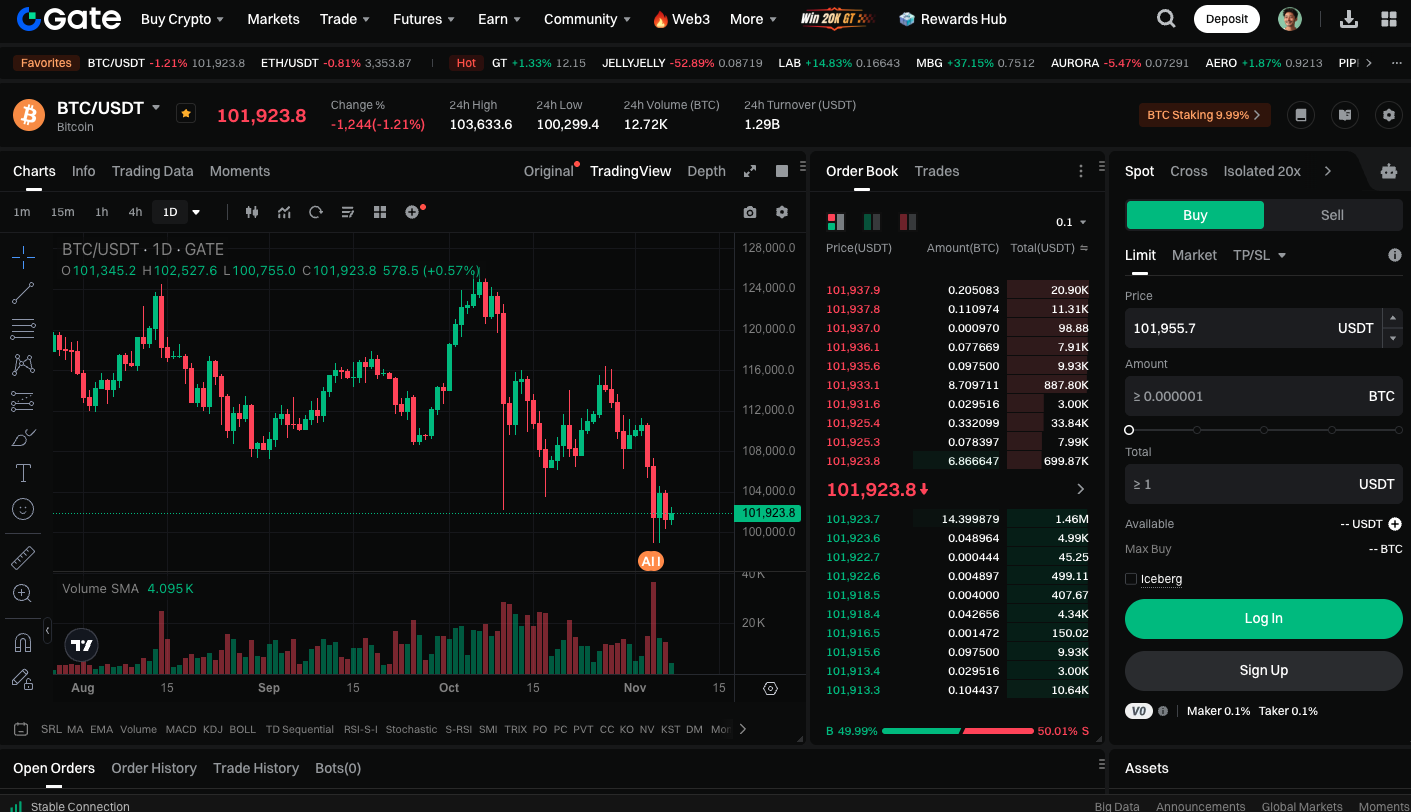

Bitcoin Price Prediction: BTC Drops Below Key Cost Basis, May Retest $88,500 Support Zone

Preface

Recent on-chain data suggest that Bitcoin (BTC) may experience further downside risk. According to the latest report from on-chain analytics firm Glassnode, Bitcoin’s current trading price is well below the Realized Price for short-term holders (STH), signaling a possible weakening of market sentiment and structural support.

Short-Term Holder Realized Price Breach: A Warning Signal

Realized Price is a critical concept in on-chain analysis. It represents the average cost basis for all investors across the network, effectively the benchmark cost per BTC. When the market price drops below this level, most investors are underwater, resulting in increased selling pressure and increased market uncertainty.

Glassnode data shows the current Realized Price for short-term holders—those who purchased within the past 155 days—is approximately $112,500. Bitcoin has recently traded well below this threshold, leaving this cohort mostly experiencing losses and significant psychological stress.

(Source: Glassnode)

Historically, when BTC falls below the short-term holder Realized Price and trades at a notable discount, this often precedes further declines. Prices may move toward deeper support levels.

Next Potential Support Level

Glassnode highlights another crucial support metric observed in multiple correction cycles: Active Realized Price. This represents the average cost of the economically active supply of Bitcoin in the market, excluding coins that have remained unmoved for extended periods and are likely lost—assets that no longer affect current liquidity.

Currently, Active Realized Price sits around $88,500. Historically, this zone has repeatedly served as a key inflection point for stabilization and rebound during bear markets and major corrections. If the market remains weak, BTC may approach this support area in search of a new price equilibrium.

Trade BTC spot now: https://www.gate.com/trade/BTC_USDT

Conclusion

The current price of BTC is approximately $102,000, and it may remain volatile in the near term. If the market does not quickly recover to the short-term holder price range (around $112,500), the probability of a retest of $88,500 remains significant. For long-term investors, interim corrections may present buying opportunities. Historically, recoveries after Bitcoin drops below key price levels have often signaled the beginning of a new upward cycle.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article