Dogecoin Price Prediction: DOGE Eyes 60% Rally Toward $1 After Breaking $0.33 Resistance

Preface

Dogecoin experienced renewed upward momentum in October, with technical breakout signals and expanding global adoption cases gradually boosting investor and long-term holder confidence.

Technical Analysis

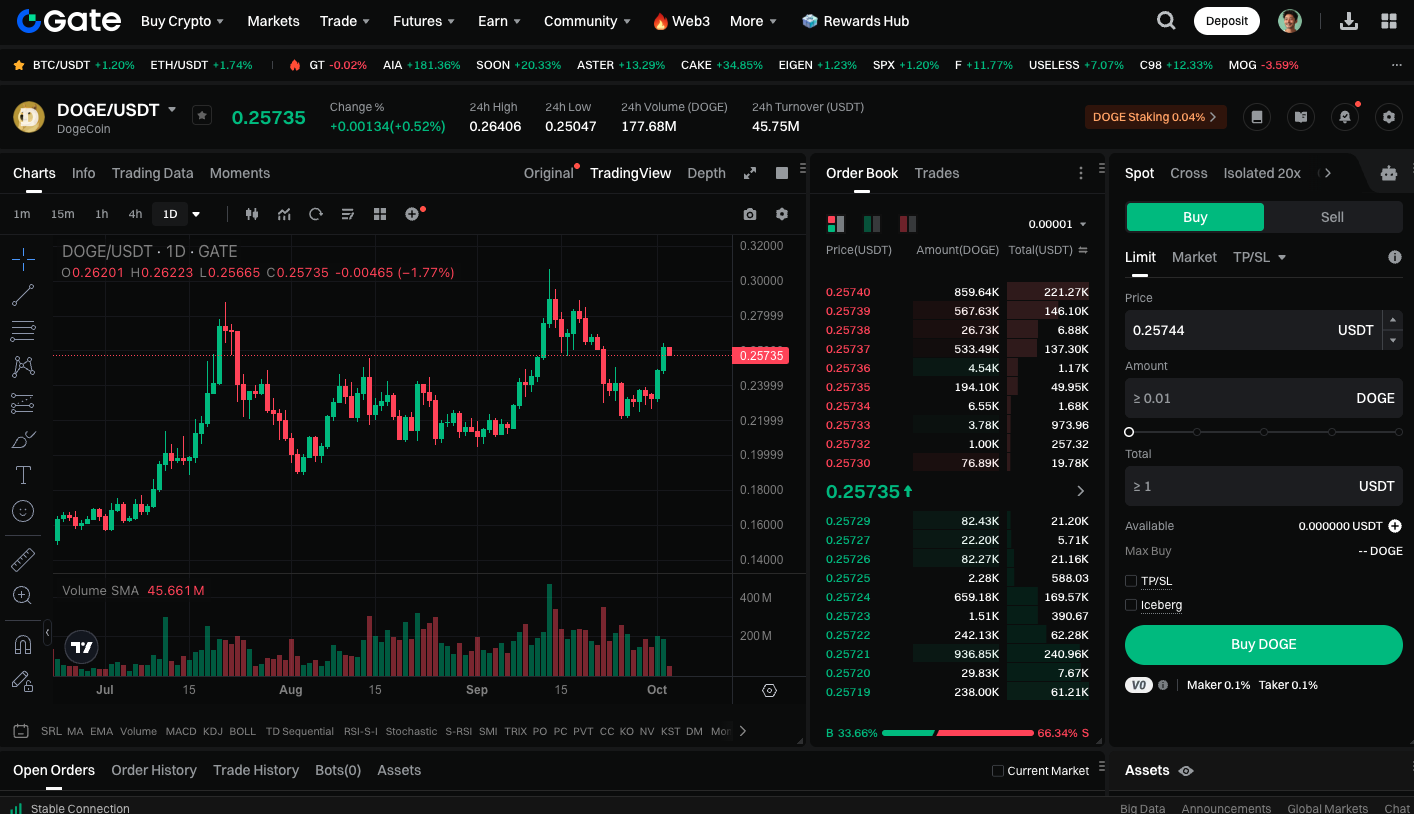

Across multiple timeframes, DOGE is forming a golden cross—a bullish indicator where the short-term moving average overtakes the long-term moving average, historically preceding significant rallies. At the time of writing, DOGE remains above the $0.25 support level and is consolidating near $0.258. The MACD indicator has turned green, signaling strengthening buying pressure. If DOGE breaks above the $0.33 resistance, its price could rally toward $0.37, representing nearly a 60% potential gain from current levels.

Adoption Expansion

In addition to technical signals, DOGE’s practical adoption is accelerating. Buenos Aires, Argentina, recently approved DOGE for tax payments, marking a shift from its meme coin image toward payment and mainstream use. Sentiment in the derivatives market is also bullish. According to data, DOGE open interest now exceeds $3.9 billion, with major trading platforms such as Gate among the leading exchanges. This reflects active positioning by traders anticipating the next breakout move.

Trade DOGE spot now: https://www.gate.com/trade/DOGE_USDT

DOGE’s Next Stop: $1?

Short-term price targets remain at $0.30 and $0.34, but some analysts suggest that the weekly chart’s consolidation could lay the groundwork for a long-term parabolic surge, with the potential to challenge $1 by 2026. If this scenario materializes, DOGE will maintain its hallmark of explosive, community-driven momentum. Given October’s historical strength for cryptocurrencies, continued bullish sentiment could allow Dogecoin to reclaim key resistance levels and further cement its leading status among meme coins.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

What is N2: An AI-Driven Layer 2 Solution