The Edge You Lose Before the money

Self-confidence is the most important quality to becoming a successful trader. If you lack self-confidence, it is unlikely you’ll be able to achieve the goal of being a successful trader. You must be able to trade with and against the crowd at your own convictions.

Don’t be a statistic.

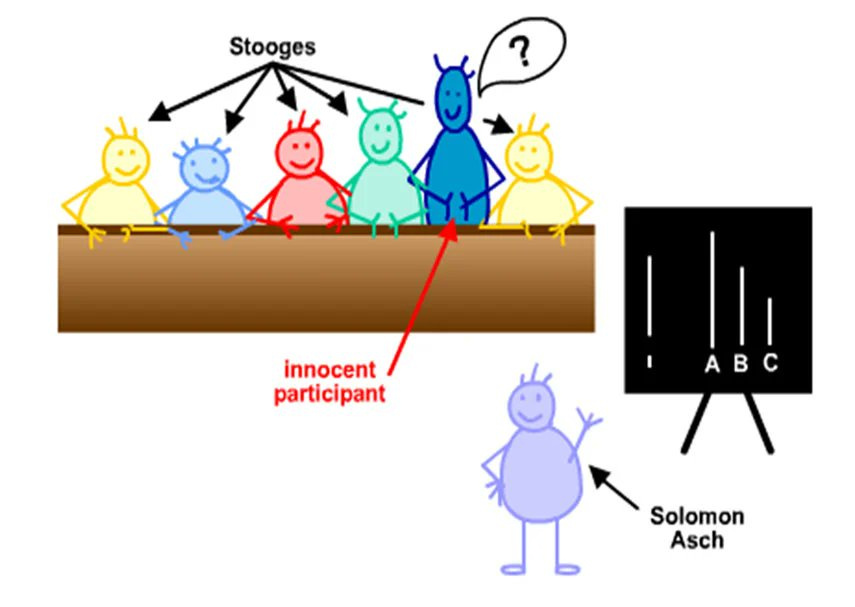

Back in the 1950s Solomon Asch conducted experiments about how individuals modify their opinions to better conform with the group.

** cough cough, crypto twitter. In these experiments actors would pretend unequal lines had the same length to see if a singular non-paid actor would just follow the crowd consensus. ~33% of the time, the test subject would accept the clearly false claims made by the actors. The point was to show how easily we as humans are swayed by consensus even when we know the truth is contrary to consensus.

Obviously this experiment has many parallels to trading.

Asch Conformity Line Experiment

The Downward Spiral: When Confidence Cracks

Losing confidence doesn’t announce itself with a single catastrophic moment. Its erosion.

You start second-guessing trades you would’ve previously trusted without hesitation. You are early, you see the setup; chart looks right , narrative is forming, fundamentals align, the crowd is still behind but something holds you back. Then you watch it run without you.

You fall into a spiral of self-doubt

This creates a vicious cycle that looks like this:

Missed opportunity → Diminished confidence → More hesitation → More missed opportunities →Further erosion of self-belief

You’re not making bad trades, you’re making no trades. Or worse, you’re sizing so small that even when you’re right, it doesn’t move the needle. You’ve become sidelined in your own trading career, watching others front run the trades you identified first.

The cruelest part? You knew the trade was good. The narrative was there. It was a new shiny thing. Your analysis was sound but you couldn’t trust yourself enough to act.

- Confidence → Conviction → Capital

There’s a chain reaction that separates successful traders from perpetual observers:

Confidence births conviction.

Without it, you can’t commit. The set up is there, everything checks out, you’ve seen this play out the same way before, but you can’t pull the trigger.

Your hand hovers over the buy button and you talk yourself out of it. “Maybe i will wait for confirmation.” “Let me see if anyone else is talking about this.” “What if I’m wrong?”

Confidence separates signal from noise.

When you believe in your thesis, you can hold through the development phase ,while most of CT are still in the dark; waiting for them to catch up to the new thing.

You are early because you have the conviction to act while others are still watching from the sidelines.

Being early is everything. And here’s what most traders don’t realize: most narratives don’t appear fully formed. They don’t spawn from the void with a neat bow on top.

- Someone Has To Be First

Narratives are born from a simple formula:

New shiny thing + First confident voice(s) + Hungry traders = Narrative formation.

Go back and study any major narratives that moved markets. AI Meta( eg goat), Solana/BSC memecoins , RWA plays. Gaming ecosystems(eg footballdotfun) and even the current x402 tokens.

Every single one started with someone finding a token, posting about it on x or in their channel, and having the confidence to say “this is it” before anyone else cared.

That first mover didn’t have more information than you. They didn’t have insider knowledge. They didn’t have a crystal ball.

They had more confidence

They were willing to be wrong publicly. To front run everyone on a thesis that wasn’t obvious yet.

The main characters of cycles are birthed through a public trade

Look at the main characters of any cycle. The guys everyone follows for alpha. The guys everyone hold to high esteem. The names that move markets when they tweet a ticker.

Most of them cemented their reputation with one absolutely goated public trade that they called early and rode to generational gains.

They bought it , they talked about it, they were right and suddenly everyone wanted to know what they were buying next

Take Ansem and the Solana thesis

Ansem was the one of the first to spot Solana’s potential and became well known for his relentless advocacy.

When you hear about that guy who bought SOL at $1 and rode it to $200, you immediately think of Ansem.

Ansem’s solana call @ $1

Ansem didn’t just buy SOL in silence and hope he was right.He talked about it relentlessly. He shilled his bags. He laid out the thesis publicly. He took the social risk of being wrong when the entire crowd was bearish.

He wasn’t trading in the shadows

SOL went from the single digits to over $200. The Solana meme ecosystem exploded. Tokens he called early did 50x,100x, some even more and Ansem became one of the most followed traders of the cycle; not because he was smarter than everyone else but because he had the conviction to be loud about what he believed in when it wasn’t obvious yet.

That’s how main characters are made. One public trade. Massive conviction. Willingness to be wrong where everyone can see it.

Meanwhile, most traders take positions and then wonder why they’re losing money when they can’t even articulate what they bought or why they bought it.

They’re trading in the shadows ,copy trading the main characters, but getting none of the upside that comes from building conviction publicly.

If you can’t explain your thesis to someone else, do you even have a thesis? Or are you just spraying and praying?

Someone Has to Shill the Bag

Here’s an uncomfortable truth; sometimes you have to buy a bag and tell others about it.

Because if they don’t know about it, how would they buy it?

Narratives need momentum. Momentum needs attention. Attention needs someone willing to be first, to be loud, to stick their neck out and say “this is the one” before it’s obvious.

If @ 0xmert_ can shill ZEC to his entire timeline, what’s stopping you from talking about coins you buy?

The difference between a token that you bought that goes nowhere and one that becomes a narrative isn’t always fundamentals. Sometimes it’s just that nobody talked about it. Nobody created social proof. Nobody put it on other traders’ radar.

The reason why you keep missing narratives early is because you’re waiting for someone else to create them instead of realizing you could be that person.

Think about it, every single runner that came out of nowhere had a first buyer. Had a first person who tweeted about it. Had a first trader who took a risk on something unproven and said “I think this could be something”

The main question isn’t whether you can find good trades. The question is whether you have the conviction to be first, to be loud, and to own the outcome either way.

That’s the edge.

- Confidence Controls Your Size

Heres an invisible edge that separates great traders from mediocre ones: knowing when to size up and when to size down

This doesn’t come from a spreadsheet or Kelly Criterion calculator. It comes from pattern recognition born of experience + the confidence to act on it.

When you’ve taken hundreds of trades, when you’ve seen tokens 10x and seen them rug, when you’ve been early and you’ve been late, when you’ve sized big and won and sized big and lost; you develop an intuition. You know what conviction feels like in your bones.

Take the first meme on a new ecosystem play

You’ve watched this pattern unfold across multiple cycles. A new chain launches or gains momentum. Within days or weeks, a meme token emerges as the cultural flagship of that ecosystem. This captures attention first and becomes synonymous with the chain itself.

Trillions on Plasma chain

The first major meme on Plasma. If you had pattern recognition from previous ecosystem launches, you knew this playbook.

Your edge here would be being early enough to build a position cheap or sizing in at a reasonable market cap that still has room to run.

Ping on x402

Same pattern. X402 ecosystem launches, hype slowly builds up, and Ping as the meme that captures attention.

Take the starvation play pattern

Markets go through dry times. No major narratives. No clean set ups. Traders are hungry, bored, sitting on cash with nowhere to deploy it.

Then something emerges that’s good enough; not perfect, but credible. And because everyone’s been starved for a play, the liquidity floods in fast.

$Aster and $AVNT are perfect examples. After a period where traders had been starved for a major play, people figured out these could be hyperliquid competitors on different chains.

It was simply the timing it surfaced and not just the fundamentals. Traders were ready to deploy capital on something with a thesis.

Then there’s the first-mover advantage on new tech

Every cycle introduces new mechanisms, new protocols ,new ways to financialize things that didn’t exist before. And every single time, the first credible implementation of that new tech captures a huge amount of attention and capital

Take Token Strategy Launches

The protocol launches DATS ( Decentralized Autonomous Tokens) for NFT collections, a mechanism for financializing bluechip NFTs.

PunkStrategy was the first strategy coin launched from the experiment tied to CryptoPunks.

If you recognized the pattern ( first implementation of new tech + blue chip NFT brand + novel mechanism traders haven’t seen before), you knew this deserved size.

$PNKSTR ran to over ~300M MarketCap.

Why? Because it was the first DAT from Token Strategy. It had the credibility of the CryptoPunks brand behind it. It was something new and shiny that traders could understand and ape into. By the time the second or third NFT DAT launched, the novelty had worn off and returns compressed significantly.

The confident trader doesn’t need to perfectly understand the tech sometimes. They need to recognize “This is the first credible implementation of something new, and that’s worth sizing into.”

A confident trader can instantly assess: “This is a 0.5% position” versus “This is a 5% position ,maybe more.” You’re not just gambling, you’re calibrating based on accumulated wisdom and trusting yourself to execute.

When confidence is intact, you trust your own judgment.

When confidence is broken, everything feels like the same murky bet. You size everything small ( or nothing at all) because you no longer trust your ability to distinguish between high conviction setups and marginal plays.

Every trade becomes a coin flip in your mind, even when your analysis tells you otherwise.

Your edge doesn’t come from simply just finding the trade, it comes from knowing how much to put behind it.

- Rebuilding: The Edge Before the Money

The market will always be there. Money will always be there. But if you lose your edge; your belief in your ability to recognize and act on opportunity, you’ve lost the game before you’ve lost a single dollar.

Before you can fix your PnL, you must rebuild your confidence:

→ Take small, high conviction trades

not to make money, but to prove to yourself you can still execute. You’re reconditioning your brain to trust your thesis again.

→ Journal your trades

Separate outcome from decision quality. A good trade that loses money is still a good trade. A bad trade that makes money is also a bad trade. Focus on the trade execution.

Your journal can be a telegram channel created solely for yourself or your x account to document your trades and thoughts; some good examples are @ DidiTrading , @ onchainsorcerer , @ real_y22 ( the 100k to 1m challenge)

→ Celebrate correct executions even when trades don’t work

You sized appropriately. You had a thesis. You managed risk. Thats a win and an experience gained , regardless of the PnL.

→ Remember every trader you respect has been where you are.

Every single one has experienced the confidence crisis, the self doubt, the paralysis. The difference is they got their confidence back.

They decided to trust their execution even when it felt uncomfortable. They took the trade they wanted to fade. They sized up when the fear inside them whispered to size down. They front ran and executed their trades without waiting for confirmation from the crowd. They took winning and losing trades as gained experience.

The edge you lose before the money is the only edge that truly matters.

Protect it like your portfolio depends on it.

Because it does.

me when you gain some self confidence

Disclaimer:

- This article is reprinted from [herxbt]. All copyrights belong to the original author [herxbt]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?