Not just a wallet, Little Fox also launched a stablecoin

MetaMask is commonly cited as the first on-chain application for many entering crypto—the wallet extension with a fox logo backed by Consensys, a powerhouse in Ethereum technology.

Founder Aaron Davis launched MetaMask in 2016, and it quickly became a staple in the blockchain world. Now, nine years later, while the community has long awaited a native token, MetaMask has taken its first strategic step into stablecoins.

With the U.S. GENIUS Act ushering in unprecedented regulatory clarity for stablecoins, MetaMask seized the opportunity and officially introduced its native stablecoin, MetaMask USD (mUSD), on September 15, UTC.

mUSD: Technical Architecture & Strategic Partners

MetaMask unveiled plans for a stablecoin in early August 2024. In less than six weeks, mUSD went live—strategic collaboration enabled this milestone.

mUSD’s issuance relies on a three-party framework: Bridge (a Stripe subsidiary) as issuer, M0 providing on-chain technical infrastructure, and MetaMask integrating the stablecoin directly into its wallet ecosystem.

M0’s platform is key, decoupling reserve management from programmable features. Regulated entities oversee reserves on the platform. Developers control token operations—defining minting, ownership, transfers, and creating new revenue and loyalty programs.

M0 handled on-chain programmability for mUSD’s launch. In August 2024, M0 raised $40 million, reaching $100 million in total funding. In addition to mUSD, M0 supports stablecoin launches for Noble (USDN), Usual (USD0), and is powering stablecoin development for fintech platform KAST and gaming OS Playtron.

The regulated issuer for mUSD is Bridge. Acquired by Stripe for $1.1 billion in October 2023, Bridge delivers end-to-end solutions for compliant, customized stablecoin issuance, providing licensing, monitoring, and strict reserve management.

Bridge co-founder and CEO Zach Abrams stated, “Issuing custom stablecoins used to take over a year and require complex integrations. Our technology reduces that to just weeks.”

mUSD: Positioning & On-Chain Ecosystem Deployment

Designed as a wallet-native, self-custodial, and highly functional stablecoin, mUSD’s standout feature is seamless wallet integration. Its core use cases include:

- On-chain applications: enabling frictionless deposits, swaps, transfers, and interoperability across chains.

- Real-world payments: by end of 2025, MetaMask Card will enable mUSD spending at millions of MasterCard merchants worldwide.

Gal Eldar, MetaMask’s Head of Product, stated, “mUSD is a pivotal step toward onboarding the world on-chain. It helps us tackle web3’s toughest challenges, reducing friction and costs for users. We’re not just bringing people blockchain access—we’re building compelling reasons to stay.”

mUSD will launch first on Ethereum and Linea—Consensys’ EVM-compatible Layer 2. On Linea, mUSD will serve as core DeFi infrastructure, integrated into lending markets, DEXs, and custody platforms to deliver deep liquidity. According to MetaMask representatives, mUSD will help drive TVL and protocol activity on Linea.

Stablecoins have long supported DeFi but remained external to wallets. This move signals Consensys’ ambition—not just to build wallets, but a full on-chain financial ecosystem.

Currently mUSD does not offer yield features, but MetaMask previously launched Stablecoin Earn for savings and yield, suggesting future yield options for mUSD.

Cross-chain expansion is central to mUSD’s roadmap. Wormhole is confirmed as its interoperability partner, enabling mUSD’s multi-chain evolution and enhancing liquidity and use cases across blockchain ecosystems.

mUSD: Reserve Mechanism & Transparency

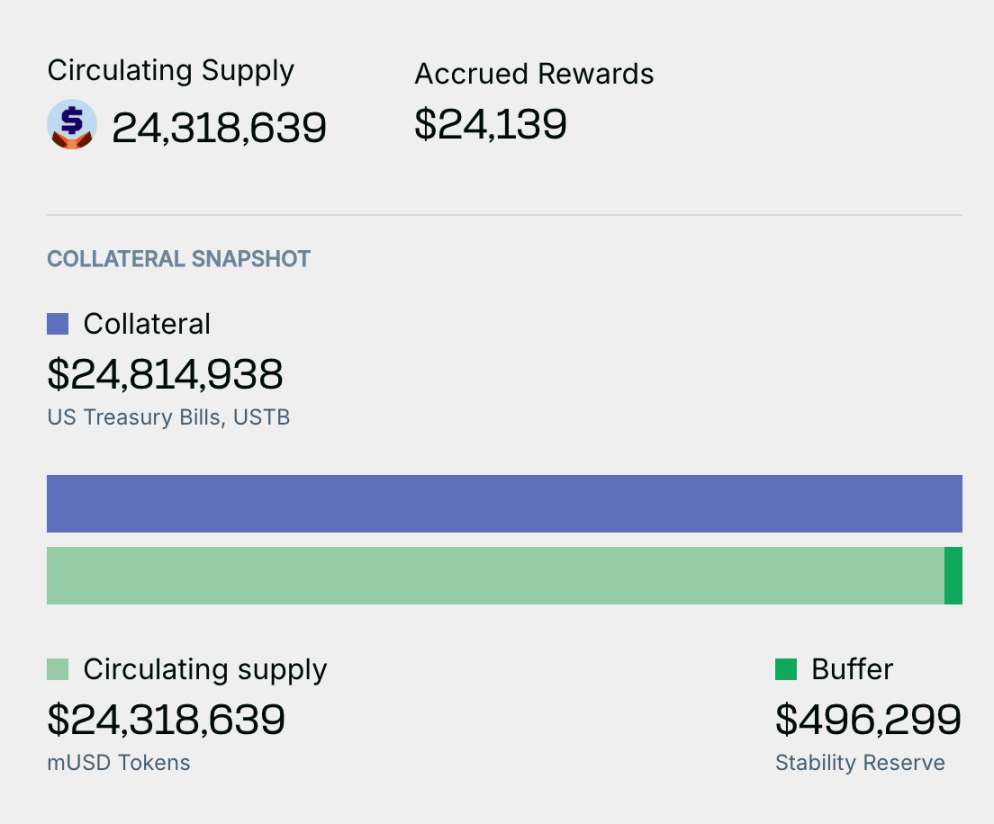

For stablecoins, reserve composition is critical. While MetaMask hasn’t publicly detailed mUSD’s reserves, M0 implements on-chain proof-of-reserve technology, allowing users to verify mUSD supply against reserve assets in real time.

The M0 dashboard reports mUSD uses overcollateralization: with $24.8 million collateral versus $24.3 million circulating supply, an overcollateralization rate of roughly 102%. Nearly $500,000 in stability reserves buffer against market volatility. All collateral consists of high-liquidity, low-risk U.S. Treasury securities.

MetaMask’s official site now features mUSD buy and swap tools. In less than 24 hours since launch, Etherscan shows mUSD circulating supply at 24.36 million tokens, 179 holders, and 1,539 transactions.

Consensys has yet to reveal mUSD’s business model or revenue streams. Stablecoin issuers typically earn via interest on reserves, transaction fees, and ecosystem value capture—industry best practices.

Toward the DeFi Super App

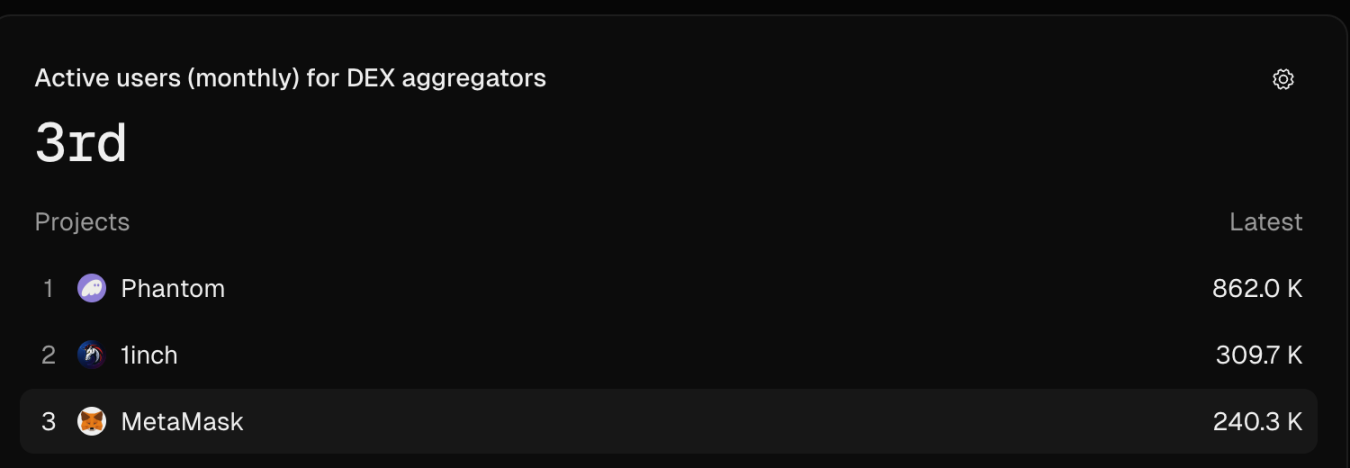

Once the clear leader in wallet solutions, MetaMask hit a stellar 30 million monthly active users in the 2021 bull run and January 2024 peak. But per Token Terminal data, recent monthly active users have dropped to about 250,000, with market share at 14.8%, placing MetaMask third among competitors.

In parallel, DeFi platforms like Uniswap and Aave have shifted from single-purpose tools to all-in-one platforms. Uniswap is building its own wallet, cross-chain standards, and advanced routing. Aave has launched its own stablecoin, integrating lending, governance, and credit. Clearly, the market favors ecosystem Super Apps over standalone products.

For MetaMask—the most iconic Ethereum wallet—the mUSD launch marks a strategic transformation. It’s a fundamental move into tokenomics, and a vital part of Consensys’ end-to-end DeFi service stack.

MetaMask is evolving from a simple wallet into a comprehensive financial services platform. As web3 matures, MetaMask’s ambition is to be more than an entry point—it aims to accompany users across the full on-chain lifecycle as a true Super App.

Statement:

- This article is reproduced from [Foresight News]. Copyright belongs to the original author [angelilu, Foresight News]. If you object to this republication, please contact the Gate Learn team for prompt resolution in accordance with our procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Do not copy, distribute, or use these translations without crediting Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.