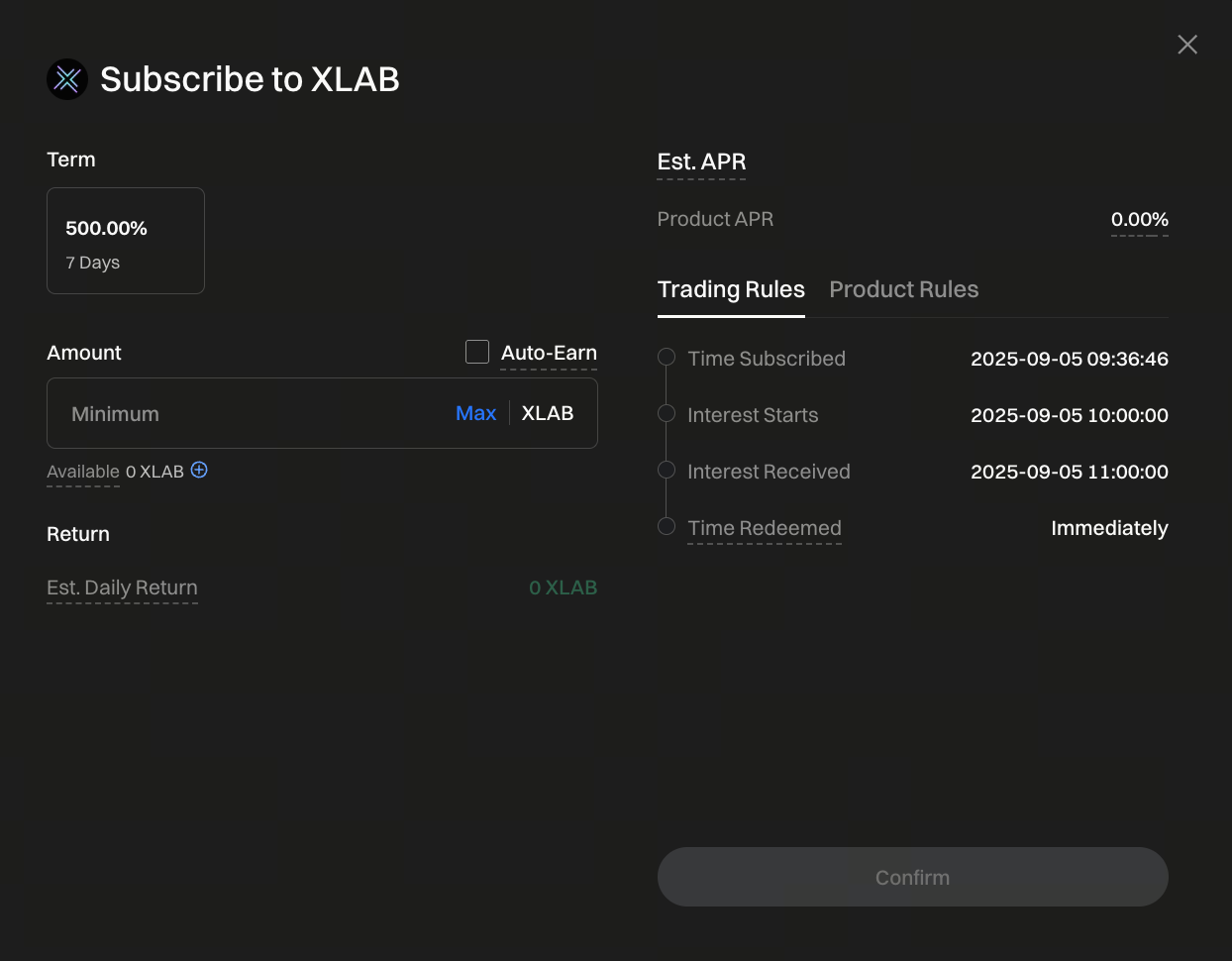

Gate Earn Launches XLAB 7-Day Fixed Term: 500% APY with Limited Subscription

XLAB 7-Day Fixed-Term Investment Product Launch

Image: https://www.gate.com/simple-earn?asset=XLAB&product_id=98&product_type_tag=1

Gate Simple Earn has introduced a new limited-time investment product—XLAB 7-Day Fixed-Term Investment. According to the official announcement, this product offers an annualized yield of up to 500%, making it a highly attractive option for short-term investors.

The total offering is capped at 26 billion XLAB, available through limited release on a first-come, first-served basis. Given that the yield is significantly higher than standard fixed-term investments, rapid subscriptions are anticipated.

Investment Returns and Subscription Guidelines

Key product features include:

- Product duration: 7 days

- Annualized yield: 500%

- Reward distribution: Interest earned will be paid in XLAB tokens and can be viewed under [Investment Records] - [Fixed-Term] - [Interest Earnings]

- Limited quota: 26 billion XLAB; available until sold out

Importantly, you will receive returns in XLAB tokens rather than stablecoins or fiat, meaning your actual earnings will be subject to fluctuations in the market price of XLAB.

Dexlab Project Background Overview

Dexlab, the team behind XLAB, is a standout within the Solana ecosystem. Originally designed as a token factory and decentralized exchange, Dexlab enables both developers and users to issue tokens without complex programming.

Since 2020, Dexlab has established itself as Solana’s largest meme token launchpad, successfully incubating prominent tokens like BONK, SLERF, and PONKE, building strong market credibility and a robust user base.

Dexlab is now progressing toward Dexlab 2.0, featuring key upgrades such as:

- Central Limit Order Book (CLOB) for transparent price formation

- Community growth tools to support token projects in scaling their ecosystem

- Cross-chain bridge to enable asset movement and boost liquidity

Dexlab has also secured a $10 million investment from Astra Fintech. It has established partnerships with top market makers including GSR, Lhava, and The20, further enhancing its advantages in liquidity and market access.

Ideal Participants and Considerations

Given the high yield, the XLAB product is best suited for:

- Short-term investors seeking only a 7-day lockup for high interest returns

- Investors optimistic about Solana’s ecosystem and anticipate future value in Dexlab and XLAB

- Individuals with a higher risk tolerance who are comfortable with potential token price volatility

Additional considerations:

- You cannot redeem your investment early

- Strict rules against fraudulent activity during the promotion; if you violate the rules, you will be immediately disqualified

- Significant market volatility may cause XLAB prices to swing, which can affect your actual returns

How Investors Should Evaluate High Yields Rationally

A 500% annualized yield appears highly attractive, but products offering such high returns typically involve substantial risk. Before subscribing, investors should consider:

- Prioritize capital safety: Never invest all your funds; manage your exposure to avoid overconcentration

- Understand the reward structure: You will receive returns in XLAB, not stablecoins, so be mindful of token price volatility

- Note the lockup period: Despite being just 7 days, your funds are inaccessible during this timeframe

- Consider your overall strategy: Investment is just one part of your asset allocation; balance it with more stable products to achieve diversification

Conclusion

The XLAB 7-Day Fixed-Term Investment introduced by Gate Simple Earn has attracted attention for its 500% yield. If you’re familiar with Solana and optimistic about Dexlab’s future, this may present a high-return short-term opportunity. However, for most investors, it’s important to stay rational when seeking returns and make decisions that fit your financial position and risk tolerance.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution