Gate Launchpad New Round: Kodiak (KDK) 100% Unlock Subscription Mechanism and Participation Value Explained

Gate Launchpad’s Role in New Token Issuance

Image: https://www.gate.com/launchpad/2362

In today’s crypto market, the approach to new token launches has shifted away from early-stage private placements and IDOs toward the more transparent and user-centric Launchpad model. Gate Launchpad was designed to give retail users direct access to participate in new projects under this evolving paradigm.

Gate Launchpad streamlines participation by eliminating the need for complex on-chain operations or direct interaction with project teams. Users simply follow standardized subscription rules to secure allocation eligibility before tokens are listed. This system lowers entry barriers and enhances process transparency.

Why Kodiak (KDK) Qualified for Gate Launchpad

Gate Launchpad maintains strict eligibility standards, and not every project qualifies. Historically, the platform favors projects that demonstrate real-world application and strong data performance in specific market niches.

Kodiak serves as the core liquidity protocol within the Berachain ecosystem, supporting spot trading, perpetual contracts, and automated liquidity management. Kodiak commands more than 90% of the DEX market share on Berachain. Its robust metrics—trading volume, TVL, and protocol revenue—reflect a mature product offering, which was key to its selection for Gate Launchpad.

What 100% Unlocked Distribution Means for Users

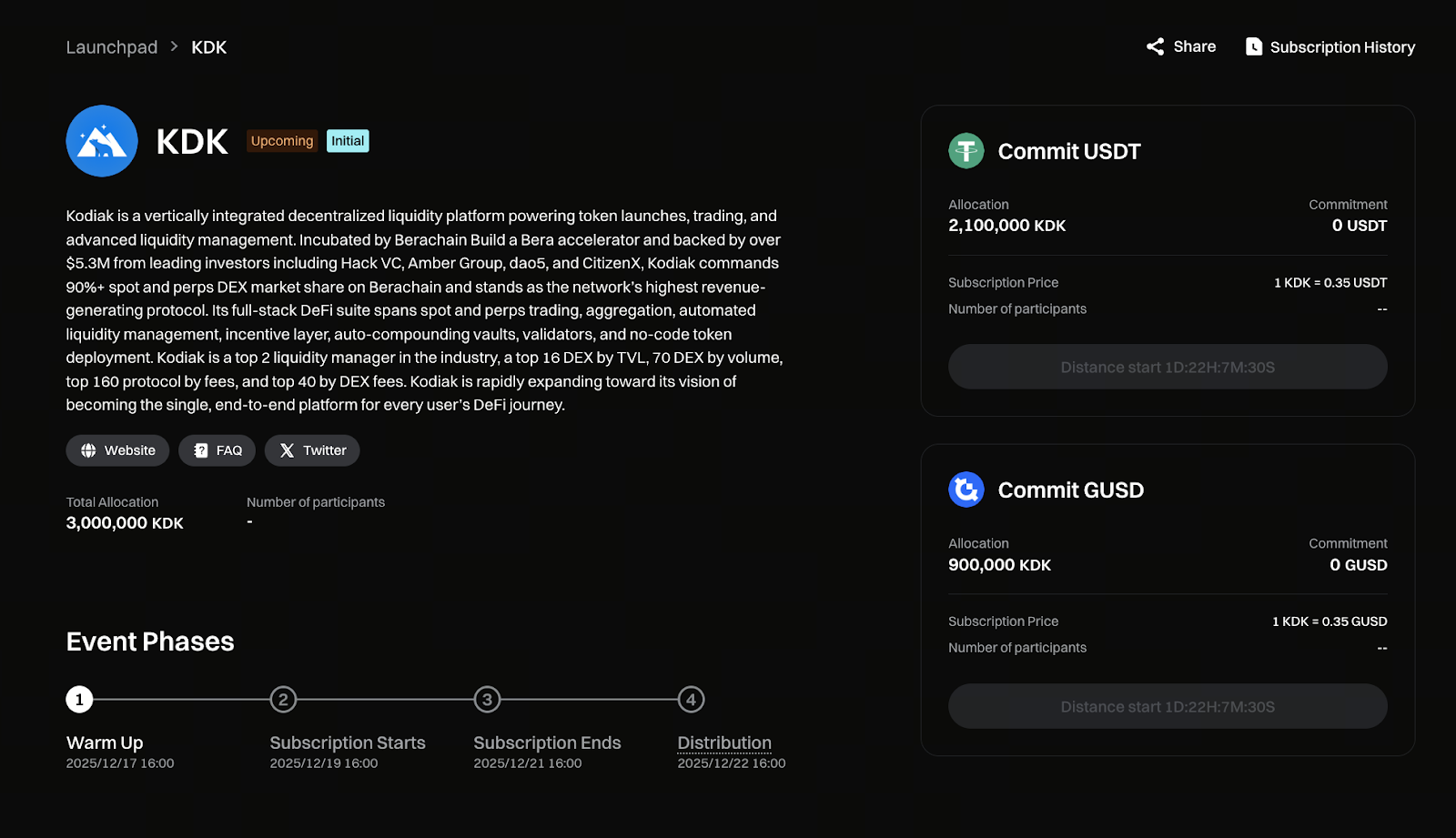

For this Gate Launchpad round, Kodiak (KDK) utilizes a 100% unlocked distribution model. Tokens acquired through the subscription process are delivered in full at distribution, with no subsequent vesting or linear unlocks.

This structure gives users greater certainty. They avoid the price volatility risks tied to extended unlocking periods and can make flexible decisions about their assets once the token is listed. The design is especially beneficial for users who prioritize liquidity.

Gate Launchpad’s Average Staking Allocation Logic Explained

Gate Launchpad does not operate on a “first come, first served” basis. Instead, allocation is determined by average staked amounts. The system tracks users’ hourly staked balances throughout the subscription period and calculates the average.

In practice, early participation and longer staking periods result in a higher average staked amount, which leads to a larger share of the token allocation. This mechanism discourages short-term, concentrated staking and rewards long-term commitment.

Differences and Selection Considerations Between USDT and GUSD Subscription Pools

This round of Gate Launchpad features both USDT and GUSD subscription pools, each with distinct allocation ratios and individual caps.

The USDT pool is ideal for users seeking high liquidity and familiar transaction processes. The GUSD pool caters to more conservative users, as GUSD generates basic yield during the holding period, allowing participants to optimize asset utilization while subscribing.

Newcomers should select a pool based on their own capital structure and do not need to participate in both simultaneously.

What Beginners Should Note Before Participating in Gate Launchpad

While Gate Launchpad offers a regulated channel for new token participation, new tokens remain highly volatile assets. After launch, prices can be affected by market sentiment, liquidity, and broader market conditions.

Beginners should prioritize understanding the rules and managing their positions rather than chasing short-term profits. Treating Gate Launchpad as a way to learn about projects and become familiar with token issuance mechanisms is often the more rational approach.

Summary: How to Rationally Approach New Token Opportunities on Gate Launchpad

Gate Launchpad provides a transparent path for users to participate in new projects through public subscription, average staking allocation, and clear rules. Kodiak (KDK) stands out in both project fundamentals and distribution mechanism this round.

For those seeking a systematic understanding of new token subscription logic and a gradual entry into the crypto market, Gate Launchpad is not only a participation tool but also a valuable learning platform.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution