2025 UMA Fiyat Tahmini: Piyasa Trendleri ve Potansiyel Büyüme Faktörlerinin Analizi

Giriş: UMA'nın Piyasa Konumu ve Yatırım Değeri

UMA (UMA), merkeziyetsiz bir finansal sözleşme platformu olarak, kuruluşundan bu yana finansal inovasyonun yaygınlaşmasında önemli adımlar atmıştır. 2025 yılı itibarıyla UMA'nın piyasa değeri 98.759.024 ABD doları seviyesine ulaşırken, dolaşımdaki arzı yaklaşık 88.099.040 token ve fiyatı 1,121 ABD doları civarındadır. "Finansal inovasyonun öncüsü" olarak anılan bu varlık, özgün ve standart finansal ürünlerin oluşturulmasında giderek daha kritik bir rol üstlenmektedir.

Bu makale, 2025-2030 döneminde UMA'nın fiyat eğilimlerine kapsamlı bir bakış sunacak; tarihsel veriler, piyasa arz-talep dengesi, ekosistem gelişmeleri ve makroekonomik faktörler ışığında profesyonel fiyat tahminleri ve yatırımcılara yönelik pratik stratejiler paylaşacaktır.

I. UMA Fiyat Geçmişi ve Güncel Piyasa Durumu

UMA Tarihsel Fiyat Gelişimi

- 2020: UMA Nisan'da piyasaya çıktı, 30 Nisan'da 0,303625 ABD doları ile tüm zamanların en düşük seviyesini gördü

- 2021: Boğa piyasası zirvesinde, 4 Şubat'ta 41,56 ABD doları ile tüm zamanların en yüksek seviyesine ulaştı

- 2022-2024: Ayı piyasası etkisiyle fiyat, zirveden önemli ölçüde geriledi

UMA Güncel Piyasa Görünümü

20 Ekim 2025 itibarıyla UMA, 1,121 ABD doları seviyesinden işlem görüyor ve kripto piyasasında 411. sırada yer alıyor. Token son 24 saatte %2,46 yükselirken, işlem hacmi 4.713.487 ABD doları oldu. UMA'nın piyasa değeri 98.759.024 ABD doları ile toplam kripto piyasasının %0,0036'sını oluşturuyor.

Mevcut fiyat, 41,56 ABD doları olan tüm zamanların zirvesinin oldukça altında, ancak 0,303625 ABD doları olan dip seviyesinin oldukça üzerinde bulunuyor. UMA, zaman dilimine göre farklı performans sergiledi: son bir haftada %11,46 artış, son bir ayda %12,57 düşüş ve son bir yılda %59,63 değer kaybı yaşadı.

Dolaşımdaki UMA arzı 88.099.040 token olup, bu toplam arzın (126.398.868 token) %76,88'ine denk geliyor. Projede maksimum arz limiti bulunmuyor.

Güncel UMA piyasa fiyatını görüntüleyin

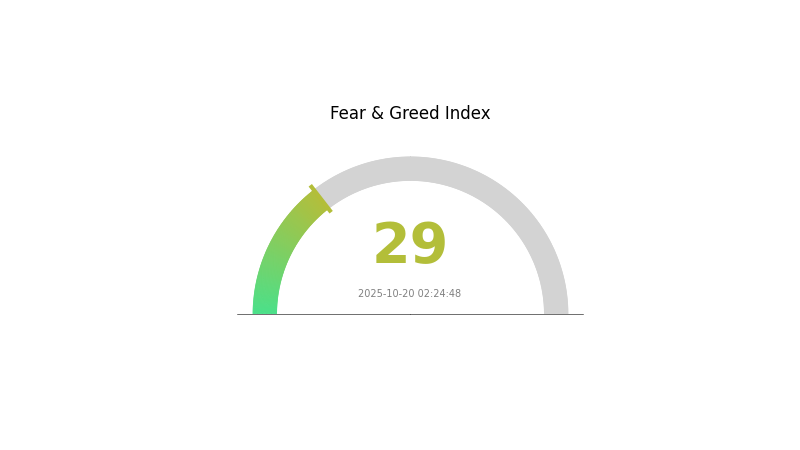

UMA Piyasa Duyarlılık Göstergesi

20 Ekim 2025 Korku ve Açgözlülük Endeksi: 29 (Korku)

Güncel Korku & Açgözlülük Endeksini görüntüleyin

Kripto para piyasası şu anda korku döneminde; Korku ve Açgözlülük Endeksi 29 seviyesinde. Bu durum, yatırımcıların temkinli davrandığını gösterirken, "başkaları korkarken cesur ol" ilkesini benimseyenler için alım fırsatına işaret edebilir. Ancak yatırım kararı öncesinde mutlaka kapsamlı araştırma yapılmalı ve kişisel risk toleransı göz önünde bulundurulmalıdır. Bu dalgalı ortamda bilinçli tercihler için piyasa trendleri ve güncel haberler sürekli takip edilmelidir.

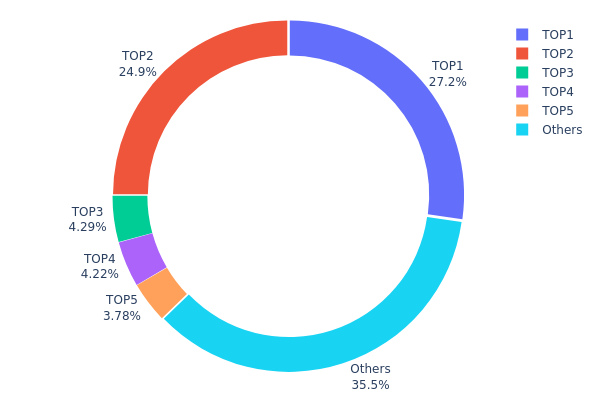

UMA Varlık Dağılımı

UMA'nın adres bazında varlık dağılımı, tokenlerin büyük bölümünün az sayıda adreste yoğunlaştığını gösteriyor. İlk iki adres toplam arzın %52'sinden fazlasına sahip; bu oranlar sırasıyla %27,22 ve %24,94. Bu yüksek yoğunlaşma, potansiyel piyasa manipülasyonu ve oynaklık riski oluşturuyor.

İlk beş adres UMA tokenlerinin %64,43’ünü elinde tutarken, geri kalan %35,57 diğer yatırımcılar arasında dağılmış durumda. Bu dengesiz dağılım, büyük adreslerin satışa geçmesi halinde fiyat oynaklığını artırabilir; ayrıca merkeziyetsizliğin görece düşük düzeyde olduğunu göstererek, daha geniş dağılım arayan yatırımcılar için endişe kaynağı oluşturabilir.

UMA tokenlerinin büyük kısmının sınırlı sayıda adreste toplanması, projenin yönetimi ve karar süreçlerinde bu adreslerin etkisini artırır. Sektörde bu dağılım yaygın olsa da, büyük sahiplerin işlemlerinin UMA'nın piyasa istikrarı ve uzun vadeli gelişimi üzerindeki etkileri dikkatle izlenmelidir.

Güncel UMA varlık dağılımını görüntüleyin

| Üst | Adres | Varlık Miktarı | Varlık (%) |

|---|---|---|---|

| 1 | 0x7b29...463fa8 | 34.413,11K | 27,22% |

| 2 | 0x0043...bd34ac | 31.530,25K | 24,94% |

| 3 | 0x61d6...5c9fcd | 5.424,86K | 4,29% |

| 4 | 0xf977...41acec | 5.332,83K | 4,21% |

| 5 | 0x8bd1...6e370c | 4.775,29K | 3,77% |

| - | Diğerleri | 44.914,17K | 35,57% |

II. UMA'nın Gelecek Fiyatını Etkileyecek Başlıca Faktörler

Teknolojik Gelişmeler ve Ekosistem İnşası

-

Optimistic Oracle V2: Bu yükseltme, UMA'nın oracle altyapısını geliştirerek farklı DeFi uygulamalarına daha güvenilir ve verimli fiyat akışı sağlayabilir.

-

Ekosistem Uygulamaları: UMA teknolojisi, sentetik varlık platformları ve tahmin piyasaları dahil birçok DeFi projesinde kullanılarak token talebini artırabilir.

III. 2025-2030 UMA Fiyat Tahminleri

2025 Görünümü

- Ihtiyatlı tahmin: 0,92 - 1,13 ABD doları

- Tarafsız tahmin: 1,13 - 1,40 ABD doları

- İyimser tahmin: 1,40 - 1,68 ABD doları (olumlu piyasa koşulları halinde)

2027-2028 Görünümü

- Piyasa fazı: Kademeli büyüme ve artan kullanım

- Fiyat aralığı tahmini:

- 2027: 1,41 - 1,59 ABD doları

- 2028: 1,22 - 2,17 ABD doları

- Başlıca tetikleyiciler: Kullanım alanlarının genişlemesi, ağ iyileştirmeleri ve kripto piyasasında genel toparlanma

2029-2030 Uzun Vadeli Görünüm

- Temel senaryo: 1,85 - 1,95 ABD doları (istikrarlı piyasa artışı varsayımıyla)

- İyimser senaryo: 2,05 - 2,54 ABD doları (benimsemede hızlanma ve olumlu piyasa koşulları halinde)

- Dönüştürücü senaryo: 2,54+ ABD doları (öncü uygulamalar ve ana akım entegrasyonu ile)

- 31 Aralık 2030: UMA 1,95 ABD doları (2025'e göre %74 artış)

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 1,67774 | 1,126 | 0,92332 | 0 |

| 2026 | 1,54206 | 1,40187 | 0,79907 | 25 |

| 2027 | 1,58972 | 1,47196 | 1,41308 | 31 |

| 2028 | 2,1738 | 1,53084 | 1,22467 | 36 |

| 2029 | 2,05607 | 1,85232 | 1,57447 | 65 |

| 2030 | 2,54046 | 1,9542 | 1,8174 | 74 |

IV. UMA'da Profesyonel Yatırım Stratejileri ve Risk Yönetimi

UMA Yatırım Metodu

(1) Uzun Vadeli Tutma Stratejisi

- Kimler için uygun: Yüksek risk toleransına sahip uzun vadeli yatırımcılar

- Öneriler:

- Piyasa geri çekilmelerinde UMA biriktirin

- Kısmi kar için fiyat hedefleri belirleyin

- Tokenleri donanım cüzdanlarında güvenle saklayın

(2) Aktif Al-Sat Stratejisi

- Teknik analiz araçları:

- Hareketli Ortalamalar: Trendleri ve dönüş noktalarını tespit için kullanılır

- RSI: Aşırı alım/aşırı satım bölgelerini belirlemek için takip edilir

- Swing trade için kilit noktalar:

