registration-free, the platform empowers users to retain full control over their assets. Key features include:

- Perpetual Futures: No expiry—hold positions as long as you wish.

- Leverage Up to 50x: Amplify returns and accommodate diverse risk preferences.

- Isolated Margin: Risk on individual positions can be isolated, reducing liquidation risk.

- Funding Rate: Settled hourly, requiring the side with greater open interest to pay fees, maintaining market equilibrium.

- Instant Matching and Liquidity Support: Liquidity providers act as counterparties in real time, ensuring orders never stall due to insufficient liquidity.

- Transparent Pricing: Real-time index pricing is provided by Pyth Oracle, mitigating risks of price manipulation.

- Competitive Fees: MYX Finance commits to industry-leading, low-cost transaction fees across on-chain derivatives.

Role of the Liquidity Pool and Market Balancing

The Liquidity Pool (LP) is central to MYX Finance, acting as the counterparty for trades in real time.

- Market Imbalances: When long or short positions dominate, the LP assumes the inverse position and locks collateral to cover potential losses.

- Market Rebalancing: As new trades restore equilibrium, the LP offloads portions of its position, redistributing risk to traders and freeing capital.

- Funding Rate Incentives: The side with excess open interest pays a funding rate, incentivizing balance toward a 50:50 split.

This design safeguards the LP from prolonged overexposure and enhances capital efficiency in balanced markets.

Risk Management and Automatic Deleveraging (ADL)

Surges in trading volume can push open interest beyond the liquidity pool’s capacity. MYX Finance counters this with an Automatic Deleveraging (ADL) mechanism.

- Capital Utilization Limits: When usage hits the maximum, new open orders are rejected; closing and forced liquidations remain unaffected.

- ADL Activation: The system automatically closes the most profitable counterparty positions, reducing long and short exposure simultaneously to prevent worsening imbalances.

This built-in adjustment mechanism requires no external capital and ensures platform stability under extreme conditions.

Transparent and Decentralized Trade Execution

MYX Finance breaks away from the black-box matching of most DEXs and CEXs by utilizing the Keeper Network for transparent execution:

- Open-Source Contracts: All rules are public and immutable.

- Manipulation-Proof Price Feeds: Pyth Oracle ensures trustworthy, real-time price data.

- Community-Nominated Keeper Nodes: Decentralized keepers process orders, eliminating delays and censorship risks.

Becoming a keeper requires staking a minimum of 300,000 MYX tokens; keepers rotate weekly to maintain decentralized control. Successful keepers are rewarded with fee sharing, MYX buybacks, and additional incentives, creating a positive feedback loop for network health.

Tokenomics

$MYX is the governance token for the MYX protocol, forming the backbone of the ecosystem. Beyond serving as a transaction medium, $MYX is tightly integrated with protocol governance, liquidity incentives, and the functioning of the Keeper Network. Key roles include:

- Governance Voting: Determine future upgrades and protocol parameters.

- Liquidity Incentives: Liquidity providers earn $MYX rewards.

- Fee Buybacks and Distribution: The protocol uses part of its revenue to buy back $MYX and distribute it to Keeper nodes and stakers.

- Keeper Network Participation: Node eligibility requires substantial $MYX staking, securing the network.

Token Allocation

The total supply of MYX is 1 billion tokens, distributed among the community, team, and institutional investors as follows:

- Ecosystem & Community Building (54.7%): Over half allocated for ecosystem growth and community rewards, underscoring MYX’s long-term vision.

- Team & Advisors (20%): To fuel ongoing tech and product innovation.

- Institutional Investors (17.5%): Early investment and strategic support to strengthen the foundation.

- Initial Liquidity (4%): To meet demand at launch.

- Binance Wallet IDO (2%): Public sale portion for retail participation at inception.

- Future Reserve (1.8%): For strategic expansion and ecosystem growth.

This allocation model empowers decentralized community engagement and sustainable growth while preventing undue concentration of control.

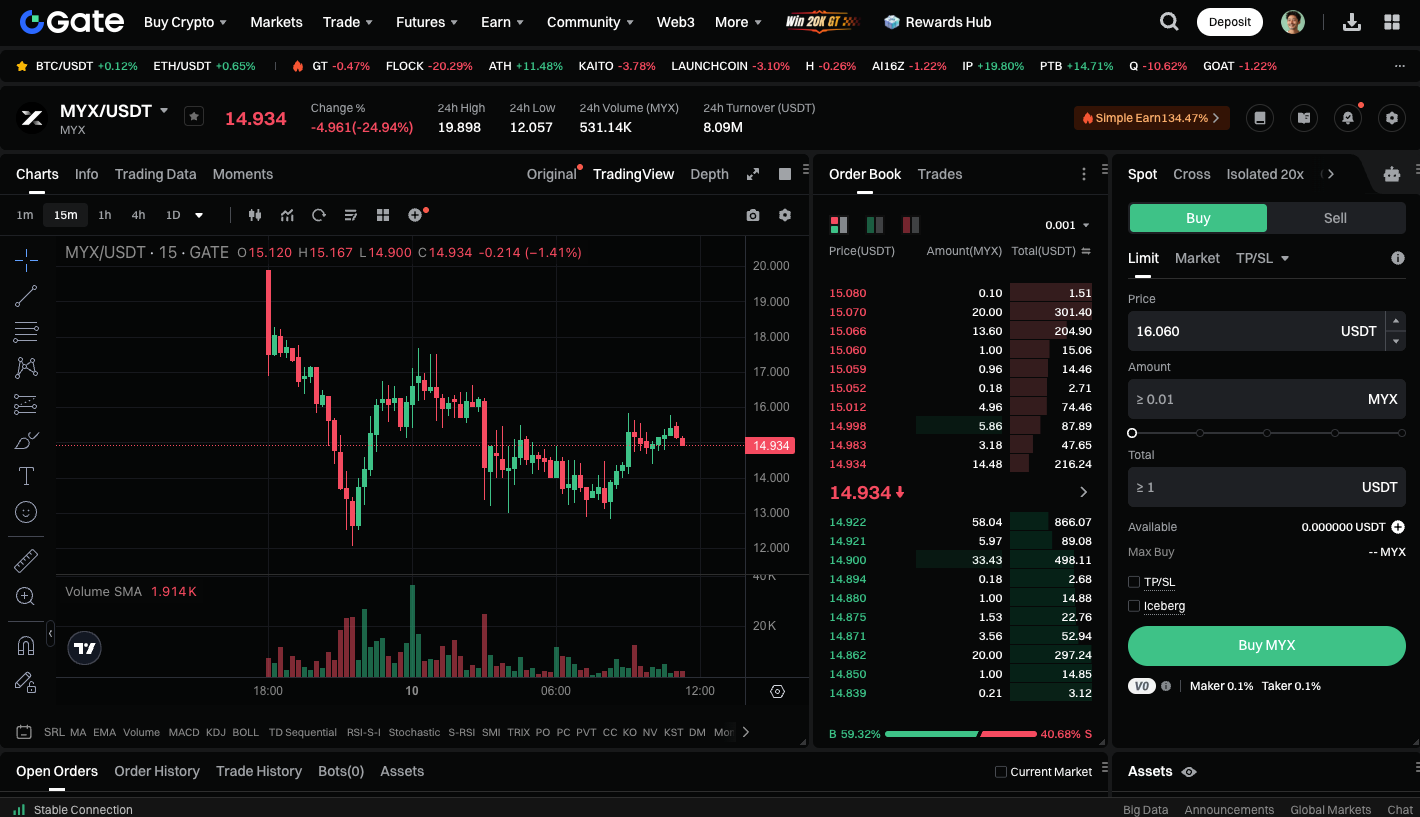

Start trading MYX spot today: https://www.gate.com/trade/MYX_USDT

Conclusion

MYX Finance (MYX) redefines decentralized perpetual trading, centering on its Matching Pool Mechanism and Keeper Network. The platform delivers zero-slippage execution, instant matching, decentralized operations, and superior capital efficiency—creating a next-level experience for both traders and liquidity providers. As the on-chain derivatives market continues to expand, MYX Finance is well positioned to become a key driver of the next generation in DeFi derivatives.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article