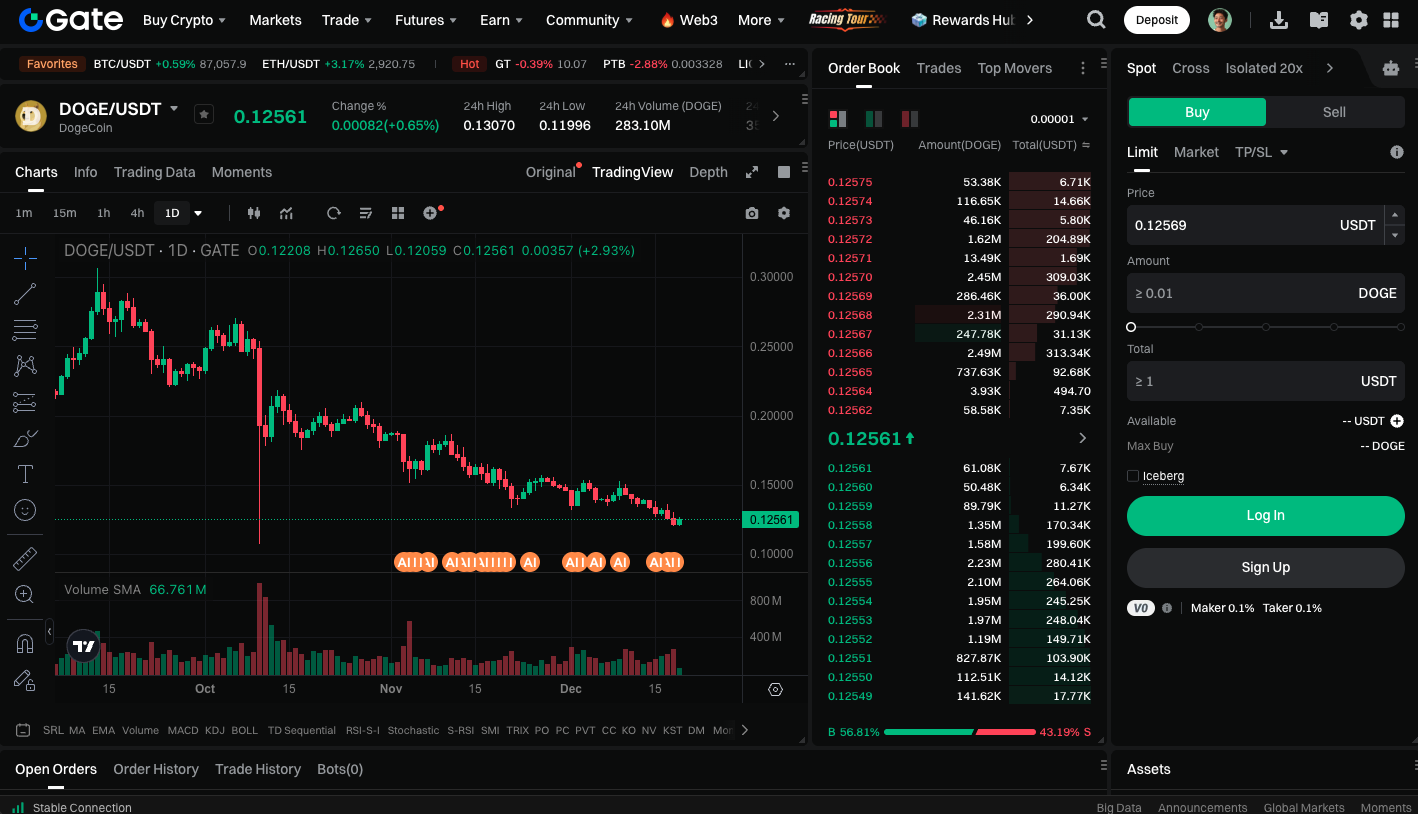

Dogecoin Price Prediction: Support at 0.115 USD Could Trigger Drop to 0.10 USD

Market Momentum Weakens, DOGE ETF Inflows Stall

Dogecoin’s recent performance in exchange-traded funds (ETFs) has slowed significantly. Since December 11, neither the Grayscale nor Bitwise DOGE ETFs have seen any new inflows, with cumulative investments since launch totaling only about $2 million.

Assets under management currently stand at roughly $5.2 million, which represents just a tiny fraction of Dogecoin’s total market cap. In contrast, other altcoin ETFs like XRP and Solana have attracted hundreds of millions of dollars, making DOGE ETF’s lackluster performance stand out and underscoring a decline in investor risk appetite. The Crypto Fear & Greed Index remains firmly in the fear zone, reflecting a broadly cautious market mood.

Whale Activity and Derivatives Market Flash Bearish Signals

On-chain data indicates that large holders are pulling back. Wallets with 100 million to 1 billion DOGE have reduced their balances by over 1 billion tokens since early December. The share of DOGE holders in profit has dropped to around 50%, meaning fewer investors are seeing gains.

The derivatives market also signals caution. Short positions now make up more than half of all open interest, and over $5 million in long positions were liquidated in the past 24 hours. The drop in open interest further suggests that speculative sentiment is fading, with little evidence of aggressive dip buying.

Technical Support Levels to Watch

Technically, DOGE is trading between $0.123 and $0.126, a support zone tested multiple times since April. If the price fails to break above the $0.13 resistance, further declines are likely. Initial support lies near $0.12, with the main support at $0.115. A break below $0.115 could see prices fall to $0.105 or even $0.10.

Trade DOGE spot markets now: https://www.gate.com/trade/DOGE_USDT

Summary

DOGE’s short-term outlook remains cautious. Stalled ETF inflows, reduced whale holdings, and bearish derivatives data all reinforce downside pressure. If DOGE cannot break above $0.13, investors should watch for possible further corrections, with the $0.115 to $0.10 range as the key support zone.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution