Take Profit or Build a Position: A Plain-Language Guide to Observing Recent Market Changes from a Macro Perspective

Summary: The market has recently entered a perplexing phase. Blue-chip cryptocurrencies remain at elevated levels, trading sideways without a decisive trend, and the anticipated broad-based bull run for altcoins hasn’t materialized. Meanwhile, DAT assets and crypto-equities are outperforming in traditional financial markets. There’s a growing consensus on social media that this bull cycle is being driven by traditional capital, a view that I share. This influx of capital differs from previous cycles in several ways: it is heavily influenced by macroeconomic factors, has a lower risk appetite, is more concentrated, exhibits weaker wealth spillover effects, and features less pronounced sector rotation. As the macro environment undergoes major shifts, reassessing these changes will help us make better-informed decisions. Overall, I believe that with Powell shifting the Fed’s policy approach, the near-term performance of the U.S. labor market will determine market confidence in a September rate cut, which will, in turn, impact risk asset pricing.

How Powell’s Speech Changed the Landscape

In recent months, the market’s main macro debate has centered on whether the Powell-led Fed would deliver the sizable rate cuts sought by the Trump administration within this year. But why is the Trump administration so determined to push the Federal Reserve to cut rates—even at the potential cost of undermining its independence and the dollar’s credibility—by leveraging executive power to steer monetary policy? As discussed in earlier analyses, the Trump administration’s economic strategy has focused on “reshoring manufacturing,” but this approach faces two core challenges:

Domestic costs are too high to compete with international peers;

Excessive government debt leaves limited budget for incentivizing industrial reshoring;

During Trump’s tenure, his policy implementation has generally followed two steps. First, right after taking office, he acted quickly to fulfill campaign promises and shore up his authority—such as granting DOGE extensive privileges and shifting cryptocurrency policy. After solidifying his political base, the administration rolled out sweeping tariffs. This sequencing was necessary, since raising tariffs tends to spark concerns about imported inflation and amplifies internal resistance. Once political capital was secured, and following months of negotiation, Trump’s tariff playbook took shape and began to deliver results. According to Treasury Secretary Bessent, as of August 22, tariffs had generated nearly $100 billion in fiscal surplus over the past six months, with projections of up to $300 billion for the full year. There have also been substantial investment commitments, including $550 billion from Japan and $600 billion and $750 billion in energy deals from the European Union.

While domestic costs—like labor and logistics—can’t be reduced in the short term (resetting factor costs would require a market clearing event akin to a major depression), the Trump administration’s tariff policy has meaningfully altered both domestic competition and capital structures. This sets the stage for the next policy move: a Fed rate cut.

