Gate ETF Leveraged Tokens: A Trend-Based Trading Option Between Spot and Futures

Gate ETF Leveraged Tokens: Product Positioning

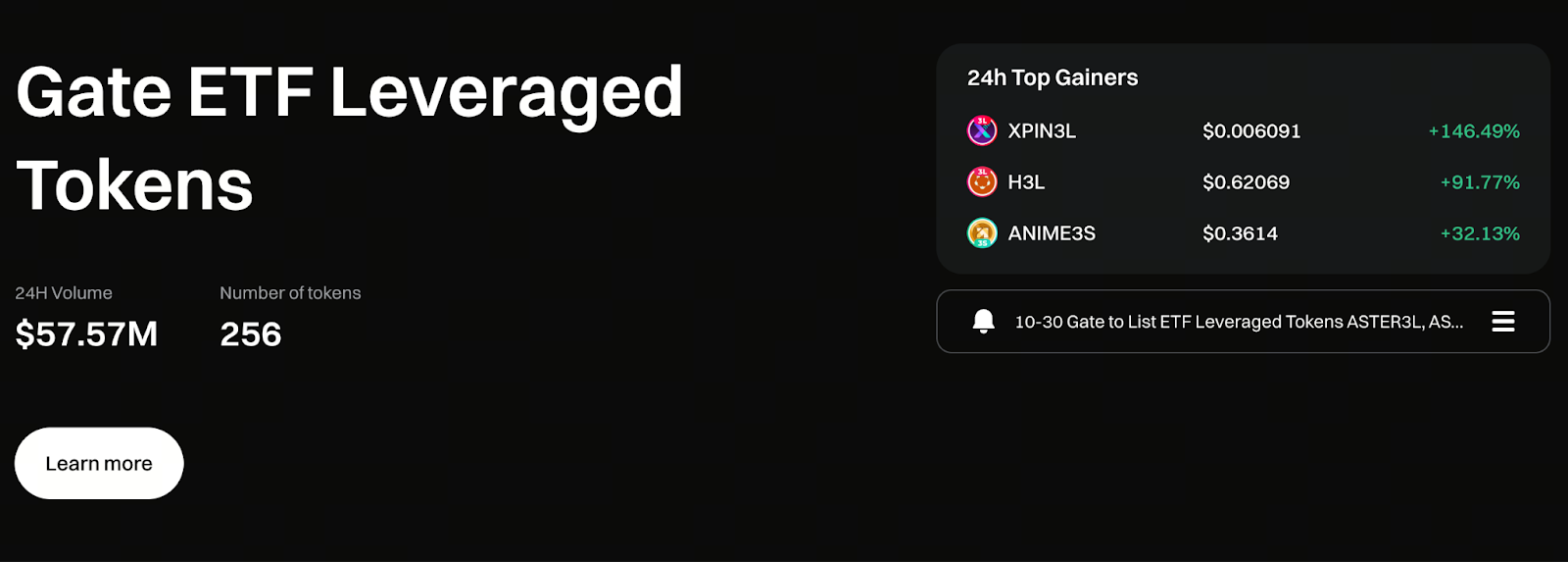

Image: https://www.gate.com/leveraged-etf

Within the crypto trading ecosystem, spot, futures, and options each serve distinct purposes. Yet for most retail traders, these instruments are either inefficient or carry excessive risk and complexity. Gate’s ETF Leveraged Tokens bridge the gap between spot trading and futures contracts.

These tokens are not intended to replace futures. Instead, they deliver a trend-following tool that is more efficient than spot, easier to use than futures, and features a transparent risk structure.

Users don’t need to grasp concepts like margin ratios, liquidation thresholds, or funding rates. They simply determine market direction to participate in leveraged price movements.

ETF-Like Design Philosophy of ETF Leveraged Tokens

Gate ETF Leveraged Tokens are not ETFs in the traditional financial sense. However, their design draws inspiration from several core ETF features:

- Independent net asset value (NAV) structure

- Automated position management

- Investors only need to buy or sell the token directly

- Complex operations are managed internally

This structure transforms sophisticated leveraged futures strategies into straightforward tokens, sharply lowering the barrier to entry for users.

That’s why many traders consider ETF Leveraged Tokens as “exchange-traded funds for the crypto market.”

How Gate ETF Leveraged Tokens Operate

Each Gate ETF Leveraged Token provides fixed-direction, fixed-multiplier exposure, such as 3x long or 3x short.

When market prices move:

- The token’s NAV adjusts according to the target leverage ratio

- The system automatically rebalances underlying positions

- This maintains stable overall leverage

For users, only two actions matter: buy and sell.

This makes ETF Leveraged Tokens functionally similar to spot trading, rather than traditional derivatives trading.

Why Do ETF Leveraged Tokens Appear “Milder”?

Many first-time users notice that Gate ETF Leveraged Tokens do not trigger extreme risk events as frequently as futures contracts.

This is because:

- There is no margin requirement

- No forced liquidation threshold

- Risk is reflected through changes in NAV

As a result, even during sharp market swings, risk is “gradually reflected” in the token’s price, rather than being abruptly released via forced liquidations.

This design makes ETF Leveraged Tokens psychologically more approachable for everyday traders.

Practical Value of Gate ETF Leveraged Tokens in Trending Markets

Gate ETF Leveraged Tokens perform best in clearly trending markets.

Their advantages stand out in scenarios such as:

- Accelerated price action following key technical breakouts

- Sustained moves driven by news or macro events

- Strong and weak sector rotation dynamics

In these conditions, ETF Leveraged Tokens enable traders to capture larger price swings with fewer trades.

Why Exercise Caution in Sideways Markets?

Unlike trending markets, ETF Leveraged Tokens often underperform during sideways or highly volatile periods.

This is due to:

- Automated rebalancing causing NAV erosion during repeated reversals

- Price oscillations may lead to a gradual decline in NAV

Therefore, ETF Leveraged Tokens are best used as trading tools, not long-term holdings.

Typical Usage Scenarios for Gate ETF Leveraged Tokens

In practice, users typically deploy ETF Leveraged Tokens with these strategies:

- Trend-following after confirmation

- Short-term swing trading

- Event-driven market participation

- Temporary hedging for spot positions

No complex trading systems are required—success depends on accurate market direction calls.

Significance in Today’s Market Environment

As regulatory scrutiny of high-risk derivatives intensifies, more traders are seeking “milder” leveraged trading options.

Gate ETF Leveraged Tokens offer a balanced solution in this context:

- Preserve leverage efficiency

- Simplify trading operations

- Eliminate forced liquidation mechanisms

This gives them enduring relevance in the fast-moving, volatile crypto market.

Conclusion

Gate ETF Leveraged Tokens are not designed for unlimited leverage. Instead, they provide a transparent, easily understood way to participate in trending markets.

- When the market trend is clear, these tokens are highly effective tools.

- When markets become choppy, they serve as a reminder to reduce risk exposure.

Understanding product positioning and respecting market conditions are essential for effective use of Gate ETF Leveraged Tokens.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution