From Ethereum Copycat to Public Chain Giant: BNB Chain's Five-Year Ecosystem Evolution and Outlook

1. Introduction

BNB Chain recently marked its fifth anniversary, evolving from its early reputation as an “Ethereum clone” into a super blockchain network supporting over 600 million users, tens of millions of daily transactions, and more than 5,000 ecosystem projects. What began with a focus on low fees and high throughput quickly drew DeFi users, but today BNB Chain spans multiple tracks—including GameFi, NFTs, RWAs, Social, and AI—signaling its transformation from a follower to an ecosystem powerhouse. This journey has been fueled by ongoing performance and security upgrades, as well as the powerful backing of Binance Exchange. In early 2025, Binance’s launch of the Web3 wallet and Alpha platform became pivotal engines for a new era of growth, funneling millions of users from centralized platforms to on-chain activity. This led to a dramatic increase in active addresses and transaction volume. Alpha further cemented itself as a core venue for project incubation and user education, bringing continuous innovation to BNB Chain.

This article first traces BNB Chain’s five-year development, mapping its path from the DeFi explosion to ecosystem diversification. It then leverages on-chain metrics and competitive analysis with Ethereum, Solana, Base, and others to present a holistic view of BNB Chain’s ecosystem and competitive posture. Subsequently, it explores how Binance Alpha and the Web3 wallet drive ecosystem expansion, reviewing performance across emerging areas such as meme coins, RWAs, and AI. Finally, it evaluates the potential of key BNB ecosystem tokens and assesses opportunities and challenges for the next five years. Through this comprehensive review, readers gain insight into BNB Chain’s distinctive industry position and its long-term value proposition in technology, compliance, and innovation.

2. Five Years of BNB Chain: From Emergence to Prosperity

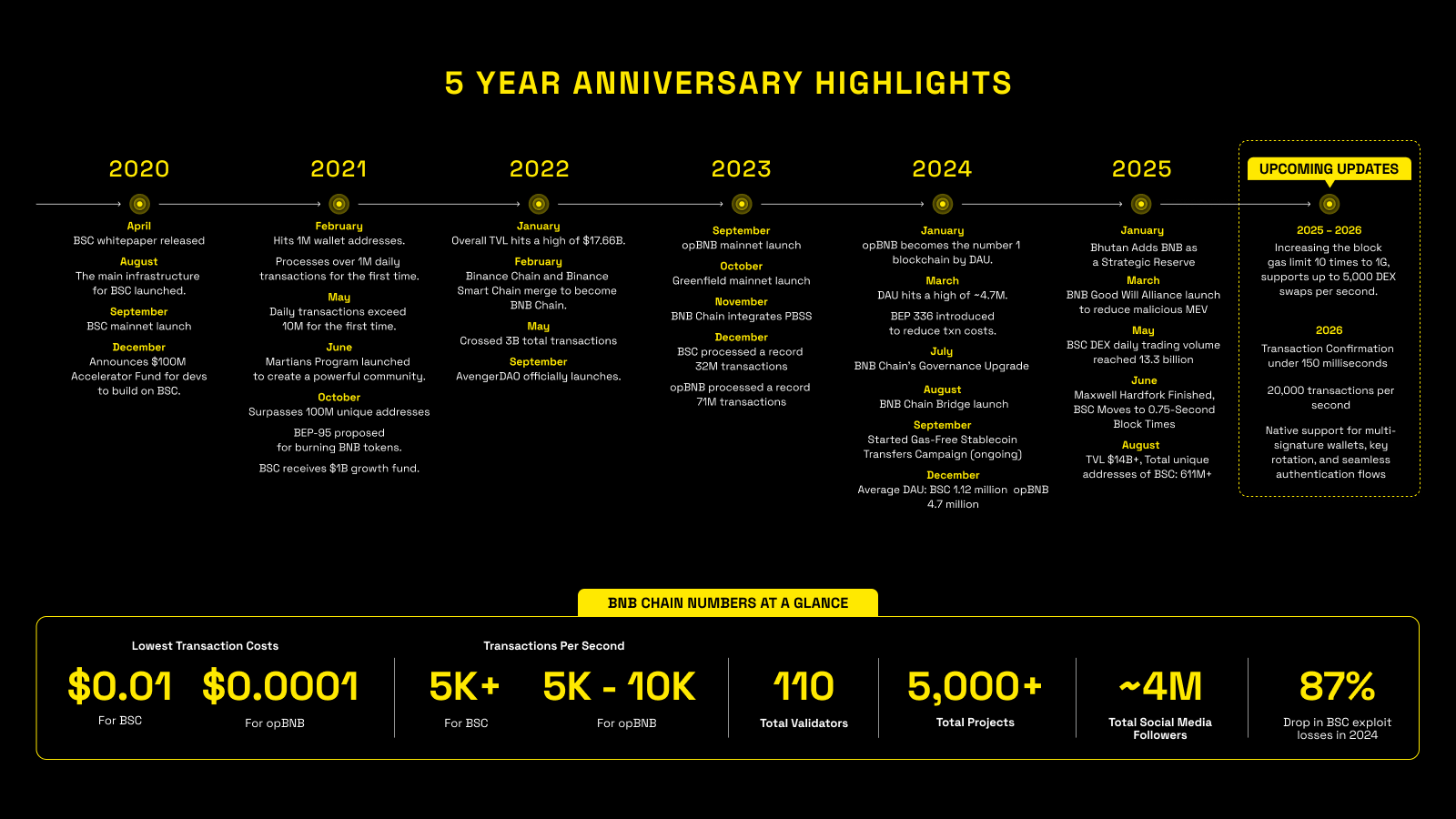

Source: https://www.bnbchain.org/en/blog/5-years-of-bnb-chain-accelerating-the-future-of-web3

- Initial Positioning: Low-Cost, High-Performance Ethereum Alternative. In April 2019, Binance unveiled the original Binance Chain (now BNB Beacon Chain) for BNB issuance and decentralized trading, but the ecosystem truly ignited with the launch of Binance Smart Chain (BSC) in September 2020. Designed to address Ethereum’s congestion and expensive transactions, BSC implemented Proof of Staked Authority (PoSA) consensus with just 21 validators, resulting in fast block times and minimal fees. During the DeFi boom, Ethereum’s high gas fees restricted retail participation, while BSC offered performance up to 100x higher at just pennies per transaction, quickly earning it the label “faster, cheaper Ethereum.”

- 2021 Breakout: DeFi Cloning Wave and User Surge. From late 2020 through early 2021, DeFi “yield farming” propelled explosive growth for BSC. BNB’s price soared in tandem with DeFi and found new recognition as a mainstream layer-one token. PancakeSwap and other decentralized exchanges adopted Uniswap’s model, adding high-yield liquidity mining incentives that attracted significant capital. Next, Ethereum-inspired projects such as Venus (lending), Alpaca (leveraged farming), and Mdex (cross-chain DEX) launched, fueling exponential TVL growth that peaked at $20 billion in 2021. Daily transactions exceeded 10 million—far outpacing Ethereum’s one million—and active addresses hit a record 1.5 million by year’s end. Binance’s bridge and marketing efforts drove massive user inflows, pushing BNB Chain addresses past 100 million and solidifying BSC as a leading hub for DeFi users and developers.

- Ecosystem Diversification: Rise of GameFi and NFTs. The 2021 bull market saw GameFi and NFT activity surge on BSC, alongside DeFi. BSC’s low cost and high throughput made it a prime venue for gaming DApps such as CryptoBlades, Faraland, and Plant vs Undead. NFT projects also thrived, with BakerySwap blending DEX and NFT marketplace features, NFTb pioneering NFT lending, and Binance’s own NFT marketplace driving more trading. BSC’s ecosystem blossomed, laying early foundations for GameFi and NFT sectors.

- 2022 Pivot: Brand Refresh and Security Incidents. As the market shifted bear in 2022, BSC underwent consolidation. In February, Binance unified its chains under the “BNB Chain” brand, signaling independence from the Binance identity. TVL fell sharply to $3 billion, over 80% off peak, and speculative projects—especially in GameFi—quickly declined. Still, BNB Chain supported developers via the Most Valuable Builder (MVB) accelerator and faced major security tests: a cross-chain bridge hack in October cost $100 million, but swift validator action limited losses. Many copycat projects failed, denting market reputation. In response, BNB Chain launched AvengerDAO and pushed for increased decentralization. Even during the downturn, user addresses exceeded 200 million by year’s end, showing continued adoption.

- 2023 Recovery: Technical Upgrades Drive Rebound. With the market stabilizing in 2023, BNB Chain experienced renewal. LayerZero and other cross-chain innovations expanded lending and bridging scenarios, and protocols like Radiant Capital and Stargate saw robust activity. SocialFi apps, notably Hooked’s “Quiz to Earn” and CyberConnect’s Launchpad debut, drew new users. Major hard forks—Planck and Luban—introduced parallelism and boosted both performance and security. The launch of opBNB Layer 2 in September slashed transaction costs to $0.0001 and set the stage for multi-chain expansion. Testing of BNB Greenfield, a decentralized storage chain, started in late 2023. By year’s end, daily active addresses rebounded to 1.4 million and TVL surpassed $5 billion—laying strong groundwork for the next growth phase.

- 2024–2025 Acceleration: Performance Leap and Tokenization of Real-World Assets. Entering 2024–2025, BNB Chain doubled down on network upgrades for “the next wave of Web3 users.” The Maxwell and Lorentz hard forks cut block times from 3 seconds to 0.75 seconds, dropped gas fees to $0.001, and improved TPS and confirmation to sub-second levels. The rollout of Goodwill Alliance security curbed MEV and sandwich attacks by up to 95%, reducing hacker-related losses by 87% year-over-year. BNB Chain capitalized on the RWA boom, onboarding U.S. Treasuries via VanEck, stock tokens from Backed Finance, and institutional T-bill funds from Ondo, rolling out new incentives for traditional financial assets. These advances made BNB Chain number one for stablecoin trading and user activity in 2024, with stablecoin market cap over $11 billion, 611 million addresses, and more than 5,000 projects. From a single chain, BNB Chain has grown into a global, multi-chain ecosystem with four million fans across 100+ countries.

For its fifth anniversary, BNB Chain announced a new roadmap: by 2025–2026, gas limits will grow tenfold to 10G (enabling 5,000 DEX tx/sec), confirmation times will drop to 150 milliseconds, and network-wide TPS will rise to 20,000. Next-gen security—account abstraction, key rotation, multisig—will lay the foundation for future DeFi, gaming, and AI infrastructure. BNB Chain is clearly preparing for the next five years’ opportunities and challenges.

3. BNB Ecosystem Landscape: On-Chain Data and Competitive Positioning

Five years of growth have made BNB Chain one of the world’s leading blockchains after Ethereum, with top-tier user scale and transaction activity. The following is a detailed ecosystem and network status snapshot, drawing on on-chain data and direct comparisons to other public chains.

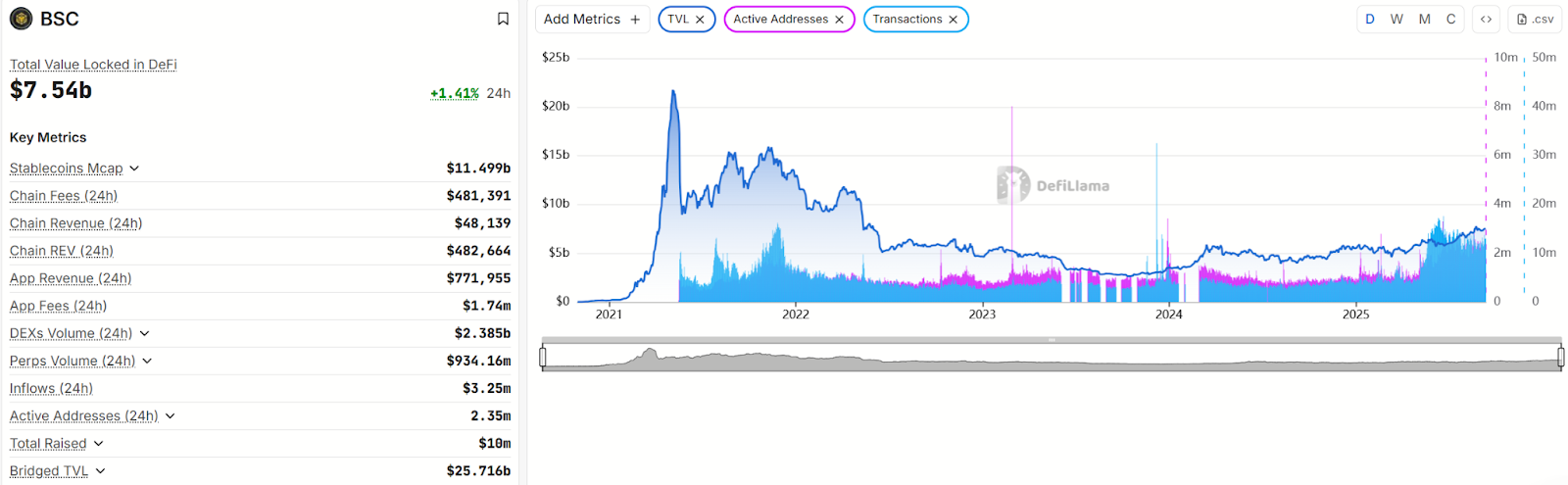

Source: https://defillama.com/chain/bsc

- On-Chain Data: User and Transaction Leadership. As of September 2025, BNB Chain (BSC mainnet plus opBNB) leads in key metrics: millions of daily active addresses, with 10–15 million daily transactions. Single-day transaction volume reached 13.72 million—up over 330% year-on-year. Total cumulative transactions are in the tens of billions. The number of unique addresses exceeds 630 million, reflecting a 34% yearly increase. BNB Chain is also a leader in decentralized trading, with DEX volume surpassing Ethereum multiple times in 2023–2024. Stablecoin supply on BSC topped $10 billion. These stats confirm BNB Chain’s mainstream adoption and dominant transactional frequency.

- Performance and Cost: Best-in-Class Throughput and Fees. BNB Chain’s growth strategy emphasizes performance. The BSC mainnet’s PoSA consensus relies on just 21 active validators (40–50 candidates), elected by holders, compressing block time to 0.75 seconds and allowing for massive parallel processing. Ethereum’s PoS requires global consensus, resulting in 12-second blocks. Solana’s architecture enables high TPS but has suffered multiple outages due to complex consensus and high hardware demands. BNB Chain’s current TPS hits thousands, with a 20,000 TPS target. Fees are kept extremely low—$0.001–$0.01 via gas optimizations—making on-chain participation affordable for all users. Plans to expand validators to 100 and reward balanced mining further balance performance and decentralization. BNB Chain remains the leading choice for mass-market usability.

- Decentralization and Compliance: Competitive Tradeoffs. Debate continues around BNB Chain’s decentralization, as most validators maintain close ties to Binance despite formal independence. This delivers rapid expansion but raises neutrality questions, unlike Ethereum’s robust community governance. Ethereum dominates in security and decentralization, with the largest developer pool and blue-chip DeFi, but faces scaling and cost issues. Solana’s architecture offers decentralization via thousands of nodes yet has faced stability challenges; performance has since improved, helping its expansion into equities and decentralized social. Base, launched by Coinbase, delivers compliance and user funneling, but remains highly centralized, with a nascent ecosystem. Nonetheless, Base’s U.S. focus and compliance make it a formidable contender, especially for institutional assets—an area where BNB Chain is also aggressively expanding.

- Ecosystem Characteristics: “Mainstreamization” of Users. BNB Chain’s user base is characterized by mass-market retail, especially from emerging markets seeking low cost and high yield—evident in meme coin and gaming popularity. Wallets like Trust Wallet facilitate speculative activity among users in Southeast Asia, South Asia, and Latin America. Ethereum draws more HNW individuals and institutional capital, favoring safety and rational returns. Solana appeals to Western tech, NFT, and meme enthusiasts; Base taps into regulated Western audiences. BNB Chain’s community spans Asia (especially China and SE Asia), Turkey, Russia, Africa, and other regions demanding low fees. Transaction behavior is marked by frequent, small swaps, yield farming, and games—contrasting Ethereum’s infrequent, high-value transactions.

BNB Chain leads in scale and activity, but Ethereum remains the source of developer activity and original innovation, with Solana rising. Early BSC projects were mostly forks; breakthrough technical innovation remains limited. Compliance and regulatory uncertainties also loom, as BNB Chain’s fate remains intertwined with Binance. Base enjoys greater regulatory favor. While BNB Chain leads in RWA deployment, global regulatory endorsement is still pending. The platform is moving toward “de-Binance” governance, but Binance remains a critical pillar in the near term.

4. Binance Alpha and Web3 Wallet: Accelerating BNB Chain’s Ecosystem Growth

Binance’s wallet and Alpha platform have lowered entry barriers for on-chain users, bridging assets from centralized platforms and driving a major surge in liquidity and capital activity on BNB Chain. Alpha’s innovative TGE plus airdrop mechanism effectively activates existing users, with points and airdrop races spurring deeper engagement and giving new projects large initial communities.

1. On-Chain User Growth: Exchange Flow Drives Engagement

Binance’s launch of an integrated Web3 wallet and upgraded Alpha platform in early 2025 led to dramatic user growth on BNB Chain. One-tap activation in the Binance app channeled massive CEX user numbers into on-chain participation, making DApps and DeFi easily accessible. In Q1 2025, over two million new wallet users joined, with around 40% experiencing BNB Chain for the first time via Alpha’s TGE events. Daily active addresses climbed from 1.2 million to 1.6 million in Q2, transactions spiked from six million to over fifteen million per day, and daily active addresses neared two million. The seamless wallet onboarding pushed millions of Binance users on-chain, supercharging BNB Chain’s user base and activity.

2. On-Chain Capital Activity: TVL and Liquidity Trends

Alpha and the Web3 wallet brought substantial new capital to BNB Chain, evident in surging TVL and decentralized trading. In Q2 2025, DeFi TVL reached $9.9 billion, up 14% quarter-on-quarter, driven by Alpha’s new launches. The “Mubarak” token TGE on Alpha locked 3.2 million BNB—nearly $100 million—providing a major liquidity boost. BNB Chain also saw record DEX volume: $3.3 billion daily in Q2 2025. To support this scale, the network cut gas fees by 90% (to 0.1 gwei) and shortened block times to 0.75 seconds, maintaining stability and affordability under high concurrency. These improvements incentivized users to keep assets on-chain for trading and DeFi, creating a positive growth cycle.

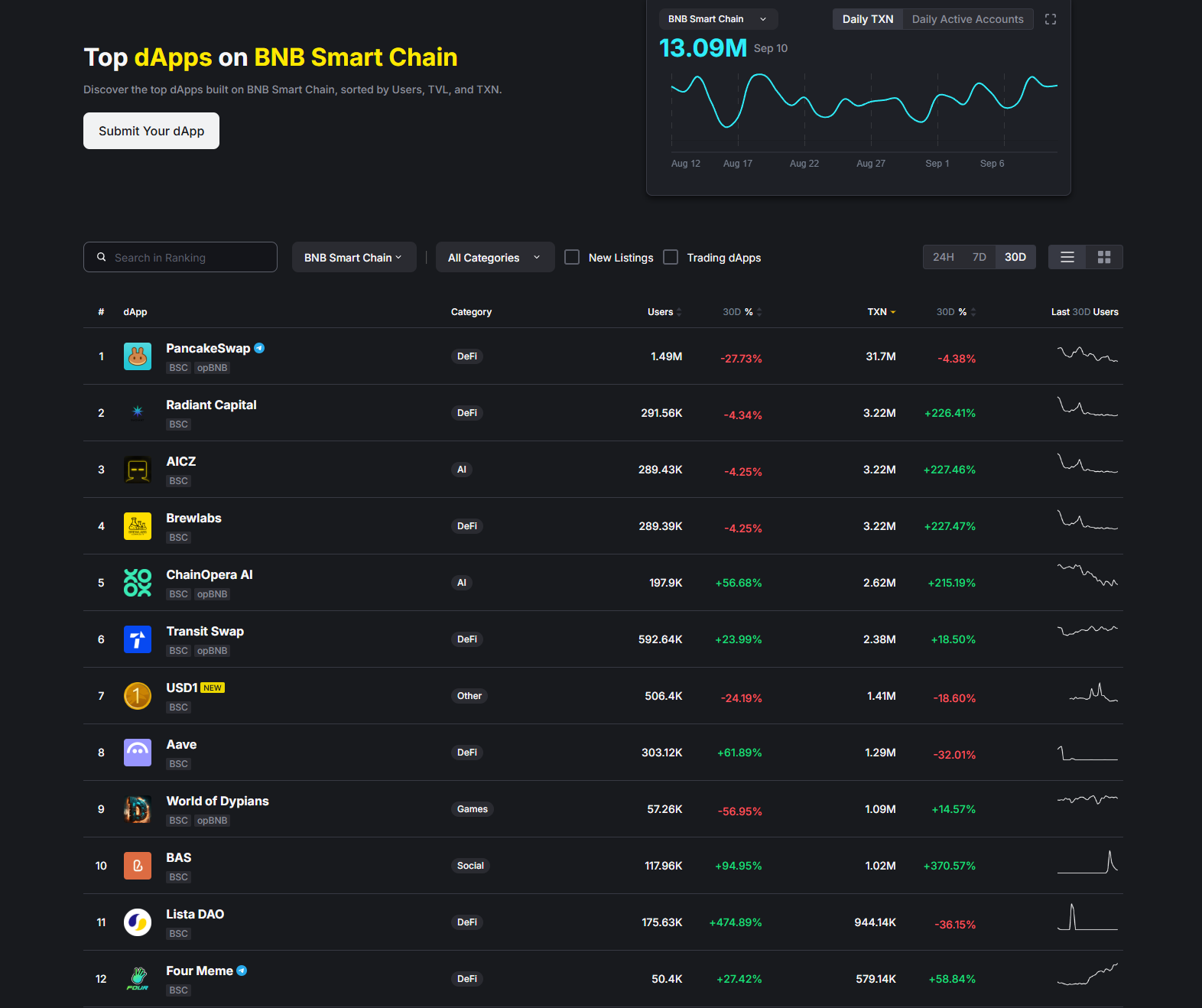

3. DApp Activity Surge: Interaction and Gas Usage

The spread of Alpha and the Web3 wallet drove significant upticks in DApp usage and user interactions. Daily transaction volume more than doubled from 2024, hitting ten million by mid-2025. PancakeSwap led DEX volume, responsible for about 85% of BNB Chain’s DEX activity. Meme boom projects like Four.Meme generated $747,000 in one-day fees, ranking among top earners, while shifts in gas usage showed meme contracts and airdrop interactions now occupy meaningful share. The launch of opBNB attracted cross-chain inflows ($64.9 million TVL in H1 2025), providing even lower gas and higher TPS, and fueling new deployments in games and social DApps.

Source: https://dappbay.bnbchain.org/ranking

4. Meme Coin Revival: Community Impact and Growth

The early 2025 meme coin boom—sparked by CZ’s casual mention of “Broccoli”—drove unprecedented activity on BNB Chain. The token rapidly hit $30 million volume, while CZ’s symbolic purchases of “MUBARAK” and “TEST” sent those coins soaring to $200 million and $50 million market caps, respectively, in just 48 hours. Social media posts from He Yi spurred BUBB’s run from $3 million to $34 million. This wave lifted daily transactions beyond four million and active addresses to 4.4 million. In response, BNB Chain Foundation launched a meme support program to channel and incentivize the trend, turning speculative surges into sustained community and project assets.

5. Empowering AI, RWA, GameFi, and Other Growth Tracks

Binance Alpha and the wallet ecosystem channeled new users and capital into AI, RWA, GameFi, and more.

- AI: Alpha prioritized AI+blockchain launches, making BNB Chain a top AI incubation platform. Projects like SIREN and support via MVB accelerator/hackathons position BNB Chain at the forefront of on-chain AI innovation.

