ETH Nedir: Ethereum ve Kripto Parası Üzerine Kapsamlı Bir Rehber

Ethereum’un Konumu ve Önemi

2015 yılında Vitalik Buterin ve ekibi, Bitcoin blokzincirinin sınırlarını aşmak ve programlanabilir akıllı sözleşmeler sunmak için Ethereum’u (ETH) hayata geçirdi.

İlk akıllı sözleşme platformu olan Ethereum, DeFi, NFT’ler ve merkeziyetsiz uygulamalar (DApp’ler) ekosisteminde merkezi bir rol üstlenmektedir.

2025 yılı itibarıyla Ethereum, piyasa değeriyle dünyanın en büyük ikinci kriptopara birimidir ve 414 milyonu aşkın cüzdan adresi ile dinamik bir geliştirici topluluğuna sahiptir. Bu makalede teknik mimarisi, piyasa performansı ve geleceğe yönelik potansiyeli detaylı şekilde ele alıyoruz.

Kökeni ve Gelişim Süreci

Arka Plan

Ethereum, Vitalik Buterin ve ekibi tarafından 2015 yılında, blokzincir teknolojisinin yalnızca değer transferinden öte işlevler sunabilmesi amacıyla geliştirildi.

Blokzincir teknolojisinin erken yükseliş döneminde ortaya çıkan Ethereum, kapsamlı bir platform sunmayı amaçladı ve merkeziyetsiz uygulamalar ile akıllı sözleşmeler için altyapı oluşturdu.

Ethereum’un piyasaya sürülmesi, merkeziyetsiz çözümler geliştirmek isteyen geliştirici ve işletmeler için yepyeni fırsatlar sundu.

Önemli Dönüm Noktaları

- 2015: Ana ağın başlatılması ve akıllı sözleşme işlevinin tanıtılması.

- 2022: Merge (Birleşme) yükseltmesiyle Ethereum, Proof-of-Work (İş Kanıtı) sisteminden Proof-of-Stake (Hisse Kanıtı) sistemine geçti.

- 2023: Shanghai yükseltmesiyle staking (hisseleme) çekimlerinin etkinleşmesi ve ağ katılımının artması.

- 2025: DeFi protokolleri ve NFT platformlarının zirveye ulaşmasıyla ekosistemde büyük bir patlama yaşandı.

Ethereum Vakfı ve küresel topluluğun desteğiyle Ethereum, teknolojisini, güvenliğini ve gerçek dünyadaki uygulamalarını geliştirmeye devam ediyor.

Ethereum Nasıl Çalışır?

Merkeziyetsiz Yapı

Ethereum, dünya genelinde dağıtık binlerce bilgisayar (düğüm) tarafından desteklenen merkeziyetsiz bir ağ üzerinde çalışır; herhangi bir banka veya devletin denetimi altında değildir.

Düğümler, işlemleri birlikte doğrulayarak sistemin şeffaflığını artırır ve saldırılara karşı dayanıklılık sağlar. Böylece kullanıcılar daha fazla kontrol sahibi olur ve ağın güvenliği güçlenir.

Blokzincir Temeli

Ethereum blokzinciri, tüm işlemleri kaydeden herkese açık, değiştirilemez bir dijital defterdir.

İşlemler bloklar halinde gruplanır ve kriptografik hash’lerle birbirine bağlanarak güvenli, zincir yapısında saklanır.

Her kullanıcı bu kayıtları görüntüleyebilir; bu da aracılara gerek kalmadan güven ortamı yaratır.

Katman 2 çözümleri ve yaklaşmakta olan parçalara ayırma (sharding) teknolojisi, performansı ve ölçeklenebilirliği daha da artırmaktadır.

Adil İşleyiş

Ethereum, işlemleri doğrulamak ve çift harcama gibi dolandırıcılık girişimlerini önlemek için Proof-of-Stake (Hisse Kanıtı, PoS) mekanizmasını kullanır.

Doğrulayıcılar, ağı korumak için ETH stake eder (hisseler) ve katkıları doğrultusunda ödüller kazanır.

Bu yenilikçi yöntem, eski Proof-of-Work (İş Kanıtı) sistemine göre daha az enerji tüketir. Ayrıca işlem kapasitesini artırır.

Güvenli İşlemler

Ethereum, işlemlerin güvenliğini sağlamak için açık anahtar-özel anahtar kriptografisi kullanır:

- Özel anahtarlar (kişisel şifre gibi), işlemleri imzalamak için kullanılır,

- Açık anahtarlar (hesap numarası gibi), sahipliğin doğrulanmasında kullanılır.

Bu yapı, fonların güvenliğini sağlarken işlemlerin anonim olarak yapılmasını mümkün kılar.

Akıllı sözleşmeler ise Ethereum ağındaki işlemlere ek bir güvenlik ve otomasyon katmanı ekler.

Ethereum’un Piyasa Performansı

Dolaşımdaki Arz

10 Eylül 2025 itibarıyla, Ethereum’un dolaşımdaki arzı 120.704.920,9341557 kripto para, toplam arzı ise yine 120.704.920,9341557 seviyesindedir. Maksimum arz bulunmaması, sistemin enflasyonist yapısını gösterir.

Piyasaya yeni kripto paralar madencilik ve staking ödülleriyle girerek arz-talep dengesini etkiler.

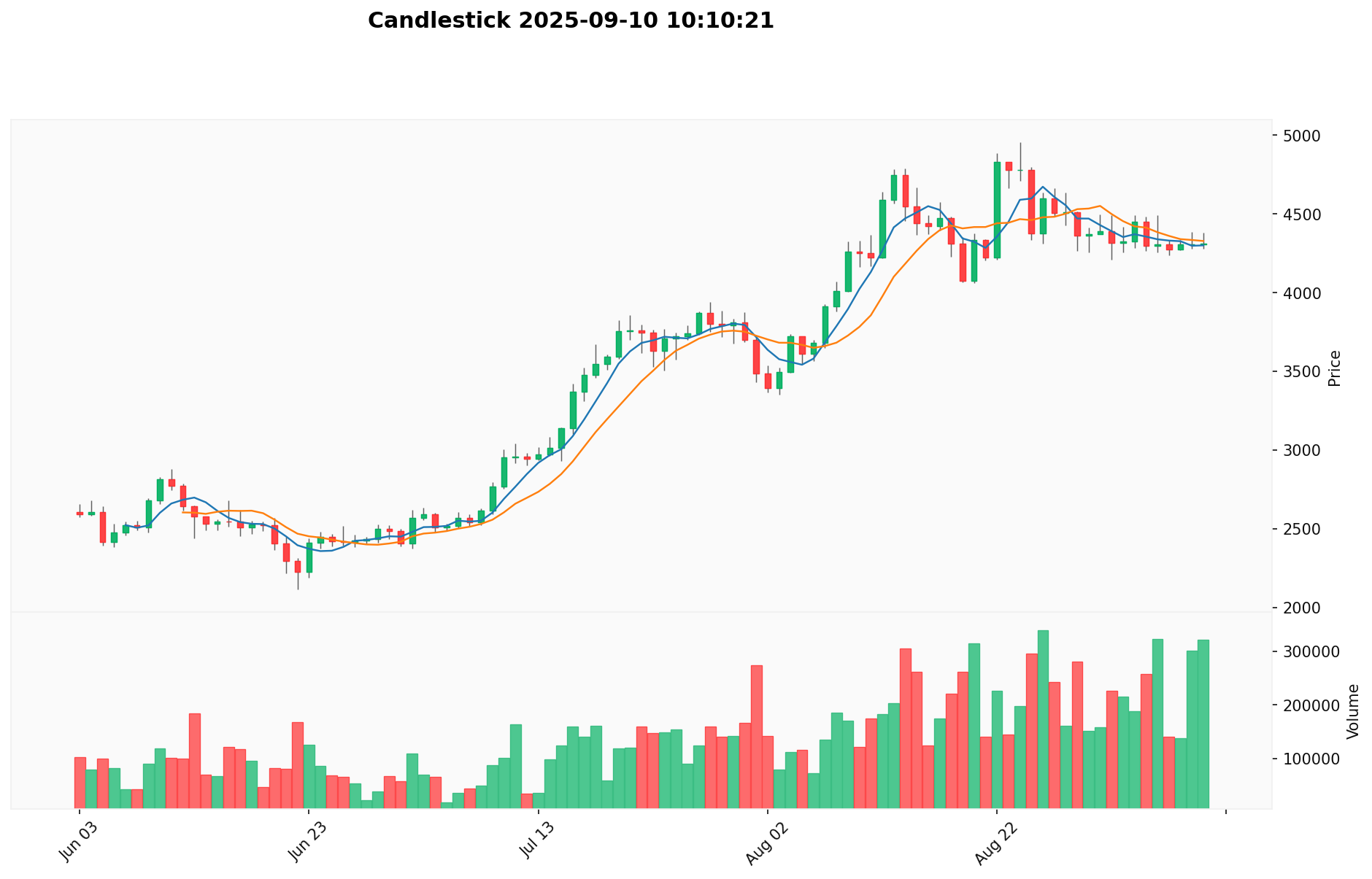

Fiyat Dalgalanmaları

Ethereum, 25 Ağustos 2025 tarihinde 4.946,05 $ ile tüm zamanların en yüksek seviyesine ulaşmıştır. Bu yükselişte piyasadaki genel olumlu hava ve kurumsal benimsenme artışı etkili oldu.

En düşük fiyatı ise 0,432979 $ ile 20 Ekim 2015 tarihinde, projenin erken dönemlerinde ve piyasa farkındalığının düşük olduğu bir zamanda gerçekleşti.

Bu fiyat dalgalanmaları, piyasadaki algıyı, benimseme eğilimlerini ve dış etkenleri yansıtır.

Zincir Üstü Göstergeler

- Günlük İşlem Hacmi: 1.205.566.455,23 $ (ağdaki etkinliği gösterir)

- Aktif Adres Sayısı: 414.154.304 (kullanıcı katılımını yansıtır)

Ethereum Ekosistemi: Uygulamalar ve İş Birlikleri

Temel Kullanım Alanları

Ethereum ekosistemi çok çeşitli uygulamalara olanak sağlar:

- DeFi: Uniswap ile merkeziyetsiz alım-satım imkanı sunar.

- NFT: OpenSea ile dijital koleksiyon ve sanat alanının öncüsüdür.

Stratejik İş Birlikleri

Ethereum, Microsoft, EY ve JP Morgan ile iş birlikleri sayesinde teknolojik kapasitesini ve pazar etkisini büyütüyor. Bu ortaklıklar, ekosistemin büyümesi için sağlam bir temel oluşturuyor.

Tartışmalar ve Zorluklar

Ethereum’un karşı karşıya olduğu belli başlı sorunlar şunlardır:

- Teknik zorluklar: Ölçeklenebilirlik darboğazları ve yüksek gas ücretleri,

- Düzenleyici riskler: SEC incelemelerine yönelik olası riskler,

- Rekabet baskısı: Solana gibi yeni blokzincir projelerinin yükselişi.

Bu konular, topluluk ve piyasada sürekli tartışmalara yol açmakta; Ethereum’u inovasyona teşvik etmektedir.

Ethereum Topluluğu ve Sosyal Medya Atmosferi

Topluluk İlgisi

Ethereum topluluğu oldukça hareketli; günlük işlem hacmi 1 milyonun üzerinde, cüzdan adresi sayısı ise 414 milyonu aşıyor.

X (eski Twitter) platformunda, #Ethereum etiketli paylaşımlar sıkça gündem oluyor ve aylık gönderi hacmi milyonlara ulaşıyor.

Fiyat artışları ve yeni özellik duyuruları topluluğun heyecanını yükseltiyor.

Sosyal Medya Duyarlılığı

X (eski Twitter)’te Ethereum ile ilgili paylaşımlarda görüşler kutuplaşmış durumda:

- Destekçiler, Ethereum’un yüksek güvenlik ve merkeziyetsizliğini öne çıkararak onu “geleceğin finansının temeli” olarak görüyor.

- Eleştirmenler ise fiyat oynaklığı, ölçeklenme sorunları ve çevresel etkileri eleştiriyor.

Son dönemde, piyasa yükselişe geçtiğinde genellikle olumlu bir hava gözleniyor.

Gündemdeki Konular

X (eski Twitter) kullanıcıları aktif biçimde Ethereum’un düzenleyici belirsizlikleri, enerji tüketimi ve enflasyonist riskleri hakkında tartışıyor; bu, projenin dönüştürücü öngörüsünü ortaya koyarken, yaygın benimseme yolundaki engellere de işaret ediyor.

Ethereum Hakkında Daha Fazla Bilgi Kaynağı

- Resmî Web Sitesi: Ethereum’un resmi web sitesi üzerinden özelliklere, kullanım alanlarına ve en güncel haberlere ulaşabilirsiniz.

- White Paper: Vitalik Buterin imzalı Ethereum White Paper, teknik mimari, hedefler ve vizyon konularında ayrıntılı bilgi sunar.

- X Güncellemeleri: X (eski Twitter)’de resmi @ethereum hesabının 10 Eylül 2025 itibarıyla 3,8 milyon takipçisi bulunuyor. Paylaşımlar, teknik güncellemeler, topluluk etkinlikleri ve iş birliği duyuruları içererek binlerce beğeni ve retweet alıyor.

Ethereum’un Gelecek Yol Haritası

- 2025-2026: Parçalara ayırma (sharding) ile TPS’in (işlem sayısının) artırılması ve gas ücretlerinin düşürülmesi

- Ekosistem Hedefi: 10.000+ DApp desteği ve 1 milyar kullanıcıya ulaşmak

- Uzun Vadeli Vizyon: Akıllı sözleşmeler ve Web3 altyapısında küresel standart haline gelmek

Ethereum’a Nasıl Katılabilirsiniz?

- Satın Alma Kanalları: Gate.com üzerinden ETH edinin

- Saklama Çözümleri: Güvenli saklama için MetaMask kullanın

- Yönetişim Katılımı: Ethereum yönetişim forumlarında topluluk kararlarına katılın

- Ekosistem Geliştirme: Ethereum Geliştirici Dokümantasyonu’nu ziyaret ederek DApp geliştirebilir veya koda katkıda bulunabilirsiniz

Özet

Ethereum, blokzincir teknolojisiyle dijital parayı yeniden tanımlıyor; şeffaflık, güvenlik ve verimli akıllı sözleşme yürütümü sağlıyor. Aktif topluluğu, kapsamlı kaynak havuzu ve güçlü piyasa performansıyla kriptopara ekosisteminde öne çıkıyor. Tüm düzenleyici ve teknik zorluklara rağmen, Ethereum’un yenilikçi yaklaşımı ve net yol haritası, onu merkezsiz teknolojinin geleceğinde vazgeçilmez kılıyor. İster kriptoya yeni giriyor olun ister deneyimli bir yatırımcı olun, Ethereum’a katılmak için uygun bir zamandasınız.

Sıkça Sorulan Sorular

ETH hangi amaçlarla kullanılır?

ETH, Ethereum ağında akıllı sözleşmeleri ve işlemleri çalıştırmak için kullanılır. Ayrıca piyasa değeriyle en büyük ikinci kriptoparadır.

Şu anda 1 ETH’nin değeri nedir?

Eylül 2025 itibarıyla, 1 ETH yaklaşık 4.295 $ değerindedir. Kripto piyasasında fiyatlar hızlı şekilde değişebilir.

ETH, para olarak ne anlama gelir?

ETH, Ethereum’un kısaltması olup, Ethereum ağı üzerindeki işlemler ve akıllı sözleşmelerin yürütülmesi için dijital bir yakıttır.

ETH neden değerlidir?

ETH; işlemler, ağ güvenliği ve akıllı sözleşmelerin çalıştırılması için gereklidir. Kullanım alanı ve talebi, değerinin temelini oluşturur.

Ethereum Gaz Ücretleri Açıklanmıştır

2025 ETH Fiyat Tahmini: Birleşme Sonrası Ekosistemde Ethereum’un Değerini Etkileyen Temel Faktörlerin Analizi

ETH Nedir: Ethereum’un Yerel Kripto Parası Üzerine Kapsamlı Bir Rehber

OP nedir: Popüler internet kısaltmasının ve çeşitli anlamlarının kapsamlı bir şekilde açıklanması

POL nedir: Konum Kanıtı (Proof of Location) ve Modern Blok Zinciri Ağlarındaki Uygulamaları

Ethereum Ana Ağı Nedir? Temel Blok Zincirini Anlamak

ZEX Nedir: Yeni Nesil Merkeziyetsiz Borsa Platformuna Kapsamlı Rehber

LAB Nedir: Laboratuvar Bilgi Sistemleri ve En İyi Uygulamalar Hakkında Kapsamlı Rehber

USDT'yi Çevrimiçi Satın Almanın Uygun Maliyetli Yöntemleri

2025 DOLO Fiyat Tahmini: Uzman Analizi ve Piyasa Öngörüleri Gelecek Yıl İçin

2025 EDEN Fiyat Tahmini: Uzman Analizi ve Gelecek Yılın Piyasa Tahmini