2025 WOO Fiyat Tahmini: WOO Network'ün Gelecekteki Değerine Yönelik Piyasa Trendleri ve Uzman Tahminlerinin Analizi

Giriş: WOO’nun Piyasa Konumu ve Yatırım Potansiyeli

WOO (WOO), CeFi ve DeFi piyasalarını birleştiren yeni nesil bir alım-satım platformu olarak kurulduğu günden bu yana kayda değer başarılar elde etti. 2025 itibarıyla WOO’nun piyasa değeri 81.861.002 $’a ulaştı, dolaşımdaki arz yaklaşık 1.905.073.374 token ve fiyatı 0,04297 $ civarında seyrediyor. “Likidite köprüsü” olarak anılan bu varlık, merkezi ve merkeziyetsiz piyasalarda derin likidite sunarak giderek daha kritik bir konum kazanmaktadır.

Bu makalede, WOO’nun 2025-2030 yılları arasındaki fiyat hareketleri; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik etkenler ışığında kapsamlı biçimde incelenecek, yatırımcılar için profesyonel fiyat tahminleri ve uygulanabilir stratejiler sunulacaktır.

I. WOO Fiyat Geçmişi ve Güncel Durum

WOO Fiyatının Tarihsel Seyri

- 2021: WOO, 15 Kasım’da 1,78 $ ile tüm zamanların en yüksek seviyesine ulaştı

- 2022: Piyasa düşüşü WOO’yu olumsuz etkiledi ve fiyatı belirgin biçimde geriledi

- 2023-2024: Kademeli toparlanma ve ekosistem genişlemesiyle fiyat dalgalandı

WOO Güncel Piyasa Görünümü

21 Ekim 2025 itibarıyla WOO, 0,04297 $ seviyesinden işlem görüyor. Token, son 24 saatte %1,6 artış gösterirken, son 30 günde %39,86 ve son bir yılda %79,75 oranında önemli bir düşüş yaşadı. Güncel piyasa değeri 81.861.002 $’dır ve WOO kripto piyasasında 466. sırada yer almaktadır. Dolaşımdaki 1.905.073.374 WOO token, toplam arzın %63,5’ini oluşturuyor ve proje yüksek dolaşım oranı ile dikkat çekiyor. 24 saatlik işlem hacmi 133.213 $ olup, orta düzeyde piyasa aktivitesi gösteriyor. Token’ın tüm zamanların en yüksek seviyesi hâlâ 1,78 $’da, en düşük seviyesi ise 0,02211546 $’da bulunuyor; bu da WOO’nun kuruluşundan bu yana geniş bir fiyat aralığına sahip olduğunu gösteriyor.

Güncel WOO piyasa fiyatını görüntüleyin

WOO Piyasa Duyarlılığı Göstergesi

21 Ekim 2025 Korku ve Açgözlülük Endeksi: 34 (Korku)

Güncel Korku ve Açgözlülük Endeksi’ni inceleyin

Kripto piyasası, Korku ve Açgözlülük Endeksi’nin 34 değerinde olmasıyla bugün bir korku dönemi yaşıyor. Bu durum, yatırımcıların piyasa koşullarına karşı temkinli ve belirsiz olduklarını gösteriyor. Böyle zamanlarda, yatırım kararları öncesi dikkatli olunmalı ve kapsamlı araştırma yapılmalıdır. Piyasa duyarlılığı hızla değişebilir; korku dönemleri uzun vadeli yatırımcılar için fırsat sunabilir. Gelişmeleri takip edin ve riskinizi portföy çeşitliliği ile yönetin.

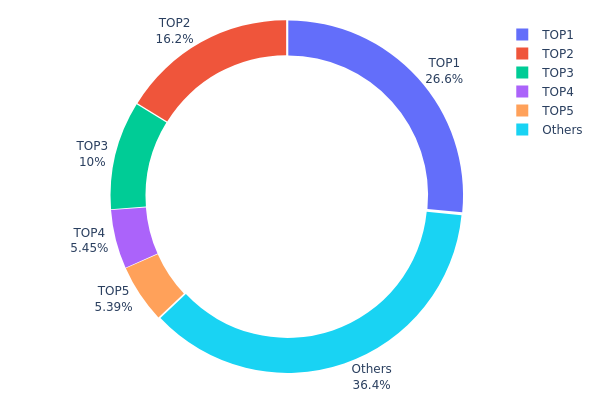

WOO Varlık Dağılımı

WOO’nun adres bazlı varlık dağılımı, tokenlerin birkaç büyük adres arasında yoğunlaştığını ortaya koyuyor. 0x0000 ile başlayan en büyük sahip, toplam arzın %26,55’ini kontrol ediyor; ilk beş adres ise birlikte WOO tokenlerinin %63,58’ini ellerinde bulunduruyor.

Bu yoğunlaşma, token dağılımının merkeziyetçi olduğunu ve piyasa dinamikleri üzerinde önemli etkiler yaratabileceğini gösteriyor. Özellikle, arzın dörtte birinden fazlasını kontrol eden en büyük adresin varlığı, volatilite ve olası piyasa manipülasyonu risklerini artırıyor. Bu büyük sahiplerin satış kararı alması halinde ani fiyat dalgalanmaları görülebilir.

Öte yandan, tokenlerin %36,42’si diğer adreslere dağılmış durumda; bu da piyasada daha geniş bir katılım olduğunu gösteriyor. Dağılımda büyük paydaşlarla küçük yatırımcılar arasındaki denge, token’ın uzun vadeli istikrarı ve merkeziyetsizleşme hedefi açısından önem taşıyor. Bu dağılımdaki değişimleri düzenli izlemek, WOO’nun piyasa yapısını ve risklerini değerlendirmek için gereklidir.

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x0000...000000 | 796.550,75K | 26,55% |

| 2 | 0xa3a7...d60eec | 485.786,72K | 16,19% |

| 3 | 0x3592...1bd60a | 300.000,00K | 10,00% |

| 4 | 0xdcf0...711071 | 163.588,40K | 5,45% |

| 5 | 0xba91...a89b13 | 161.702,44K | 5,39% |

| - | Diğerleri | 1.092.371,69K | 36,42% |

II. WOO’nun Gelecek Fiyatını Etkileyen Temel Unsurlar

Arz Mekanizması

- Piyasa Dinamikleri: Piyasadaki arz-talep dengesi WOO’nun fiyatını doğrudan etkiler.

- Tarihsel Süreç: Platformdaki kullanıcı büyümesi ve likidite artışı genellikle WOO’nun fiyatında yukarı yönlü hareketlere yol açmıştır.

- Güncel Etki: Yüksek likidite ve işlem hacmi fiyat istikrarı sağlarken, düşük likidite fiyat oynaklığını artırabilir.

Kurumsal ve Balina Dinamikleri

- Kurumsal Katılım: WOO Network, yüksek likidite, derin piyasa ve düşük maliyetli hizmetleriyle yatırımcıların ilgisini çekerek WOO token’a yönelik talebi ve piyasa değerini artırabilir.

Makroekonomik Ortam

- Para Politikası Etkisi: ABD ekonomik verileri ve politika kararları, WOO dahil kripto piyasasının genelini önemli ölçüde etkiler.

- Enflasyona Karşı Koruma: Makroekonomik bozulma, piyasalardaki geri çekilmenin ana nedeni olarak görülüyor ve WOO’nun fiyatı enflasyon baskılarına karşı hassas olabilir.

- Jeopolitik Unsurlar: Küresel ekonomik gelişmeler ve piyasa duyarlılığı, WOO’nun fiyat hareketlerinde rol oynar.

Teknolojik Gelişim ve Ekosistem İnşası

- Synthetic Proactive Market Making (sPMM): WOO’nun inovatif sPMM altyapısı, platformun temel teknolojisini oluşturuyor.

- Ekosistem Uygulamaları: WOO X Global, tokenlar piyasaya sürülmeden önce işlem yapılabilen perpetual futures piyasalarını açtı; bu gelişmeler, WOO ekosistemi ve fiyatı üzerinde etkili olabilir.

III. 2025-2030 Dönemi için WOO Fiyat Tahmini

2025 Görünümü

- Temkinli Beklenti: 0,03605 $ - 0,04 $

- Tarafsız Beklenti: 0,04 $ - 0,0429 $

- İyimser Beklenti: 0,0429 $ - 0,0455 $ (olumlu piyasa koşullarında)

2027-2028 Görünümü

- Piyasa aşaması: Büyüme dönemi olasılığı

- Fiyat aralığı tahmini:

- 2027: 0,02999 $ - 0,05155 $

- 2028: 0,03149 $ - 0,06249 $

- Başlıca katalizörler: WOO Network’ün artan benimsenmesi, genel kripto piyasasında toparlanma

2029-2030 Uzun Vadeli Beklenti

- Temel senaryo: 0,05585 $ - 0,06646 $ (istikrarlı piyasa büyümesiyle)

- İyimser senaryo: 0,06646 $ - 0,07244 $ (güçlü boğa piyasasıyla)

- Dönüştürücü senaryo: 0,07244 $ - 0,07707 $ (yaygın benimseme ve entegrasyonla)

- 31 Aralık 2030: WOO 0,07244 $ (potansiyel zirve fiyat)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,0455 | 0,04292 | 0,03605 | 0 |

| 2026 | 0,04951 | 0,04421 | 0,02873 | 2 |

| 2027 | 0,05155 | 0,04686 | 0,02999 | 9 |

| 2028 | 0,06249 | 0,0492 | 0,03149 | 14 |

| 2029 | 0,07707 | 0,05585 | 0,03407 | 29 |

| 2030 | 0,07244 | 0,06646 | 0,05383 | 54 |

IV. WOO için Yatırım Stratejileri ve Risk Yönetimi

WOO Yatırım Yaklaşımı

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı tipi: Uzun vadeli bakış açısına sahip, risk toleransı yüksek yatırımcılar

- Operasyonel öneriler:

- Piyasa düşüşlerinde WOO token biriktirin

- Tokenları stake ederek ödül kazanın ve ağ yönetimine katılın

- Tokenları güvenli, saklama hizmeti olmayan cüzdanlarda saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve olası giriş/çıkış noktalarını tespit etmek için kullanılır

- Göreli Güç Endeksi (RSI): Aşırı alım/aşırı satım durumlarını izleyin

- Dalgalı alım-satım için dikkat edilmesi gerekenler:

- WOO ekosistemindeki gelişmeleri ve ortaklıkları takip edin

- WOO platformlarında işlem hacmi ve likidite verilerini izleyin

WOO Risk Yönetim Yapısı

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3’ü

- Orta seviyede yatırımcılar: Kripto portföyünün %3-5’i

- Agresif yatırımcılar: Kripto portföyünün %5-10’u

(2) Riskten Korunma Yöntemleri

- Çeşitlendirme: WOO varlıklarınızı diğer kripto varlıklarla dengeleyin

- Zarar durdur emirleri: Olası kayıpları sınırlamak için çıkış noktaları belirleyin

(3) Güvenli Saklama Yöntemleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk saklama: Uzun vadeli tutum için donanım cüzdanı kullanın

- Güvenlik önlemleri: İki faktörlü doğrulama etkinleştirin, güçlü şifreler kullanın

V. WOO için Olası Riskler ve Zorluklar

WOO Piyasa Riskleri

- Oynaklık: Kripto piyasasındaki dalgalanmalar WOO’nun fiyatını etkileyebilir

- Rekabet: Yeni DeFi ve CeFi platformları WOO’nun pazar payını tehdit edebilir

- Likidite: İşlem hacmindeki değişiklikler WOO’nun değerini ve kullanılabilirliğini etkileyebilir

WOO Düzenleyici Riskler

- Küresel düzenleme belirsizliği: Değişen kripto kuralları WOO’nun faaliyetlerini etkileyebilir

- Uyum maliyetleri: Yeni düzenlemelere uyum operasyonel giderleri artırabilir

- Coğrafi sınırlamalar: Düzenleyici kararlar WOO’nun bazı bölgelerdeki erişimini kısıtlayabilir

WOO Teknik Riskler

- Akıllı kontrat açıkları: WOO’nun kodunda olası güvenlik zafiyetleri

- Ağ tıkanıklığı: Blokzincirlere yoğun talep işlem hızını etkileyebilir

- Entegrasyon sorunları: Yeni blokzincir veya protokol entegrasyonlarında teknik güçlükler

VI. Sonuç ve Eylem Önerileri

WOO Yatırım Değeri Analizi

WOO, CeFi ve DeFi likiditesini birleştirerek benzersiz bir değer sunar ve uzun vadede büyüme potansiyeline sahiptir. Ancak kısa vadeli oynaklık ve düzenleyici belirsizlikler, önemli riskler barındırmaktadır.

WOO Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayın, WOO ekosistemini öğrenmeye odaklanın ✅ Deneyimli yatırımcılar: Risk toleransınıza uygun şekilde portföyünüzün bir kısmını ayırmayı değerlendirin ✅ Kurumsal yatırımcılar: WOO’nun likidite ve piyasa yapıcılığı potansiyelini analiz edin

WOO Alım-Satım Yöntemleri

- Spot alım-satım: Gate.com’da WOO token alıp satabilirsiniz

- Stake: WOO Network’te stake programlarına katılarak pasif gelir elde edebilirsiniz

- Likidite sağlama: WOOFi likidite havuzuna katkı sağlayarak ödül kazanabilirsiniz

Kripto para yatırımları son derece yüksek riske sahiptir ve bu makale yatırım tavsiyesi değildir. Yatırımcılar kendi risk toleranslarına göre hareket etmeli ve profesyonel finansal danışmanlara danışmalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayınız.

SSS

WOO coin’in geleceği nasıl?

WOO coin, yapay zekâ entegrasyonu, çoklu zincir açılımı ve potansiyel gelir artışıyla gelecek vaat ediyor. Yenilikçi özellikleriyle yatırımcı ve kurumların ilgisini çekmeyi hedefliyor.

Wink 2030’da ne kadar olacak?

Piyasa tahminlerine göre WINkLink’in 2030’da 0,000448 $ ile 0,000491 $ aralığında işlem görmesi bekleniyor.

2025’te hangi coin 1 $’a ulaşır?

MoonBull ($MOBU) 2025’te 1 $ seviyesine ulaşacak şekilde öngörülüyor. Yenilikçi ön satış modeli, deflasyonist yapısı ve güçlü topluluk desteğiyle öne çıkıyor.

Wink’in geleceği var mı?

Evet, Wink’in gelecek potansiyeli yüksek. Analistlere göre 2030’da 0,00189981 $ seviyelerine ulaşabilir, bu da önümüzdeki yıllarda önemli bir büyüme potansiyelini gösteriyor.

2025 JOE Fiyat Tahmini: Trader Joe’nun Yerel Token’ı için Piyasa Trendleri ve Büyüme Potansiyelinin Analizi

Aark (AARK) iyi bir yatırım mı?: Bu Yükselen Kripto Paranın Potansiyelini ve Risklerini Değerlendirmek

BLZ vs GMX: İki Önde Gelen Bulut Servis Sağlayıcısının Kapsamlı Analizi

DIAM ve GMX: Likiditeyi ve işlem verimliliğini artırmaya yönelik iki önde gelen merkeziyetsiz borsa protokolünün karşılaştırılması

ASK ve GMX: İş İletişimi İçin İki Lider E-posta Sağlayıcısının Karşılaştırılması

ASTER'ın sermaye akışı, 2025 yılında piyasa eğilimini nasıl yansıtıyor?

Spur Protocol Günlük Quiz Cevabı Bugün 18 Aralık 2025

Dropee 18 Aralık 2025 Günün Sorusu

DRIFT Nedir: Dijital Risk İstihbaratı ve Dolandırıcılık Takibi Hakkında Kapsamlı Bir Rehber

IOTX nedir: IoTeX Blockchain Platformu ve Yerel Kripto Parası Üzerine Kapsamlı Bir Rehber

USELESS nedir: Modern Hayatta Değersiz Şeylerin Tanımı, Örnekleri ve Etkileri