Options Weekly Report – November 3: Implied Volatility Retreats as Year-End Market Strategies Take Shape

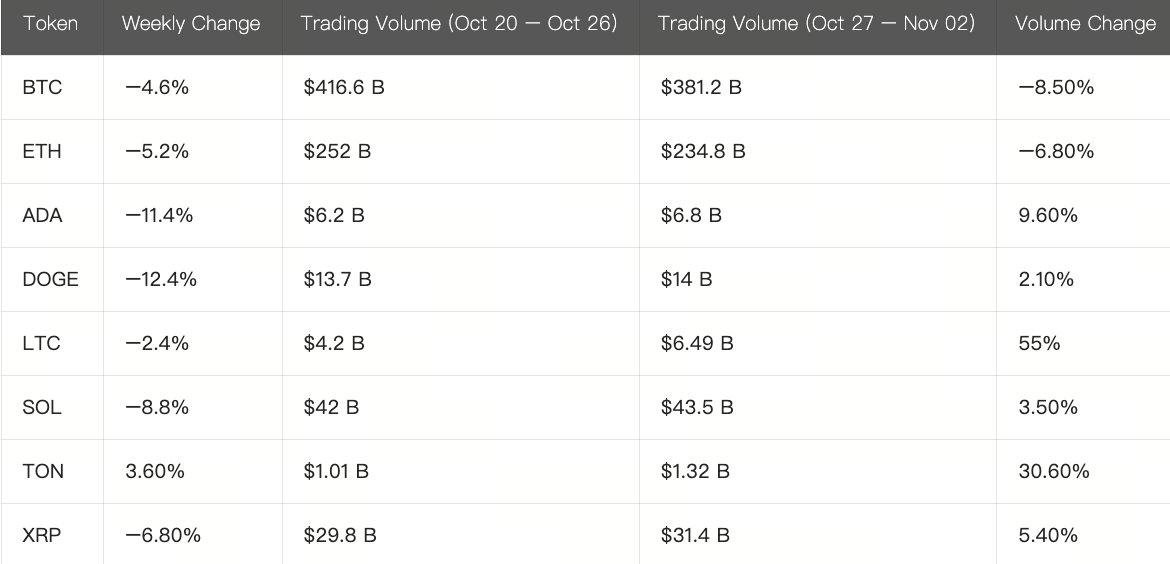

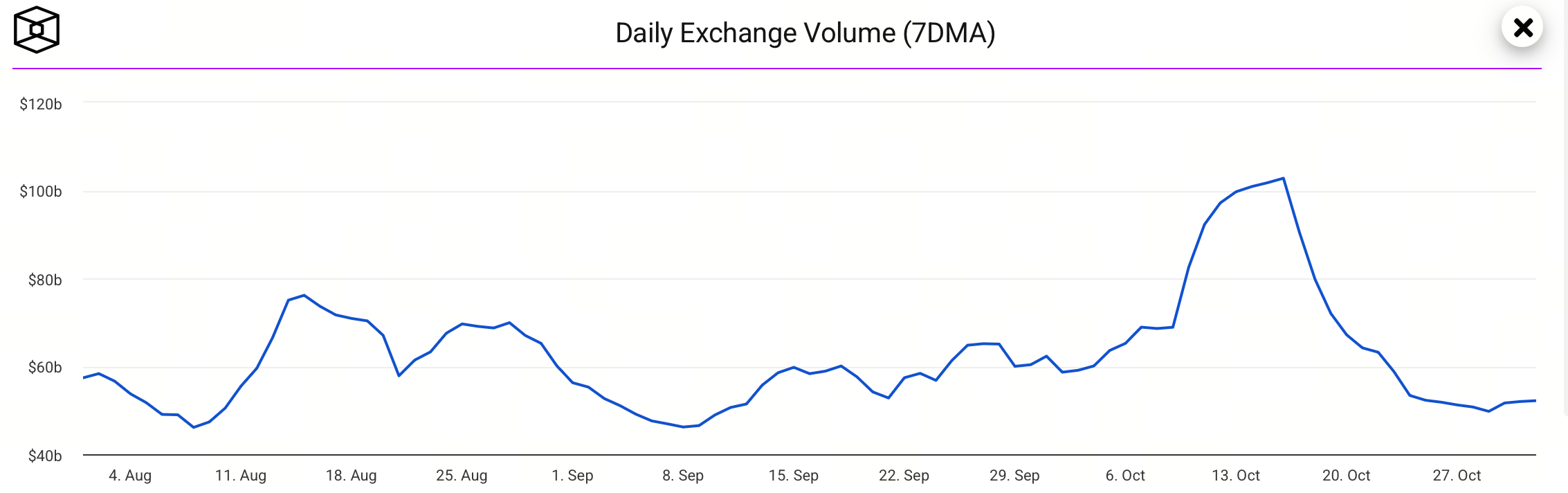

After two consecutive weeks of sharp decline, the 7-day average spot trading volume across the entire market has stabilized at a low level.

As October closed, the market remained relatively stable but lacked a clear direction. Investors are now looking for cues following two major developments: the rate cut announced at the end of October and the easing trade signals from the summit between the world’s two largest economies. Both events have played a decisive role in shaping short-term risk appetite.

During the past week (October 27–November 3), the ongoing government shutdown led to the unavailability of key economic data and decreased policy transparency. As a result, the market has become more cautious regarding a potential rate cut in December, with the probability of a 25 basis point cut dropping from around 90% to approximately 67.3%.

Despite these uncertainties, trading volume rebounded in October, demonstrating that market activity has not been completely exhausted.

Regarding capital flows, current inflows are marked by greater discipline and are predominantly institution-driven—such as the year-to-date net inflows into spot Bitcoin ETFs, which have supported price fundamentals but also revealed a reliance on leading products (e.g., BlackRock). Short-term net outflows on certain trading days highlight the fragility and concentration risk of capital flows. If future net inflows diversify across more products and managers, market sustainability would be further enhanced.

Trading strategies should remain event-driven: manage positions carefully during uncertain periods, prioritize options strategies (buying volatility/protective puts), or build positions incrementally with small allocations to address both liquidity and directional uncertainties.

Bitcoin (BTC) Options Market Summary

BTC spot performance: Over the past week, Bitcoin traded in a downward channel between $108,000–$115,000, displaying a high-level consolidation and short-term downward probing pattern. Multiple midweek tests of support around $108,000 were met with short-term buying, indicating that short-term absorption remains healthy. Strong resistance persists in the $115,000–$120,000 zone, and a breakout will require more robust capital inflows or favorable macro factors.

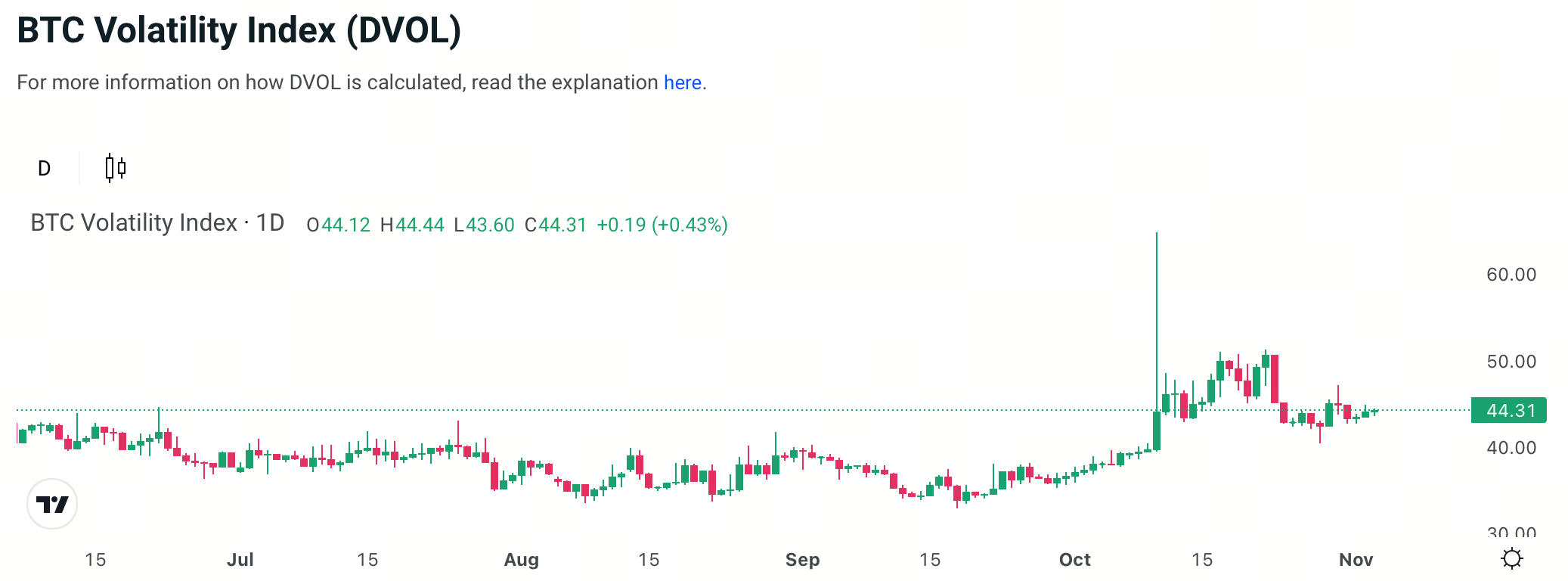

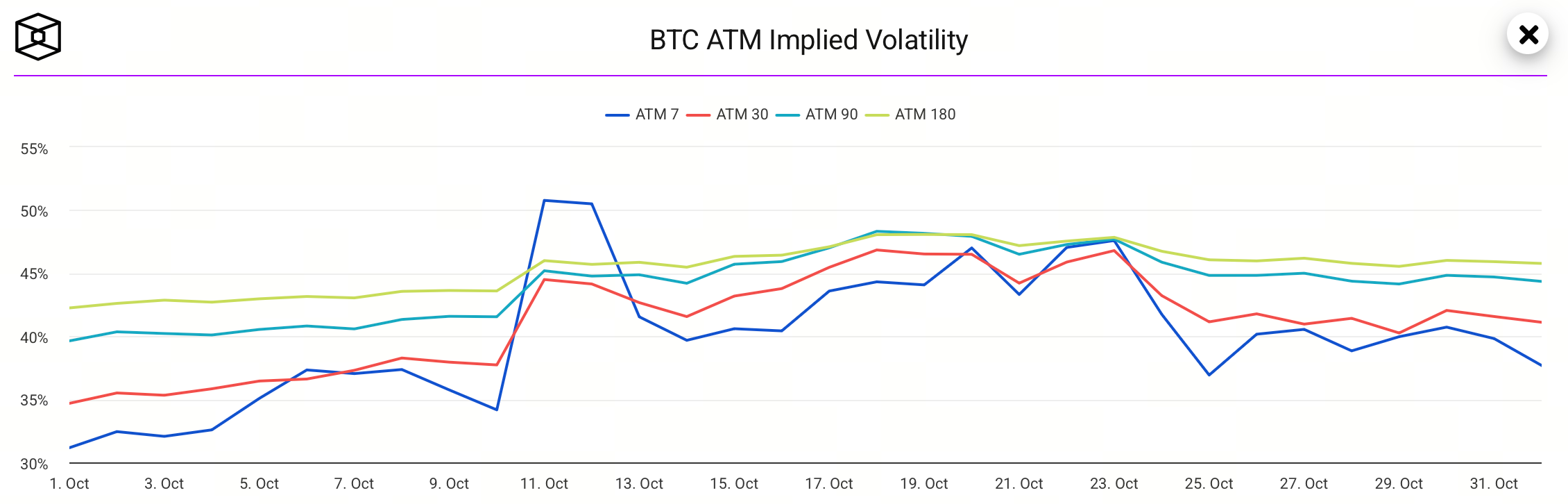

Options market: The latest public data shows BTC implied volatility (IV) at 44.3%, which has stabilized after retreating from recent highs, suggesting that future price volatility is likely to converge.

The spread between near-term and longer-dated IV has normalized, indicating that the market is taking a more rational approach to short-term volatility.

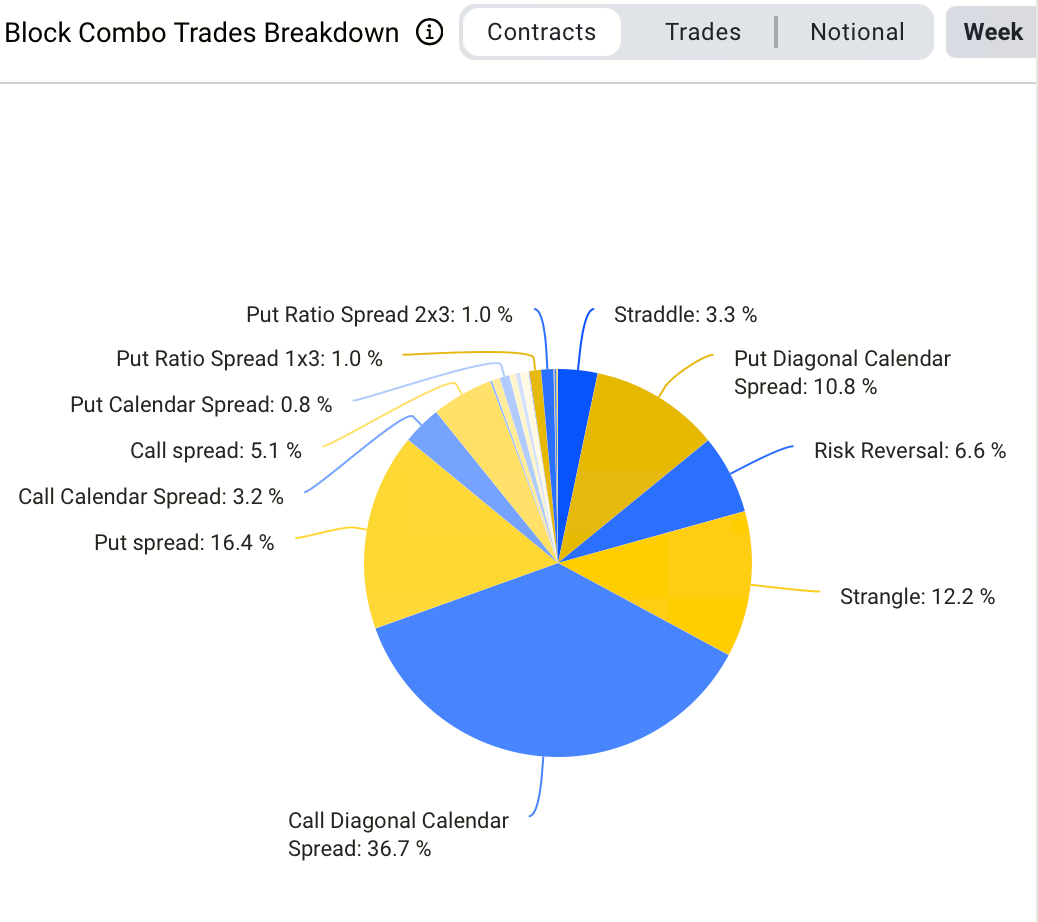

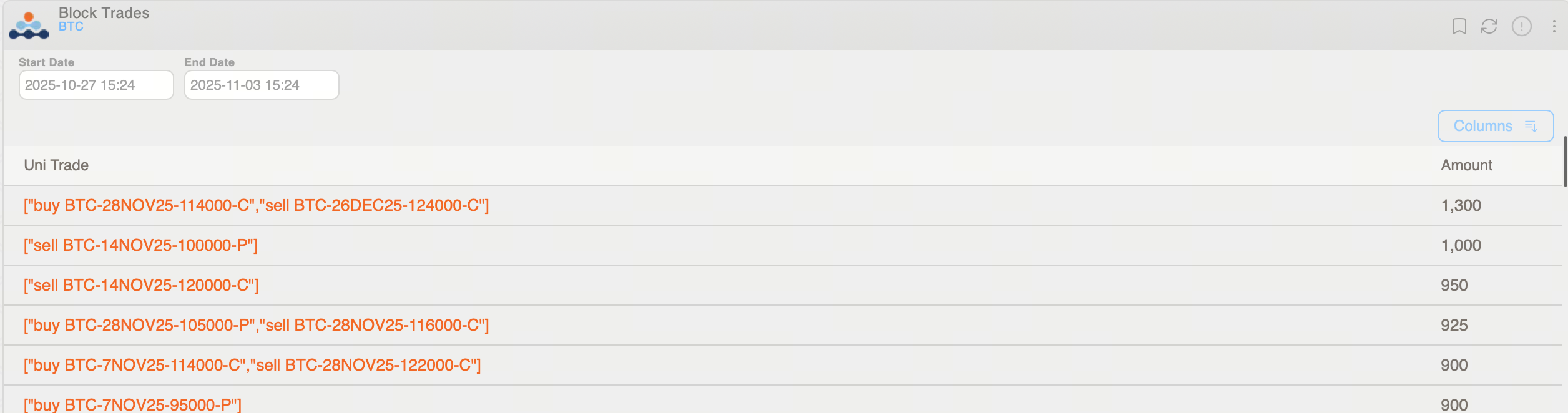

In block trades, the most prominent strategy this week—accounting for 36.7% of trades—was the bullish calendar spread. The largest block trade activity involved 1,300 BTC: buying BTC-281125-114000-C and selling BTC-261225-124000-C in a reverse bullish calendar spread, with a premium outlay of $9.2 million. This reflects a tactical bet on short-term upside while shorting volatility.

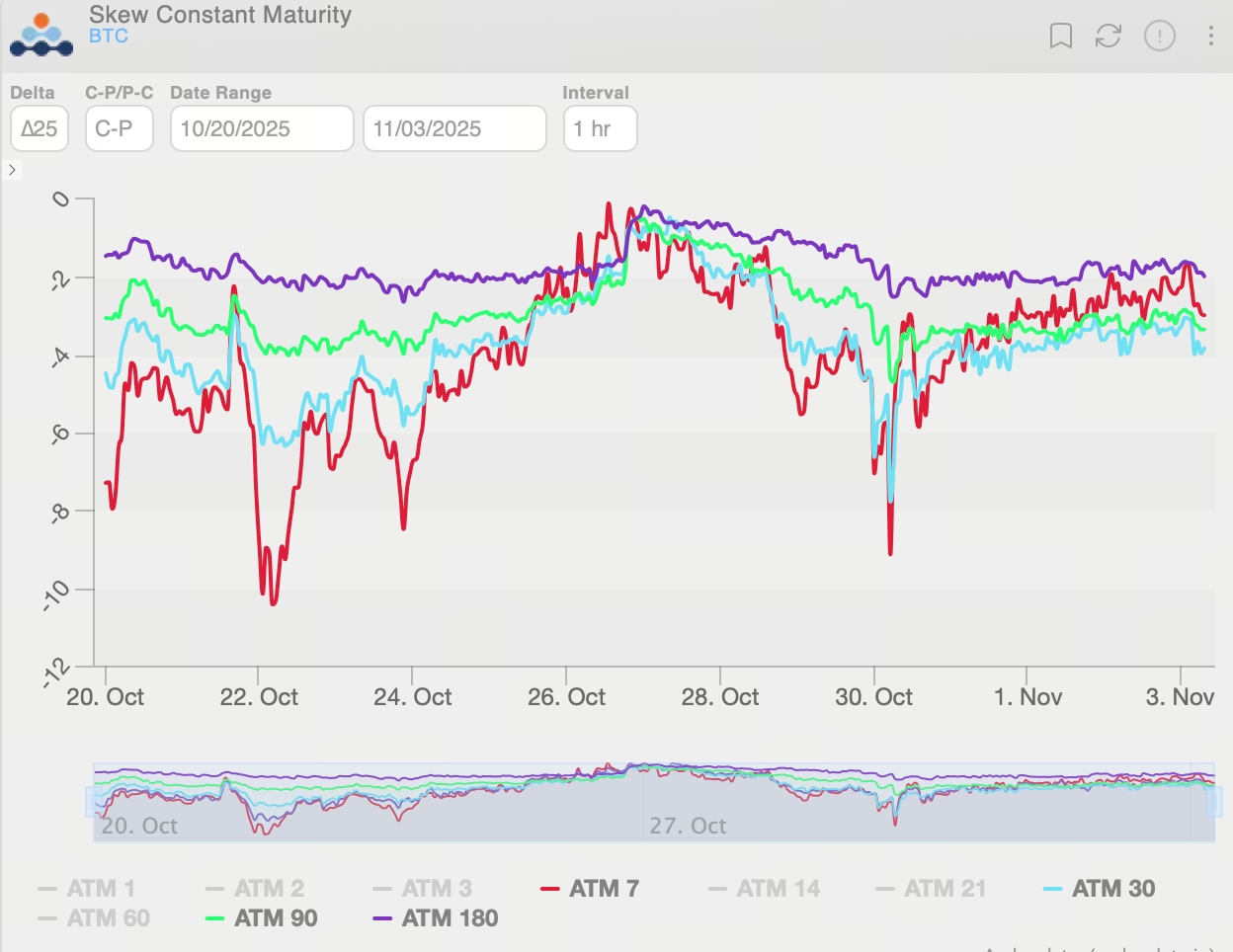

The BTC options 25-Delta Skew remained negative throughout the week, indicating persistent hedging against downside risk. The skew term structure flattened, reflecting an uptick in demand for short-term bearish hedges.

In summary, long-dated BTC options remain bearish, with institutional investors focused on risk hedging rather than aggressive long positioning. The market outlook remains cautious for the medium to long term.

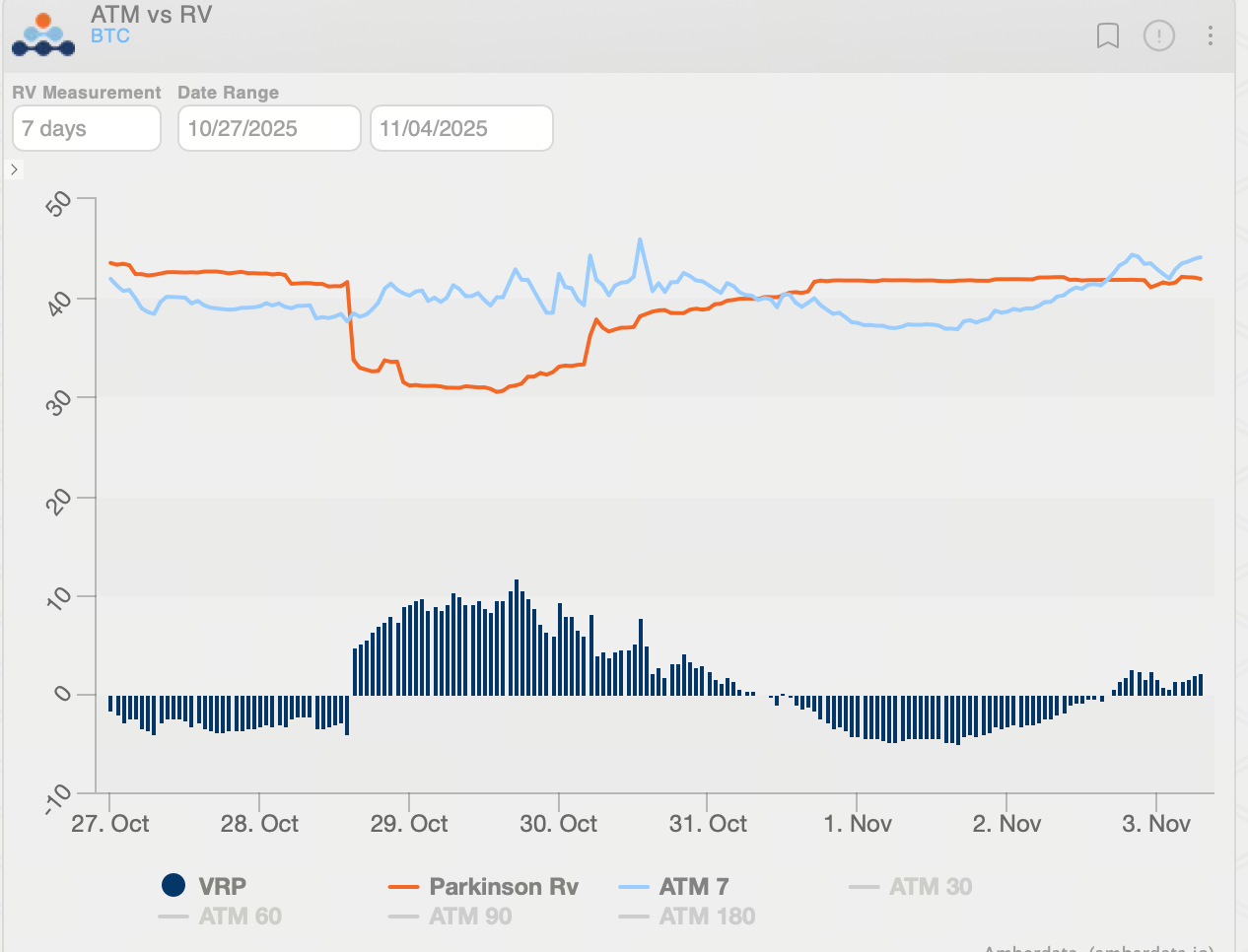

Bitcoin (BTC) realized volatility has rebounded to approximately 40, while the VRP (IV−RV) has narrowed to 2.18 vol, significantly flattening from -7.38 vol during last week’s panic. Currently, implied volatility (IV) remains above realized volatility (RV), resulting in a positive VRP. In this context, the market is pricing in higher future volatility, making short volatility strategies—such as Short Straddle, Short Calendar Spread, or other short Vega structures—potentially favorable.

Ethereum (ETH) Options Market Summary

For this cycle (October 27–November 3), ETH consolidated within the $3,700–$4,250 range. At the start of the week, prices approached resistance at $4,250 and faced selling pressure. Midweek, the price fell to support near $3,700, and by the weekend, rebound momentum faded, resulting in an overall “range-bound consolidation and attempted rebound” pattern. Short-term traders should pay close attention to whether the $3,700 support holds and if resistance in the $4,250–$4,300 area can be breached to determine near-term direction.

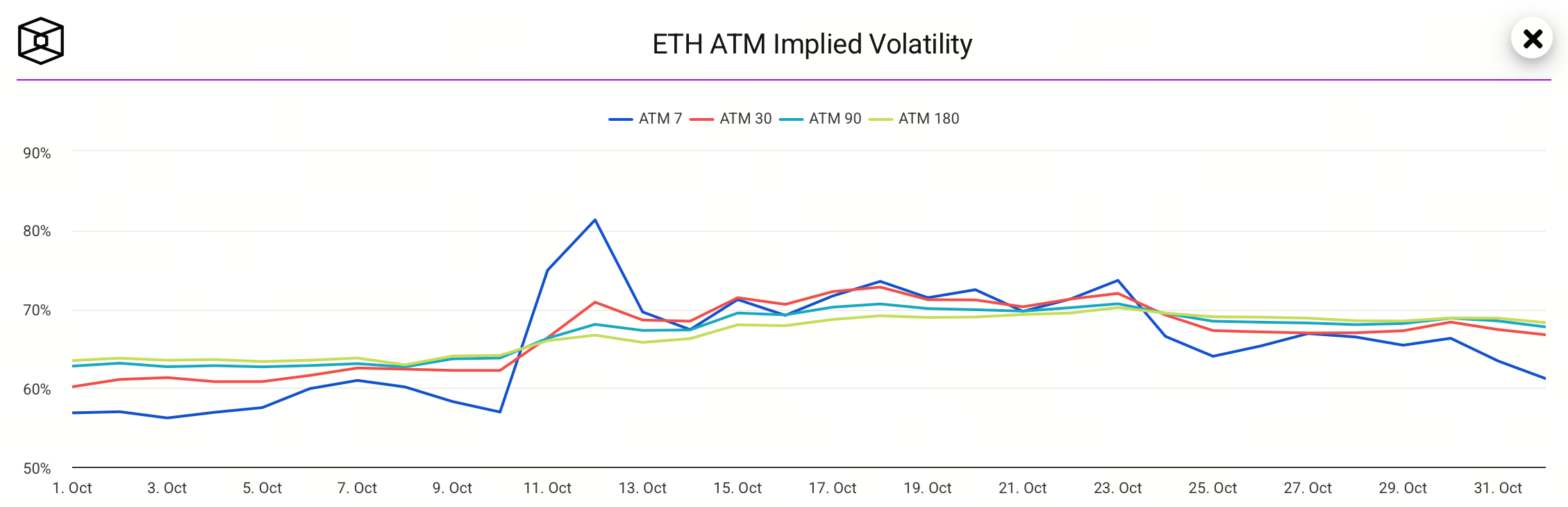

Options market: The latest public data shows ETH implied volatility (IV) at approximately 69%, now stable after retreating from previous highs, reflecting a calmer market sentiment and reduced expectations for major future price swings.

The gap between near-term and longer-dated IV has normalized, suggesting a more rational short-term volatility outlook among market participants.

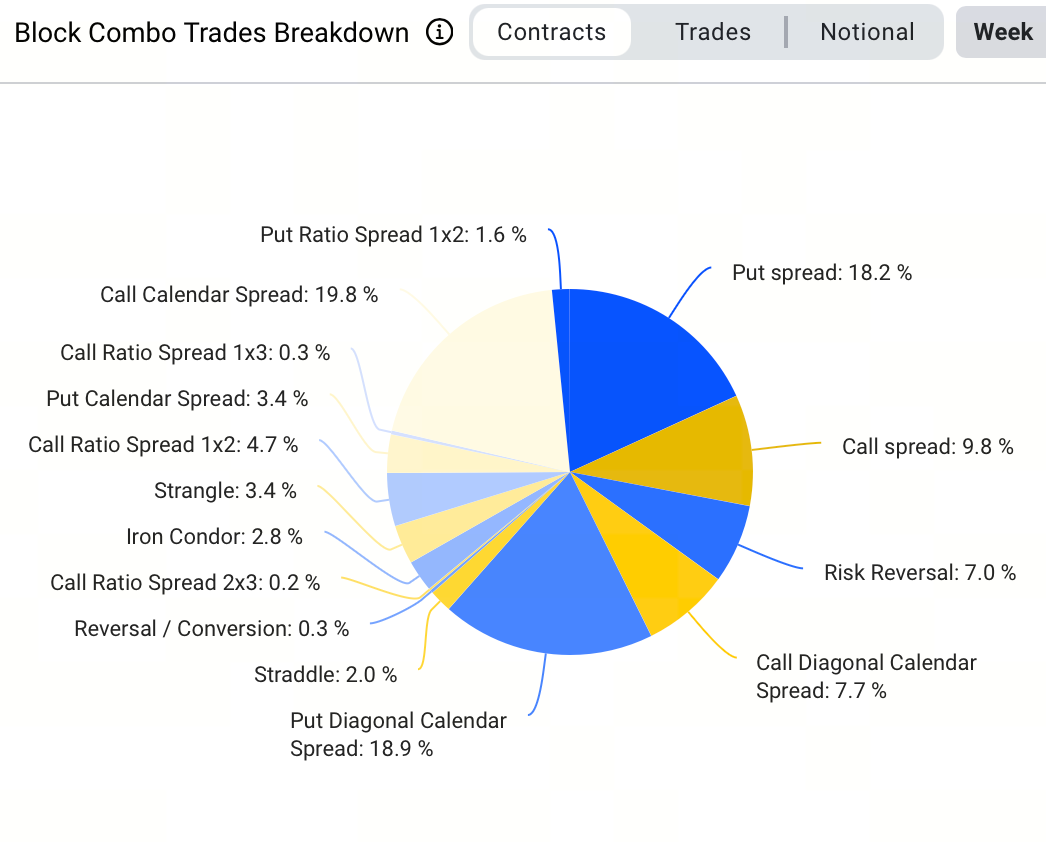

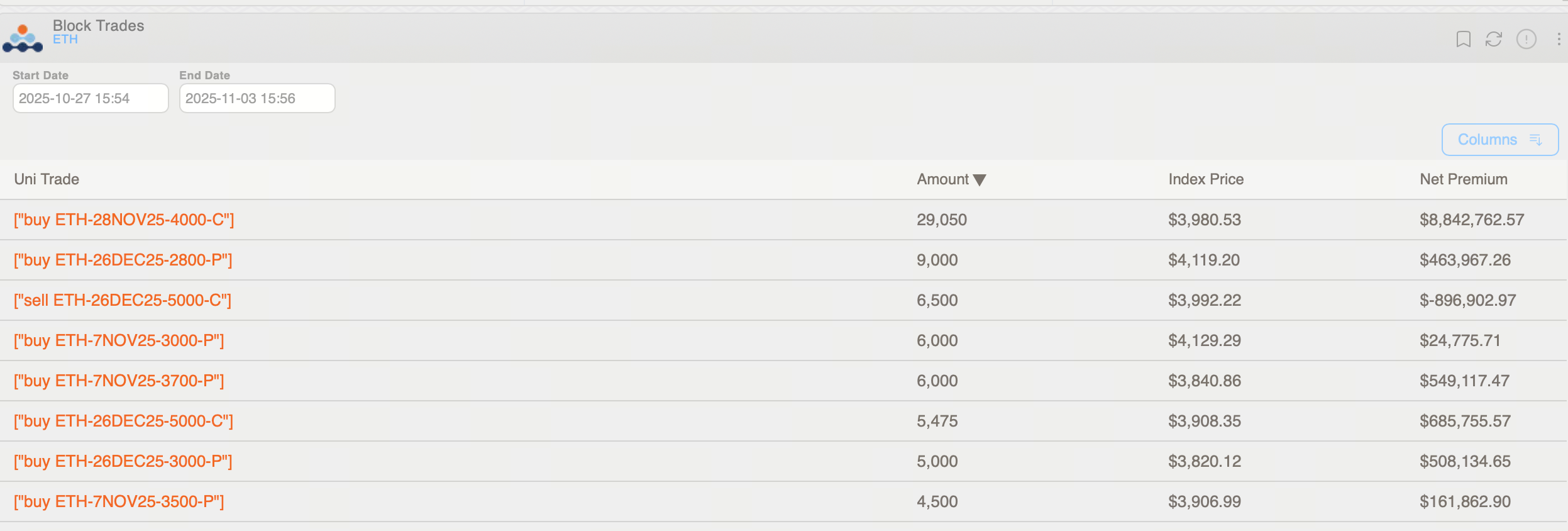

In block trades, the most popular strategy this week, accounting for 18.9% of trades, was the calendar put spread—demonstrating investors’ preference for low-cost, long-term bearish positioning. The largest transaction involved selling 3,000 ETH of ETH-071125-3700-P and buying ETH-261225-3700-P. Simultaneously, a notable short-term bullish play was observed, with 29,000 ETH of ETH-281125-4000-C contracts purchased for a total premium of $8.84 million.

This week, the ETH options 25-Delta Skew steepened sharply in the short term, reflecting heightened demand for downside hedges. By the weekend, term structures flattened as bearish sentiment eased somewhat, though short-term put options continued to command significant premiums. During the week, implied volatility for puts exceeded calls by about 7 vol before converging to a roughly 5 vol spread, illustrating persistent, albeit moderating, bearish sentiment.

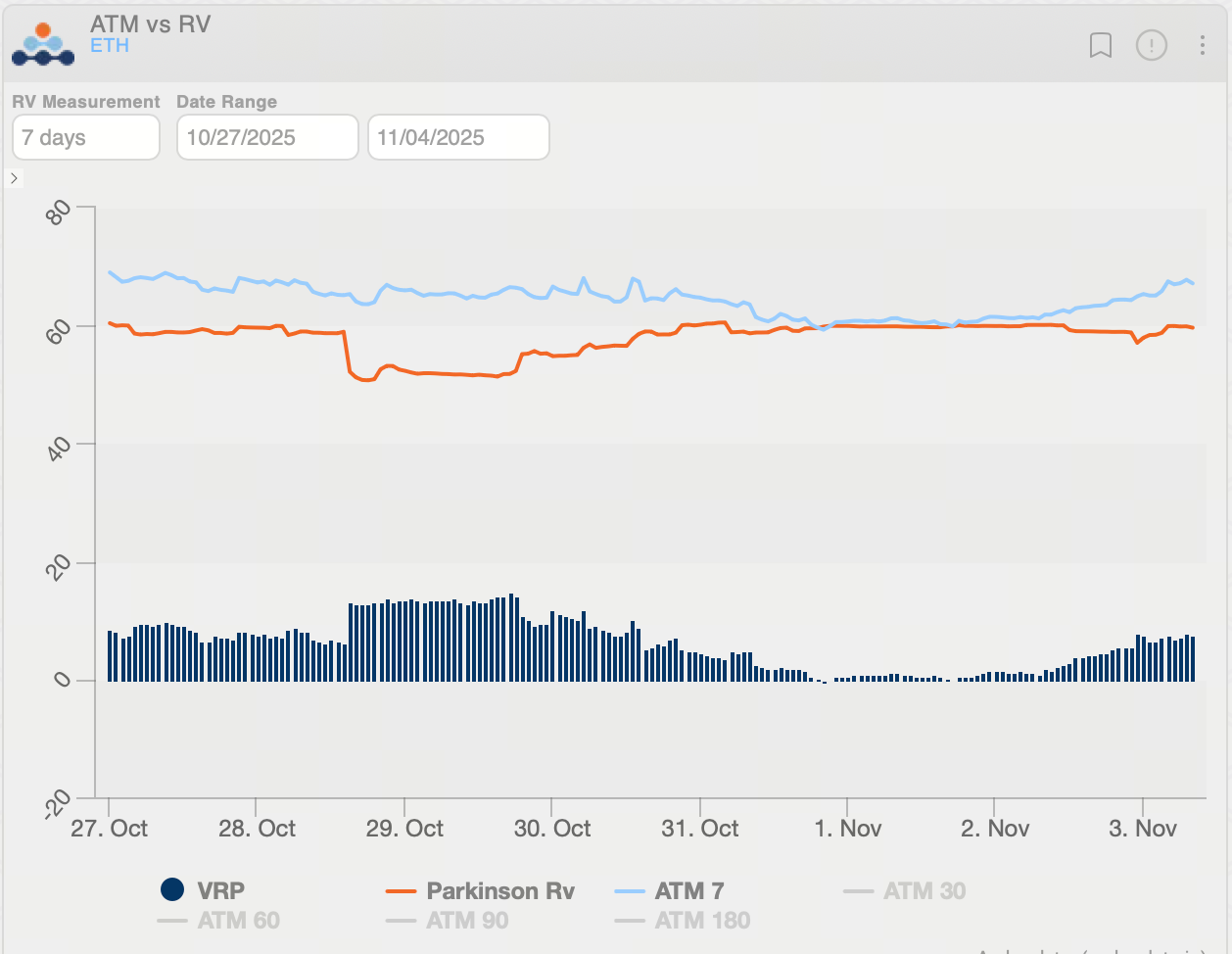

Ethereum (ETH) realized volatility has dropped back to roughly 60, while the VRP (IV−RV) has climbed to 7.52 vol. This indicates that, amid a recent pickup in risk appetite, short-term implied volatility has increased. With implied volatility (IV) above realized volatility (RV), the market is putting a premium on future volatility. In this context, volatility-selling strategies—such as generating Theta returns by selling option structures or constructing short Vega positions—have a relative advantage.

Policy Events Overview and Market Impact

1. Rising U.S. Government Shutdown Risk. As of November 3, the federal government shutdown has lasted nearly 35 days and is expected to weigh on Q4 GDP. The absence of timely data releases (such as employment and inflation figures) presents the market with uncertain liquidity and unclear policy expectations.

2. Federal Reserve December Rate Cut Expectations Delayed. At the end of October, the Federal Reserve cut the federal funds rate by 25 basis points to 3.75–4.00% and clarified that another rate cut in December is “not predetermined.” The likelihood of a December rate cut has fallen from over 90% to about 70%. This narrows the window for “liquidity improvement” and poses a headwind for risk assets, including cryptocurrencies.

3. Limited but Notable Progress in Trade Tension Easing. After talks in Busan, the U.S. and China reached a phase of trade de-escalation. The U.S. reduced some tariffs, while China resumed agricultural imports and temporarily suspended rare earth restrictions—providing a short-term boost to market sentiment. However, structural differences persist, and the relationship remains one of “tactical easing rather than fundamental resolution.”

4. Crypto Market Fund Flows Indicate Cautious Sentiment. With diminished rate cut expectations and no clear improvement in liquidity, Bitcoin and related ETFs have recently seen significant net outflows (about $800 million in one week), signaling a cautious shift in crypto market capital momentum and heightened price sensitivity to capital flows.

Related Articles

SOL Price Consolidates Today Amid Market Volatility

Ethereum Price Prediction 2030: In-Depth Analysis of ETH’s Long-Term Outlook

Boost Your Crypto Yield with the Covered Call Strategy

What is Typus?

Dogecoin (DOGE) Price Prediction: Price Trends and Influencing Factors