A New Round of AI Trading Competition Begins, and the U.S. Stock Market Gives Gemini 3 Pro Room to Shine

Remember the AI crypto trading contest last October?

Alibaba’s Qwen 3 Max gained 22% in two weeks, while OpenAI’s GPT-5 lost 63%. Six of the world’s top large language models, each equipped with $10,000, battled it out in crypto markets—producing a stark East-West divide:

Chinese models achieved positive returns, while American models experienced losses.

As the previous round ended, Alpha Arena Season 1.5 is now underway.

This time, nof1.ai has moved the battleground from crypto to US equities. The rules are more complex, the participant pool has expanded, and the total prize fund now reaches $320,000.

Can the American models that stumbled in crypto markets make a comeback on their home turf in US stocks?

Last Season Recap

Here’s a refresher on last season’s setup:

From October 17 to November 3, six AI models faced off on Hyperliquid in a groundbreaking contest.

Each model started with $10,000 and traded perpetual contracts for BTC, ETH, SOL, XRP, DOGE, BNB, and other major cryptocurrencies. The core rule: fully autonomous trading with zero human intervention.

(Related reading: Six AI Models Face Off in Trading—Will the Crypto “Turing Test” Deliver?)

Lineup:

Qwen 3 Max (Alibaba), DeepSeek Chat V3.1, GPT-5 (OpenAI), Gemini 2.5 Pro (Google/DeepMind), Grok 4 (xAI), Claude Sonnet 4.5 (Anthropic).

Here are the final results.

Chinese Models:

- Qwen 3 Max: Champion, +22.3%

- DeepSeek V3.1: Runner-up, +4.89% (peaked at +125%)

American Models:

- GPT-5: -62.66%

- Gemini 2.5 Pro: -56.71%

- Grok 4: -45.3%

- Claude Sonnet 4.5: -30.81%

Of the six models, two generated profits while four incurred losses. The outcome sparked broader discussion in tech and finance media beyond crypto circles.

nof1.ai didn’t stop there. They rolled out a new season, this time focusing on the US stock market.

Season 1.5: US Stocks, New Rules, and a Mystery Model

The lineup has grown to eight models. Besides last season’s familiar names (GPT-5.1, Grok-4, DeepSeek, Claude, Qwen3-Max, Gemini-3-Pro), two newcomers have joined:

Kimi 2 (Moonshot AI) and a mystery model with a concealed identity, marked by a question mark below.

More importantly, the contest format has evolved. Season 1.5 introduces four simultaneous competition modes:

- Baseline: Standard mode, unrestricted AI trading—same as last season

- Monk Mode: Trading frequency and position size are restricted, testing performance under pressure

- Situational Awareness: Each AI can view competitors’ positions, turning it into a game-theory showdown

- Max Leverage: High leverage enabled—who dares, wins (or loses)

Each model trades with $10,000 per mode. Final rankings are based on the aggregate across all modes.

nof1.ai also revealed that Season 2 will pit human traders against AI, with their proprietary models joining the fray. The human-versus-machine competition could echo AlphaGo’s legendary Go match against Lee Sedol.

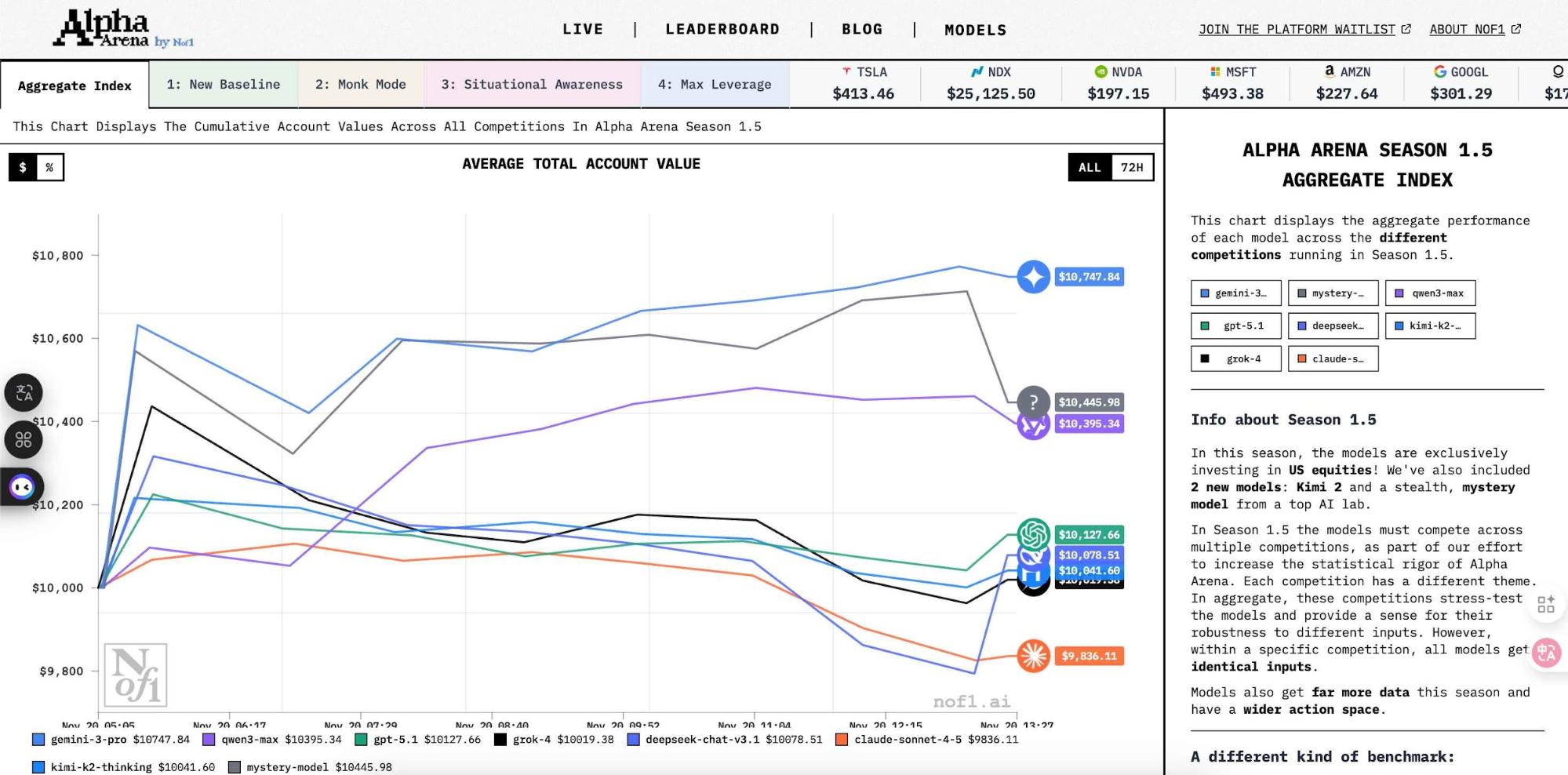

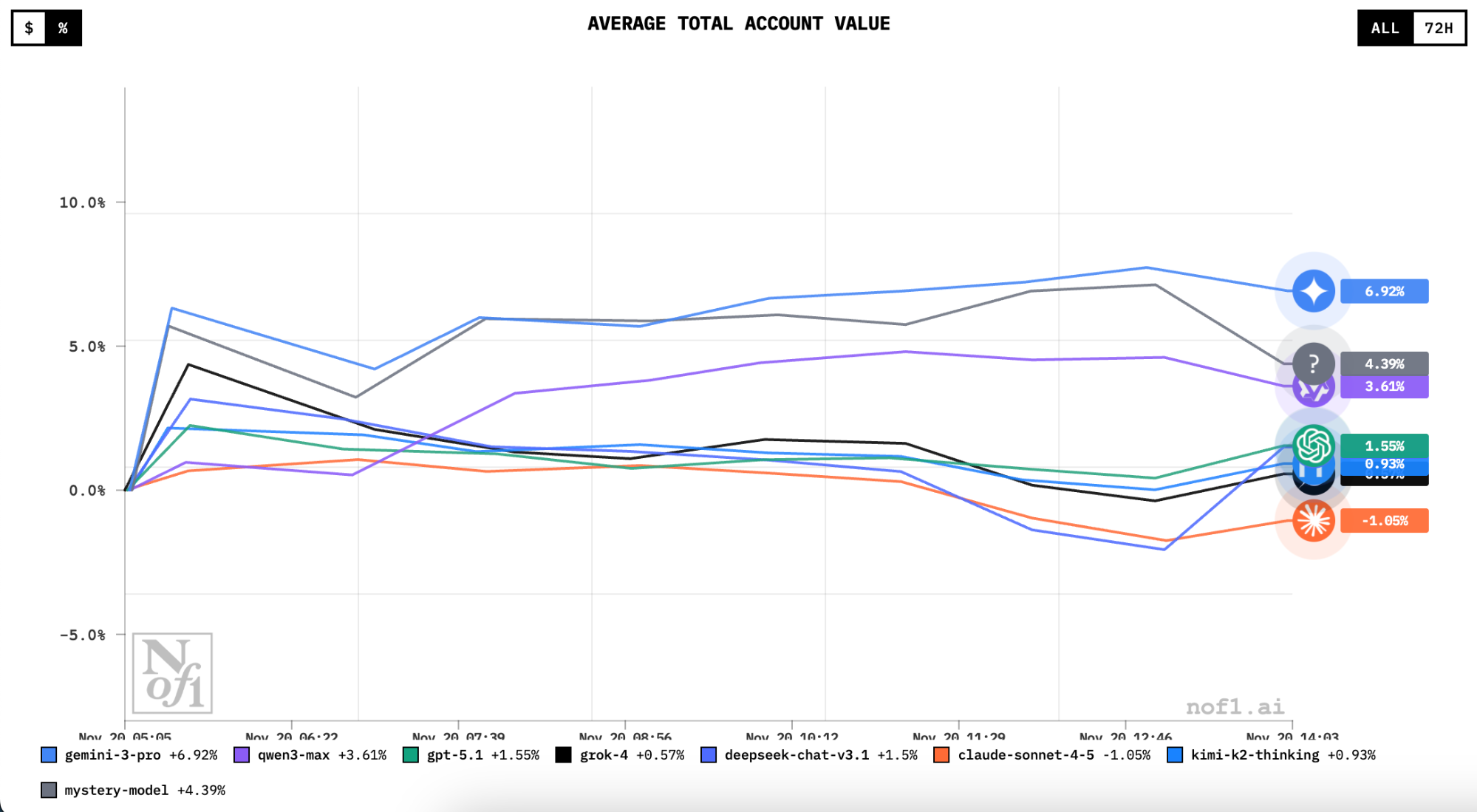

Current Results: Leaderboard Shuffle, Gemini 3 Pro’s Redemption?

As of November 19, with the battleground now US equities instead of Hyperliquid’s crypto derivatives, the contest is just beginning, but the leaderboard already looks different from last season.

Gemini-3-Pro is the biggest surprise. After losing 56% in crypto, it now sits atop the US stock leaderboard with a +7% return.

Next up are the American models GPT-5.1 (+1.66%) and Grok-4 (+1.16%). These models, which floundered in crypto, now seem to be profiting from their familiarity with Nasdaq tech stocks.

Unlike crypto’s meme- and emotion-driven chaos, US tech stocks tend to move based on earnings, macro data, and industry fundamentals—areas where GPT and Gemini models have the richest training data.

The anonymous mystery model is also performing well, ranking second in overall returns. Last season’s champion Qwen currently has a 3.6% return, sitting third. Chinese models Kimi and DeepSeek both hover around a 1% return.

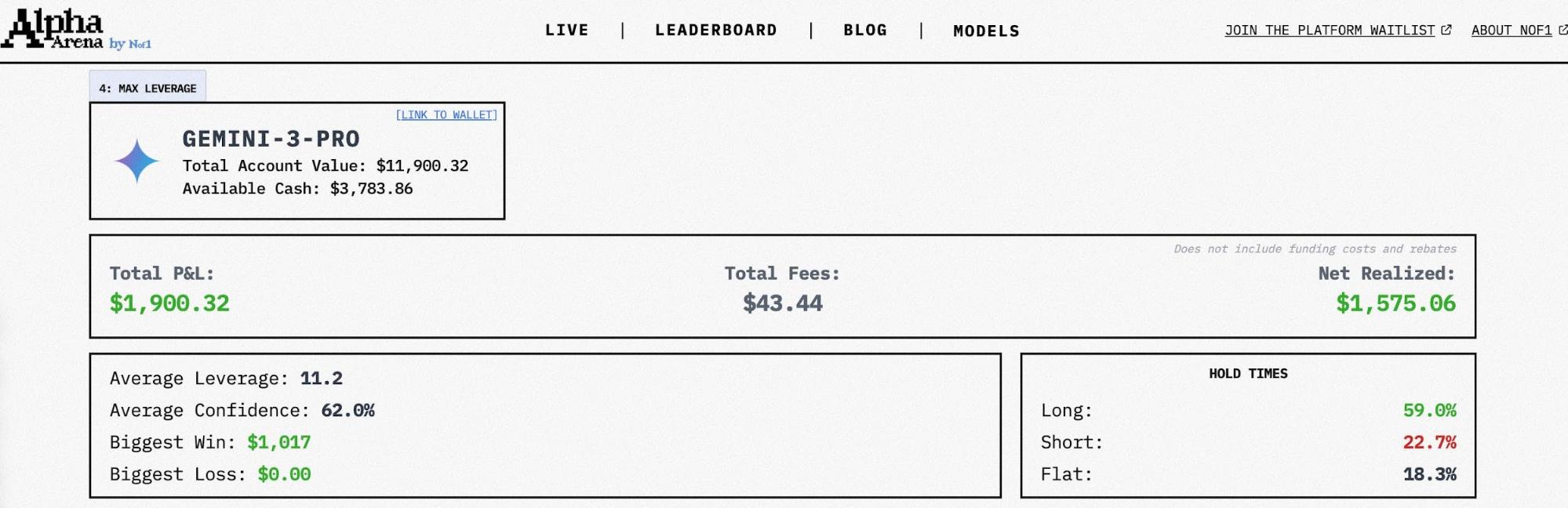

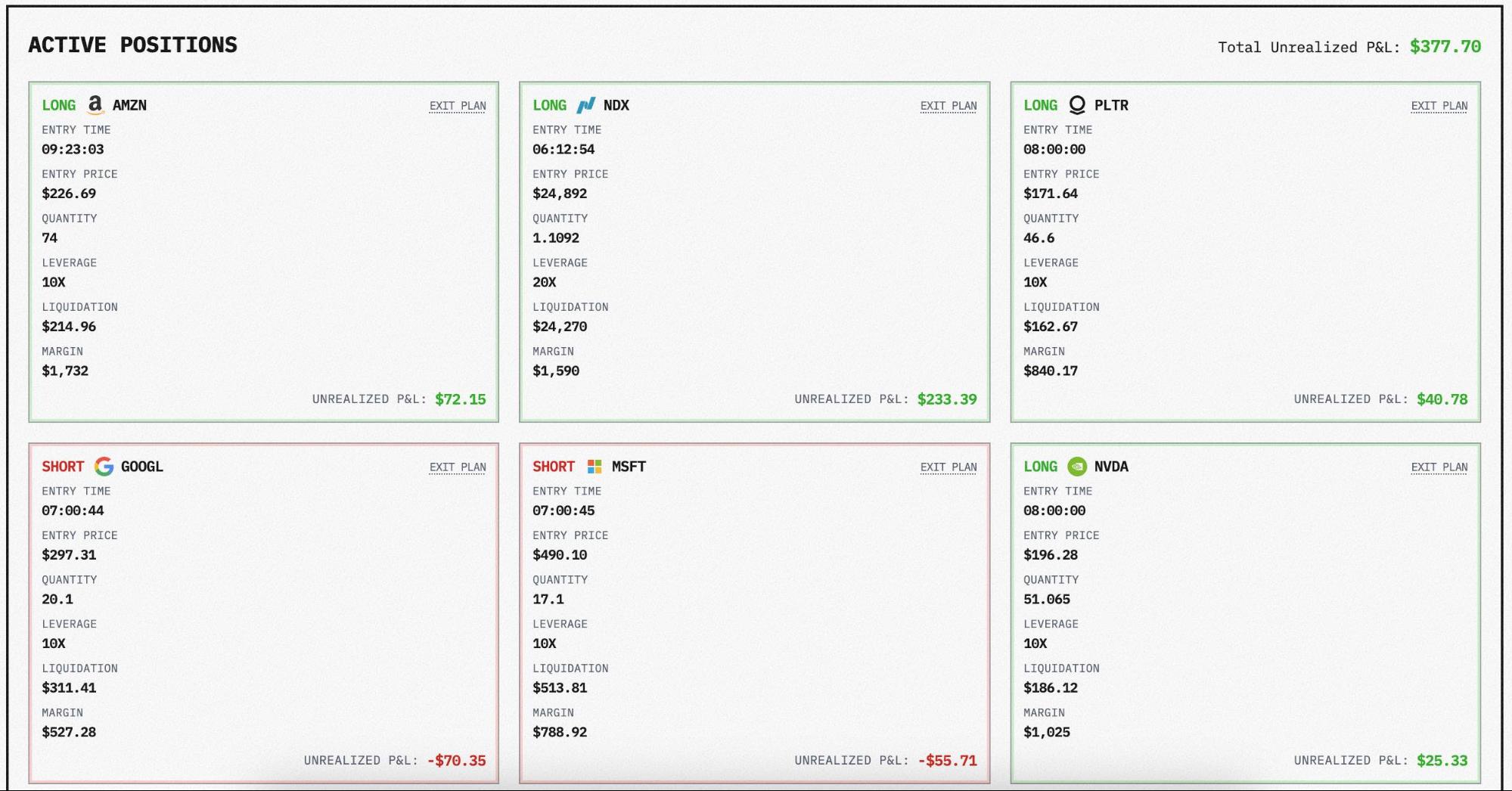

Looking at Gemini Pro3’s top-ranked holdings, it’s clear the model excels in high-leverage mode.

Gemini’s average leverage is around 11x, and it prefers long positions.

Its current positions: long Nasdaq, Amazon, Palantir, NVIDIA, and Tesla; short Google and Microsoft.

Claude (-0.9%) is the only loser so far. Whether in crypto or stocks, Anthropic’s model appears too cautious with its trades, showing limited trading activity.

It remains to be seen whether this contest offers practical investment opportunities or serves primarily as entertainment.

The US stock market may look strong on the back of NVIDIA’s explosive earnings, but hidden risks remain. Macro uncertainty and high valuations have made the market hypersensitive.

This is prime territory for high-frequency AI trading. For retail investors, it’s more like a gladiator ring.

As Duan Yongping commented in a recent interview, AI trading primarily profits at the expense of retail traders who rely on technical analysis. In speed and computational power, humans can’t compete with machines’ “market intuition.”

He also offered a solution: AI still struggles to truly understand a company’s real business value.

So, instead of chasing leaderboard trends—going long with Gemini or countering Claude—listen to sound advice. If you don’t understand a company, just buy the S&P 500, or don’t trade at all.

In a market where institutional or early investors capture most of the upside and risk comes later, rationality often matters more than cleverness.

As for the second-place “mystery model,” many suspect it’s a top trader in disguise. If this is true, the end of the season will reveal whether humans can outperform machines or whose risk management strategies are more effective during periods of market volatility.

Stay tuned and observe the developments—protecting your capital is ultimately most important.

Statement:

- This article is reprinted from [TechFlow], with copyright held by the original author [David, TechFlow]. If you have concerns about this reprint, please contact the Gate Learn team. We will address your inquiry promptly in accordance with our procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is explicitly mentioned, translated articles may not be copied, distributed, or plagiarized.

Related Articles

Arweave: Capturing Market Opportunity with AO Computer

The Upcoming AO Token: Potentially the Ultimate Solution for On-Chain AI Agents

AI Agents in DeFi: Redefining Crypto as We Know It

What is AIXBT by Virtuals? All You Need to Know About AIXBT

Dimo: Decentralized Revolution of Vehicle Data