Is Copy Trading Profitable? Real Profit Potential of Gate Futures Copy Trading

What Is Copy Trading

Copy Trading is an automated trading approach that enables investors to mirror the actions of professional traders, including opening and closing contracts and adjusting positions. In the crypto market, Copy Trading is especially prevalent in contract trading and is seen as a way to lower the entry barrier for participants.

However, Copy Trading does not equate to “automatic profits,” which is why many people frequently ask, is copy trading profitable.

Why “Is Copy Trading Profitable” Is a Top Concern for Investors

As volatility in crypto asset prices increases, more investors recognize that trading contracts independently is becoming more challenging. Copy Trading, by replicating the strategies of experienced traders, appears to offer a shortcut for everyday users.

In practice, some users achieve steady returns through copy trading, while others incur losses due to failed strategies or poor risk management. As a result, “is copy trading profitable” does not have a straightforward answer.

How Gate’s Contract Copy Trading Works

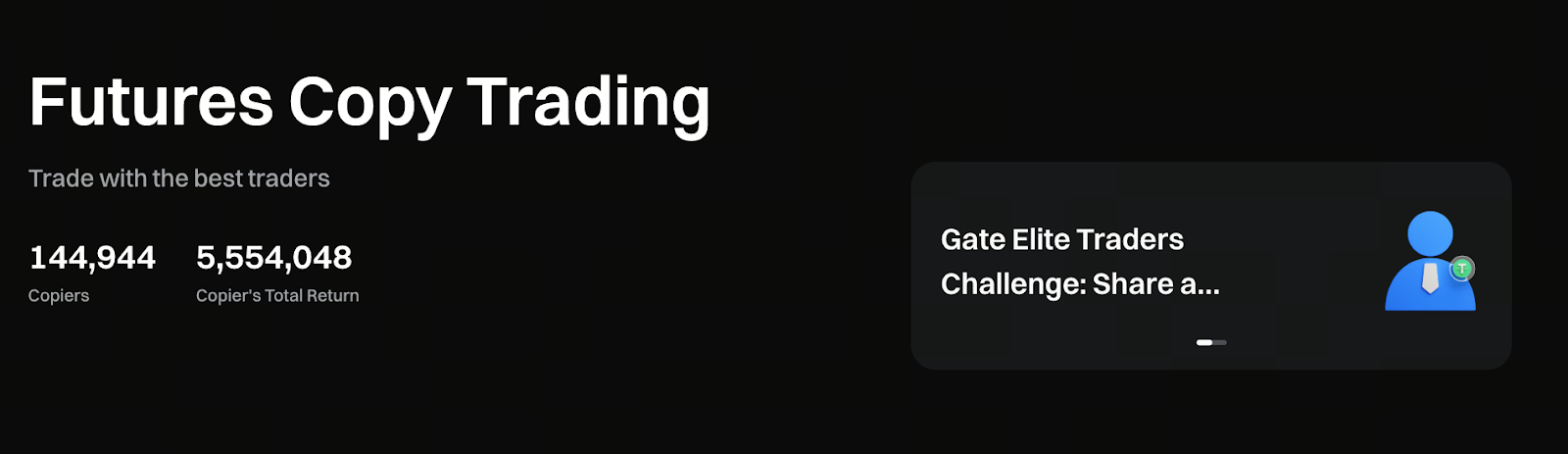

Image: https://www.gate.com/copytrading

Gate’s contract copy trading solution emphasizes transparent data and user autonomy:

- Trader historical returns and drawdowns are fully accessible

- Customizable copy amounts and maximum position sizes

- Risk control parameters allow users to stop copying at any time

- Covers major contract products with high matching efficiency

These mechanisms are designed not to guarantee profits, but to help users manage risk more effectively in uncertain markets.

Understanding the Sources of Profit in Copy Trading

The profitability of Copy Trading is not determined by the act of “copying” itself, but by several key factors:

- The trader’s ability to generate consistent profits

- The strategy’s compatibility with current market conditions

- The soundness of risk management practices

In essence, Copy Trading is an execution tool; real profits depend on how well the trading strategy captures market price movements.

Market Prices, Leverage, and Copy Trading Returns

In contract Copy Trading, leverage is the primary factor influencing return volatility. Moderate leverage can improve capital efficiency, but excessive leverage can quickly magnify losses.

Many users assessing “is copy trading profitable” focus solely on returns, neglecting the impact of leverage and drawdowns. This approach carries significant risk.

Gate Copy Trading: Strengths and Limitations

Strengths:

- Simplifies the operational complexity of contract trading

- Allows users to copy multiple traders simultaneously, diversifying risk

- Flexible risk parameter settings

Limitations:

- Past performance does not guarantee future results

- Slippage may occur during extreme market conditions

- High-return strategies often come with sizable drawdowns

Therefore, Copy Trading is not a risk-free alternative.

Risks Commonly Overlooked in Copy Trading

In Gate contract copy trading, typical risks include:

- Poor timing when starting to copy trades

- Over-concentrating funds with a single trader

- Ignoring maximum drawdown and position ratios

- Treating Copy Trading as a passive investment tool

These pitfalls are often the main reasons for disappointing copy trading experiences.

How to Increase Your Copy Trading Success Rate on Gate

If you want to improve your Copy Trading outcomes, consider these principles:

- Choose traders with stable, long-term performance data

- Limit the proportion of funds allocated to any single trader

- Set clear stop-loss and copy limits

- Regularly review whether strategies are suited to current market conditions

While these methods cannot guarantee profits, they help strengthen long-term sustainability.

Conclusion: Is Copy Trading Truly Profitable?

Let’s return to the central question: Is copy trading profitable?

The objective answer is: With favorable market conditions, careful trader selection, and disciplined risk management, Copy Trading can be profitable. However, it is never a sure thing.

Gate’s contract copy trading offers robust tools and data support, but your final results depend on your own decisions and risk management skills.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution