Gate Ventures Research Insights: The Bittensor Revolution — The Rise of AI’s Bitcoin and the New Economic Landscape

Gate Ventures

Investment Overview

Bittensor is a general-purpose incentive platform inspired by the Bitcoin network, built on a subnet architecture and game theory. Bitcoin incentivizes miners through token issuance to perform SHA-256 computations and maintain network availability. Bittensor, in contrast, incentivizes subnet miners by issuing tokens for providing various resources, including AI inference, data storage, GPU compute power, and bandwidth.

Team: The three core members all have computer science backgrounds. Ala focuses more on academic research and AI algorithms, Jacob specializes in machine learning and blockchain architecture, while Garrett brings engineering execution and product development expertise. Together, they form a strong technical founding team.

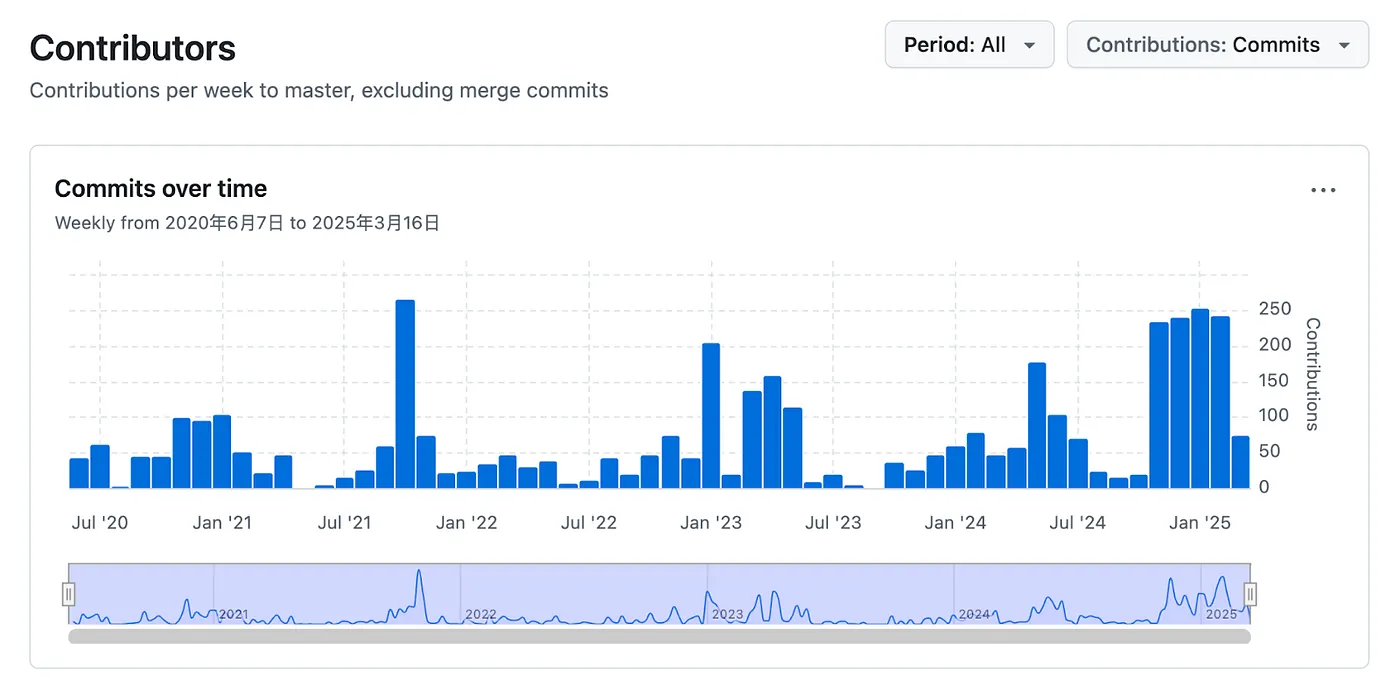

Development Progress: The project has maintained steady development progress, with an uptick in activity over the past three months.

Product: Innovative tokenomics — subnet teams can only earn incentives if they improve the quality of their projects, thereby driving up the price of their subnet tokens. Under Bittensor’s game-theoretic design, subnets compete to deliver optimal resources, including model performance, GPU pricing, storage efficiency, and even protein-folding discovery speed.

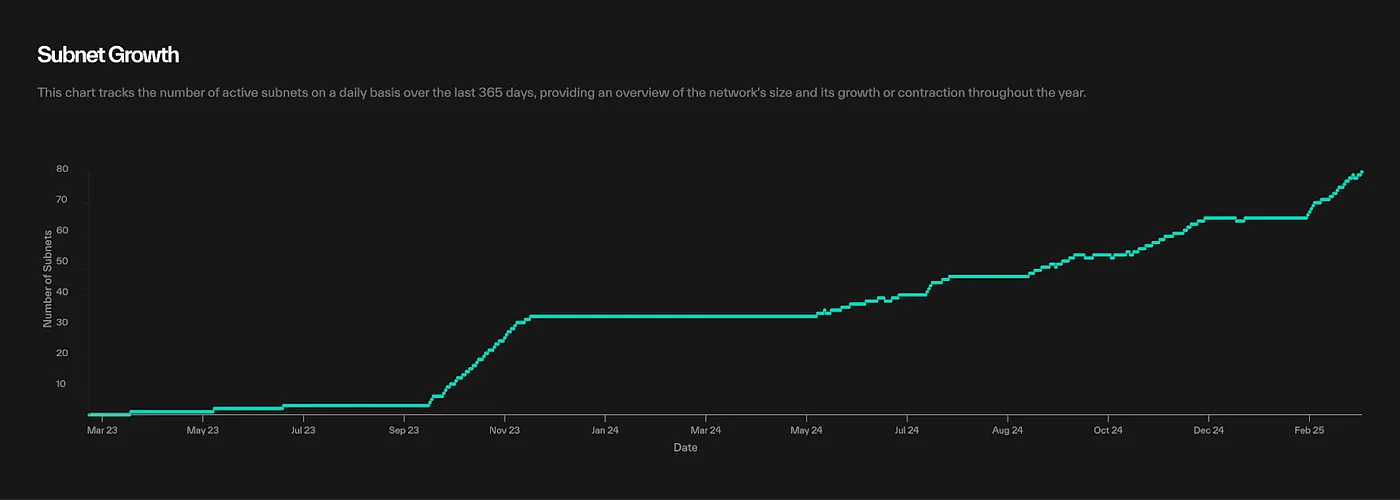

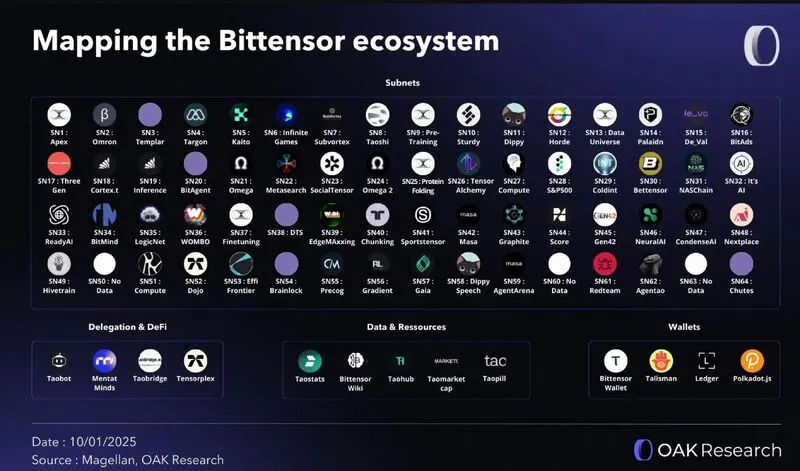

Ecosystem Growth: The ecosystem currently consists of about 80 subnet projects, with growth accelerating. However, many projects are repetitive and similar in business scope.

Narrative: Bittensor aligns strongly with broader narratives such as AI, DePIN, and Layer-1 blockchains.

Risks

Infrastructure limitations: Insufficient infrastructure, weak marketing, and lack of community support result in a high degree of opacity.

High ecosystem redundancy: There is a lack of independent external developer teams. A single lab may create as many as five or six subnet projects, which prevents the lab from focusing on any single one. This makes them more likely to lose to independent competitors in a market environment.

Complexity of TAO’s mechanism: The design of TAO involves multiple technical details, making it costly for retail users to learn, while also requiring project teams to have deep knowledge reserves.

That said, Bittensor’s ecosystem is accelerating in growth, and its architecture is highly unique — no closely similar competitors currently exist. Most AI products today are competitors to subnet projects, rather than to Bittensor itself. We remain optimistic about its ecosystem development. Unlike Allora and Sentiment, where miners can only provide large models, or Sahara AI, which only provides data, Bittensor’s subnets (miners) are more like multiple “nations” operating within a unified global system. Bittensor rewards the nations that develop best, while allowing each nation the freedom to choose what business to pursue, as long as they do not exceed the worldview set by Bittensor. The evaluation standard is whether each nation’s currency holds value. Under this more open and subnet-token-based incentive structure, Bittensor has the potential to foster a vibrant ecosystem. We have also observed VCs, such as YZi Labs, beginning to invest in the Bittensor ecosystem.

1 Basic Overview

1.1 Project Introduction

Bittensor is a general-purpose incentive platform inspired by Bitcoin’s PoW network, built on a subnet architecture and game theory. Bitcoin incentivizes miners through token issuance to perform SHA-256 computations and maintain network availability. Bittensor, on the other hand, incentivizes subnet miners through token issuance to provide resources such as AI inference, data storage, GPU computing power, and bandwidth. By combining game theory with token incentives, Bittensor creates a competitive environment that fosters distributed crowdsourced services.

1.2 Basic Information

Note: Information sourced from CoinMarketCap & Coinglass, as of March 17, 2025.

2 Project Details

2.1 Team Background Check

Jacob Robert Steeves: Founder

Jacob Robert Steeves (Founder):

Graduated from Simon Fraser University with a Bachelor of Applied Science, majoring in Mathematics and Computer Science. During his studies, he participated in the ACM-ICPC programming competition, achieving 8th place in the Northwestern North America region in 2014.

Jacob’s career spans machine learning research (Knowm), algorithm development (Google), and exploration in decentralized technologies (Bittensor). His expertise lies in machine learning, distributed computing, and cryptographic technologies, complemented by experience in traditional tech enterprises.

Ala Shaabana: Co-Founder

Ala Shaabana (Co-Founder):

Holds a Bachelor’s degree in Computer Science from the University of Windsor and a PhD from McMaster University. His career spans software development (firmCHANNEL, VMware, Instacart) as well as academic research at universities. Ala’s work focuses on computer science, machine learning, and distributed computing, combining both industry R&D experience and an academic research background.

Garrett Oetken: CTO

Garrett Oetken (CTO):

Graduated from the University of Idaho, majoring in Computer Science. His career spans software development (Safeguard Equipment), AI research, and tech entrepreneurship (Quantum Star Technologies, Opentensor Foundation). His areas of expertise include AI, computer vision, natural language processing, and distributed computing. Opentensor is the development team behind Bittensor. The Opentensor Foundation was established in March 2023 and currently has about 40 employees, down 3% in the past six months, with an average tenure of 1.3 years.

Among the three core members: Ala focuses more on academic research and AI algorithms, Jacob specializes in machine learning and blockchain architecture, and Garrett excels in engineering implementation and product development. Together, they form a strong technical founding team.

2.2 Funding / Capital

Bittensor has never publicly disclosed any primary market fundraising. The only available information shows several OTC token transactions worth several million dollars involving Polychain, DCG, and DAO5.

2.3 Code

Contributors, source:Github

The development of Opentensor’s main Github repository, Tensor, has been progressing well, with a noticeable acceleration in updates during Q1 2025.

2.4 Product

2.4.1 Background

The concept for Bittensor originated from an interpretation of the Bitcoin network. From Bittensor’s perspective, Bitcoin uses token-based economic incentives to motivate miners around the world to run algorithms that maintain the network’s availability. However, the computational resources contributed by the Bitcoin network are very basic and singular in nature.

Inspired by this, Bittensor incentivizes miners to provide broader categories of digital resources, or intelligent computational resources more relevant in the AI era. In the Bitcoin network, all miners run the same SHA-256 algorithm. In contrast, within Bittensor, miners can run different algorithms or provide different resources (AI inference, data storage, computing power, bandwidth, etc.), which can then be abstracted into a decentralized marketplace, where Bittensor’s unified incentive mechanism distributes rewards.

2.4.2 Product Description

Bittensor is an open-source platform where participants can produce digital goods, including computing power, storage space, AI inference and training, protein folding, and financial market predictions. The network is composed of different subnets. Each subnet is an independent community of miners (who produce goods) and validators (who evaluate the miners’ work). Subnet creators are responsible for managing the incentive mechanisms, while TAO stakers can support specific validators by staking their TAO tokens.

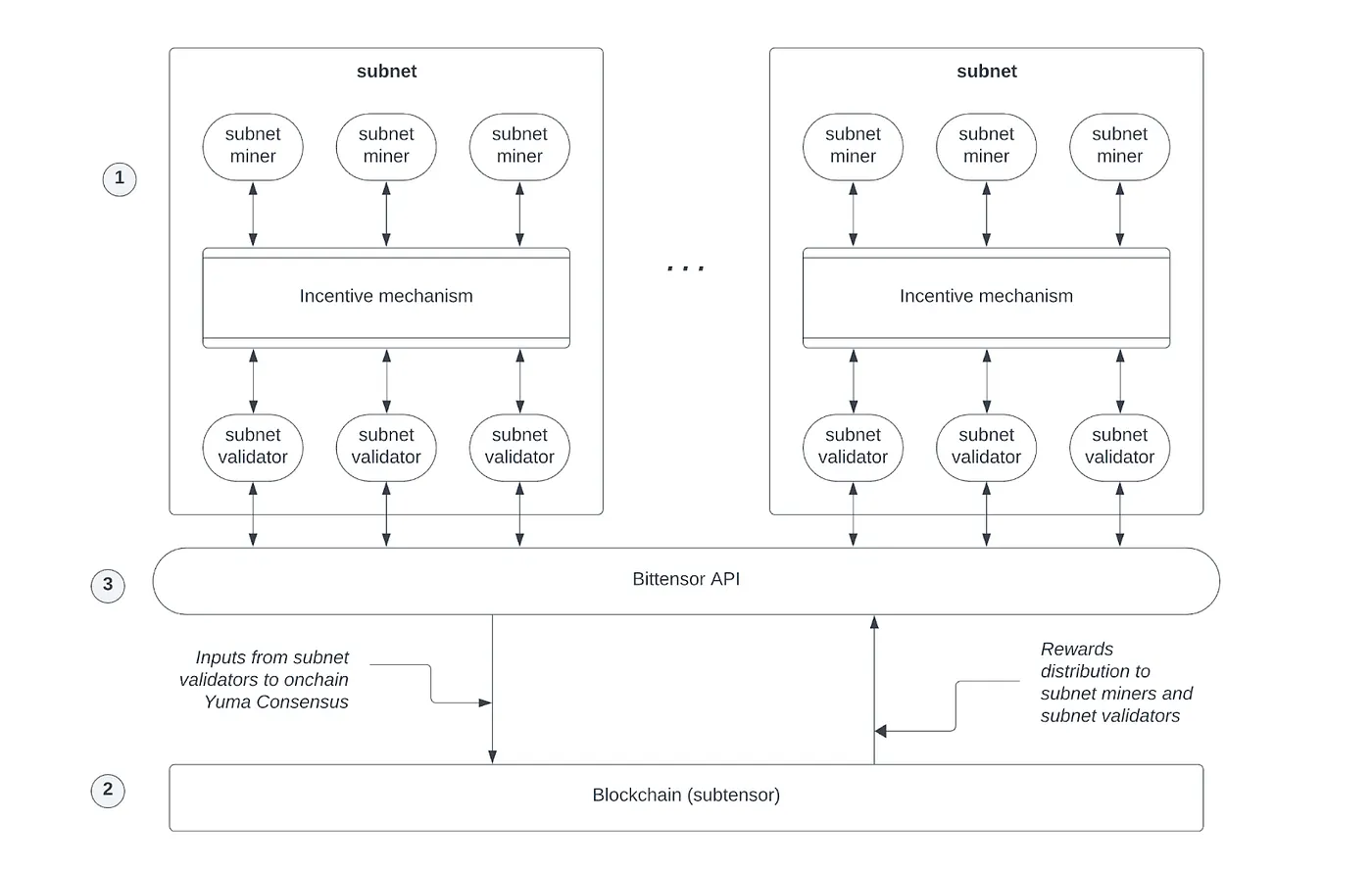

Architecture of TAO, Source: Bittensor

TAO consists of the following components, as shown above:

Subnets: Each subnet is an incentive-driven competitive marketplace that produces a specific digital good related to AI. It is made up of a community of miners, who produce the goods, and validators, who measure the miners’ work according to the subnet’s criteria to ensure quality.

Bittensor Mainnet: Functions as the ledger. Its native token, TAO, is used as the incentive for participating in subnet activities. The blockchain records balances and transactions of miners, validators, and subnet creators.

Bittensor API: Supports interactions between miners and validators within subnets, and allows all parties to interact with the blockchain as needed.

Each subnet features two key roles: miners and validators.

Miners: In Bittensor’s model, “miners” are not simply running computational power for PoW. Instead, they provide training or inference resources for AI models (or other digital goods, such as data bandwidth). Different subnets may be dedicated to different tasks (NLP, CV, multimodal, etc.). Miners can choose subnets that match their hardware or algorithms, contribute resources, and receive incentives.

Validators: Validators maintain the security of the Bittensor main chain by producing blocks, validating transactions, and ensuring the network operates smoothly (similar to Polkadot/Substrate’s mechanism). At the subnet level, validators also verify that subnet participants follow consensus rules and prevent malicious behavior.

Subnet Liquidity

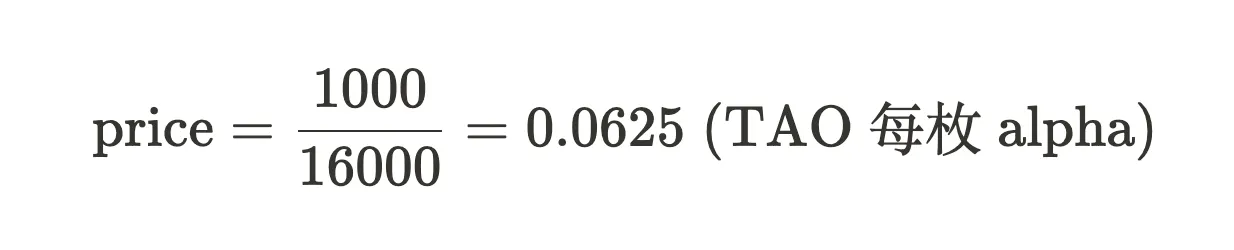

A key mechanism introduced by Bittensor is that each subnet has its own AMM mechanism. This AMM pool contains two token reserves: one is TAO (the native token of the mainnet), and the other is the subnet’s own token (which we will refer to collectively as the Alpha Token). To acquire a subnet’s Alpha token, TAO must be staked into the subnet’s reserve pool. For example, suppose a pool holds 1,000 TAO and 16,000 Alpha tokens. According to the formula:

This means that one Alpha token is worth 0.0625 TAO. When people are optimistic about the Alpha token, they purchase it with TAO. As Alpha tokens decrease in supply while TAO increases, the price of Alpha rises.

It is important to note that at each block, the network also injects a certain amount of newly issued TAO and new subnet tokens into the pool according to specific rules, which further affects token pricing.

However, the details of how subnet tokens are issued, and how TAO incentivizes subnets, are tied to Bittensor’s latest Dynamic TAO (dTAO) mechanism, which we will introduce next.

2.4.3 Technical Details

In the past, Bittensor’s key technology was its Yuma Consensus algorithm, which aimed to solve one major problem: how to reach consensus and distribute incentives for “AI model contributions” in a decentralized network, while also defending against collusion and cheating among nodes. The algorithm not only handled validator consensus voting, but also determined which subnet should receive how much TAO incentive.

However, there were several issues:

Validators were unable to comprehensively evaluate a large number of subnets, leading to inaccurate scoring, indifference, or bribery.

Subnets could potentially bribe validators privately to boost their votes.

High-quality subnets deserving greater rewards might be overlooked in an unfair environment.

To address these problems, Bittensor introduced an improved mechanism called Dynamic TAO (dTAO).

The new idea of dTAO: instead of relying solely on validator voting, it allows the market to decide which subnets should receive more token issuance. This is achieved by issuing a subnet-specific token (Alpha) for each subnet, paired with an AMM pool. The market price of Alpha tokens determines the subnet’s perceived value.

If a subnet is seen as more promising, its Alpha token price rises.

This leads to a larger share of TAO issuance going to that subnet.

At the same time, Alpha token issuance incentives for that subnet also increase.

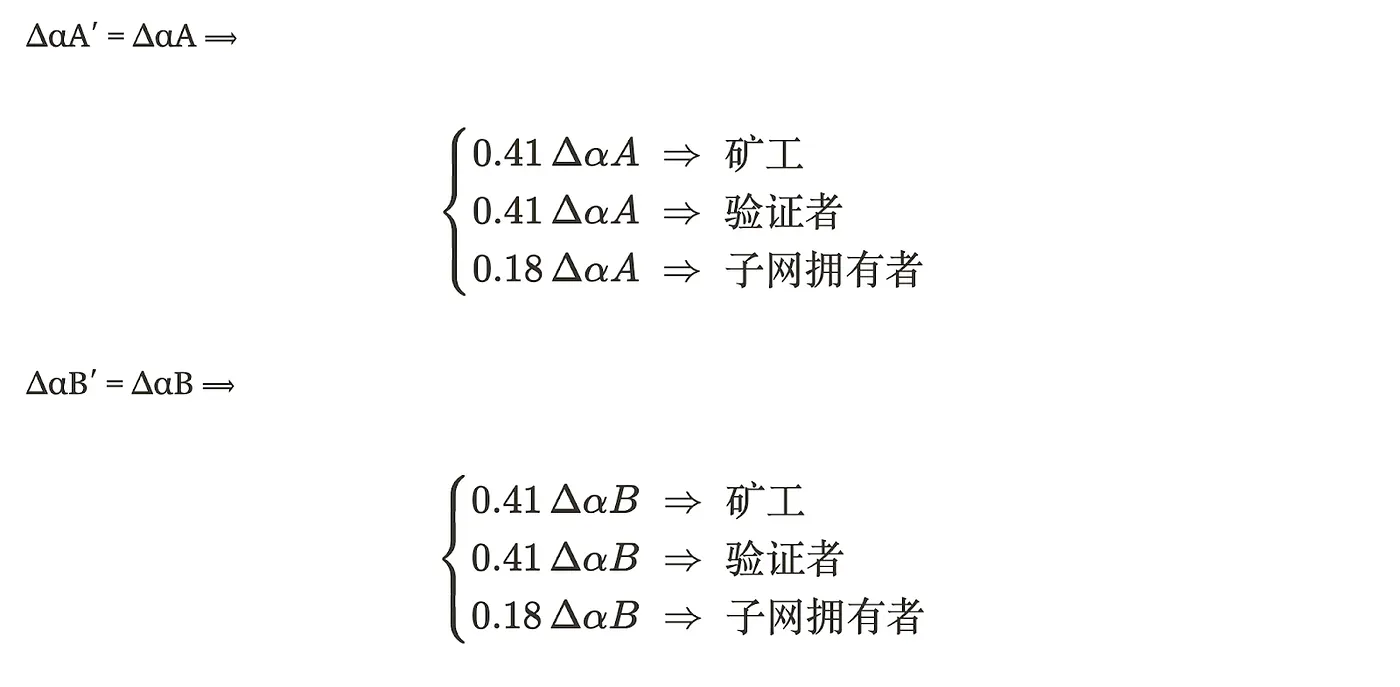

Example: Suppose we have two subnets, Subnet A and Subnet B, and one TAO is issued per block.

When Subnet A and Subnet B are launched, they each have their own subnet token (AlphaA and AlphaB) with prices Pₐ and P_b. Normally, the starting ratio is 1:1 with TAO, and the total supply cap of Alpha tokens is the same as TAO, at 21 million.

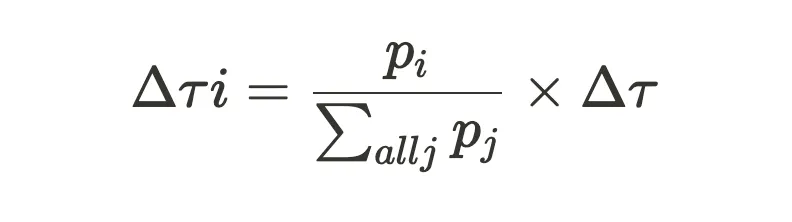

The total amount of TAO injection (Δτ) that each subnet can receive is proportional to the share of its token price relative to the sum of all subnet token prices in the network. The general formula is:

Therefore, suppose the prices of the two subnets, Pₐ and P_b, are both equal to 1 TAO. After each block issuance, the subnet can receive 0.5Δτ. If the market favors AlphaA, then more TAO will be injected into Subnet A’s AMM pool.

To keep the AMM pool price stable, the subnet also receives a corresponding Alpha token injection. The usual process is:

Calculate Δαᵢ — the amount of Alpha that needs to be injected in order to maintain the current price pᵢ.

If the calculated value exceeds the subnet’s Alpha issuance cap, the actual injected value will be truncated (only injected up to the cap).

Under the dTAO rules, in addition to the Alpha injected into the pool, an equivalent amount of Alpha tokens is also distributed directly to subnet participants, replacing the previous method of distributing TAO. The distribution is as follows:

- Miners: 41%

- Validators: 41%

- Subnet Owner: 18%

The injection into the pool is meant to maintain price stability, while the distribution to nodes is intended to incentivize ecosystem participants. Alpha tokens are held back and then distributed in bulk after one Tempo period (360 blocks), to avoid overly fragmented rewards. Miners are responsible for providing computing, storage, and inference functions for the subnet, and the only tokens they can earn are through this issuance mechanism. Validators are responsible for verification. A common issue here is that with each injection of TAO, although Alpha tokens are issued proportionally into the AMM pool to keep the pool price constant, the additional issuance of corresponding tokens creates extra selling pressure. This is similar to Bitcoin’s miner reward mechanism.

The proportional injection of TAO and Alpha into the AMM pool serves to deepen subnet token liquidity, reduce slippage, improve market pricing accuracy, and build confidence among token holders. Meanwhile, the proportional Alpha issuance as rewards is meant to compensate high-quality miners and subnet developers. In practice, since the total token supply is capped at 21 million, subnet tokens will not be issued indefinitely but will asymptotically approach 21 million units — just like Bitcoin’s issuance mechanism for miners and block rewards.

