Bitcoin Price Prediction: Galaxy Cuts BTC Forecast to $120,000

Galaxy Revises Bitcoin Forecast Down to $120,000

Investment firm Galaxy has recently revised its 2025 Bitcoin (BTC) price forecast, lowering the target from $185,000 to $120,000. Galaxy attributes the adjustment to multiple market headwinds and ongoing structural changes.

Alex Thorn, Galaxy’s Head of Research, explained that although Bitcoin’s long-term fundamentals remain strong, evolving capital structures are actively reshaping market dynamics. Thorn calls this stage the “Mature Era” for Bitcoin—a new stage marked by rising institutional participation and market dominance by ETFs and passive capital flows, which have significantly reduced volatility. He added, “If BTC can hold above $100,000, we believe the nearly three-year bull market remains structurally sound, but future rallies will likely be more moderate.”

October Flash Crash Deepens Market Uncertainty

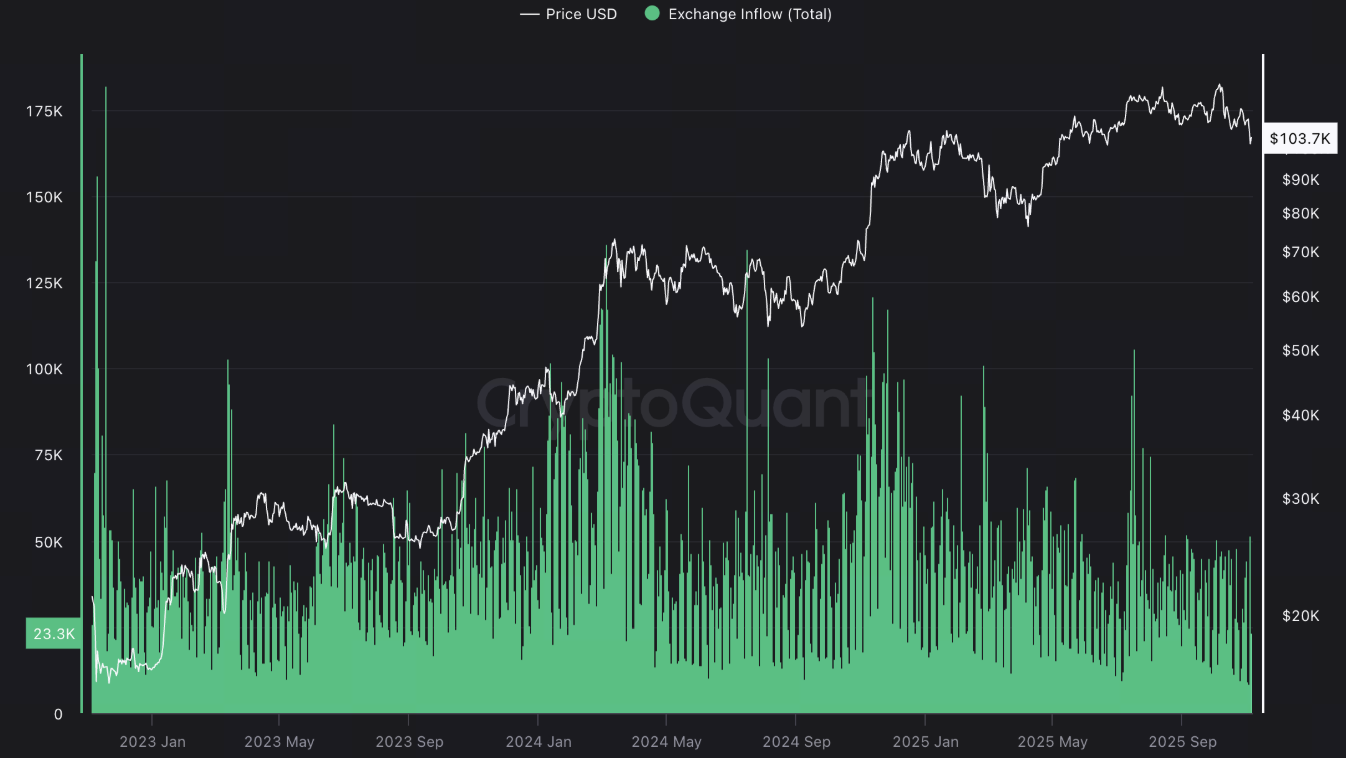

CryptoQuant data indicates that over 400,000 BTC flowed into exchanges in October—a multi-year high—suggesting a surge in holders moving assets onto trading platforms, thereby increasing potential sell-side pressure.

(Source: CryptoQuant)

Thorn highlighted that the flash crash marked a pivotal turning point. Approximately $2 billion in leveraged positions were liquidated in a single day—setting a record for the largest one-day liquidation in crypto market history and directly disrupting the bullish trend. He added that capital has rotated into alternative assets such as gold, AI, and stablecoins, further diverting attention from Bitcoin and weakening its upward momentum.

Rising Market Panic

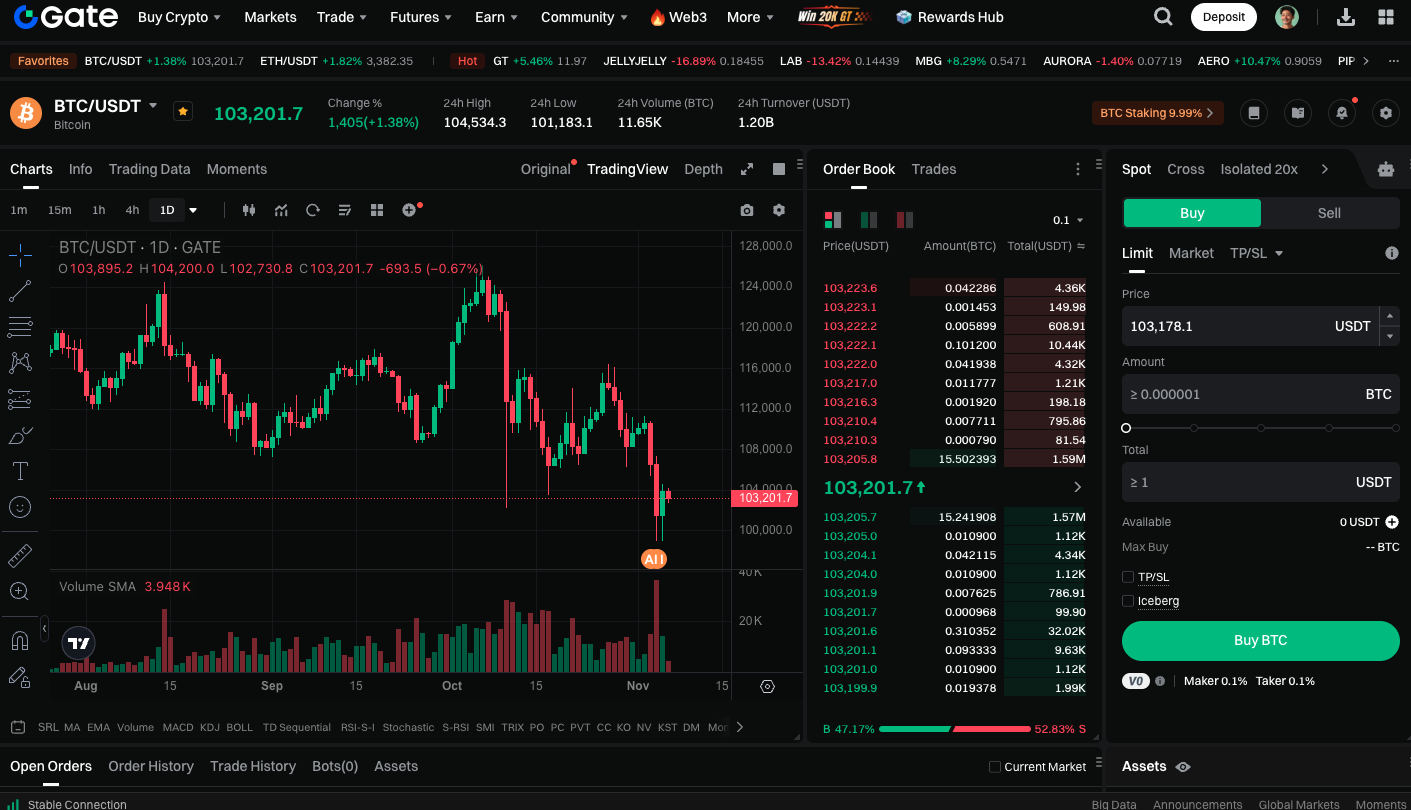

Market sentiment shifted to panic starting Tuesday, with around $1.3 billion in leveraged positions liquidated, causing BTC to dip below $100,000 for the first time in four months. Since the mid-year peak of $126,000, Bitcoin has pulled back by more than 20%. Some investors interpret this as a bear market signal; however, many traders view the drop as a healthy correction.

Long-Term Outlook Remains Bullish

Despite Galaxy’s lowered price forecast, Thorn emphasized that this does not signal the end of Bitcoin’s long-term upward trajectory. He pointed out that increased involvement from ETFs and institutional capital is strengthening market structure, and declining volatility reflects a maturing marketplace.

Trade BTC spot now: https://www.gate.com/trade/BTC_USDT

Summary

Galaxy’s latest report reveals a fundamental shift in the nature of the Bitcoin market. In the short term, investors should closely monitor whether the $100,000 psychological support level holds. If it does, the bullish market structure is likely to remain intact.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article