Destruction is Uniswap's last resort.

UNI surged nearly 40% overnight, lifting the entire DeFi sector.

The rally stemmed from Uniswap revealing its final move. Founder Hayden Adams submitted a new proposal focused on the longstanding “fee switch”—a topic that has been discussed seven times over the past two years and is well-known within the Uniswap community.

This proposal stands out because Hayden personally initiated it. It goes beyond just the fee switch—it also covers token burns, the merger between Uniswap Labs and the Uniswap Foundation, and several other measures. Some whales have already expressed their support, and prediction markets currently estimate a 79% chance of approval.

7 Failures in 2 Years: The Never-Ending Challenge of the “Fee Switch”

The fee switch is a standard feature in DeFi. For example, Aave successfully activated its fee switch in 2025, using a buyback and distribution model to funnel protocol revenue into AAVE token buybacks, driving the price from $180 to $231—a 75% annualized gain.

Other protocols—Ethena, Raydium, Curve, Usual—have also implemented fee switches with notable success, providing sustainable tokenomics models for the industry.

With so many proven examples, why does Uniswap keep failing to pass its own?

a16z Relaxes, But Uniswap’s Real Troubles Begin

That brings us to a16z—a pivotal player.

Historically, Uniswap votes required low quorum, typically around 40 million UNI; meanwhile, a16z held about 55 million UNI, wielding direct influence over outcomes.

a16z has consistently opposed fee switch proposals.

In July 2022, they abstained in two preliminary votes, expressing only concerns on the forum. By December 2022, with pools like ETH-USDT and DAI-ETH set for a 1/10 fee rate on-chain vote, a16z cast a clear “no,” using 15 million UNI. That vote ended with 45% support—enough for a majority, but not for quorum. a16z stated on the forum: “We ultimately cannot support any proposal that does not consider legal and tax factors.” This was their first public opposition.

a16z held firm in subsequent votes. In May and June 2023, GFX Labs introduced two fee-related proposals; June’s earned 54% support but failed due to a16z’s 15 million “no” votes and lack of quorum. The same scenario repeated in March 2024—about 55 million UNI in support, but a16z’s opposition led to defeat. Most dramatically, in May–August 2024, proposers tried to set up a Wyoming DUNA entity to avoid legal risk. Stakeholders postponed the vote scheduled for August 18 indefinitely due to “new issues from unnamed stakeholders”—widely assumed to be raised by a16z.

What’s a16z afraid of? Legal risk is the crux.

a16z believes activating the fee switch could classify UNI as a security. Under the U.S. Howey Test, if investors expect “profits from the efforts of others,” the asset may be deemed a security. The fee switch creates that expectation—protocol revenue shared with token holders, echoing traditional profit-sharing securities. a16z partner Miles Jennings bluntly wrote: “A DAO without a legal entity exposes individuals to personal liability.”

Tax issues are equally thorny. If fees flow to the protocol, the IRS could demand corporate tax, with back taxes estimated up to $10 million. DAOs, as decentralized organizations, lack a legal entity and structured finances—who pays, and how, remains unresolved. Without a clear solution, activating the fee switch may expose all governance participants to tax risk.

UNI remains a16z’s largest single crypto holding, with about 64 million tokens—still enough to swing votes single-handedly.

But with Trump’s election and changes at the SEC, the crypto sector has entered a period of political stability, easing Uniswap’s legal risk and softening a16z’s stance. This hurdle appears to be fading, and chances of proposal approval are much improved.

However, deeper challenges remain. Uniswap’s fee switch mechanism is still controversial.

You Can’t Have It Both Ways

To grasp these new controversies, let’s briefly explain how the fee switch works.

Technically, the proposal refines the fee structure. In V2, the fee remains 0.3%, split as 0.25% to LPs and 0.05% to the protocol. V3 is more flexible: protocol fees are one-fourth to one-sixth of LP fees. For example, in a 0.01% pool, the protocol takes 0.0025% (25%); in a 0.3% pool, it takes 0.05% (about 17%).

Uniswap estimates annual revenue between $10 million and $40 million, with bull market peaks potentially reaching between $50 million and $120 million. The proposal also calls for burning 100 million UNI (16% of supply) and establishing an ongoing burn mechanism.

With the fee switch, UNI transitions from a “valueless governance token” to a genuine revenue asset.

This is great news for UNI holders, but it also highlights the dilemma. The fee switch essentially reallocates income from LPs to the protocol.

Trader fees stay the same, but some LP profits now go to the protocol. More protocol revenue means less LP earnings.

When choosing between LPs and protocol revenue, Uniswap clearly favors protocol revenue.

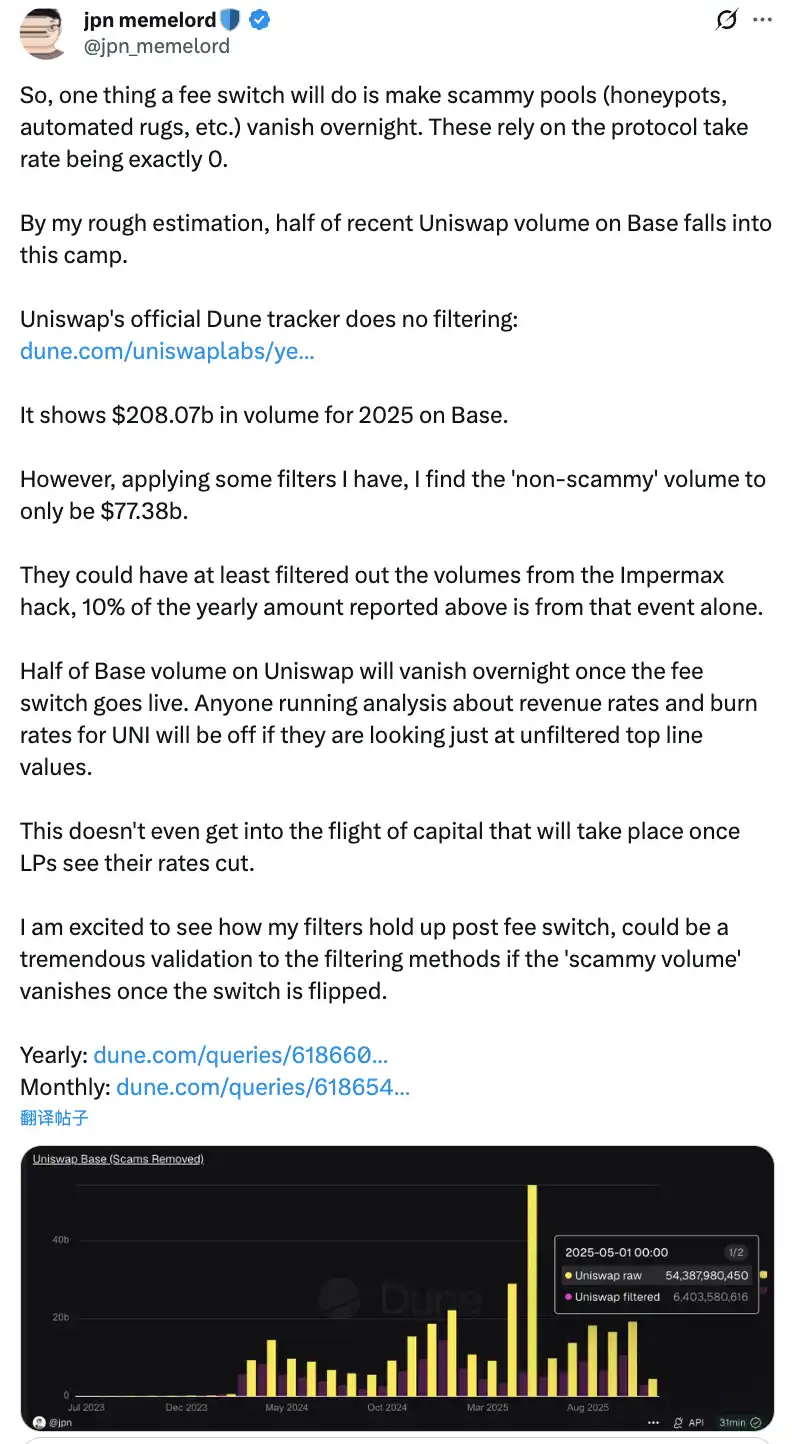

Community members predict that activating the fee switch could cut Uniswap’s Base chain trading volume in half overnight.

This reallocation could have real negative effects. In the short term, LP earnings might drop 10–25%, depending on the protocol fee split. Worse, models predict 4–15% of liquidity could migrate to competitors.

To offset these drawbacks, the proposal includes novel compensation methods—like internalizing MEV via PFDA, giving LPs extra income ($0.06–$0.26 per $10,000 traded). V4’s Hooks feature enables dynamic fee adjustments and new revenue sources. The proposal also recommends phased implementation, with pilot programs for key pools and real-time data adjustments.

The Fee Switch Dilemma

Whether the proposal will ease LPs’ concerns and be enacted is still uncertain. Hayden’s direct involvement may not be enough to resolve Uniswap’s core impasse.

The more immediate threat is fierce competition—especially on Base chain, versus Aerodrome.

After Uniswap’s proposal, Dromos Labs CEO Alexander remarked sarcastically on X: “I never thought, on the eve of Dromos Labs’ biggest day, our top competitor would deliver such a blunder.”

Aerodrome Is Crushing Uniswap on Base

In the past 30 days, Aerodrome’s trading volume hit $20.465 billion—56% of Base’s market share—while Uniswap managed only $12–15 billion, or 40–44%. Aerodrome leads by 35–40% in volume, and by TVL: $473 million vs. Uniswap’s $300–400 million.

The gap is mainly due to LP yield differences. For ETH-USDC, Uniswap V3’s yield is 12–15% (from fees), while Aerodrome offers 50–100%+ via AERO incentives—three to seven times Uniswap’s rate. Aerodrome distributed $12.35 million in AERO rewards over 30 days, using veAERO voting for precise liquidity guidance. Uniswap relies mostly on organic fees and occasional incentives, but at a much smaller scale.

As a community member put it: “Aerodrome wins on Base because LPs only care about ROI per dollar. Aerodrome delivers.”

LPs don’t stick with Uniswap for its brand—they seek returns. On new L2s like Base, Aerodrome, as a native DEX, uses optimized ve(3,3) models and huge token rewards for a strong first-mover edge.

If Uniswap activates the fee switch and further cuts LP yields, liquidity will likely accelerate toward Aerodrome. Models suggest 4–15% liquidity outflow; on Base’s competitive landscape, that could be higher. As liquidity drops, slippage rises, volume falls, and a negative spiral takes hold.

Will the New Proposal Save Uniswap?

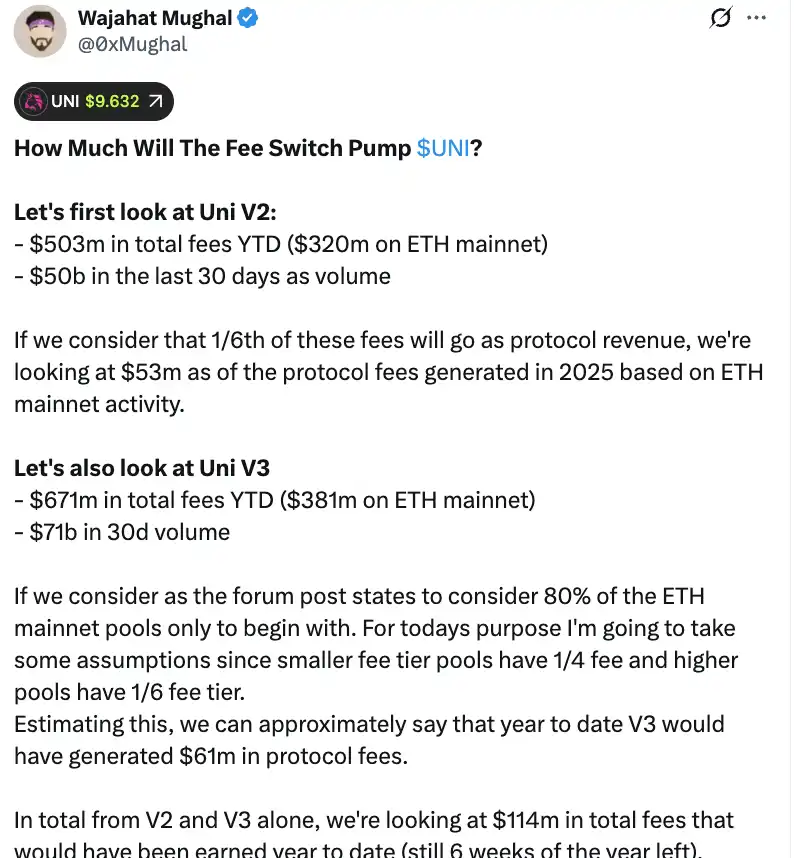

By the numbers, the fee switch could deliver substantial protocol revenue. Community member Wajahat Mughal’s analysis shows V2 and V3 results are already impressive.

V2 produced $503 million in fees since early 2025, with $320 million from Ethereum mainnet and $50 billion in 30-day volume. At a 1/6 split, Ethereum mainnet could generate $53 million protocol revenue for 2025. V3 did even better: $671 million in fees, $381 million from mainnet, $71 billion in monthly volume. With low-fee pools at a 1/4 split and high-fee pools at 1/6, V3 may generate $61 million in protocol revenue this year.

Together, V2 and V3 have generated $114 million in protocol revenue year-to-date, with six weeks left. Crucially, this doesn’t capture Uniswap’s full earning power. It excludes the remaining 20% of V3 pools, non-Ethereum chains (especially Base, which rivals mainnet), V4 volumes, protocol fee auctions, UniswapX, aggregator hooks, and Unichain sequencer revenue. When all sources are included, annualized revenue could easily exceed $130 million.

The plan to burn 100 million UNI (worth over $800 million) will fundamentally reshape Uniswap’s tokenomics. After the burn, fully diluted valuation falls to $7.4 billion, market cap to $5.3 billion. At $130 million annual revenue, Uniswap could buy back and burn 2.5% of circulating supply per year.

This means UNI’s P/E ratio is about 40x—not cheap, but with more growth drivers ahead, it could drop. As one community member notes: “For the first time, UNI actually looks worth holding.”

Still, concerns remain. First, 2025’s trading volume is inflated by the bull market. If conditions worsen, volumes and fee income will shrink. Using bull market data for long-term valuation is misleading.

Second, the specifics of the burn and buyback remain unclear. Will it use Hyperliquid-style automation, or something else? Frequency, price sensitivity, and market impact all matter—poor execution could cause volatility and leave UNI holders exposed.

With rivals like Aerodrome, Curve, Fluid, and Hyperliquid all offering high incentives, Uniswap’s LP cuts could accelerate outflows. Great numbers don’t matter if liquidity—the bedrock—vanishes; projections become meaningless.

The fee switch undeniably supports UNI’s value, but time and the market will determine whether it can truly “save” Uniswap and restore its DeFi dominance.

Disclaimer:

- This article is reprinted from [BlockBeats] with copyright belonging to the original author [律动小工]. For republication objections, please contact the Gate Learn team, who will address your concerns in accordance with relevant procedures as soon as possible.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team and may not be copied, distributed, or plagiarized unless Gate is specifically mentioned.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?