EVAA for Beginners: From Tokenomics to Future Outlook

What Is EVAA?

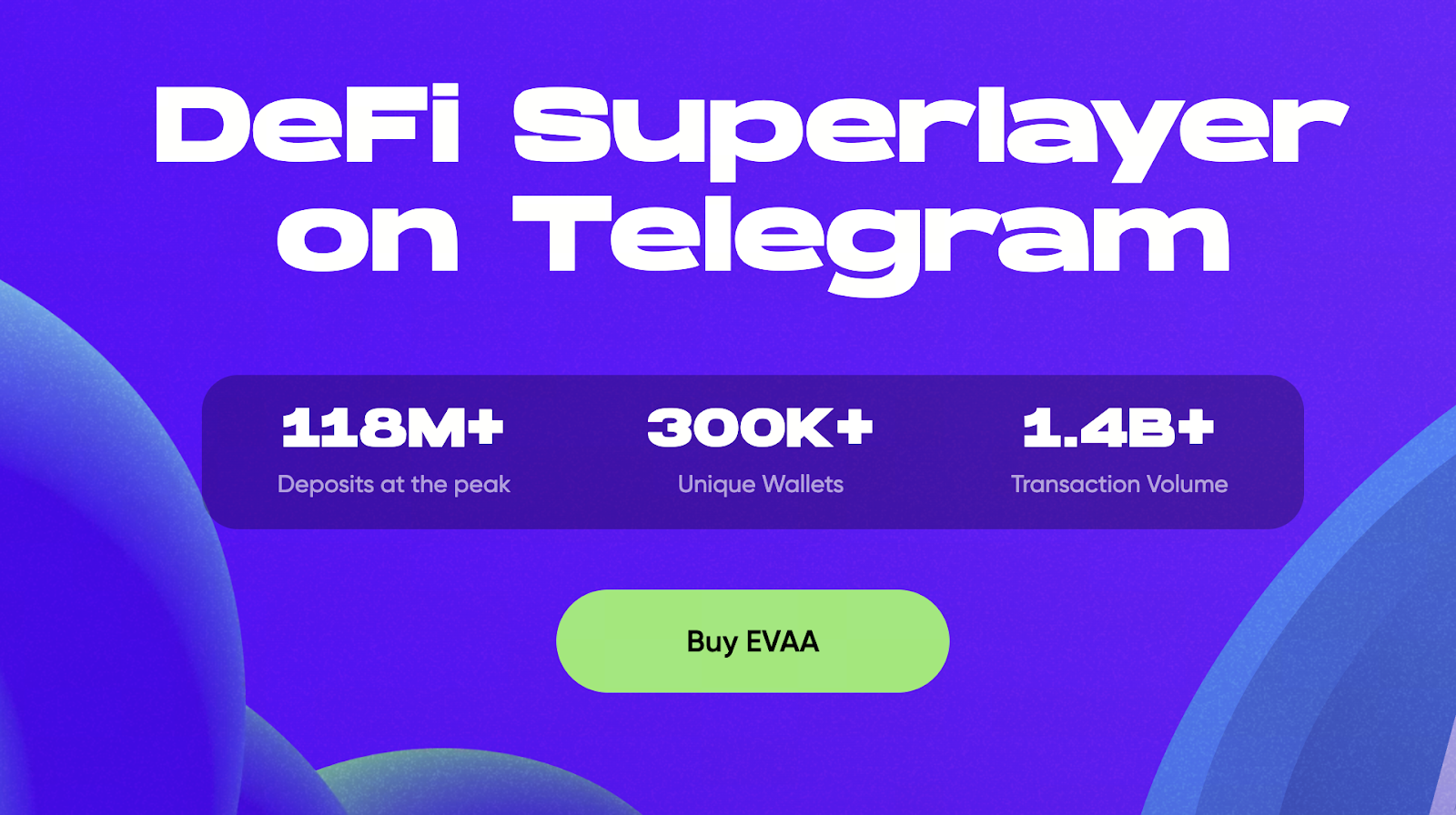

Image: https://token.evaa.finance/

EVAA is a decentralized liquidity protocol built on the TON blockchain and integrated directly into the Telegram ecosystem. Users can participate as depositors to provide liquidity and earn returns, or as borrowers by collateralizing assets to access loans. EVAA’s mission is to make DeFi accessible and convenient within Telegram, lowering the barriers to entry for crypto finance.

The EVAA token serves as both a governance asset and the core economic link in the ecosystem, powering rewards, staking, fee allocation, and more.

EVAA Tokenomics: Core Mechanisms

EVAA has a total supply of 50,000,000 tokens, released via a long-term linear unlock schedule to control market inflation. The allocation breakdown includes:

- Community Rewards: Incentives for liquidity providers and early adopters to drive ecosystem growth;

- Team & Advisors: Subject to long-term lockup and phased vesting to ensure ongoing project commitment;

- Investors & DAO Treasury: Dedicated to ecosystem development, partnership incentives, and governance voting;

- Market & Ecosystem Fund: Supporting market expansion, cross-chain initiatives, and other long-term strategies.

Furthermore, EVAA features an automatic buyback and burn mechanism—when protocol revenue hits a set threshold, tokens are repurchased and burned to maintain scarcity and increase long-term value.

Latest Price & Market Performance

As of mid-October 2025 (UTC), EVAA trades near $2.19, with 24-hour volume around $21 million and circulating supply of approximately 6.6 million tokens. While the price remains well below the initial listing high of about $7, overall trading activity is stable. Trade here: https://www.gate.com/trade/EVAA_USDT

Over the past week, EVAA saw roughly 30% price volatility, driven by broader market corrections and short-term unlocking expectations. As trading depth and exchange coverage expand, EVAA’s market liquidity continues to improve.

Recently, the team announced new ecosystem initiatives, including multi-asset collateralized lending on TON and strategic partnerships with leading Web3 wallets to expand user access.

Advantages, Challenges & Risks

Advantages:

- Native Telegram Integration: EVAA directly serves Telegram’s user base, leveraging built-in social distribution advantages.

- Prudent Unlock & Buyback Mechanisms: Effectively reduces early sell-off risk and enhances token scarcity.

- Multi-Exchange Support: EVAA is listed on major platforms, providing a range of trading and yield management options.

Challenges & Risks:

- Market Volatility: Short-term price swings may destabilize investor sentiment;

- Extended Unlock Schedule: Ongoing token releases could create periodic sell pressure;

- Ecosystem Adoption: Moving from Telegram’s social context to on-chain finance demands continual product upgrades and user education;

- Yield Sustainability: If protocol revenue falls short of covering incentives and buybacks, long-term token value may face pressure.

Future Roadmap

EVAA’s development roadmap prioritizes:

- Unsecured Lending: Plans to launch credit score-based borrowing to broaden use cases;

- EVAA Payment Card: Web3 wallet integration enabling direct token payments and settlements;

- DAO Governance Enhancements: Greater community voting power and treasury oversight;

- Cross-Chain Expansion & Security Upgrades: Improved protocol compatibility and asset protection.

If executed successfully, these initiatives position EVAA as a foundational DeFi liquidity solution within the TON and Telegram ecosystems.

Summary & Actionable Insights

Overall, EVAA is a high-potential DeFi project distinguished by its innovative blend of social onboarding and financial utility. For newcomers, it offers a low-barrier entry point to crypto finance.

Nonetheless, all new tokens are subject to price volatility and execution risk. Investors should thoroughly research project mechanics, manage exposure, and monitor future unlocks and ecosystem progress. If the roadmap delivers and revenue mechanisms remain stable, EVAA could become a flagship DeFi platform within the Telegram ecosystem.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution