DeFi Risks: Curators as new Brokers

The curator economy

Over the past eighteen months, a new class of financial intermediary has emerged in decentralized finance. These entities call themselves risk curators, vault managers, or strategy operators. They manage billions of dollars in user deposits across protocols like Morpho (approximately $7.3 billion) and Euler (approximately $1.1 billion), setting risk parameters, selecting collateral types, and deploying capital into yield strategies. They collect performance fees ranging from 5% to 15% of generated yields. They operate without licenses, without regulatory oversight, without mandatory disclosure of qualifications or track records, and often without revealing their real identities.

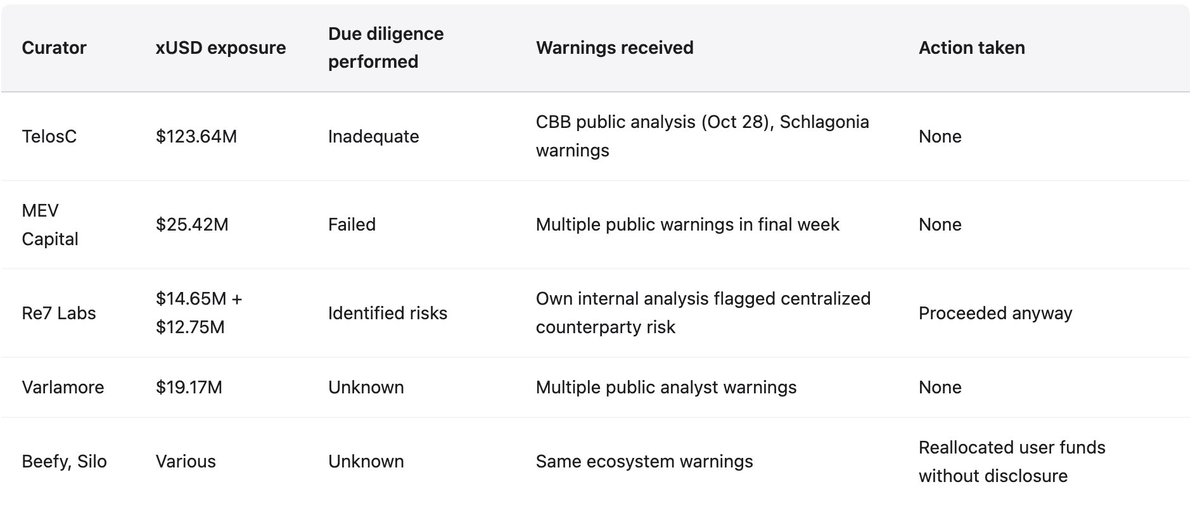

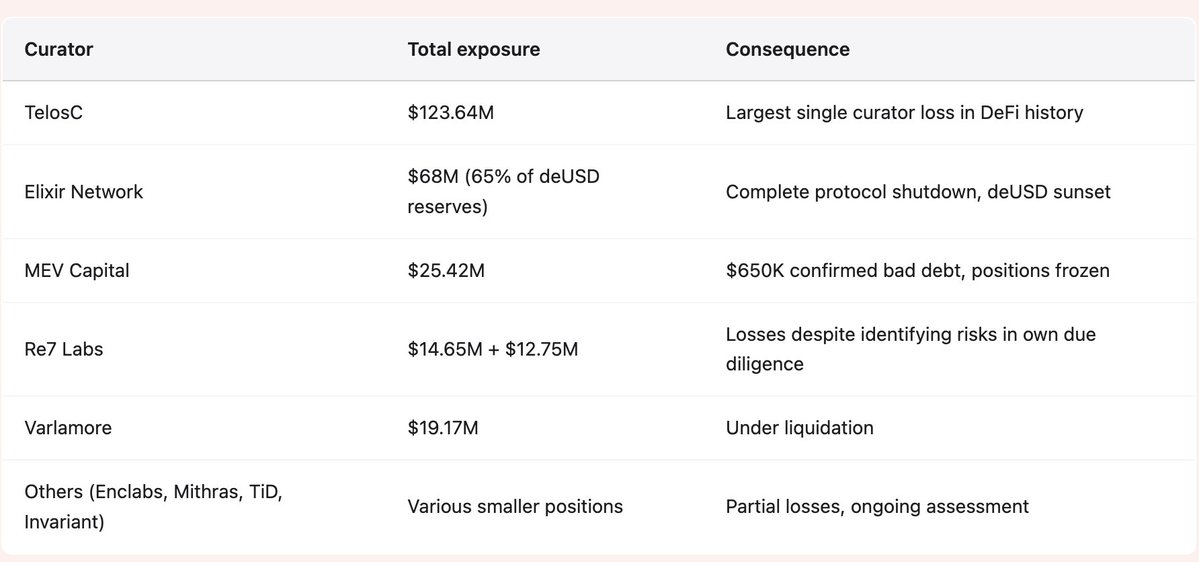

The November 2025 collapse of Stream Finance exposed what this architecture produces when tested. The contagion reached $285 million across the ecosystem. Curators including TelosC ($123.64 million), Elixir ($68 million), MEV Capital ($25.42 million), Re7 Labs ($27.4 million across two vaults), and others had concentrated user deposits into a single counterparty running 7.6x leverage on $1.9 million in real collateral. The warnings were public and specific. CBB published the leverage ratios on October 28. Schlagonia warned Stream directly 172 days before the collapse. The warnings were ignored because the incentive structures reward ignoring them.

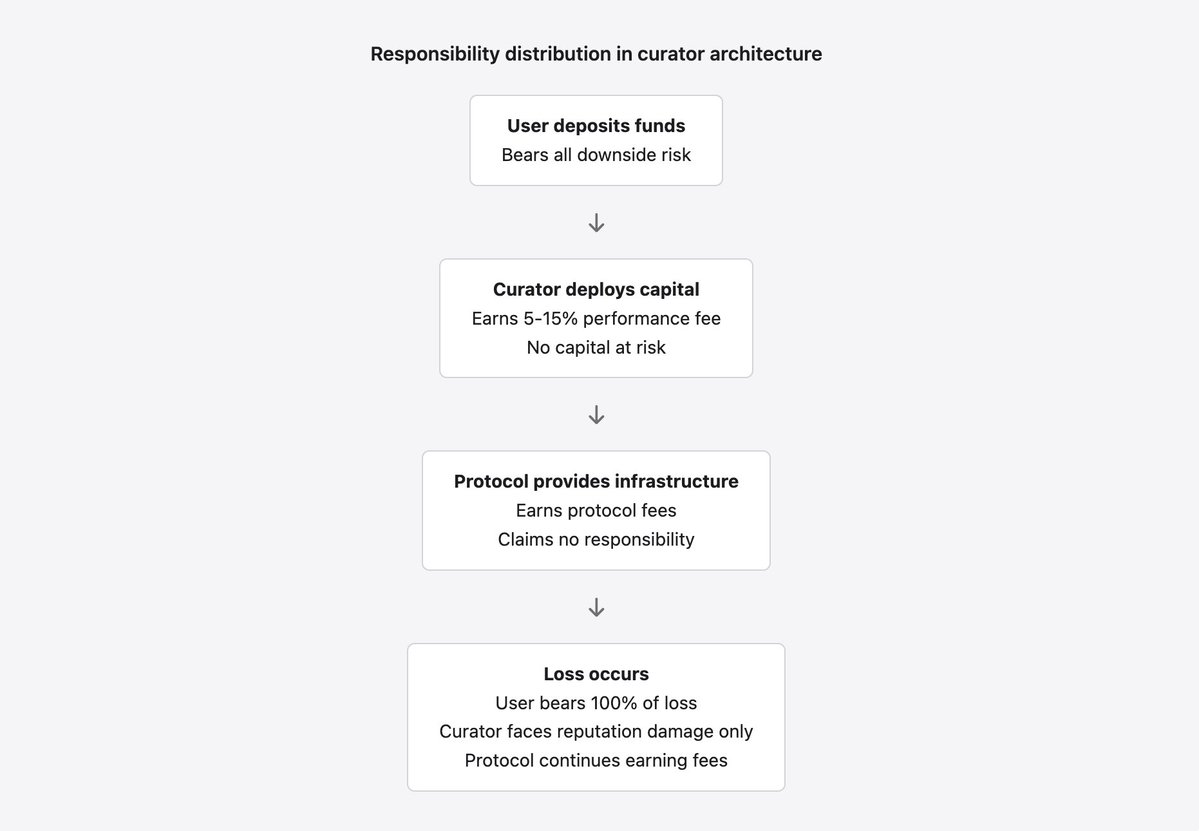

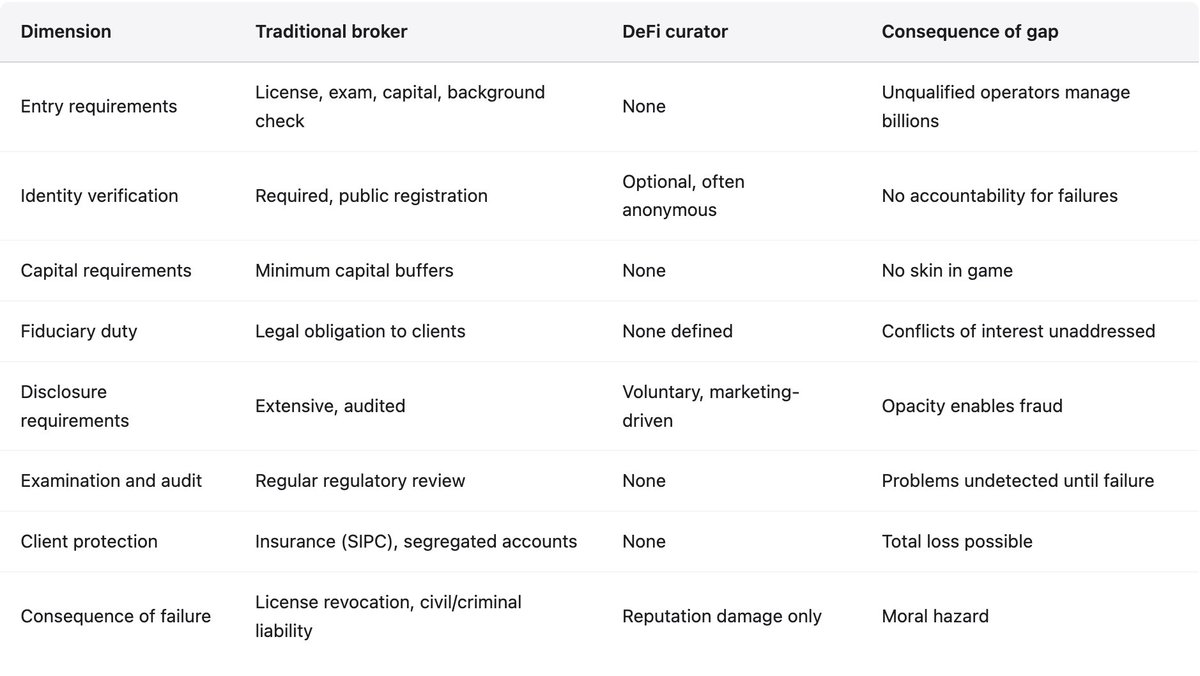

The curator model follows a familiar pattern from traditional finance, but stripped of the accountability mechanisms that developed over centuries of expensive failures. When banks or broker-dealers manage client funds, they face capital requirements, registration obligations, fiduciary duties, and regulatory examination. When DeFi curators manage client funds, they face market incentives only, and market incentives reward asset accumulation and yield maximization above risk management. The protocols that enable curators claim to be neutral infrastructure, earning fees from activity while disclaiming responsibility for the risks that activity creates. This is an untenable position that traditional finance abandoned decades ago after repeated disasters taught the hard lesson that fee-earning intermediaries cannot disclaim all accountability.

Permissionless architecture and its consequences

Morpho and Euler operate as permissionless lending infrastructure. Anyone can create a vault, set risk parameters, select which collateral to accept, and begin attracting deposits. The protocols provide the smart contract infrastructure and earn fees from the resulting activity. This architecture has genuine benefits. Permissionless systems enable innovation by removing gatekeepers who might block new approaches based on unfamiliarity or competitive interest. They provide access to financial services for participants who might be excluded from traditional systems. They create transparent, auditable records of all transactions on-chain.

The architecture also creates fundamental problems that November 2025 made inescapable. Without gatekeeping, there is no quality control on who becomes a curator. Without registration requirements, there is no accountability when curators fail. Without identity disclosure, curators can accumulate losses under one name and restart under another. Without capital requirements, curators have no skin in the game beyond reputation, which is easily discarded. Ernesto Boado, founder of BGD Labs and a contributor to Aave, summarized the problem directly: curators are “selling your brand to gamblers for free.” The protocols get fee revenue and the curators get performance fees. The users get the losses when inevitable failures occur.

The permissionless architecture creates a specific failure mode that Stream Finance exemplified. Because anyone can create a vault, curators compete for deposits by offering higher yields. Higher yields require either genuine alpha (rare and unsustainable at scale) or higher risk (common and catastrophic when realized). Users see “18% APY” and do not investigate the source. They assume someone with the title “risk curator” has done due diligence. The curator sees fee revenue opportunity and accepts risks that prudent risk management would reject. The protocol sees growing TVL and fee revenue and does not intervene because permissionless systems are not supposed to gatekeep.

This competitive dynamic produces a race to the bottom. Curators who manage risk conservatively generate lower yields and attract fewer deposits. Curators who take excessive risk generate higher yields, attract more deposits, earn more fees, and appear successful until the inevitable failure occurs. The market cannot distinguish between sustainable yield and unsustainable risk-taking until the failure happens. By then, the losses are socialized across all participants, and the curator faces no consequence beyond reputation damage that matters little when they can launch again under a new name.

Conflicts of interest and incentive failures

The curator model embeds fundamental conflicts of interest that make failures like Stream Finance predictable. Curators earn fees on assets under management and performance. This creates direct incentive to maximize deposits and yield, regardless of the risk required to achieve those numbers. Users want safety and reasonable returns. Curators want fee revenue. These incentives diverge precisely when the divergence is most dangerous, during periods when yield opportunities require accepting risks that users would reject if they understood them.

The RE7 Labs case is instructive because they documented their own failure mode. Before launching xUSD integration, their due diligence identified “centralized counterparty risk” as a concern. This was correct analysis. Stream had concentrated risk in an anonymous external fund manager with zero transparency about positions or strategies. RE7 Labs understood this risk and proceeded to integrate xUSD anyway, citing “significant user and network demand.” The fee revenue opportunity outweighed the risk to user funds. When those funds were lost, RE7 Labs faced reputation damage but no financial consequence. The users bore 100% of the loss.

This incentive structure is worse than misalignment. It actively punishes prudent behavior. A curator who refuses a high-yield opportunity because of excessive risk loses deposits to competitors who accept that risk. The prudent curator earns lower fees and appears to be underperforming. The reckless curator earns higher fees and attracts more deposits until the failure occurs. In the interim, the reckless curator accumulates substantial fee revenue that they keep regardless of subsequent losses to users. Multiple curators and vault managers reallocated user funds into xUSD positions without transparent disclosure, leaving depositors unknowingly exposed to Stream’s recursive leverage and off-chain opacity. Users deposited into vaults marketed for conservative yield strategies and found their capital concentrated in a counterparty running 7.6x leverage.

Curator fee structures typically involve performance fees on yields generated, ranging from 5% to 15%. This sounds reasonable until you examine the asymmetry. Curators capture a percentage of upside returns with no corresponding exposure to downside losses. They have strong incentive to maximize yield and weak incentive to minimize risk. Consider a vault with $100 million in deposits earning 10% yield. The curator earns $1 million in performance fees (at 10% of yield). If the curator takes double the risk to earn 20% yield, they earn $2 million. If the risk materializes and users lose 50% of principal, the curator loses future fee revenue from that vault but keeps all fees already earned. The users lose $50 million. This is heads-I-win-tails-you-lose economics.

The protocols themselves have conflicts of interest in how they handle curator failures. Morpho and Euler earn fees from vault activity. They have financial incentive to maximize that activity, which means maximizing deposits, which means allowing high-yield vaults that attract deposits even when those vaults take excessive risk. The protocols claim neutrality, arguing that permissionless systems should not gatekeep. But they are not neutral. They earn revenue from the activity they enable. Traditional financial regulation recognized this problem centuries ago. Entities that profit from intermediation cannot disclaim all responsibility for the risks that intermediation creates. The broker who earns commissions has some obligation to the clients whose orders generate those commissions. DeFi protocols have not yet accepted this principle.

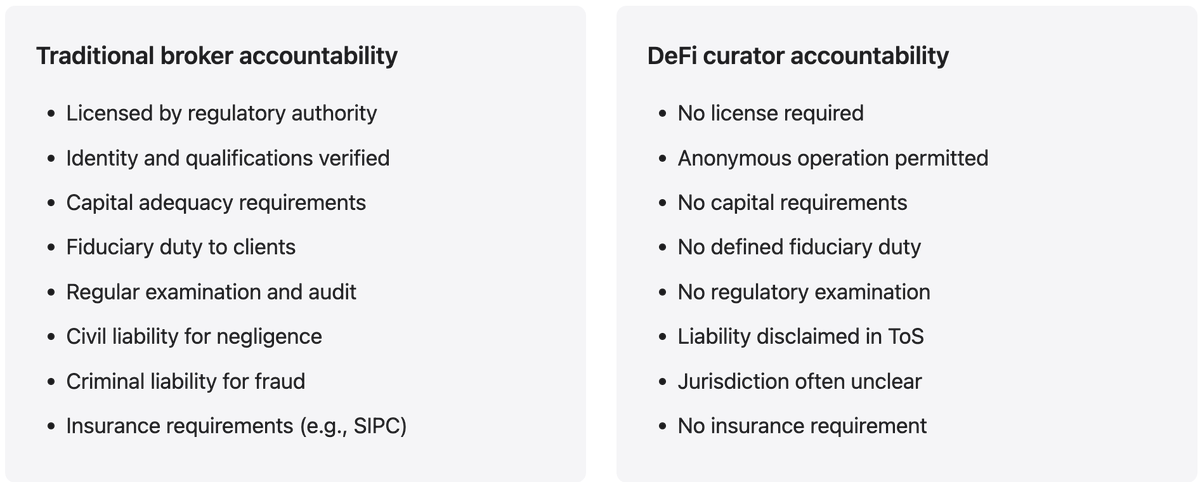

The accountability vacuum

When traditional brokers or asset managers lose client funds, the consequences include regulatory investigation, potential license revocation, civil liability for breach of fiduciary duty, and in cases of fraud or gross negligence, criminal prosecution. These consequences create ex ante incentives for prudent behavior. Managers who might take excessive risk for personal gain understand that the personal consequences of failure are severe. This does not prevent all failures, but it substantially reduces reckless behavior compared to a system with no accountability.

When DeFi curators lose client funds, they face reputation damage and nothing else. They have no licenses to revoke. They face no regulatory investigation because no regulator has jurisdiction. They have no fiduciary duty because the legal status of the curator-depositor relationship is undefined. They face no civil liability because their identities are often unknown and because the terms of service for most DeFi protocols explicitly disclaim liability. They can accumulate losses, shut down the vault, and launch again under a new name with a new vault on the same protocol.

The March 2024 incident on Morpho illustrates how the accountability vacuum operates in practice. A Morpho vault using Chainlink oracles experienced a loss of approximately $33,000 due to oracle price deviation. When users sought recourse, they encountered systematic deflection. Morpho stated it was merely infrastructure that did not control vault parameters. The vault curator stated they were only operating within protocol guidelines. Chainlink stated the oracle performed within specification. No entity accepted responsibility. No user received compensation. The incident was small enough that it did not trigger broader market consequences, but it established the precedent that when losses occur, no one is accountable.

This accountability vacuum is by design rather than oversight. Protocols explicitly structure themselves to avoid responsibility. Terms of service disclaim liability. Documentation emphasizes that protocols are permissionless infrastructure that does not control user behavior. Legal structures place protocol governance in foundations or DAOs in jurisdictions chosen for regulatory distance. All of this is legally rational from the protocol perspective, but it creates a system where billions of dollars in user funds are managed by entities with no meaningful accountability for how those funds are managed. The economic term for this is moral hazard. When entities bear no consequence for failure, they take excessive risk because the potential gains accrue to them while the losses are socialized to others.

Identity disclosure and accountability

Many curators operate pseudonymously or anonymously. This is sometimes justified on grounds of personal security or privacy, but it has direct consequences for accountability. When curators cannot be identified, they cannot be held legally responsible for negligence or fraud. They cannot be excluded from operating if they accumulate a record of failures. They cannot be subject to professional sanctions or reputational consequences that follow real identities across ventures. Anonymous operation eliminates the principal accountability mechanism that exists in the absence of regulation. In traditional finance, even absent regulatory enforcement, managers who destroy client funds face civil liability and reputation consequences that follow their real identities. In DeFi, they face neither.

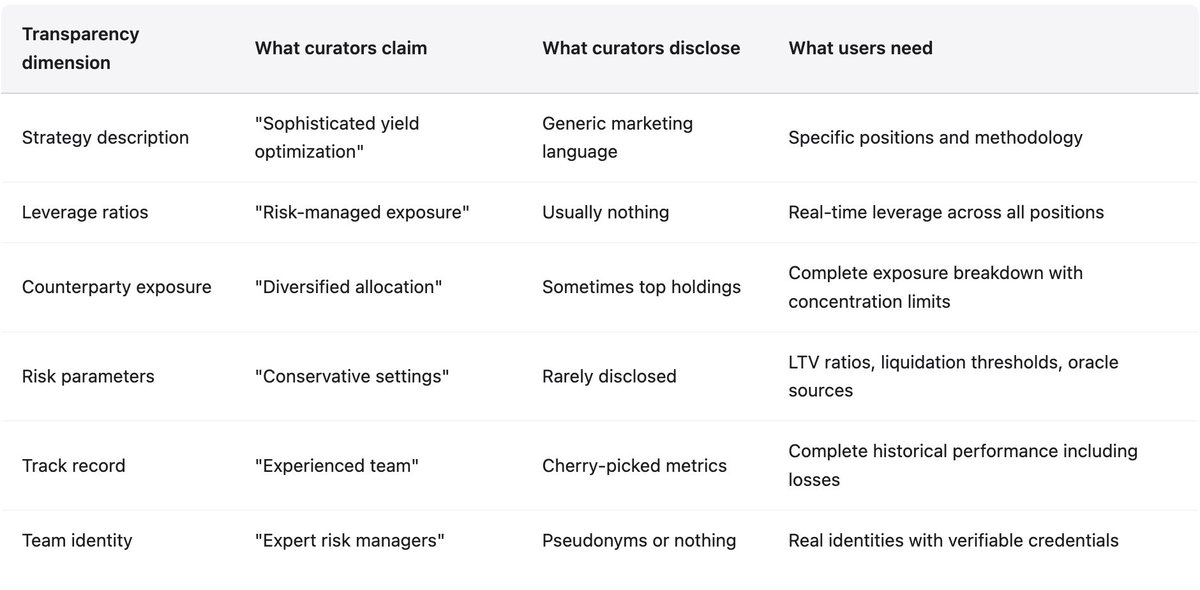

Black box strategies and the myth of expertise

Curators present themselves as risk management experts who select safe assets, set appropriate parameters, and deploy capital wisely. The marketing language emphasizes expertise, sophisticated analysis, and careful risk management. The reality, as November 2025 demonstrated, is that many curators lack the infrastructure, expertise, or even the intention to manage risk appropriately. Traditional financial institutions typically allocate 1-5% of their workforce to risk management functions, with independent risk committees, dedicated oversight teams, stress testing capabilities, and regulatory requirements for scenario analysis. DeFi curators are often small teams or individuals focused primarily on yield generation and asset accumulation.

The strategies themselves are rarely disclosed in meaningful detail. Curators use terms like “delta-neutral trading,” “hedged market making,” or “optimized yield farming” that sound sophisticated but provide no insight into actual positions, leverage ratios, counterparty exposures, or risk parameters. This opacity is sometimes justified on grounds of protecting proprietary strategies from front-running or competition. But users have legitimate need to understand the risks they are taking with their capital. Opacity is not a feature. It is a bug that enables fraud and recklessness to persist until failure forces discovery.