- UMA'nın başlıca kriptolarla korelasyonunu izleyin

- Proje güncellemeleri ve geliştirmeleri takip edin

UMA Risk Yönetim Çerçevesi

(1) Varlık Dağılımı İlkeleri

- Temkinli yatırımcılar: Kripto portföyünün %1-3'ü

- Agresif yatırımcılar: Kripto portföyünün %5-10'u

- Profesyonel yatırımcılar: Kripto portföyünün %15'ine kadar

(2) Riskten Korunma Yöntemleri

- Diversifikasyon: Yatırımları farklı kripto varlıklara yaymak

- Zarar durdur emirleri: Potansiyel kayıpları sınırlamak için kullanılır

(3) Güvenli Saklama Çözümleri

- Sıcak cüzdan önerisi: Gate Web3 Cüzdan

- Soğuk depolama: Uzun vadeli saklama için donanım cüzdanları tercih edin

- Güvenlik: 2FA etkinleştirin, güçlü şifreler kullanın

V. UMA'nın Olası Riskleri ve Zorlukları

UMA Piyasa Riskleri

- Oynaklık: Kripto piyasasına özgü büyük fiyat dalgalanmaları

- Likidite: Yüksek hacimli işlemlerde kayma riski

- Rekabet: DeFi alanındaki yeni projeler UMA'nın pazar payını azaltabilir

UMA Düzenleyici Riskler

- Belirsiz düzenlemeler: DeFi projeleri için değişken yasal ortam

- Uyum zorlukları: Yeni yasal gerekliliklere adaptasyon süreci

- Sınır ötesi kısıtlamalar: Farklı ülkelerde farklı düzenlemeler

UMA Teknik Riskler

- Akıllı sözleşme açıkları: Protokol kodundaki muhtemel güvenlik açıkları

- Ölçeklenebilirlik sorunları: Artan ağ yükünü yönetme güçlükleri

- Oracle güvenilirliği: Dış veri kaynaklarına bağımlılık

VI. Sonuç ve Eylem Önerileri

UMA Yatırım Değeri Analizi

UMA, finansal sözleşme altyapısıyla DeFi alanında eşsiz bir değer sunuyor. Ancak yatırımcılar, kısa vadede yüksek oynaklık ve düzenleyici belirsizliklere karşı dikkatli olmalı.

UMA Yatırım Önerileri

✅ Yeni başlayanlar: Küçük pozisyonlarla başlayıp teknolojiyi öğrenmeye odaklanmalı ✅ Deneyimli yatırımcılar: UMA'yı çeşitlendirilmiş bir DeFi portföyünde değerlendirmeli ✅ Kurumsal yatırımcılar: Kapsamlı araştırma yapmalı ve büyük işlemler için OTC işlemlerini değerlendirmeli

UMA İşlem Katılım Yöntemleri

- Spot işlemler: Gate.com üzerinden UMA alım-satımı

- DeFi protokolleri: UMA tabanlı finansal ürünlere katılım

- Staking: Ek gelir için staking fırsatlarını değerlendirme

Kripto para yatırımları son derece yüksek risk içerir; bu makale yatırım tavsiyesi değildir. Yatırımcılar, kendi risk toleranslarına göre karar vermeli ve profesyonel finansal danışmanlara başvurmalıdır. Kaybetmeyi göze alabileceğinizden fazlasını asla yatırmayın.

SSS

UMA coin’in geleceği nedir?

UMA'nın geleceği umut verici; DeFi alanında büyüme potansiyeli taşıyor. Yenilikçi oracle sistemi ve zincirler arası özellikleri, 2025’e kadar benimsenmeyi ve değer artışını destekleyebilir.

UMA'nın ulaştığı en yüksek fiyat nedir?

UMA'nın en yüksek fiyatı 4 Şubat 2021’de 43,37 ABD doları olmuştur. Bu seviyenin üzerine çıkmamıştır.

UMA coin’in sahibi kim?

UMA coin’in tek bir sahibi yoktur. Proje, token sahiplerinden oluşan topluluk tarafından bir DAO (Merkeziyetsiz Otonom Organizasyon) yoluyla yönetilir.

Hamster Kombat Coin 1 ABD dolarına ulaşır mı?

Hamster Kombat Coin’in 1 ABD dolarına ulaşması pek olası değildir. Mevcut fiyatı ve piyasa değeriyle, bu seviyeye ulaşması için olağanüstü büyüme ve benimseme gerekir; bu da meme coinler için oldukça zordur.

WLFI'nin zincir üstü veri analizi, ilk dolaşımdaki arzını nasıl gösteriyor?

2025 yılında on-chain veri analizi, EVAA Protocol'ün piyasa trendlerini nasıl ortaya koyar?

ICP'nin zincir üstü verileri, 2025'teki piyasa konumunu nasıl gösteriyor?

UNO: Arkadaşları ve aileyi bir araya getiren klasik kart oyunu

2025 yılında zincir üstü veri analizi, DEXE Token'ın piyasa trendlerini nasıl gösterebilir?

Kripto para fon akışı, piyasa duyarlılığını ve fiyat dalgalanmasını nasıl etkiler?

ZOO Token Satın Alma Rehberi: Listeleme Bilgileri, Fiyat Tahmini ve Satın Alma Süreçleri

VANRY nedir: Bu Yenilikçi Dijital Platformu Anlamak İçin Kapsamlı Bir Rehber

LAT nedir: Latissimus Dorsi Kası ve Antrenman Yöntemleri Hakkında Kapsamlı Bir Rehber

NFT Hazine Avcılığına Yeni Başlayanlar İçin Rehber: Fırsatları Belirleme ve Alım-Satım Platformlarını Anlamak

2025 BAS Fiyat Tahmini: Uzman Analizi ve Önümüzdeki Yıl İçin Piyasa Beklentileri