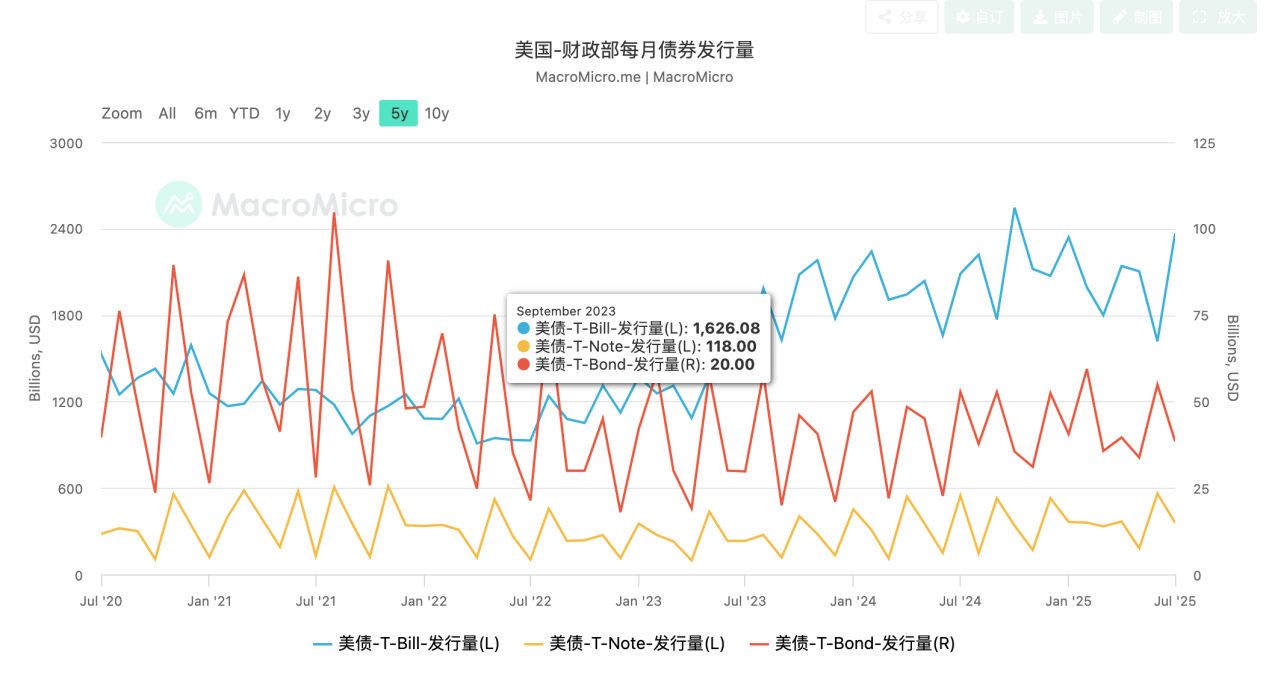

What would a rate cut change? Primarily two things. First, it would ease debt pressure. Under former Treasury Secretary Yellen, the Treasury increased short-term debt issuance—a strategy Bessent retained. This approach allows short-term rates, which are directly managed by the Fed, to reduce the fiscal drag from long-term debt. With strong demand for short-term Treasuries, borrowing costs have remained low. The downside, however, is a shorter debt maturity and increased near-term repayment risk—hence the recent attention to the debt ceiling debate. Cutting rates would bring down interest expenses on existing short-term debt. Second, rate cuts lower financing costs for small and medium-sized businesses, supporting supply chain expansion. Unlike large corporations, SMEs rely more on bank loans for working capital, so high rates suppress their appetite for expansion. After tariffs altered domestic competition, there’s now an urgent need to incentivize SME growth to quickly backfill supply gaps and curb inflation. All in all, the Trump administration is applying relentless pressure for Fed rate cuts—it’s no empty threat.

Whether it’s direct intervention in the Fed’s own building renovations or persistent attacks on progressive, hawkish Fed Governor Cook, these moves underscore the administration’s aggressive agenda. Powell’s appearance at last week’s Jackson Hole global central bank symposium seemed to validate the effectiveness of this pressure campaign. The most striking surprise to markets was that Powell—long a staunch defender of Fed independence—appeared to yield to Trump’s forceful tactics. Several key takeaways from his remarks illustrate this shift:

- Powell stated that the primary risk to the U.S. economy has shifted from inflation to the labor market;

- He emphasized that the inflationary effects of tariffs will take time to materialize and aren’t leading to a runaway inflation spiral;

- He signaled an update to the monetary policy framework—sharply downplaying the importance of the effective lower bound as a “normal economic condition.”

Simply put, the Fed now appears less wary of tariff-driven inflation and more concerned with a potential collapse in jobs stemming from a downturn, while also indicating that rate cuts could proceed without a hard lower limit. To elaborate, the “effective interest rate” refers to the point at which further rate cuts, beyond a certain level, have no real impact on the economy. This pivot dovetails with the Trump policy agenda and has sparked renewed expectations for further monetary easing across the markets.

Implications for the Cryptocurrency Market

The crypto market is widely seen as a leading indicator for global risk appetite. After Powell’s remarks, cryptocurrencies rallied, only to pull back—signaling that markets had already partially priced in a rate cut this year. With new trading logic established, sentiment shifted from emotional to rational, and further evidence will be needed to judge the depth of potential rate cuts.

As for how deep the correction may go, ETH—a bellwether asset—warrants special attention. I believe that as long as ETH remains within its short-term uptrend channel, investor sentiment remains stable and risks are contained. In the coming week, labor market data will play a key role, with next Friday’s nonfarm payrolls likely to trigger significant volatility. If jobs data misses expectations, the odds of a September Fed rate cut spike; if it exceeds expectations, it signals strength in the labor market and eases rate-cut pressure, possibly fueling further downside in crypto markets. One way or another, this policy-driven environment calls to mind the CPI-led action of 2023.

Disclaimer:

- This article is republished from [TechFlow], with copyright belonging to the original author [@ Web3Mario]. If you have concerns about this republishing, please contact the Gate Learn team; we will address your inquiry promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless explicitly referencing Gate, reproduction, distribution, or copying of this translated article is strictly prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?