2025 USDP Fiyat Tahmini: Küresel Stablecoin Ekosisteminde Pax Dollar’ın Piyasa Trendleri ve Gelecekteki Beklentilerinin Analizi

Giriş: USDP'nin Piyasa Konumu ve Yatırım Değeri

Dünyanın ilk regüle edilmiş stablecoin'i olan Paxos (USDP), 2018'deki lansmanından bu yana önemli başarılar elde etti. 2025 yılı itibarıyla USDP'nin piyasa değeri 63.245.588 dolar, dolaşımdaki arzı yaklaşık 63.264.568 token ve fiyatı 0,9997 dolar seviyesinde. “Nakitin dijital alternatifi” olarak tanımlanan bu varlık, kripto para ticareti için likidite sağlama ve tüm varlık sınıflarında anında işlem mutabakatı alanında giderek daha önemli bir rol üstleniyor.

Bu makale, USDP'nin 2025-2030 dönemi fiyat eğilimlerini tarihsel desenler, piyasa arz-talep dengesi, ekosistem gelişimi ve makroekonomik faktörler temelinde kapsamlı şekilde analiz edecek; yatırımcılara profesyonel fiyat tahminleri ve uygulanabilir yatırım stratejileri sunacaktır.

I. USDP Fiyat Geçmişi ve Mevcut Piyasa Durumu

USDP Tarihsel Fiyat Değişimi

- 2018: USDP, Paxos Standard (PAX) olarak piyasaya sürüldü, ilk fiyatı 1 dolar

- 2021: PAX'tan USDP'ye yeniden markalandı, 1 dolar sabitliğini korudu

- 2024: 16 Nisan'da tüm zamanların zirvesi 1,502 dolar, 3 Ocak'ta en düşük seviye 0,9824 dolar

USDP Mevcut Piyasa Durumu

29 Eylül 2025'te USDP, 0,9997 dolar seviyesinden işlem görüyor ve 24 saatlik işlem hacmi 617.330,87 dolar. Token düşük volatilite sergiledi ve son 24 saatte %0,03 artış kaydetti. USDP'nin piyasa değeri 63.245.588,90 dolar olup, kripto para piyasasında 605. sırada yer alıyor. Dolaşımdaki arz, toplam arzla eşit şekilde 63.264.568,27 USDP ve maksimum arz limiti bulunmuyor. USDP, ABD dolarının değerini yakından takip ederek stablecoin statüsünü koruyor.

Güncel USDP piyasa fiyatını görüntülemek için tıklayın

USDP Korku ve Açgözlülük Endeksi

2025-09-29 Korku ve Açgözlülük Endeksi: 50 (Nötr)

Güncel Korku ve Açgözlülük Endeksi için tıklayın

Bugün kripto para piyasası duyarlılığı dengede; Korku ve Açgözlülük Endeksi 50 seviyesinde sabit kaldı. Bu nötr değer, yatırımcıların USDP'nin performansına karşı ne aşırı iyimser ne de aşırı kötümser olduğunu gösteriyor. Piyasa belirgin bir yön eğiliminden yoksun olsa da hem alıcılar hem de satıcılar için fırsatlar sunuyor. Yatırımcılar dikkatli olmalı ve risk yönetimi stratejilerini uygulamalıdır. Karar vermeden önce kapsamlı araştırma ve analiz yapılması önerilir.

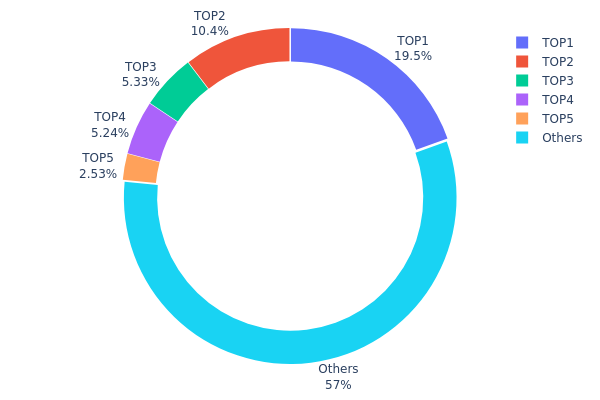

USDP Varlık Dağılımı

Adres varlık dağılımı, USDP piyasasında kayda değer bir yoğunlaşma olduğunu gösteriyor. İlk beş adres toplam arzın %42,96'sına sahipken, en büyük sahip %19,51 oranında kontrol ediyor. Bu konsantrasyon seviyesi, potansiyel piyasa manipülasyonu ve volatilite açısından endişe yaratıyor.

USDP'nin %57,04'ü diğer adresler arasında dağılmış olsa da, az sayıdaki büyük sahibin hakimiyeti merkeziyetçiliğe işaret ediyor. Bu yoğunlaşma, büyük yatırımcıların fiyat hareketlerini alım veya satım işlemleriyle etkileyebileceği anlamına geliyor. Ayrıca, bu büyük sahiplerin kararları USDP ekosisteminin genel istikrarını doğrudan etkileyebilir.

Piyasa yapısı açısından bu dağılım, orta seviyede bir merkeziyetçiliğe işaret ediyor ve daha merkeziyetsiz bir stablecoin arayan yatırımcılar için bir endişe kaynağı olabilir. Mevcut varlık dağılımı, USDP'nin zincir üzerindeki yapı istikrarının az sayıda büyük paydaşın aksiyonlarına karşı hassas olduğunu gösteriyor.

Güncel USDP Varlık Dağılımı için tıklayın

| En İyi | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0xf840...61ab62 | 11.953,17K | 19,51% |

| 2 | 0x091d...2fb90c | 6.353,80K | 10,37% |

| 3 | 0xf845...2aabb7 | 3.263,99K | 5,32% |

| 4 | 0x28c6...f21d60 | 3.208,12K | 5,23% |

| 5 | 0x35a0...2661a4 | 1.551,97K | 2,53% |

| - | Diğerleri | 34.921,48K | 57,04% |

II. USDP'nin Gelecekteki Fiyatını Etkileyen Temel Faktörler

Arz Mekanizması

- Rezerv Yönetimi: Paxos'un USDP'yi yeterli rezervle destekleyebilmesi, istikrar ve değerini korumada kritik bir unsurdur.

- Güncel Etki: Paxos'un rezerv yönetiminin başarısı, USDP'ye olan piyasa güvenini ve fiyat istikrarını doğrudan belirler.

Kurumsal ve Büyük Yatırımcı Dinamikleri

- Regülasyon Denetimi: Stablecoin'lere yönelik artan regülasyon gözetimi, USDP'nin benimsenmesi ve fiyat istikrarı üzerinde büyük etki yaratabilir.

Makroekonomik Ortam

- Enflasyona Karşı Koruma: ABD dolarına endeksli bir stablecoin olarak USDP'nin enflasyonist dönemlerdeki performansı, USD'nin gücüne sıkı sıkıya bağlıdır.

Teknik Gelişim ve Ekosistem İnşası

- Piyasa Talebi: Kripto ekosistemindeki genel stablecoin talebi, USDP'nin kullanımının ve fiyat istikrarının temel belirleyicisidir.

- Ekosistem Uygulamaları: USDP'nin çeşitli DeFi platformlarında entegrasyonu ve sınır ötesi işlemlerde kullanımı, hem kullanım alanını hem de talebini artırabilir.

III. USDP Fiyat Tahmini 2025-2030

2025 Görünümü

- Temkinli tahmin: 0,99 - 1,00 dolar

- Nötr tahmin: 1,00 dolar

- İyimser tahmin: 1,00 - 1,01 dolar (benimsenme ve piyasa istikrarı artarsa)

2027-2028 Görünümü

- Piyasa dönemi beklentisi: İstikrarlı büyüme ve geniş çaplı benimseme

- Fiyat aralığı tahmini:

- 2027: 0,99 - 1,01 dolar

- 2028: 0,99 - 1,01 dolar

- Temel katalizörler: DeFi'de kullanımın artması, regülasyonların netleşmesi

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 0,99 - 1,01 dolar (piyasa istikrarı sürdüğü takdirde)

- İyimser senaryo: 1,00 - 1,02 dolar (küresel finans piyasalarında yaygın kullanım)

- Dönüştürücü senaryo: 1,00 - 1,03 dolar (USDP lider stablecoin olursa)

- 2030-12-31: USDP 1,01 dolar (yüksek talebe bağlı olarak hafif prim)

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. USDP Profesyonel Yatırım Stratejileri ve Risk Yönetimi

USDP Yatırım Metodolojisi

(1) Uzun Vadeli Tutma Stratejisi

- Uygun yatırımcı profili: İstikrar arayan temkinli yatırımcılar

- Uygulama önerileri:

- Portföyünüzün küçük bir bölümünü USDP ile stabil varlık olarak ayırın

- Regülasyon gelişmelerini ve ihraççının finansal durumunu izleyin

- USDP'yi güvenli bir donanım cüzdanında saklayın

(2) Aktif Alım-Satım Stratejisi

- Teknik analiz araçları:

- Hareketli ortalamalar: Kısa vadeli fiyat trendlerini takip edin

- İşlem hacmi: Potansiyel piyasa hareketlerini belirleyin

- Dalgalı alım-satım için kritik noktalar:

- Riski sınırlamak için sıkı zararı durdur emirleri kullanın

- Farklı platformlarda arbitraj fırsatlarını değerlendirin

USDP Risk Yönetimi Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %5-10'u

- Orta düzey yatırımcılar: Kripto portföyünün %10-20'si

- Agresif yatırımcılar: Kripto portföyünün %20-30'u

(2) Riskten Korunma Çözümleri

- Çeşitlendirme: Birden fazla stablecoin'e yatırım yapın

- Düzenli denetim: USDP'nin rezervlerini ve teminatını izleyin

(3) Güvenli Saklama Çözümleri

- Donanım cüzdanı: USDP'yi fiziksel donanım cüzdanında saklayın

- Web3 cüzdanı: Gate web3 cüzdanı ile erişim

- Soğuk saklama çözümü: Uzun vadeli saklama için çevrimdışı kağıt cüzdan

- Güvenlik önlemleri: İki faktörlü doğrulamayı aktif edin, güçlü şifre kullanın

V. USDP İçin Potansiyel Riskler ve Zorluklar

USDP Piyasa Riskleri

- Likidite riski: Büyük ölçekli geri ödemelerde potansiyel zorluklar

- Rekabet: Diğer stablecoin'lerle artan rekabet

- Piyasa duyarlılığı: Genel kripto piyasası koşullarına bağlı dalgalanmalar

USDP Regülasyon Riskleri

- Regülasyon gözetimi: Stablecoin regülasyonlarında olası değişiklikler

- Uyum gereksinimleri: Daha sıkı KYC (Müşterini Tanı) / AML (Kara Para Aklamayı Önleme) prosedürleri

- Hukuki zorluklar: Stablecoin ihraççılarına karşı olası yasal işlemler

USDP Teknik Riskleri

- Akıllı sözleşme açıkları: Token sözleşmesinde olası güvenlik açıkları

- Blok zinciri tıkanıklığı: Yoğun ağ aktivitesinde işlem gecikmeleri

- Entegrasyon sorunları: Yeni DeFi protokolleriyle uyumluluk problemleri

VI. Sonuç ve Eylem Önerileri

USDP Yatırım Değeri Değerlendirmesi

USDP kripto piyasasında istikrar sunar. Ancak regülasyon belirsizliği ve diğer stablecoin'lerle rekabet gibi risklerle karşı karşıyadır. Uzun vadeli değer teklifi, regülasyon uyumu ve kurumsal desteğine dayanır.

USDP Yatırım Tavsiyeleri

✅ Yeni başlayanlar: Kripto portföyünün küçük ve stabil bir bölümü için USDP tercih edin ✅ Deneyimli yatırımcılar: USDP'yi kısa vadeli ticaret ve hedge için kullanın ✅ Kurumsal yatırımcılar: USDP'yi hazine yönetimi ve düşük riskli kripto piyasası erişimi için değerlendirin

USDP İşlem Katılım Yöntemleri

- Spot alım-satım: Gate.com üzerinde USDP alıp satmak

- DeFi protokolleri: USDP'yi merkeziyetsiz finans uygulamalarında kullanmak

- OTC işlemleri: Gate.com OTC platformu üzerinden yüksek hacimli işlemler

Kripto para yatırımları çok yüksek risk taşır; bu makale yatırım tavsiyesi niteliğinde değildir. Yatırımcılar kendi risk toleranslarına göre dikkatli karar vermeli, ayrıca profesyonel finans danışmanlarından destek almalıdır. Asla kaybetmeyi göze alabileceğinizden fazlasını yatırmayın.

Sıkça Sorulan Sorular

USDP bir stablecoin midir?

Evet, USDP bir stablecoin'dir. ABD dolarına endeksli olup 1 dolar sabit değerini korumak üzere tasarlanmıştır. USDP, Ethereum blok zinciri üzerinde çalışır.

2030'da USD Coin kaç dolar olacak?

USD Coin, 2030'da da 1:1 oranında ABD dolarına sabitlenmiş şekilde tasarlanmıştır. Yapısı veya teminatında büyük bir değişiklik olmadığı sürece değeri 1 dolar olarak kalacaktır.

1 USDP kaç dolar?

2025-09-29 itibarıyla 1 USDP yaklaşık olarak 0,9999 ABD dolarıdır. USDP, 1 ABD dolarına yakın sabit bir değerle işlem görür.

USDP ile USDC arasındaki fark nedir?

USDP ve USDC ikisi de stablecoin'dir; fakat USDC nakit ve nakit benzerleriyle desteklenirken, USDP USDT'ye benzer şekilde bir varlık karmasıyla desteklenir.

2025 USD1 Fiyat Tahmini: Dijital para birimlerinin değerini etkileyen temel piyasa unsurlarının ayrıntılı analizi ve gelecek öngörüsü

Falcon Finance (FF): Nedir ve Nasıl Çalışır

USD1 Coin: Nedir ve Nasıl Çalışır

2025 CRVUSD Fiyat Tahmini: Curve Stablecoin Piyasasının Geleceğine Bakış ve Belirleyici Temel Faktörler

2025 BPrice Tahmini: Piyasa Eğilimleri ve Gelecekteki Değerlemeleri Belirleyen Temel Faktörlerin Analizi

GUSD: Kripto piyasasında güvenilir bir stablecoin varlık yönetim aracı.

Kripto Airdrop’larını ücretsiz ve verimli bir şekilde nasıl elde edebileceğiniz

Kripto Borç Verme Protokollerinin İşleyişini Anlamak