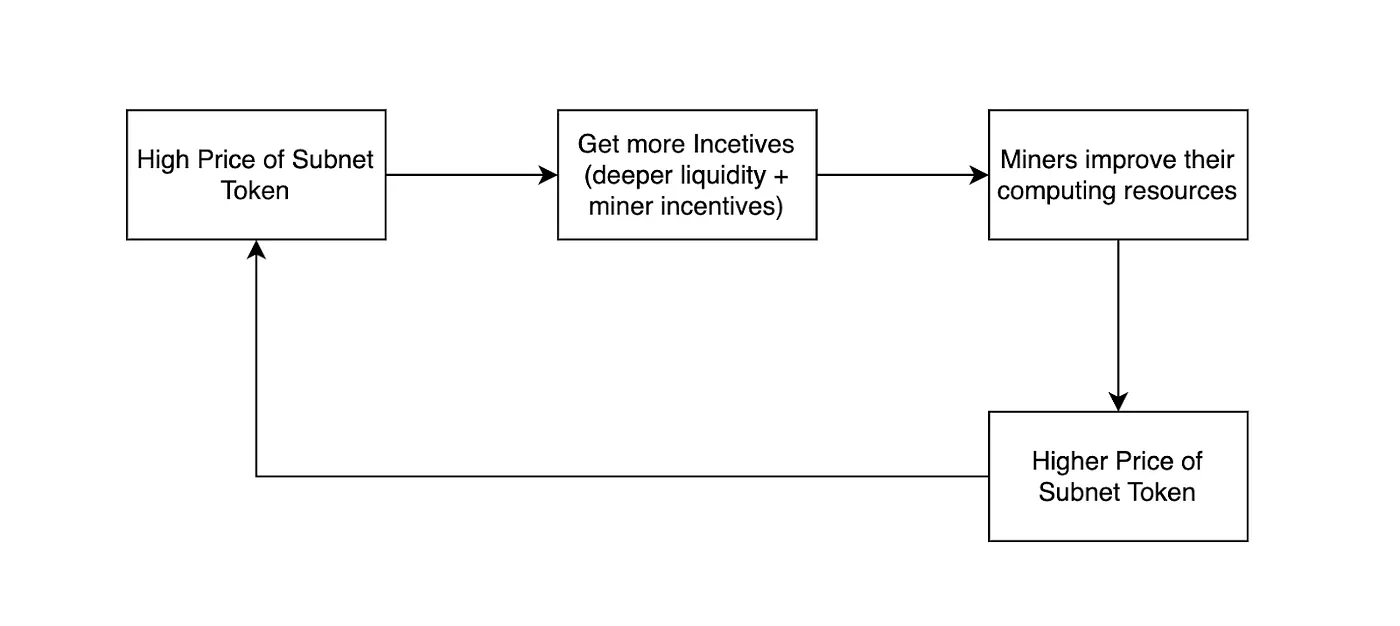

Positive Feedback Mechanism

Under the new Dynamic TAO (dTAO) architecture, there exists a positive feedback loop that incentivizes subnet developers to build, as they often rely on new issuance to obtain fairer and more transparent rewards. This incentive mechanism helps effectively prevent vote manipulation, since artificially inflating a subnet’s price requires real capital. Only subnets with strong fundamentals can maintain high prices over the long term. Weaker subnets that try to boost prices through artificial means will find it unsustainable, and in practice, even the token holders of such subnets would prefer to see genuinely strong fundamentals driving value.

3 Development

3.1 Past

3.2 Present

Subnets went live in October 2023, and after a year and a half of development, Bittensor currently has 80 subnets (including the Root subnet). The ecosystem is showing a trend of rapid growth. As of March 23, the total market capitalization of the ecosystem reached $1.65 billion, with $47.66 million in total 24-hour trading volume for subnet tokens.

3.2.1 Ecosystem Development

Bittensor ecosystem, source: OKA Research

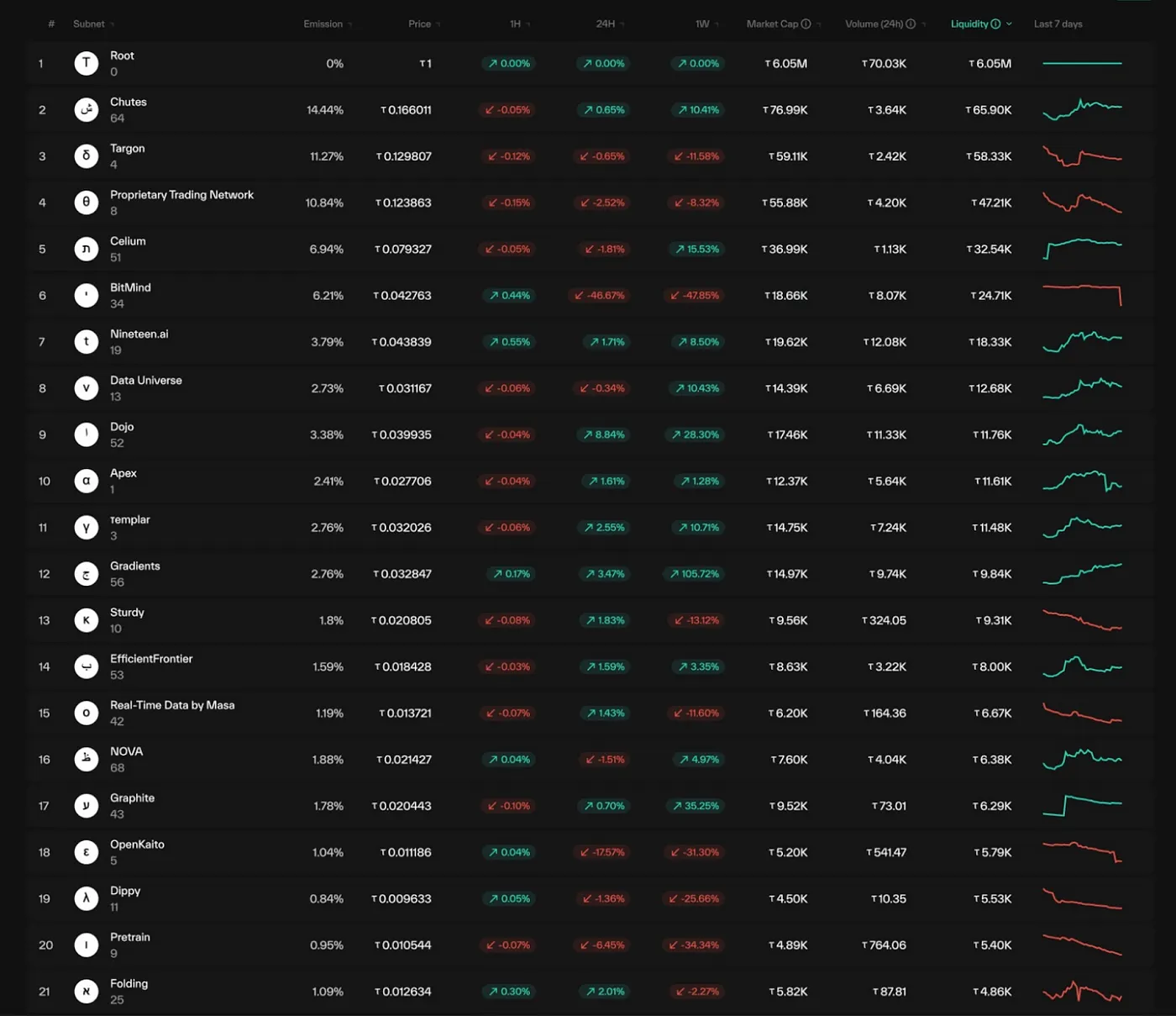

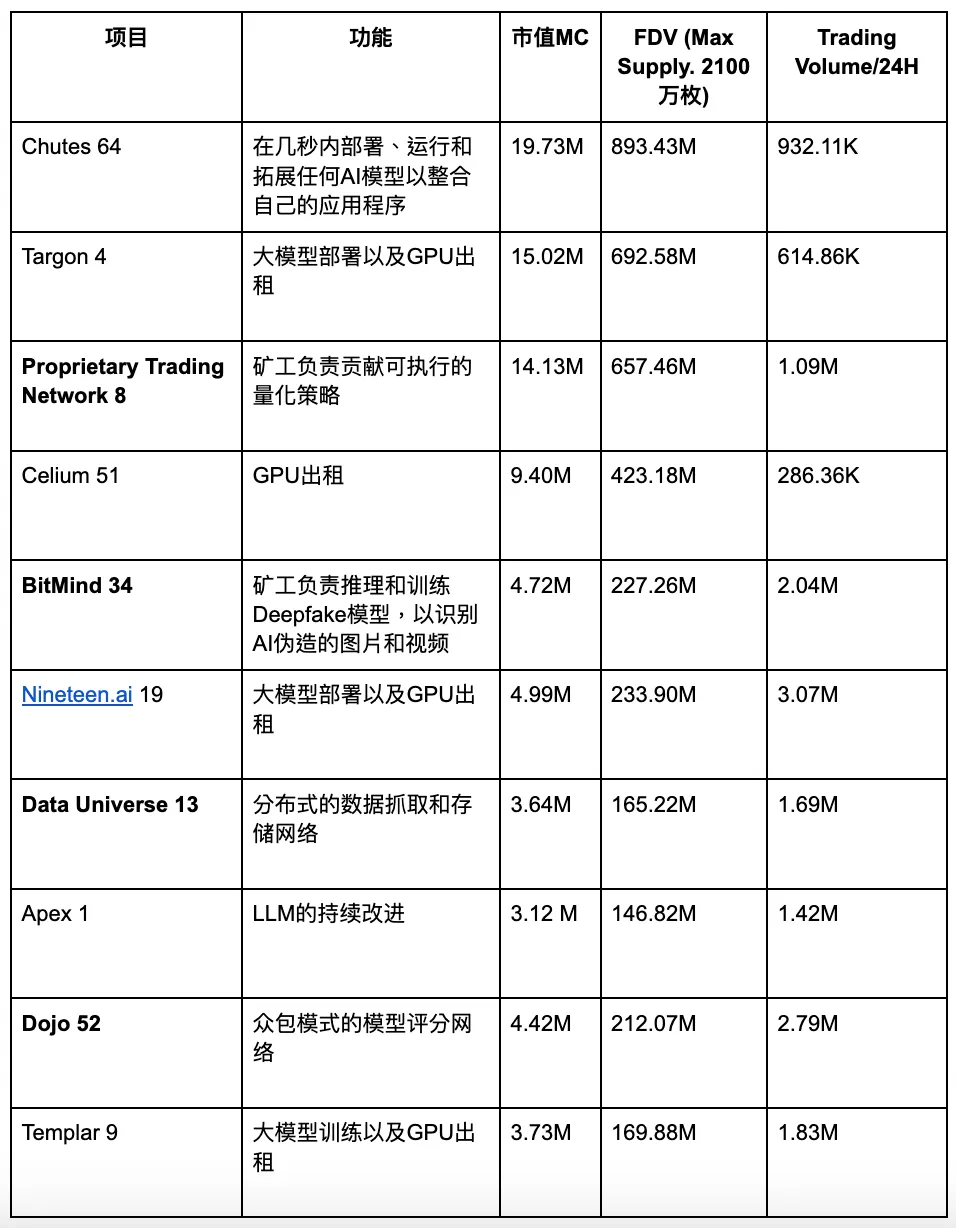

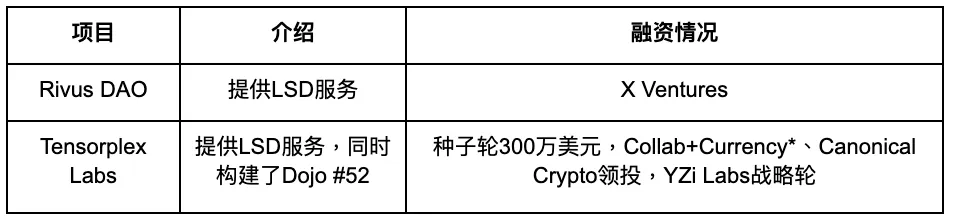

Top20 rankings by Liquidity, source:Taostates

We compiled statistics on the top 20 subnets (excluding the Root network)—the Root was Bittensor’s previous token distribution mechanism, which relied on validators to determine contributions but has since been deprecated. These subnets were ranked according to liquidity in their AMM pools, which reflects the long-term accumulation of value and recognition within the ecosystem.

Bittensor’s ecosystem shows a high degree of redundancy. Among the top 20 projects, 11 are focused on leveraging existing GPUs for large model pre-training, training, fine-tuning, and inference. However, we also see subnets being applied to decentralized GPU usage for other tasks, including protein folding, graph theory, and large model computation. It is worth noting that many subnets are developed by the same studios, such as Microcosmos (#1, #9, #13, #25, #37) and Rayon Labs (#64, #19, #Gradients). This suggests that the ecosystem may still lack a sufficient number of independent developer teams.

In terms of the real utility of the ecosystem, there are indeed some community concerns that deserve reflection. For example:

Since the launch of the Dynamic TAO mainnet, Bittensor has evolved into a decentralized, general-purpose incentive network. However, with the shutdown of the Root subnet (which previously provided centralized oversight) and the mechanism now relying on subnet market capitalization, certain meme tokens may end up receiving incentives. This could undermine the network’s long-term vision.

Some LLM inference-focused subnets face inefficiency and redundancy due to a large number of miners. At the same time, the incentive mechanisms and quality assessment of inference vary across subnets. As a result, miners tend to rely on the same model to avoid being misjudged, which reduces diversity.

In our view, the first issue is indeed noteworthy. Introducing additional mechanisms to assess value, or even reintroducing a DAO structure, could help prevent activities that harm the network. Regarding the second issue, we believe it highlights shortcomings in the subnet owner’s execution. If a subnet fails to provide real value, its price and incentives will gradually decline — a problem that the market can adjust autonomously. From a long-term perspective, Bittensor as a general-purpose incentive network still holds significant value. Later in the ecosystem section, we will discuss its suitable application scenarios.

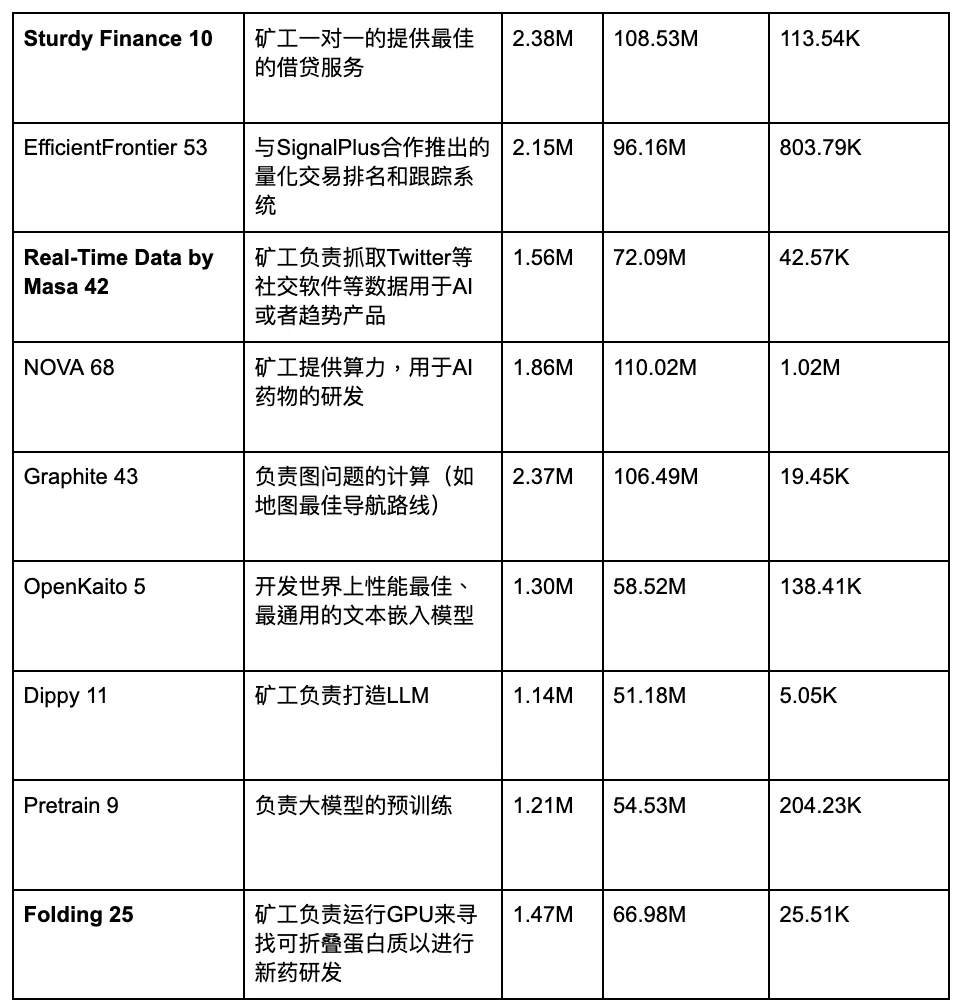

In terms of capital support, the Bittensor ecosystem is also gradually expanding, and we have seen projects begin to secure VC funding. For example:

3.2.2 Social Media

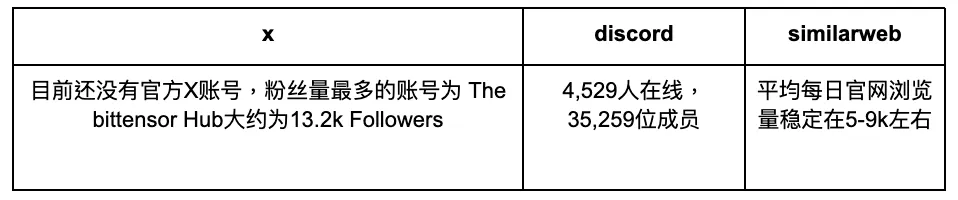

Bittensor has limited engagement with its community. Apart from Discord, it lacks official community communication channels, and there is also a noticeable absence of marketing and promotional activities.

3.3 Future

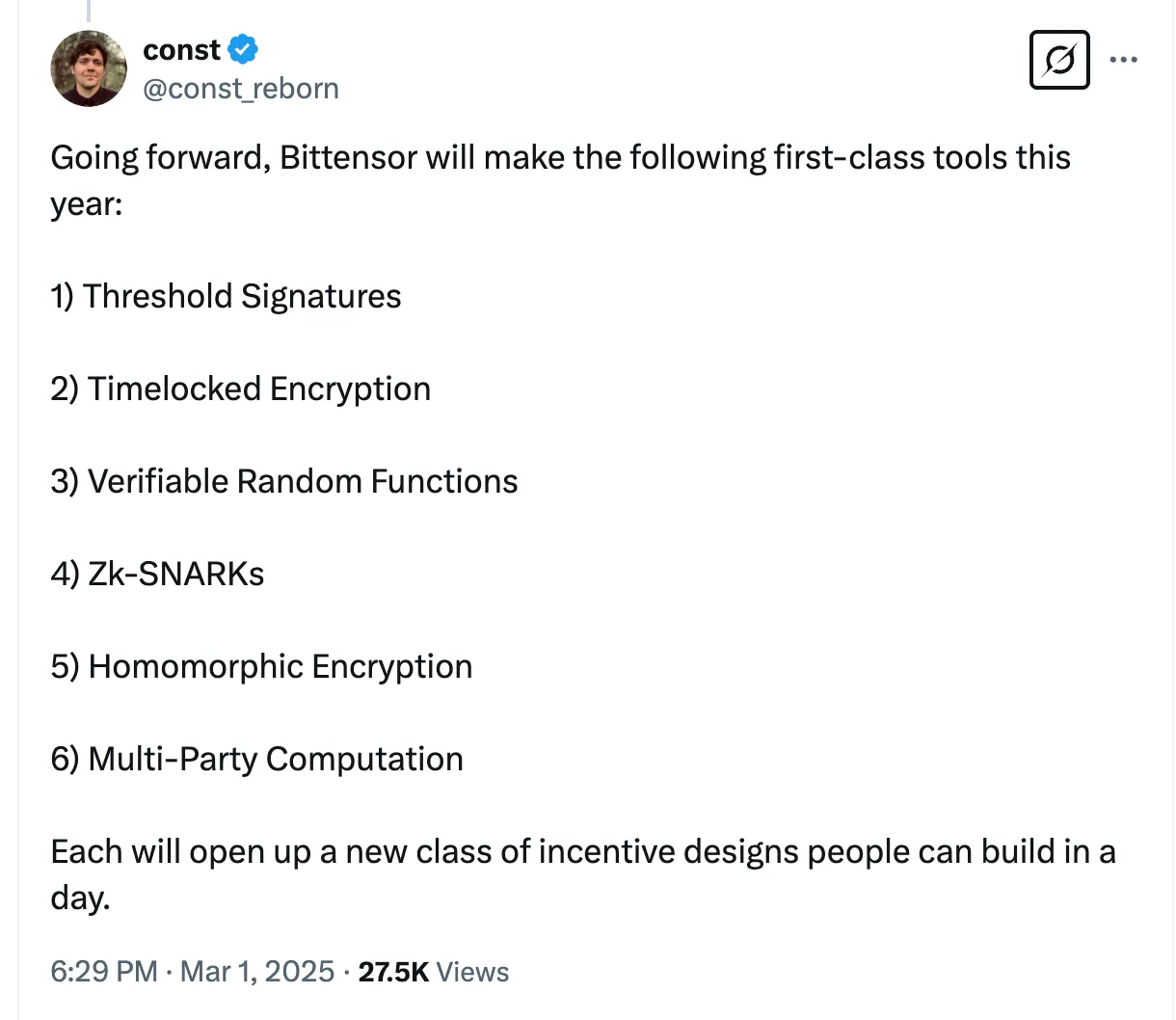

Team Member X, Source: const

The official blog stopped updating last year, and there is no official 2025 roadmap. The team places far greater emphasis on developers than on the community. On X (Twitter), the founder has broadly outlined upcoming goals, including: threshold signatures, time-lock encryption, verifiable functions, ZK-SNARKs, homomorphic encryption, and multi-party computation. These cryptographic tools are intended to help developers redesign the network’s incentive system.

4 Tokenomics

4.1 Token Allocation

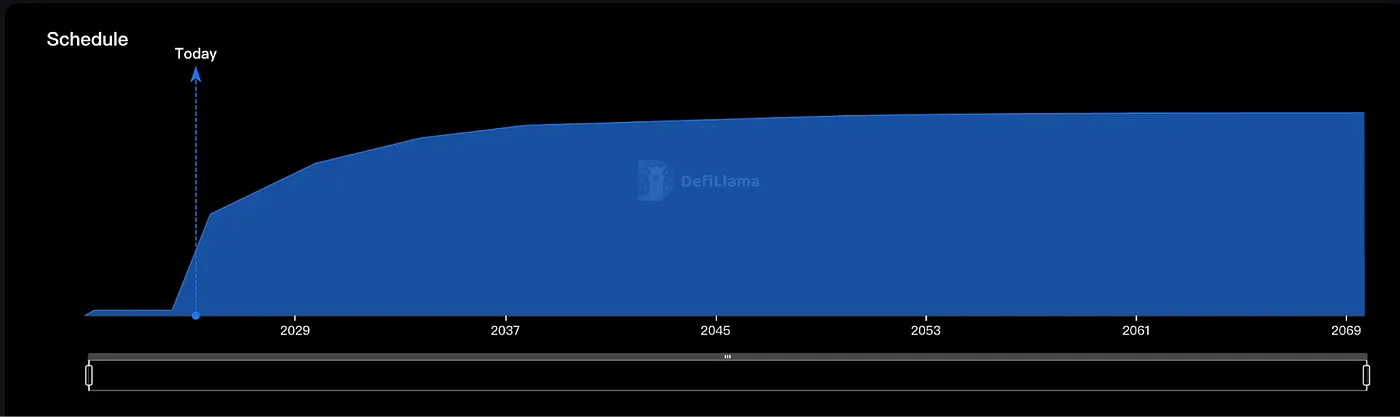

Vesting Schedule, source: Defillama

The Finney network launched on March 20, 2023, at which point the first batch of miners could begin mining. Like Bitcoin, Bittensor has no primary market allocation for the team or VCs. The total token supply is 21 million, of which 36.95% (around 8.5 million) has already been mined, leaving 68.05% yet to be mined. Each block issues 1 TAO, with an average block time of 12 seconds, resulting in approximately 7,200 TAO per day. At a price of $250, this translates to roughly $1.8 million daily issuance (while the daily spot trading volume is around $96.62 million).

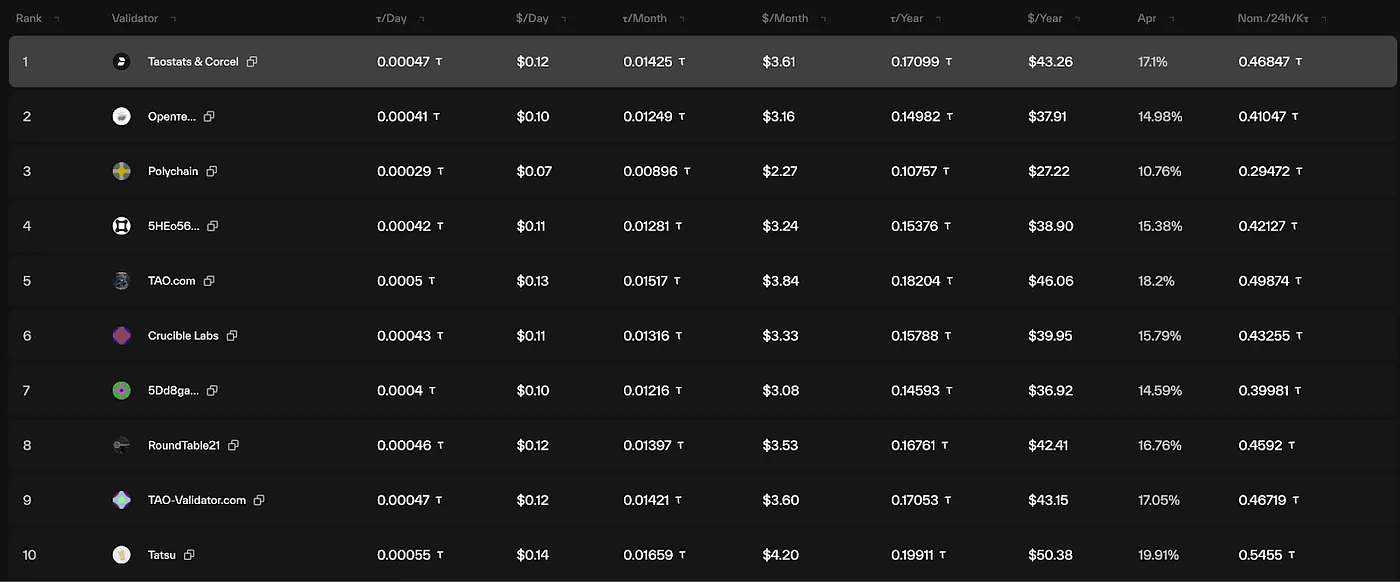

Staking Validators, source: Taostates

Currently, a total of 6,143,675 TAO are staked, accounting for 72.3% of the circulating supply. The average annualized staking yield is around 15%–17%. For comparison, Solana’s APR is 7.5%, NEAR’s is 9.2%, and Ethereum’s is 2.9%.

TAO’s tokenomics are entirely consistent with Bitcoin’s. The value of the entire network is tied to the value of TAO itself. TAO’s tokenomics are fully dedicated to validator rewards and subnet incentives, with full issuance designed to take hundreds of years, maintaining a steady and gradual release schedule.

4.2 Token Utility

- Governance and Voting

- Registration Fees (for miners, validators, and subnets)

- Recycling Mechanism: TAO has a unique recycling mechanism. Since TAO powers a general-purpose incentive network, its reward recycling system returns rewarded TAO back into the incentive pool. TAO is primarily recycled from two sources: registration fees from new miners and validators, and subnets that are shut down.

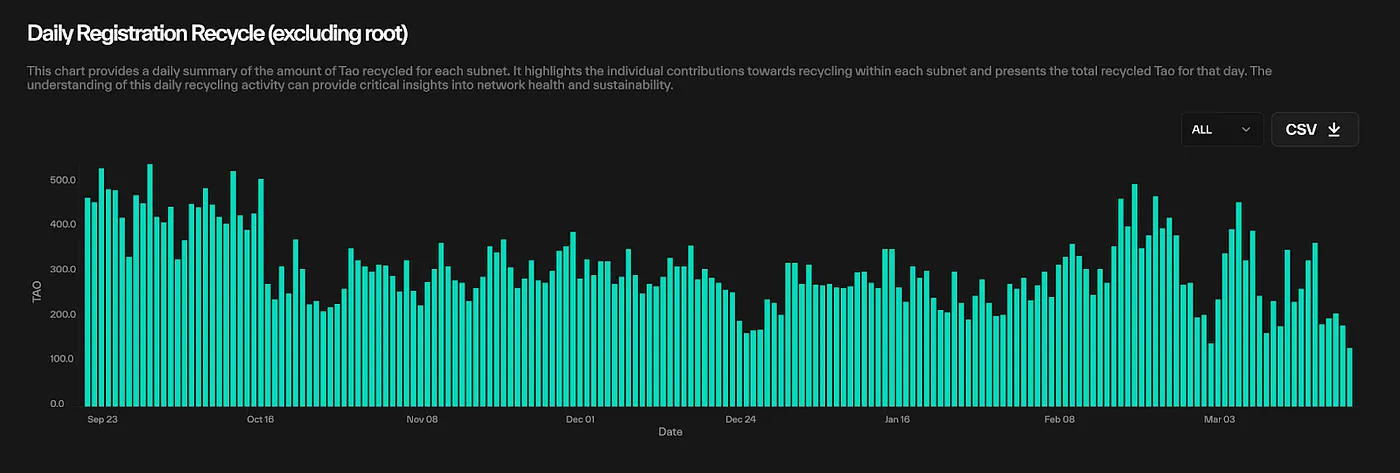

Registration Recycle, source: Taostates

The above chart shows the daily recycling volume. This recycling data partly reflects the level of attention within the ecosystem. On average, about 150–300 TAO are recycled per day.

4.3 Token Holder Addresses

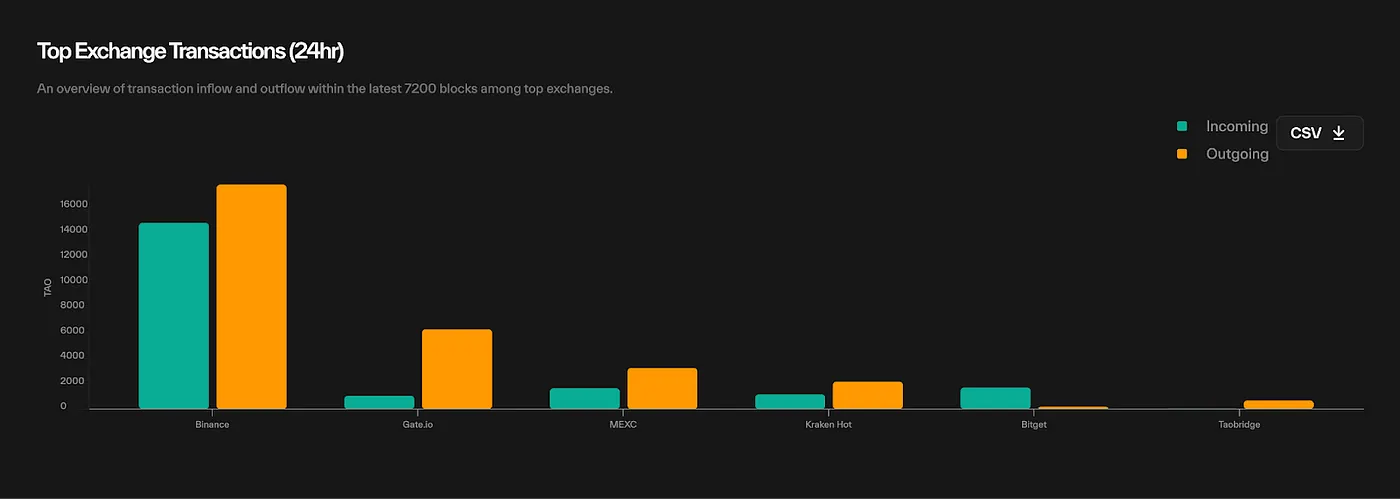

Exchange Transactions, source: Taostates

Top50 Balance, source: Taostates

The top 50 holder addresses account for roughly 30% of the circulating supply. Among exchanges, the largest trading volume is on Binance, which far exceeds the combined trading volume of all other exchanges. The single verifiable address holding the most TAO belongs to MEXC.

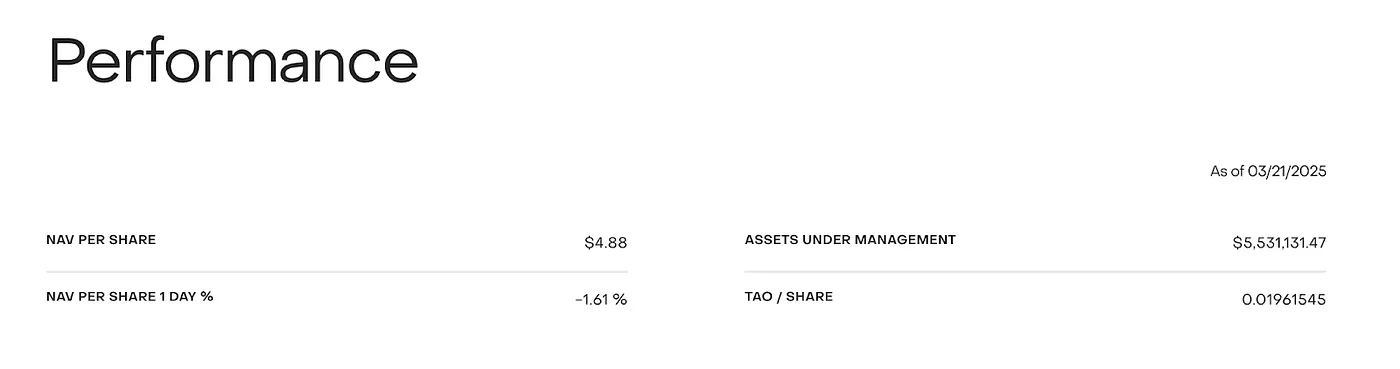

TAO Trust , source: Grayscale

In terms of ETFs, Grayscale holds TAO worth $5.5 million.

5 Market and Competition

Bittensor adopts a Bitcoin-like issuance mechanism with no reserved allocations. On the business side, it leverages game theory to build a competitive, multi-task decentralized solution covering scenarios such as GPU marketplaces, scientific research, distributed data storage and indexing, AI distributed training, and inference.

Competitors include Allora, Sentient (mainly offering model inference), and Sahara AI (mainly offering crowdsourced data). However, Sentient and Sahara AI are closer to subnet-level competitors, while Allora is seen as the most similar competitor at the architectural layer.

5.1 Market and Industry Overview

When discussing Bittensor’s market and demand, we believe its business model is similar to crowdsourcing. A comparable example in the Web2 world is Scale AI, whose model involves hiring low-cost labor from Southeast Asia to label internet data for companies that need training datasets for domain-specific large models. Scale AI’s valuation has now exceeded $14 billion.

The advantage of the crowdsourcing model, compared to centralized operations, lies in lower costs and greater flexibility. Centralized operations, however, are more stable and standardized. Decentralization inevitably suffers from efficiency drawbacks, which cannot be compared to centralized systems.

Thus, most of the resources contributed by Bittensor subnets are idle resources, but these are not without value. In fact, many idle resources still hold untapped potential. At the same time, some companies facing large-scale, short-cycle projects may choose to outsource part of their tasks to third parties in order to improve resource efficiency and maintain cost control.

5.2 Competitor Overview

Allora:

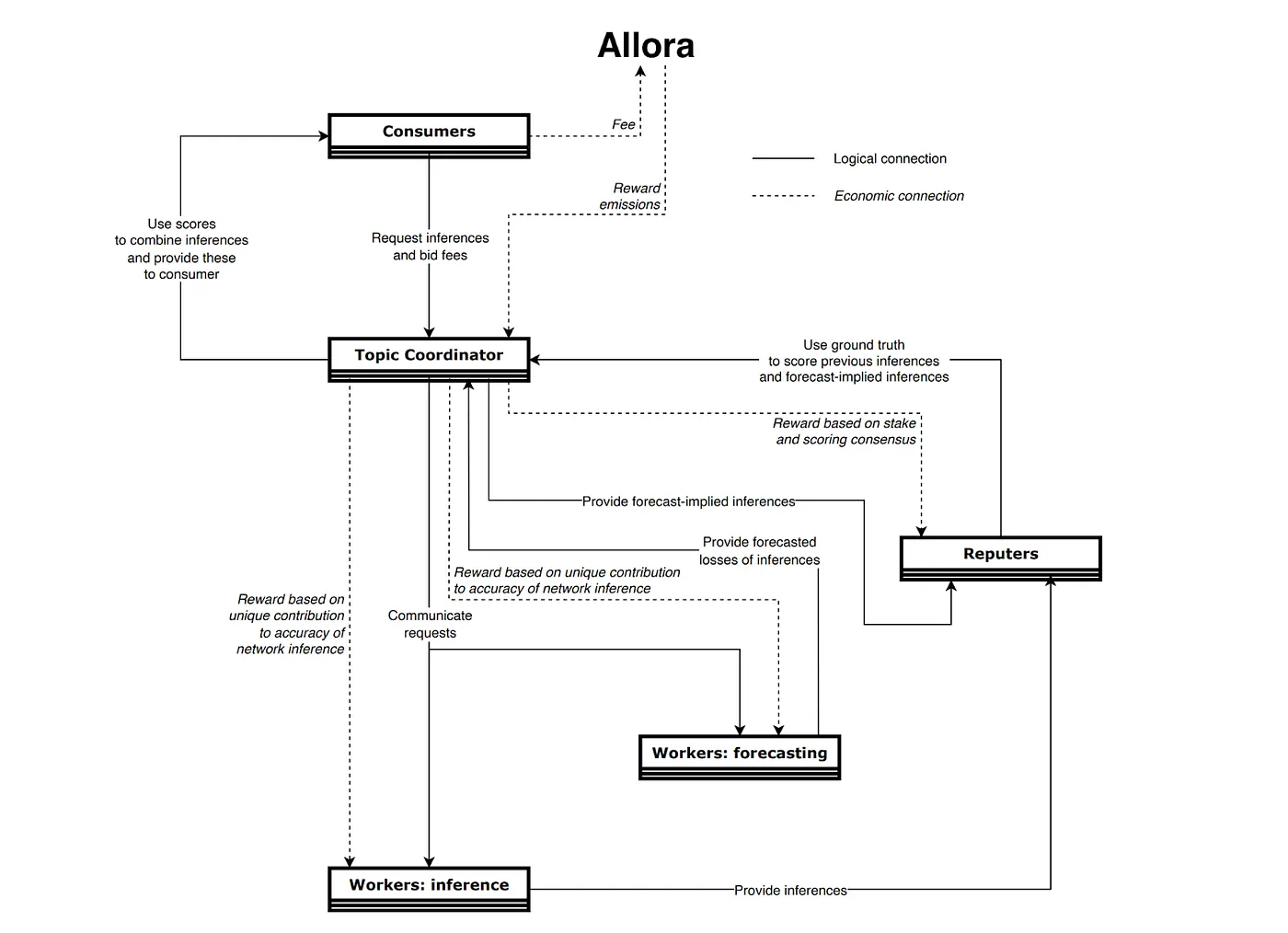

Allora is a self-improving AI network built by the community. Participants contribute resources to the network, while validators use context-aware reasoning techniques to evaluate these contributions. In Allora’s framework, participants include:

- Workers (provide specific resources, comparable to miners in Bittensor)

- Reputers (evaluate work quality, comparable to validators in Bittensor’s deprecated Root network)

- Validators (responsible for instantiating most of Allora’s infrastructure via the Cosmos architecture)

- Consumers (developers with demand for the network’s crowdsourced resources)

Allora Structure, source: Allora

In Allora’s architecture, there are three main components handling consumer requests:

- Workers: Inference — responsible for generating responses to user requests.

- Workers: Forecasting — responsible for evaluating the potential error or loss of the inferences.

- Reputers — combine the results from both types of Workers and pass them to the Top Coordinator, which directly interacts with the Consumer.

The key point here is that the Workers: Forecasting component functions as a global module that has access to the outputs of all Inference Workers. For example, in a scenario where the task is to predict the price trend of a token, the Forecasting Worker can determine from both the final results and the inference process that Worker A performs better in this scenario, while Worker B might be more suitable for predicting weather patterns.

This illustrates what Allora’s whitepaper emphasizes as context-aware technology. The core of context-awareness lies in the existence of the Forecasting Worker, which evaluates the performance of Inference Workers across different contexts.

5.3 Competitor Comparison

Allora and Bittensor pursue broadly similar goals — both use game theory to identify the best-performing workers. However, the key differences lie in several aspects:

1. Miner Quality Evaluation Methods

Bittensor uses tokenomics, relying on price discovery through subnet token prices to determine the level of subsidies. The main goal for projects is to increase the price of subnet tokens, which in turn earns them more issuance rewards.

Allora uses the popular Shapley value method — measuring how much worse network predictions would be if a worker were removed — to evaluate contributions. After an event occurs, Reputers assign a fair loss value, which can be used by the next Forecasting Worker and to evaluate the fairness of previous forecasts. For example, if removing one Worker causes a larger loss, that Worker is deemed to have contributed more and thus receives a greater reward.

A proportional system exists: for instance, if one Worker contributes 10% and another 20%, they share the rewards pool accordingly. Forecasting Workers, Reputers, and Validators also share rewards based on their contributions. This rewards pool comes from each block’s token issuance.

2. Ecosystem Openness

Bittensor’s ecosystem is significantly more open. Subnet developers have a high degree of autonomy, free to provide any services they choose and responsible for finding their own target users.

Allora’s ecosystem, by contrast, restricts miners to providing large model services, which may be specialized in fields like finance or predictive analytics. Ecosystem connections are usually centrally coordinated.

Thus, Allora is more like a large model cluster that self-adjusts and delivers real-time data — akin to an island city like Dubai. Bittensor is more like multiple islands linked by bridges, each with its own currency and primary industry.

3. Community and Capital Support

Allora has a clear advantage. It raised about $33 million in funding, with lead investors including Framework Ventures, CoinFund, Blockchain Capital, Polychain, and Archetype. It also has a strong community presence across Telegram, X (Twitter), Discord, and forums.

Bittensor has no external fundraising and only maintains a Discord community, leaning more toward a Bitcoin-inspired philosophy of grassroots, community-driven growth.

4. Tokenomics

Bittensor subnets can issue their own tokens, while Allora’s workers can only provide models and are limited to using a single Allora token.

Bittensor’s token was a fair launch, with no team or VC allocations. Allora’s token, however, includes large allocations for the team and investors.

Both follow a Bitcoin-like issuance model, with supply halved every four years.

Summary

Bittensor’s architecture is more unique, enabling a more open ecosystem with subnet-level autonomy. However, Allora’s ecosystem grows faster, as centralized coordination accelerates collaboration, while Bittensor’s reliance on independent developers limits its scale. Strictly speaking, there is still no project on the market directly comparable to Bittensor. Its design — where subnets operate as independent projects with their own tokens — further underscores the ecosystem’s distinctiveness and independence.

6 Risks

Lack of infrastructure, along with insufficient marketing and community support, leads to a relatively high level of opacity.

The ecosystem shows high redundancy and lacks independent external developer teams. A single lab may build as many as five or six subnet projects, which prevents the lab from focusing on any one project and could cause it to lose out to similar projects developed independently.

The TAO mechanism is complex, involving many detailed aspects. This results in high learning costs for retail users and requires a significant level of knowledge and preparation from project teams.

References

《Bittensor (TAO) : A comprehensive presentation of a protocol combining AI and blockchain》:https://oakresearch.io/en/reports/protocols/bittensor-tao-presentation-protocol-combining-ai-blockchain

《Bittensor Docs》:https://docs.bittensor.com/

《THUBA 研报 | Bittensor:音乐何时停止》:https://foresightnews.pro/article/detail/67830

《Demystify Bittensor :How’s the Decentralized AI Network?》:https://www.trendx.tech/news/comprehensive-analysis-of-the-decentralized-ai-network-bittensor-1215435

《Reflexivity Research》:https://x.com/reflexivityres/status/1843319486138474552

Disclaimer:

This content does not constitute any offer, solicitation, or recommendation. You should always seek independent professional advice before making any investment decisions. Please note that Gate.io and/or Gate Ventures may restrict or prohibit all or part of their services in certain restricted regions. Please refer to the applicable user agreement for more information.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures partners with global industry leaders to empower teams and startups with innovative thinking and capabilities, redefining the way society and finance interact.

Website: https://www.gate.com/ventures

Thanks for your attention.

Share

Content