2025 WELL Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Health Token

Introduction: WELL's Market Position and Investment Value

Moonwell (WELL), as a decentralized finance (DeFi) lending protocol on Moonbeam and Moonriver networks, has established itself as a significant player in the DeFi space since its inception. As of 2025, WELL's market capitalization has reached $84,259,188, with a circulating supply of approximately 4,469,983,497 tokens, and a price hovering around $0.01885. This asset, often referred to as the "Polkadot ecosystem DeFi pioneer," is playing an increasingly crucial role in open lending and borrowing services within the Moonbeam and Moonriver networks.

This article will provide a comprehensive analysis of WELL's price trends from 2025 to 2030, taking into account historical patterns, market supply and demand, ecosystem development, and macroeconomic factors, to offer professional price predictions and practical investment strategies for investors.

I. WELL Price History Review and Current Market Status

WELL Historical Price Evolution Trajectory

- 2022: WELL reached its all-time high of $0.298797 on June 23, marking a significant milestone for the token

- 2022: The market experienced a downturn, with WELL price dropping to its all-time low of $0.00298508 on December 21

- 2023-2025: The token price fluctuated between these extremes, reflecting the overall cryptocurrency market cycles

WELL Current Market Situation

As of October 21, 2025, WELL is trading at $0.01885, with a 24-hour trading volume of $46,759.57. The token has seen a 1.83% increase in the last 24 hours, indicating short-term positive momentum. However, looking at longer time frames, WELL has experienced significant declines: -13.05% over the past week, -23.81% over the past month, and a substantial -70.61% over the past year.

The current market capitalization of WELL stands at $84,259,188.92, ranking it 454th in the overall cryptocurrency market. With a circulating supply of 4,469,983,497 WELL tokens and a total supply of 5,000,000,000, the token has a circulation ratio of 89.40%.

The fully diluted market cap is $94,250,000, suggesting potential for growth if the entire supply were to enter circulation. WELL's market dominance is currently at 0.0023%, indicating it's a relatively small player in the overall crypto ecosystem.

Click to view the current WELL market price

WELL Market Sentiment Indicator

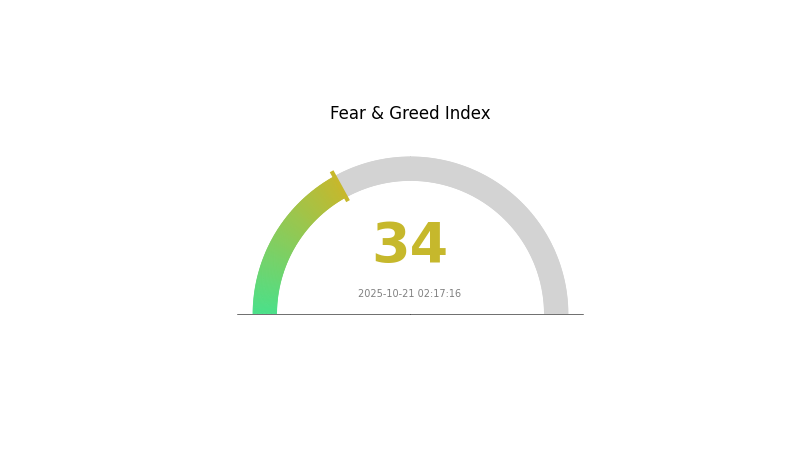

2025-10-21 Fear and Greed Index: 34 (Fear)

Click to view the current Fear & Greed Index

The crypto market sentiment remains cautious, with the Fear and Greed Index at 34, indicating a state of fear. This suggests investors are hesitant and risk-averse. During such periods, some view it as a potential buying opportunity, adhering to the contrarian principle of "be greedy when others are fearful." However, it's crucial to conduct thorough research and risk assessment before making any investment decisions. The market's fear could stem from various factors, including regulatory concerns or macroeconomic uncertainties.

WELL Holdings Distribution

The address holdings distribution data for WELL token reveals an interesting pattern in its market structure. With no specific addresses listed in the top holdings, it suggests a potentially wide distribution of tokens among various holders. This lack of concentrated holdings in top addresses could indicate a relatively decentralized ownership structure for WELL.

The absence of dominant holders often implies a reduced risk of market manipulation by large individual players. It may contribute to a more stable price action, as there are fewer large holders capable of exerting significant selling pressure. However, it's important to note that this distribution pattern could also result in lower liquidity if there are no major market makers or institutional holders actively trading the token.

This decentralized holding structure potentially reflects a healthy ecosystem for WELL, suggesting a diverse user base and possibly aligning with the project's goals of widespread adoption. However, a more detailed analysis of smaller holdings would be necessary to fully assess the token's distribution characteristics and its implications for market dynamics.

Click to view the current WELL holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Key Factors Affecting WELL's Future Price

Supply Mechanism

- Oil Production: The supply of WELL is closely tied to oil production levels.

- Historical Pattern: Past changes in oil supply have significantly impacted WELL prices.

- Current Impact: Expected changes in oil production are likely to influence WELL's price trajectory.

Institutional and Whale Dynamics

- Corporate Adoption: Major oil companies and energy firms adopting WELL could drive price movements.

- Government Policies: National policies related to energy and cryptocurrencies may affect WELL's adoption and value.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies, particularly those of major economies, are expected to influence WELL's price.

- Inflation Hedging Properties: WELL's performance in inflationary environments could affect its demand as a potential hedge.

- Geopolitical Factors: International conflicts and tensions, especially those affecting oil-producing regions, may impact WELL's price.

Technological Development and Ecosystem Building

- Blockchain Upgrades: Improvements to the underlying blockchain technology could enhance WELL's utility and value.

- Ecosystem Applications: Development of DApps and other ecosystem projects utilizing WELL may drive adoption and price.

III. WELL Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.012 - $0.015

- Neutral prediction: $0.016 - $0.019

- Optimistic prediction: $0.020 - $0.022 (requires positive market sentiment and project developments)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased adoption

- Price range forecast:

- 2027: $0.021 - $0.026

- 2028: $0.020 - $0.032

- Key catalysts: Project milestones, market recovery, and increased utility of WELL token

2030 Long-term Outlook

- Base scenario: $0.028 - $0.035 (assuming steady market growth and project development)

- Optimistic scenario: $0.038 - $0.045 (assuming strong market conditions and widespread adoption)

- Transformative scenario: $0.046 - $0.049 (assuming breakthrough innovations and mass market acceptance)

- 2030-12-31: WELL $0.04875 (potential peak price for the year)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02156 | 0.01875 | 0.012 | 0 |

| 2026 | 0.02983 | 0.02016 | 0.0125 | 6 |

| 2027 | 0.02574 | 0.02499 | 0.02149 | 32 |

| 2028 | 0.03171 | 0.02537 | 0.02004 | 34 |

| 2029 | 0.03824 | 0.02854 | 0.01798 | 51 |

| 2030 | 0.04875 | 0.03339 | 0.01736 | 77 |

IV. WELL Professional Investment Strategies and Risk Management

WELL Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Risk-tolerant investors with a long-term perspective

- Operational suggestions:

- Dollar-cost average into WELL over time

- Hold for at least 2-3 years to ride out market volatility

- Store tokens securely in a non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Use 50-day and 200-day MAs to identify trends

- RSI: Monitor overbought/oversold conditions

- Key points for swing trading:

- Set clear entry and exit points based on technical indicators

- Use stop-loss orders to limit potential losses

WELL Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across multiple DeFi protocols

- Staking: Participate in WELL staking to earn passive income

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable 2FA, use strong passwords, and regularly update software

V. WELL Potential Risks and Challenges

WELL Market Risks

- High volatility: DeFi tokens can experience significant price swings

- Competition: Increasing number of DeFi lending protocols may impact market share

- Market sentiment: Overall crypto market trends can heavily influence WELL's price

WELL Regulatory Risks

- Uncertain regulatory landscape: Potential for increased DeFi regulation

- Cross-border compliance: Challenges in adhering to various jurisdictions' rules

- AML/KYC requirements: Possible implementation of stricter identity verification

WELL Technical Risks

- Smart contract vulnerabilities: Potential for exploits or hacks

- Scalability issues: Network congestion on Moonbeam could affect performance

- Interoperability challenges: Difficulties in cross-chain asset transfers

VI. Conclusion and Action Recommendations

WELL Investment Value Assessment

WELL presents a high-risk, high-reward opportunity in the growing DeFi sector. Long-term potential exists due to Moonwell's innovative approach, but short-term volatility and regulatory uncertainties pose significant risks.

WELL Investment Recommendations

✅ Newcomers: Start with small positions and focus on education ✅ Experienced investors: Consider allocating a portion of DeFi portfolio to WELL ✅ Institutional investors: Conduct thorough due diligence and consider OTC options

WELL Trading Participation Methods

- Spot trading: Available on Gate.com and other exchanges

- DeFi interactions: Participate directly in Moonwell protocol for lending/borrowing

- Staking: Explore WELL staking options for passive income generation

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the WELL Health forecast for 2025?

Based on market analysis, WELL Health is projected to reach an average price of $0.8431 in 2025, with a potential high of $1.5464.

What is the price prediction for WELL crypto in 2030?

WELL crypto is expected to trade between $0.001231 and $27.50 in 2030, reflecting a positive outlook based on current market analysis.

What is the target price for WELL stock?

The target price for WELL stock ranges from $147.00 to $246.00, with an average suggesting a modest upside potential.

Is WELL a good stock to buy?

WELL shows promise with a 3.44% probability advantage over the market and an AI score of 7/10, indicating a potential buy opportunity.

Share

Content