- RWA: Binance’s multi-million dollar RWA incentives in May 2025 fueled tokenization of traditional assets. Highlights include BlackRock’s $2.87 billion Treasury fund and Ondo Finance’s $446 million yield token on BNB Chain.

- GameFi and Web3: Binance’s $100 million fund, launched end-2024, supported new games and social apps, with many debuting on Alpha before advancing to Launchpad. BNB Chain also funded DeSci for decentralized science, signaling expansion far beyond DeFi and meme coins.

Almost half of Binance’s new spot pairs in 2025 first appeared on Alpha, cementing its role as a launchpad for quality Web3 projects. These Alpha-incubated projects often outperform once listed, continuously advancing the ecosystem and platform. The combination of Alpha and the Web3 wallet has assembled new users, capital, and innovation for BNB Chain, fueling repeated Launchpad success and creating a winning dynamic for both users and Binance.

5. Conclusion and Outlook

In just five years, BNB Chain has grown from launch in 2020 to a global, multi-sector ecosystem, enduring both heights and challenges. It now leads the industry in daily users and transaction volume, with thriving DeFi, GameFi, RWA zones and breakout stars like PancakeSwap and Four.meme. Backed by Binance and defined by cost and performance advantages, BNB Chain has captured mass market attention, competing alongside Ethereum, Solana, and Base.

To reach new heights in the next five years, BNB Chain must focus on:

- Sustained technical upgrades to maintain performance, increase decentralization, and foster developer engagement for high-quality DApps.

- Original innovation, developing unique paradigm-shifting projects instead of simply emulating Ethereum success stories.

- Compliance and mainstream acceptance, proactively shaping industry standards and positioning BNB Chain as the preferred blockchain infrastructure for traditional institutions.

- Community governance and independence, ensuring resilience even as Binance faces potential regulatory headwinds, by building a truly community-driven governance system that earns industry trust.

As the official BNB Chain blog puts it: “The past five years proved anything is possible; the next five will set industry standards.” BNB Chain stands ready to shape the industry’s future over the coming five years.

Disclaimer:

- This article is republished from [TechFlow] with copyright held by [Hotcoin Research]. For any copyright concerns, contact the Gate Learn team for timely handling under our procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article were translated by the Gate Learn team. Unless Gate is cited, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?