How to choose a trading pair for futures trading?

BTC and ETH are the indicators of the entire crypto asset market

BTC is the preferred target for futures trading

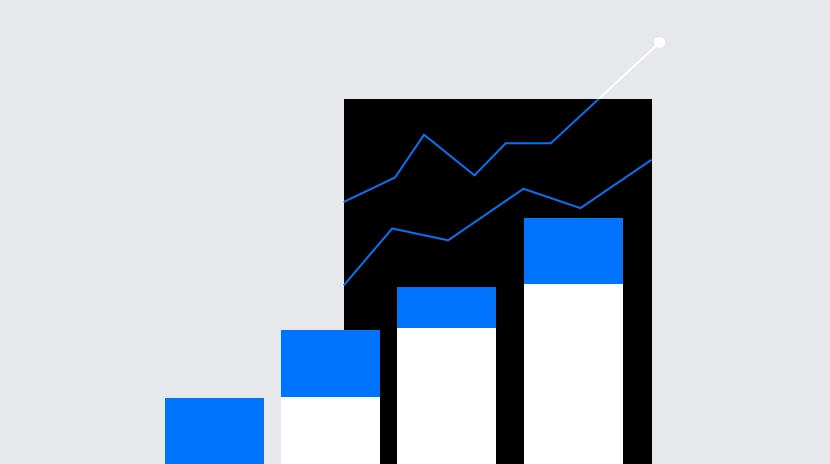

BTC, the first generation of crypto assets, has the ability to determine the ups and downs of the whole crypto asset market. Fluctuations in its value also have a significant impact on the direction of the altcoin market. So, for the majority of crypto asset contract players, BTC is always their first choice when selecting trading targets. The chart below depicts changes in BTC’s market share:

![[图片] [图片]](https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/45d9cfc0599745c8641fe5190533e35dc26aacb2.png)

ETH is the indicator of the altcoin market

With a market share as high as 20%, ETH has long held the second-place position in the market for crypto assets, measured by market value. ETH’s market movement and BTC’s are positively connected. Due to its position as the top public chain in the world, ETH is widely used in a variety of scenarios that cover practically all crypto asset sectors, including DeFi, NFT, gamefi, and the metaverse. ETH moves in the same direction as BTC but has a wider range of ups and downs throughout the same time frame. Additionally, ETH is regarded as the indicator for the altcoin market.

ETH is a well-liked trade target for traders of crypto asset contracts for all of these.

Factors to consider when choosing an altcoin contract

Market Cap

Market value is a crucial factor to consider while evaluating a cryptocurrency project. A project with a higher market value indicates that more users are holding the coins and that there is a more widespread market consensus regarding the coin. Thus, the target with a greater market value is a better option than the target with a lower market value under the same circumstances. Additionally, a higher market value denotes an asset with a more stable price as well as a lower chance of being liquidated in the event of extreme market conditions.

The market value can be queried through Coinmarketcap: https://coinmarketcap.com/zh/ or Coingecko: https://www.coingecko.com/

24-hour trading volume

Liquidity matters in the crypto contract market. A higher liquidation indicates assets with more reasonable pricing, less market volatility, an easier trading procedure, less slippage, and more accurate technical indicators.

So how can you assess a trading pair’s liquidity? Price spread, trading depth, and trading volume are the three main factors to take into account, of which the 24-hour trading volume is the most important. If you open the list of trading pairs for U-margined perpetual contracts, you may notice that the trading pairs are ranked according to their 24-hour trading volume, with the top-ranked trading pairs being the safer option.

Popularity and volatility

The crypto asset market is segmented into a number of sub-sectors by concept, such as DeFi, NFT, metaverse, gaming, storage, Polkadot, etc. The market has a different focus at different times. When a target becomes a market hit, it produces price volatility and drives investors to pursue the ups and downs. Running for the trending target is always a wise move, thus trading pairs with big 24-hour price variations deserve your attention.

Summary

This article presents the methods for selecting the ideal trading target in contract trading. Generally speaking, BTC and ETH are the recommended trade targets. Also, pay attention to trading pairs with high trading volume and significant increases and decreases. In addition, the leading currencies in various concept sectors also deserve your attention.

For more contract information, please go to the Gate.com contract platform and click to register to become a trader!

![[图片] [图片]](https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/b5afaf9de91f6c1444b31272cbdeea0f2566e66a.jpeg)

Disclaimer:

This article is for information purposes only. Gate.com does not provide such information to constitute any investment advice and is not responsible for any investment you may make. Technical analysis, market judgment, trading techniques, and trader sharing may involve potential risks, investment variables, and uncertainties. This article does not provide or imply any opportunity for guaranteed returns.

.

Related Articles

Perpetual Contract Funding Rate Arbitrage Strategy in 2025

What is Aevo? All you need to know about AEVO token (2025)

Detailed Explanation of Granville 8 Rules (Updated 2025)

Understanding The Moving Average

Introduction to Funding Rate Arbitrage Quantitative Funds