Stream Finance exemplified this opacity problem at catastrophic scale. They claimed $500 million TVL while only $200 million was verifiable on-chain. The remaining $300 million supposedly existed in off-chain positions managed by “external fund managers” whose identities, qualifications, strategies, and risk management processes were never disclosed. Stream used terms like “delta-neutral trading” and “hedged market making” without ever explaining what specific positions these involved or what the actual leverage ratios were. When Schlagonia’s post-collapse analysis revealed the recursive lending structure creating 7.6x synthetic expansion from $1.9 million real collateral, this came as a complete surprise to depositors. They had no way to know that their “stablecoin” was backed by an infinite recursion of borrowed assets rather than actual reserves.

The myth of expertise is particularly dangerous because it encourages users to suspend their own judgment. When someone with the title “risk curator” accepts a high-yield opportunity, users assume due diligence has been performed. In reality, the RE7 Labs case shows that due diligence often identifies risks that are then ignored. Their own analysis flagged Stream’s centralized counterparty risk before they integrated xUSD. They proceeded anyway because user demand and fee revenue outweighed the identified risk. The expertise existed. It was applied. It reached the correct conclusion. And it was overridden by commercial incentives. This is worse than incompetence because it reveals that even when curators have the capability to identify risks, the incentive structure causes them to ignore what they find.

Proof of reserves: technically feasible, rarely implemented

Cryptographic techniques for verifiable proof of reserves have existed for decades. Merkle trees can prove solvency without revealing individual account details. Zero-knowledge proofs can demonstrate reserve ratios without exposing trading strategies. These technologies are mature, well-understood, and computationally efficient. Stream Finance’s failure to implement any form of proof of reserves was not a technical limitation. It was a deliberate choice to operate in opacity that enabled the fraud to persist for months after multiple public warnings. Protocols should require proof of reserves from all curators managing deposits above threshold amounts. The absence of proof of reserves should be treated as equivalent to a bank refusing external audit.

Evidence from November 2025

The Stream Finance collapse provides a complete case study in how the curator model fails. The sequence of events demonstrates every problem with the current architecture: inadequate due diligence, conflicts of interest, ignored warnings, opacity, and the absence of accountability. Understanding this case in detail is necessary for understanding why systemic changes are required.

Timeline of failure

Yearn Finance developer Schlagonia examined Stream’s positions 172 days before the collapse and warned the team directly that the structure would inevitably fail. Five minutes of analysis was sufficient to identify fatal problems. Stream had $170 million in verifiable on-chain collateral supporting $530 million in borrowing across various DeFi protocols, representing 4.1x leverage. The strategy involved recursive lending where Stream borrowed against deUSD to mint more xUSD, creating circular dependencies that guaranteed both assets would collapse together. The remaining $330 million of claimed TVL existed entirely off-chain with anonymous external managers.

On October 28, 2025, industry analyst CBB published specific warnings with on-chain data: “xUSD has ~$170M backing it on-chain. They’re borrowing ~$530M from lending protocols. That’s 4.1x leverage. On many illiquid positions. This isn’t yield farming. This is degen gambling.” These warnings were public, specific, and accurate. They identified the leverage ratios, the illiquidity risk, and the fundamental recklessness of the structure. Multiple other analysts amplified these warnings over the following week.

Despite weeks of public warnings from credible analysts with detailed on-chain evidence, curators continued holding positions and attracting new deposits. TelosC maintained $123.64 million in exposure. MEV Capital maintained $25.42 million. Re7 Labs maintained $27.4 million across two vaults. The warnings were ignored because acting on them would mean reducing positions, which would reduce fee revenue, which would make the curators appear to be underperforming compared to those who stayed in.

On November 4, Stream announced that an external fund manager had lost approximately $93 million in fund assets. Withdrawals were immediately suspended. Within hours, xUSD crashed 77% from $1.00 to $0.23 on secondary markets. Elixir’s deUSD, which had concentrated 65% of its reserves in loans to Stream, collapsed 98% from $1.00 to $0.015 within 48 hours. Total contagion exposure reached $285 million across the ecosystem. Euler faced approximately $137 million in bad debt. Over $160 million was frozen across various protocols.

Curators versus traditional brokers

The comparison between DeFi curators and traditional brokers is instructive because it illustrates what accountability mechanisms the curator model lacks. This is not an argument that traditional finance is ideal or that its regulatory structure should be copied directly. Traditional finance has its own failures, costs, and exclusions. But it has developed accountability mechanisms through centuries of expensive lessons that the curator model explicitly abandons.

Technical recommendations

The curator model has genuine benefits. It enables capital efficiency by allowing specialized parties to set risk parameters rather than requiring one-size-fits-all protocol defaults. It enables innovation by allowing experimentation with different strategies and risk frameworks. It enables access by removing gatekeepers who might exclude participants based on size, geography, or unfamiliarity. These benefits can be preserved while addressing the accountability problems that November 2025 exposed. The following recommendations are based on empirical evidence from five years of DeFi failures.

Mandatory identity disclosure

Curators managing deposits above threshold amounts (suggest $10 million) should be required to disclose their real identities to a registry maintained by the protocol or an independent party. This does not require public disclosure of home addresses or personal details. It requires that curators can be identified and held accountable if they commit fraud or gross negligence. Anonymous operation is incompatible with managing other people’s money at scale. The privacy arguments that justify pseudonymous operation in DeFi generally do not apply to entities earning fees from managing client funds.

Capital requirements

Curators should be required to maintain capital at risk that is lost if their vaults suffer losses beyond specified thresholds. This aligns incentives by giving curators skin in the game. The specific structure could involve curators posting collateral that is slashed if vault losses exceed 5% of deposits, or requiring curators to hold junior tranches in their own vaults that absorb first losses. The current structure where curators earn fees with no capital at risk creates moral hazard that capital requirements would address.

Mandatory disclosure

Curators should be required to disclose strategies, leverage ratios, counterparty exposures, and risk parameters in standardized formats that allow comparison and analysis. The argument that disclosure compromises proprietary strategies is largely pretextual. Most curator strategies are variations on well-known yield farming techniques. Real-time disclosure of leverage ratios and concentration levels would not compromise alpha. It would enable users to understand what risks they are taking.

Proof of reserves

Protocols should require proof of reserves from all curators managing deposits above threshold amounts. Cryptographic techniques for verifiable proof of reserves are mature and efficient. Merkle tree proofs can demonstrate solvency without revealing individual positions. Zero-knowledge proofs can verify reserve ratios without exposing trading strategies. The absence of proof of reserves should disqualify curators from managing deposits. This would have prevented Stream Finance from operating with $300 million in unverifiable off-chain positions.

Concentration limits

Protocols should enforce concentration limits that prevent curators from allocating excessive percentages of vault deposits to single counterparties. Elixir had 65% of deUSD reserves ($68 million of $105 million) lent to Stream through private Morpho vaults. This concentration guaranteed that Stream’s failure would destroy Elixir. Concentration limits of 10-20% maximum exposure to any single counterparty would prevent this failure mode. These limits should be enforced at the smart contract level so they cannot be circumvented.

Protocol accountability

Protocols that earn fees from curator activity should accept some responsibility for the risks that activity creates. This could involve insurance funds contributed from protocol fees that compensate users for curator failures, or curation of curator lists that excludes entities with poor track records or inadequate disclosure. The current model where protocols earn fees while disclaiming all responsibility is economically incoherent. Fee-earning intermediaries have accountability obligations.

To conclude

The curator model as currently implemented represents an accountability vacuum where billions of dollars in user funds are managed by entities with no meaningful constraints on their behavior and no meaningful consequences for failure. This is not an argument against the model itself. Capital efficiency and specialized risk management have genuine benefits. This is an argument that the model requires accountability mechanisms that traditional finance developed over centuries of expensive lessons. DeFi can develop its own mechanisms appropriate to its unique characteristics, but it cannot simply abandon accountability and expect different outcomes than traditional finance experienced before accountability mechanisms were developed. The current structure guarantees recurring failures. The failures will continue until the industry accepts that fee-earning intermediaries cannot disclaim all responsibility for the risks they create.

Disclaimer:

- This article is reprinted from [yq_acc]. All copyrights belong to the original author [yq_acc]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

Dive into Hyperliquid

What is Stablecoin?

What Is a Yield Aggregator?